COVID has impacted every sector of the economy, but arguably none more so than the airline industry. At its lowest point this year, air travel demand was down 90% YoY.

This week, we hosted Morgan Stanley analysts Ravi Shanker and Kristine Liwag to discuss the path to recovery for airlines and aerospace. They walked us through current supply and demand issues, and their forecast for the future.

For more analysis from Ravi Shanker, Kristine Liwag, and the Morgan Stanley Research team, login to AlphaSense or unlock free trial access. To watch the replay of this briefing, visit the Expert Briefing Series page.

Airline Demand: Where Are We Now?

Shanker is one of the more bullish analysts when it comes to a swift air travel recovery. He expects airline usage to return to pre-COVID levels by the end of 2021 or early 2022–a big jump from the commonly accepted forecast of 2024.

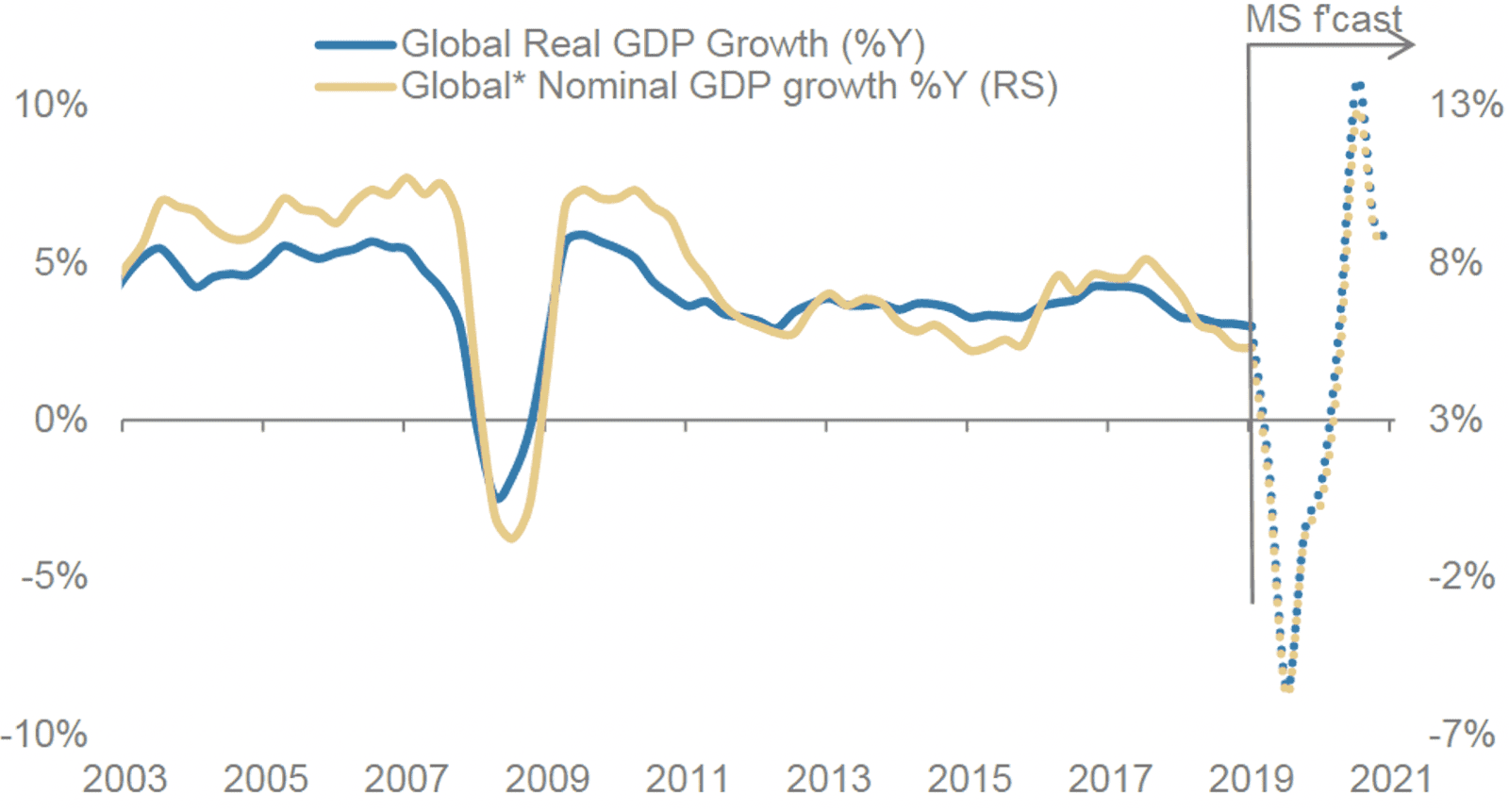

Morgan Stanley’s bullish outlook relies on three pillars of airline recovery: GDP recovery, vaccine availability, and consumer sentiment. Looking at GDP, airline demand has historically been tied to global GDP growth; Shanker forecasts that GDP will recover by the end of this year. This recovery in GDP is predicated on the availability of a vaccine by the first quarter of 2021.

