How to Calculate the ROI of Market Intelligence

Get the guide

The exponential growth of the 5G services market is undeniable, as experts are predicting it to generate $1.67 trillion by 2030–registering a CAGR of 52.0% from 2022 to 2030.

Demand for ultra-reliable and low-latency data networks capable of providing enhanced mobile connectivity is being driven by powerhouses like Apple, Samsung, AT&T, and T-Mobile USA Inc. This year alone, global 5G subscriptions are expected to double and surpass 1 billion.

Gartner even estimates that infrastructure spending required for the adoption of 5G will increase by 22% to more than $23 billion worldwide. The bottom line: there’s no shortage of potential that can come with investing in the 5G market.

And while it’s true that mobile manufacturing titans are behind this wave of capital being spent, other power players are competing for a share in the market.

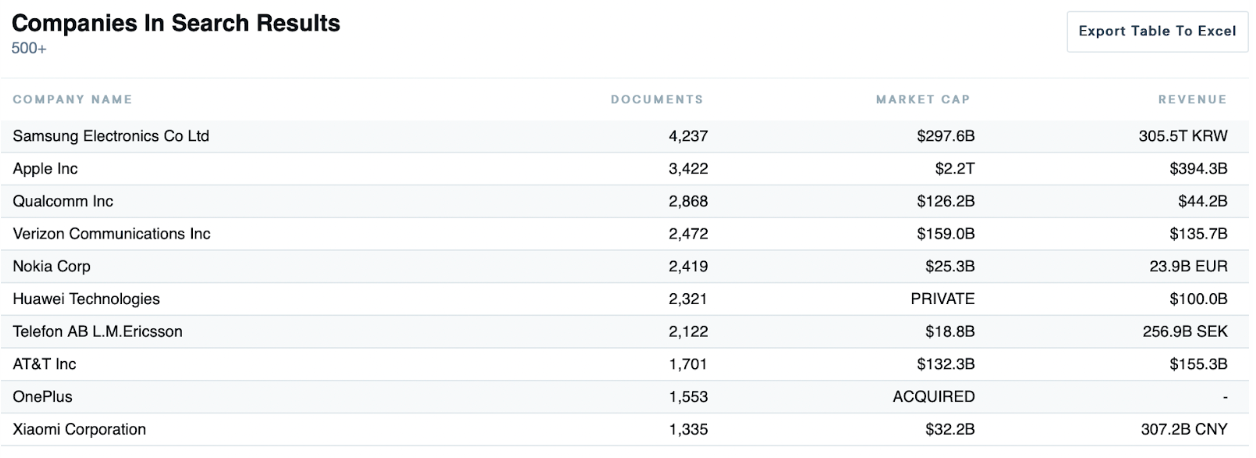

Over the last 12 months, there have been 187,862 documents in the AlphaSense platform mentioning 5G, with several, unexpected industries producing documentation. Semiconductor companies, mobile tech equipment and infrastructure manufacturers, and real estate asset holders also seem to be some of the best-positioned to benefit from the proliferation of 5G.

And beyond getting a grasp on top industries talking about 5G, the AlphaSense platform also gives you an understanding of who exactly is talking about this market moving trend and to what extent (with the number of documents uploaded).

Using the AlphaSense platform, we dove into what 5G stocks you can expect to experience financial success in upcoming quarters. Below, we touch on some of the companies mentioned above and even others outside of that list who are poised for big time growth. Learn how these companies across industries are thinking outside of the box to adopt 5G into their operations and gain a market edge.

Related reading: 10 Best Stock and Investment Research Tools for 2022

AT&T, Inc. (T)

In Q2 of this year, AT&T, Inc. reported adding more post-paid phone customers than T-Mobile, seeing major growth in expanding its 5G and fiber customer base. Recent transcripts revealed T reached its target of covering 70 million people with mid-band 5G spectrum two quarters ahead of its goal, leading C-Suites to forecast T’s coverage to reach 100 million people by the end of the year. Regarding T’s stock performance, experts are seeing T’s investment in 5G payoff, along with high-interest rates, improve its evaluation.

BT Group plc

BT Group’s CTO Howard Watson recently shared his vision for the company’s 5G network to expand ‘anywhere’ by 2028 and be a fully converged network by the middle of the decade. Watson’s aiming for 90% geographical coverage, with the remaining remote locations supported by other means such as fixed wireless access and LEO satellite. With plans to expand its 5G network to cover 50% of the UK population by 2023, BT Group plc. has already hit 50% of its population target a year ahead of schedule.

China Mobile Ltd.

China Mobile Ltd. launched a “5G+” plan to expedite 5G integration into “every industry and every walk of life.” By gradually yet extensively integrating its 5G-based infrastructure to invoke industry transformation and upgrade social governance innovation, among other aspects, China Mobile Ltd. is marketing its 5G services as benefiting all sectors of society.

Already, the company has deployed over 50,000 5G base stations and officially launched 5G commercial services in 50 cities. Additionally, SHA Conducted large-scale 5G network trials, pursued a comparable level of maturity in the 2.6GHz and 3.5GHz industry chains, and promoted the development of SA (Standalone) end-to-end industry.

China Telecom Corporation Ltd.

China Telecom is at the forefront of international telecom operators leading the 5G trend, being the first in the world to operate a cloud network and IT infrastructure in a unified and centralized manner. Since the 5G commercial launch in China in 2019, China Telecom has made many landmark technological advances, one being that the company built the world’s first, largest and fastest 5G SA network under a co-build and share model.

