Investors and analysts must be aware of critical information on the companies and industries they follow, so they can reduce any uncertainty around an investment thesis.

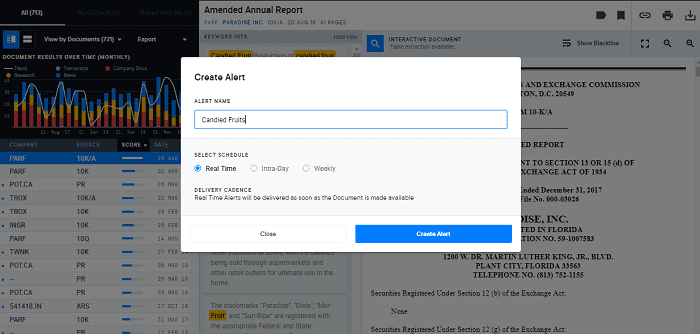

In order to ensure investors stay on top of all this information, AlphaSense includes a simple, yet brilliant ability for users to save their keyword searches and set up email or mobile push alerts on any companies, products, industries, or investment themes they care about. These automated alerts include text snippets with keywords in context, and users can be notified at a frequency of their choosing.

Time savings on equity research you already cover

Analysts who need to comb through every new SEC filing can use AlphaSense to jump directly to relevant sections of a report and ignore unimportant filings. This is especially useful when larger companies file reports that are over 100 pages long and can take hours to go through.

Related: How I Use AlphaSense For Equity Research

In order to set up alerts, you will need to perform a search that you would like to save. This search can be connected to a single stock or a group of stocks (if you’re looking at how competitors are talking about an aspect of their business, for example). You can also save a general search that will allow you to catch any other material relevant to your portfolio.

For this example, I used the keyword candied fruit to narrow my search results.

Once you have saved a search and set a frequency for your alerts, you will receive an alert whenever a new document is available and includes mention of your keywords,

I also recommend you set up searches that notify you about any negative developments regarding stocks you cover. These can span from significant searches such as SEC inquiry or adverse audit opinion, to more nuanced searches for negative factors such as lower guidance or production issue.

Expansion of your investment universe or coverage

As shown in the previous example, you can set up searches that span across all of the vast content sets included with AlphaSense, such as SEC filings, broker research, press releases, company presentations, conference call transcripts, news and industry journals. This allows you to set up a search to identify new investment opportunities or companies similar to those you have already researched.

The possibilities are endless, and you can get very creative with the keywords you track. Here are some examples of my saved searches:

SEC Inquiry

Because I am more orientated to the short-side, my core searches revolve around negative news regarding companies. SEC searches are important, because they allow me to spot stocks with a potential catalyst already built in (if the inquiry produces results, the stock is likely to be impacted). While the presence of the inquiry on its own is nothing that would automatically make the stock an investment opportunity, at the very least it allows me to learn about any new developments.

Related: How Investment Analysts Spot Critical Changes In SEC Filings

Variable Interest Entities (VIEs)

My other favorite searches are connected to company structure and accounting techniques, which can yield interesting companies I hadn’t otherwise considered. VIEs are closely related to special purposes entities (SPEs), or entities where the company does not hold a majority of voting rights, but does hold a “controlling interest,” and can be used to shield the parent company from financial risk. VIEs are frequently quite complex and point to an unusual company structure, which could lead to a need for more research.

Tender offer

More straightforward opportunities can come from searches connected to corporate actions, which can point to possible arbitrage opportunities. Tender offers by smaller companies can be an example of where investors can stumble upon a mis-pricing. I also add odd lot to the search, which is a well-known arbitrage strategy employed by smaller investors.

Better research with AlphaSense real-time alerts

Smart email and mobile push alerts are able to save analysts and investors an immense amount of time, can lead to new investment opportunities and can be used as a possible starting point for complex investment research.

Jan Svenda is an independent equity analyst focused on the U.S. Small / Micro-cap space where he searches for long ideas trading around Net Current Assets Value (NCAV) and for short ideas which showcase a significant potential for aggressive or manipulative accounting