Source: Airlines for America, US DOT

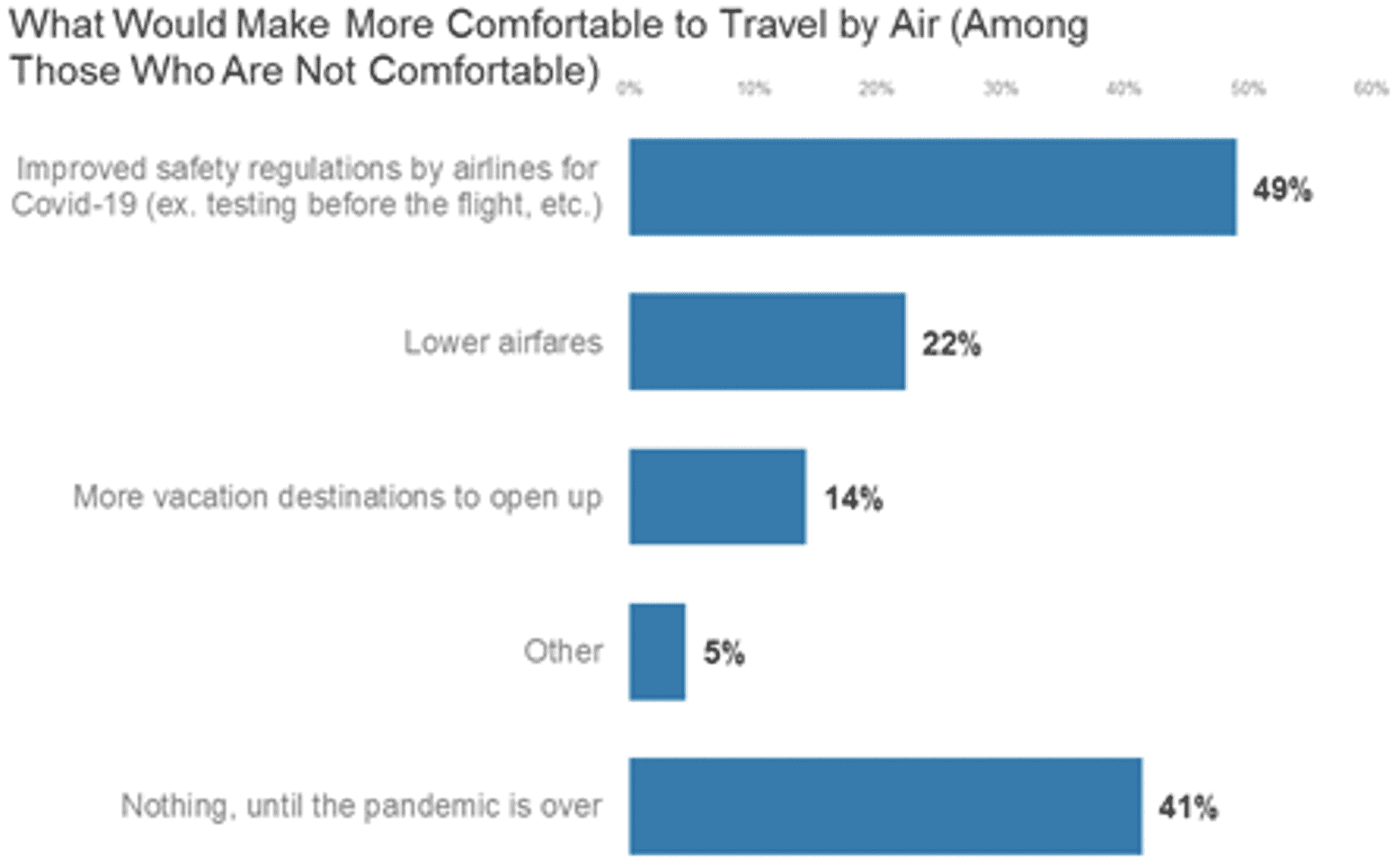

Shanker also noted that consumer surveys have shown that the airline industry is ripe for recovery, with over half of leisure travel respondents saying they would get on a plane today if they felt that it was safe. It is interesting to note that Dela Airlines just announced this week that they have had zero COVID cases transmitted on their flights this year.

As consumers get more comfortable with air travel and less comfortable with virtual interactions, Shanker expects demand for air travel to recover, beginning with domestic leisure travel and followed by business and international travel.

Source: Morgan Stanley Research, Survey Responses

Aerospace Supply: Where Are We Now?

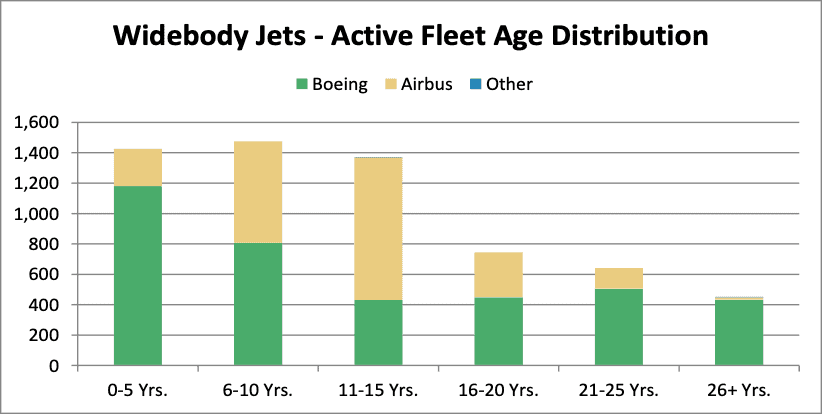

When it comes to supply in the aerospace industry, analyst Kristine Liwag explained Morgan Stanley’s bearish view in their forecasts. Liwag pointed to a couple key reasons for their outlook, namely that a vaccine will not improve the airline industry’s balance sheet overnight, and that the industry currently has a very young fleet.

Liwag noted that there are currently 8,000 aircrafts in storage, which should allow airlines to accommodate a demand recovery without ordering new planes. Even more prescient is the fact that, while the order book is strong for future years, 80% of airline orders are for growth and not replacement. Liwag noted that, in an uncertain environment, one has to wonder how many of those orders will actually get delivered.

Source: Morgan Stanley Research for Commercial Aerospace, Widebody Jets Active Fleet Age Distribution.

How will airline demand and aerospace supply evolve amid COVID? Find out by reading Morgan Stanley research within AlphaSense — log in or unlock free trial access now. To access the full webcast, please explore our Expert Briefing Series.