This week, Alphabet reported Q4 earnings, closing out the fiscal year exceeding expectations.

In its Q4 2020 earnings call transcript, Alphabet’s senior management introduced a new reporting format. The tech giant started with an overview of Alphabet, followed by new segment disclosures for Google Services, Google Cloud, and Other Bets.

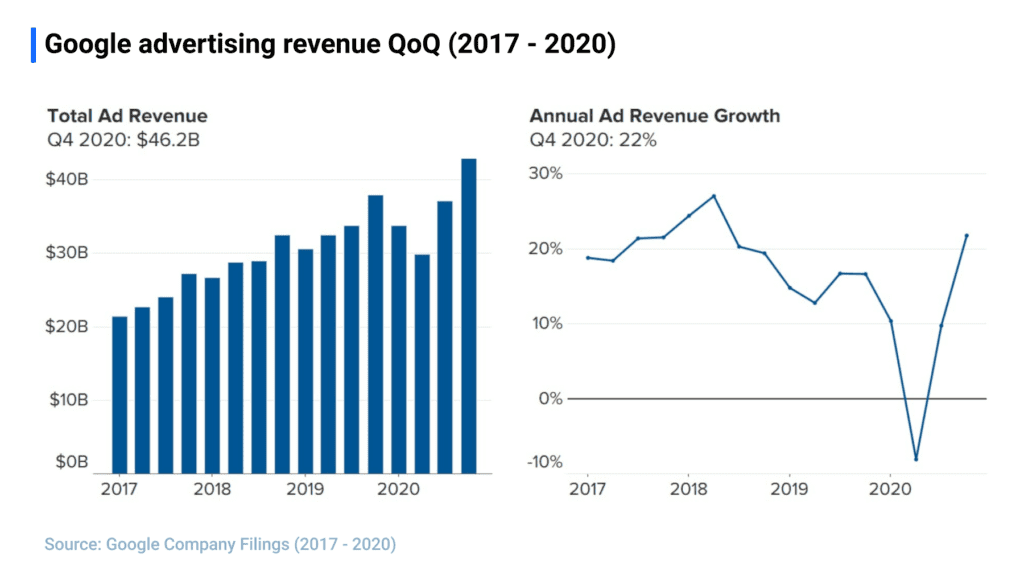

One of the most significant updates in its Q4 2020 earnings call involved Google’s advertising revenue, which far exceeded expectations, rebounding from Q2 2020’s downturn amid COVID-19. In her introduction, Alphabet’s Senior VP & CFO Ruth Porat noted that “the organization is very pleased with [its] exceptional fourth-quarter performance after an unprecedented year.”

Highlights from Alphabet’s Q4 2020 Earnings Call:

- Google announced in a press release that it would be reporting results for Google Services, Google Cloud, and Other Bets with profits and losses tied to each category

- For 2020, total Alphabet revenues were $183 billion, up 13% year-on-year or up 14% in constant currency. Google reported $56.9 billion in revenue, up 23% YoY from Q4 2019.

- YouTube advertising revenues accounted for $6.9 billion, up 46%, driven by a rebound not only in brand advertising but also ongoing strength in direct response; network advertising revenues of $7.4 billion, up 23%.

- In the fourth quarter, retail was the largest contributor to the year-on-year growth of Google’s ads business.

Source: Google Company Filings (2017 – 2020) | Leverage this search to dig into the data. | Caption: Google’s advertising revenue rebounded from its Q2 2020 downturn amid COVID-19. By Q3 2020, ad revenue had exceeded the previous years, and, by Q4 2020, total ad revenue surpassed all previous quarters since 2017.

General performance notes from Alphabet’s Q4 2020 Earnings Call:

Quotes from Sundar Pichai, CEO

“Our strong results this quarter reflect the helpfulness of our products and services to people and businesses, as well as the accelerating transition to online services and the cloud. Google succeeds when we help our customers and partners succeed, and we see significant opportunities to forge meaningful partnerships as businesses increasingly look to a digital future.”

Quotes from Ruth Porat, Senior VP & CFO

“We are very pleased with our exceptional fourth quarter performance after an unprecedented year. For 2020, total Alphabet revenues were $183 billion, up 13% year-on-year or up 14% in constant currency. With our new segment disclosures this quarter, I’ll start with quarterly results at the Alphabet level, followed by segment results and conclude with our outlook. My focus will be on year-on-year comparisons for the fourth quarter, unless I state otherwise.

For the fourth quarter, our consolidated revenues were $56.9 billion, up 23%, which reflect broad-based increases in advertiser spending in Search and YouTube within Google Services as well as ongoing strength in Google Cloud.

Total Google Services revenues were $52.9 billion, up 22%. Each component of our advertising revenues reflects the return of advertiser spend in response to the continued movement of consumer activity online that Philipp spoke about, including Google Search and other advertising revenues of $31.9 billion in the quarter, up 17%; YouTube advertising revenues of $6.9 billion, up 46%, driven by a rebound not only in brand advertising but also ongoing strength in direct response; network advertising revenues of $7.4 billion, up 23%.

Advertising notes from Alphabet’s Q4 2020 Earnings Call:

- “Two trends drove the strong results across Search, YouTube and network advertising. Consumers continued to move more of their activity online, and advertisers responded to the shift in consumer behavior by reactivating spend that they had paused earlier in the crisis.”

- “In the fourth quarter, retail was the largest contributor to the year-on-year growth of our ads business. Tech, media and entertainment and CPG were also strong contributors. The trajectory of search advertising over the past year demonstrates its responsiveness to consumer interest and needs and how marketers can quickly adjust their spending as circumstances change to focus on generating ROI for their businesses.”

- “In YouTube, Direct Response had a substantial year-on-year growth throughout the entire year, including the fourth quarter.”

- “We saw significant acceleration of brand spending on YouTube. Network revenues in the fourth quarter benefited from the same uplift in spend by advertisers, particularly in AdMob and Ad Manager. Google other revenues were driven by growth in YouTube’s non advertising revenues, primarily from subscriptions as well as by Google Play revenue growth.”

- “Our Direct Response business on YouTube was practically nonexistent 3 years ago. And now it’s one of our largest and fastest-growing ad offerings on YouTube.”

Track Alphabet’s performance throughout 2021 with AlphaSense. Login to set up custom alerts or sign up for a free trial to begin your research today.