Bharti Airtel Ltd. (BHARTIARTL)

Bharti Airtel Ltd. is one of the largest Indian multinational communication services, operating in 18 countries across Asia and Africa and generating roughly $15 billion in revenue this past year.

Rolling out its Airtel 5G Plus this past October, BHARTIARTL’s network powers eight major cities and will eventually cover all of urban India by 2023, making this one of the fastest 5G rollouts. With a focus on being eco-friendly, the company is positioning the Airtel 5G Plus network as being kinder to the environment with its “special power reduction solution”–an attractive quality for ESG investors.

NTT Docomo (DOCOMO)

This past August, NTT Docomo launched the world’s first commercial 5G standalone network with 5G NR Dual Connectivity, allowing smartphones to simultaneously utilize both mid-band (sub-6 GHz) and mmWave frequencies. DOCOMO’s network service relies on 5G mmWave and its wide coverage of 5G mid-band, giving subscribers access to speed and reliable service even in congested locations (major terminal stations, event venues, including stadiums, and commercial facilities). The innovation sets up Japan’s largest telecommunications company for major 5G investors interested in upcoming fiscal quarters.

KT Corp. (KT)

KT Corporation’s telecom branch is seeing profit margins grow due to an increase in wireless users, a deeper 5G penetration rate, and the introduction of their value-added services. The South Korean provider claims to have launched the world’s first “nationwide” 5G network in 2019 to cover the country’s key transportation routes, including two major highways, six airports, and the ground section of high-speed railways, as well as throughout major cities, large shopping malls, and college campuses across the country. KT Corp. also offers unlimited 5G data plans for consumers with varied pricing options.

Saudi Telecom Company

Saudi Arabia’s 5G services market is being driven by a few key factors: growing demand for emerging applications like augmented reality (AR) and virtual reality (VR), as well as self-driving cars, increased gaming demands, and an ongoing industrial revolution. While government policies and schemes could delay 5G service initiatives, the increasing use of smartphones and the rising trend of virtual reality in gaming, education, and training purposes are propelling demand.

Related Reading: The Top 16 Metaverse Stocks to Watch

Vodafone Group plc. (VOD)

Vodafone has been ramping up its 5G transition to boost both retail and commercial businesses and increase its market penetration. The group launched Europe’s first 5G standalone network in 2021, becoming a major leader of the 5G market in Germany and the continent by partnering with Ericsson to release its cloud-native dual-mode 5G Core. In contrast to the more limited capabilities of 5G non-standalone networks, Ericsson’s cloud-native dual-mode 5G Core is a highly capable, fully standalone, cloud-native 5G network that experts believe will shape Europe’s 5G future.

Deutsche Telekom AG

In September, Deutsche Telekom AG launched the T Phone, a smartphone created in partnership with Google that aims to make 5G accessible on a broad scale within Europe. Building on T-Mobile US’ success “REVVL” line and breaking down the price barriers associated with 5G smartphones, the T Phone and T Phone Pro allow customers to access high-speed internet at an affordable price in nine European markets (across Austria, Croatia, Czech Republic, Hungary, in Montenegro, North Macedonia, Poland, Romania and Slovakia), with both products being available in Germany from early 2023. Affordability seems to be a key characteristic for companies embracing 5G, and Deutsche Telekom AG is setting itself up to profit from this trend.

SK Telecom Co., Ltd. (SKM)

Over the past year, a surge of 5G subscriptions for SK Telecom Co., Ltd (SKM) has resulted in promising revenue growth for the company–a trend that experts predict will continue QoQ.

Fiscal reports have shown an 11% growth in the share of 5G subscribers in 2020 to over 41% in the last quarter of 2021. The past year alone we’ve seen an 80% growth in 5G subscriptions over the past year (which coincides with a 15% decrease in LTE (4G) subscriptions), a sign that consumers are already switching over to 5G and that SKM is a leader in these conversions.

Verizon Communications, Inc. (VZ)

As the biggest wireless provider in the United States based on subscribers, Verizon has been partnering with companies across industries to bring its 5G technology into different markets and take advantage of this market opportunity. Not only has Verizon partnered with AWS, Google, and Microsoft to develop 5G cloud services, but it also began offering fixed 5G broadband to homes.

T-Mobile USA Inc (TMUS)

T-Mobile, the second largest mobile provider in the US, recently reported adding 578,000 wireless home and small business broadband subscribers to be connected to its 5G network. C-Suites at TMUS plan to expand their coverage to around 260 million people with its mid-band 5G network by the end of 2022. TMUS stock has already grown 28% as of 2022 and holds the 5G wireless spectrum among US mobile service providers.

Rakuten Mobile Inc.

Following its recent 5G launch and offering customers an upgraded service plan called Rakuten UN-LIMIT V which adds 5G to existing customer plans for no additional fees in 2020, the mobile company has prioritized democratizing its 5G-powered mobile network with Rakuten Communications Platform (RCP).

According to Rakuten, RCP intends to “empower telcos and enterprises around the world to easily draw on what Rakuten Mobile has already done in Japan: offer a secure and open mobile network at speed and low cost, generate new revenue streams and offer customers innovative and immersive experiences.” Rakuten’s ability to incorporate 5G yet fight the high price points associated with mobile plans and appeal to lower-income consumers in Japan positions their stock for financial prosperity in future quarters.

Finding 5G stock investment opportunities and strategizing what opportunities to pour capital into requires more than relying on your traditional research methods. In our whitepaper, How to Calculate the ROI of Market Intelligence, learn how a market intelligence platform like AlphaSense can save you time and money in making more confident business decisions. Start your free trial today.