Since the Global Financial Crisis (GFC) in 2008, private credit investing has been on the rise when risk aversion, new regulations, and capital limitations forced banks to limit their participation in the market. Independent investors filled the gap, utilizing private credit investment strategies to diversify their portfolios and add a steadier complement to more unpredictable equity investments.

Now, investors are looking to build their post-pandemic private credit investment strategies, finding new opportunities in a period of uncertainty that began back in 2020.

Investing in private credit is only continuing to grow. JP Morgan reported earlier this year that 67% of investors surveyed intend to increase their allocation (16% of them “significantly”) to private credit in the immediate future.

Despite pains in the market stemming from the pandemic over the past year, returns on private debt investing have remained relatively stable (thanks in large part to stimulus relief measures). As the world begins to re-normalize, new opportunities are appearing for investors in the private credit space.

Here we’ll cover three post-pandemic private credit investment strategies to drive portfolio growth.

Quick takeaways

- The distressed debt market isn’t matching post-pandemic predictions, but opportunities exist for investors looking at smaller-sized companies who can afford to be patient with their capital.

- The ESG trend continues to grow, and private credit investment provides an opportunity to invest in niche ESG initiatives that align with investors’ expertise and interests.

- After last year’s forced technology transformation, tech companies will need to continue scaling up. Overall, every company will need to make long-term plans for operating in a more digital environment, and many will seek private investors to help finance these efforts.

Strategies to grow your private credit portfolio

Distressed debt

The predicted onslaught of pandemic-induced distressed debt so far hasn’t materialized in the U.S. thanks to government relief measures and a quicker economic bounce-back than anticipated at the peak of the crisis.

But distressed opportunities are there for investors who know where to look — starting with the future. JP Morgan anticipates that the wave of distressed debt is “not done but delayed” and outlines distressed investing as a core part of their post-pandemic strategy in their Private Credit Outlook Report.

They aren’t alone. Leaders in real estate anticipate that the increase in distress is still “en route,” and many across industries agree that once relief funds run out and temporary flexibility on loan repayment terms expires, companies buoyed by these measures will be in real need of capital.

In other words, patient investors will still see pandemic-related distressed payoffs in the future. But, in the meantime, firms are finding advantages in smaller and more niche opportunities away from the fierce competition for big-ticket investments that (at least for now) are few and far between.

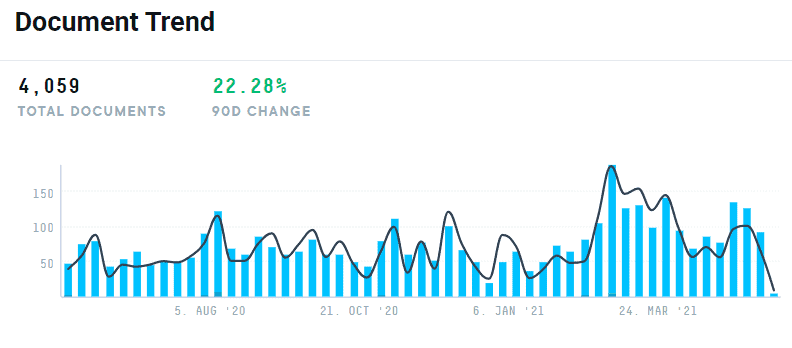

While it may seem that distressed debt isn’t much of a discussion point, macro-research shows that the subject isn’t fading from industry conversation. For example, an AlphaSense search for “distressed investing” appearing in company documents over the past 12 months shows a sharp uptick in frequency early this spring, even amidst increased signs of a pandemic recovery, especially in the U.S.

The takeaway: Distressed investing is in a unique position now, but it’s also an opportunity for portfolio growth outside the context of the pandemic and in the long term in the future.

Document trend results for “distressed investing” in company documents over the past 12 months

ESG initiatives

We recently covered ESG strategies for investors, and they apply to private credit, too. Moreover, ESG investing is rising as environmental, social, and governance issues increase in prominence on the news and in public dialogue.

Issues like climate change, gender, race equality, and voter rights dominate the headlines, and private entities are making more concerted efforts to thread ESG throughout their operations and company culture. In addition, governments are being held accountable for allocations to ESG-related initiatives, and legislation around ESG is becoming more common.

Investment firms are taking tangible steps that show their commitment to ESG.

- Brightwood Capital has joined the Institutional Limited Partners Association’s (ILPA) Diversity in Action initiative.

- OPTrust outlined their ESG efforts and focused on building relationships with ESG funds in their Responsible Investing Report.

- Addenda Capital launched two investment funds to support climate change initiatives.

These actions and others like them only point toward more numerous and better opportunities for ESG investors. In particular, the private credit market sees many middle-market or smaller companies (often more distinctive and geographically local in scope than their large-scale, government-headed ESG counterparts in the public market) needing support.

The takeaway: Private credit investors focusing on ESG can pursue opportunities and tailor their portfolios in alignment with their individual experience, expertise, and interests.

Tech transformation

The world went digital seemingly overnight in response to the pandemic. Tech companies had to scale up faster than ever before to meet a dramatically increased demand for products and services across industries and around the world. As a considerable part of the world’s workforce went remote, technological reverberations across every sector and region.

Now, companies are looking for ways to convert their fast-tracked solutions into long-term strategies, and tech companies will be the ones helping them get there.

To make this conversion happen, companies will need capital, and those that don’t want to compromise equity along the way will look to private credit options. This gives investors who may meet their tech quota on the glamorous but always fickle tech stock market an alternative investment option.

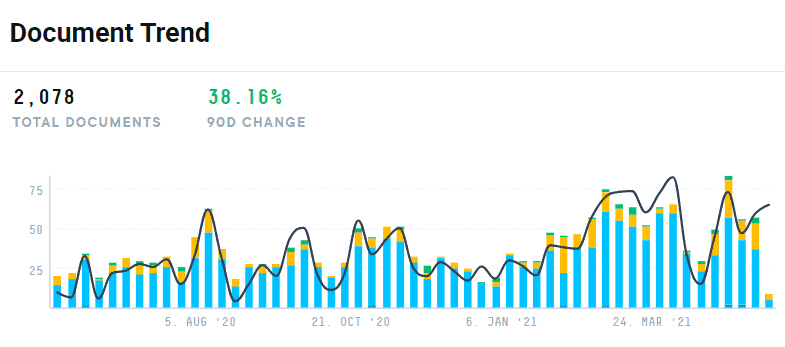

A combined search on AlphaSense for software and tech alongside private credit investing shows documents trending up heavily in the second half of the pandemic period until now, with capital markets atop the industry list and accounting for about a third (740 to be exact) of the total documents included in the search.

Document trend results for “software OR tech” and “private credit investing”

The takeaway: Investors can take the time and due diligence looking for novel private credit opportunities within the tech industry if they want a different kind of exposure to that industry.

Why it may be time to consider the private credit market

The personal credit market has been steadily growing since the GFC of 2008. There are no signs of that trajectory changing, with nearly three-quarters of recently surveyed investors indicating that they plan to increase their allocation in this sphere.

Investors are looking to make alternative investments that will diversify and grow their portfolios should be considering private credit as a strategy.

Three vital areas of focus that are particularly timely in the current market are distressed investing, ESG, and tech transformation — all areas that have seen unique positioning in the context of the pandemic but that have and will continue to stand alone high-potential strategies for growth in the future.

To learn more about technology and investment opportunities coming out of the pandemic, check out our exclusive four-part webcast series with HSBC, where experts and analysts discuss emerging technologies and trends aiming to make an impact across multiple global sectors. Register here.