As COVID-19 continues to spread across the U.S. and unemployment rises, federal economic recovery payments have been distributed throughout the country. On Friday, the Bureau of Economic Analysis reported on the impact of the stimulus, stating a 10.5% increase in personal income in the month of April. However, this increase in income did not offset an acute drop in spending, which plummeted by 13.6% during the month of April. Amidst the hardest hit businesses, restaurants and retailers have been forced to innovate during quarantine, with many shifting their focus to ghost kitchens and dark stores.

Takeaways:

- Amazon entered the food delivery market in India as startup darling, Swiggy, announced dark kitchen closures and lay-offs

- Amrest sees the pandemic as a catalyst towards online food delivery and virtual brands

- sbe, Muscle Maker Grill and FAT Brands announced investments in cloud kitchens

- Global grocery retailers have transitioned spaces into dark stores, with many planning to increase their investment, citing a shift in consumer behavior towards online

AlphaSense can track emerging trends in real-time across the entire market, by industry, or watchlist. We expect this to be an interesting theme to follow as global social distancing measures persist. Start your free trial of AlphaSense now or login to your account.

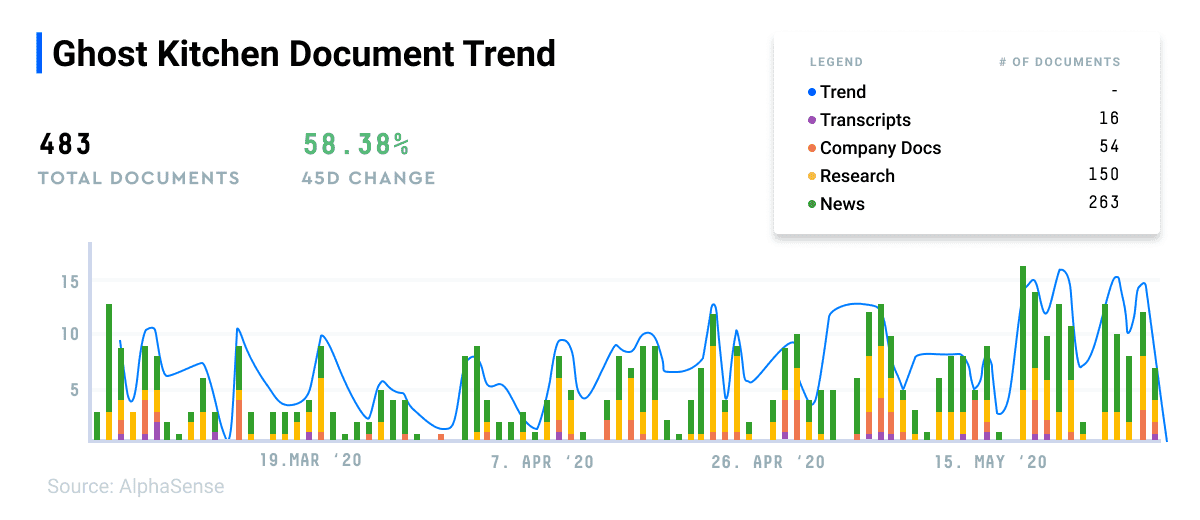

GHOST KITCHENS

Over the past 90 days, the document trend for “ghost” or “cloud” kitchens has increased almost 60%.

Google – TechCrunch – 5/28

Another change aims to address the broader way the pandemic is impacting in-person businesses. Instead of shutting down entirely, many have chosen to pivot and go virtual. Restaurants have turned themselves into virtual kitchens, for example. Yoga studios have begun streaming classes online.

In the next few weeks, merchants who are verified through Google My Business will be able to alert their customers that they’re operating in a new capacity by adding to their profiles attributes like “online classes,” “online appointments” and “online estimates.” These will display in both Search and Maps, Google says.

Q1 2020 Welbilt Inc Earnings Call – 5/22

One of the outcomes of this crisis is likely to be an increased focus on ghost kitchens. Today, as a result of the pandemic, nearly every restaurant has been transformed into a ghost kitchen. The number of ghost kitchens in the U.S. is expected to increase between 5 to 10x by 2024 compared to today and Welbilt is seen as a leader in modular design, menu management, integration with apps, speed cooking and mobility.

As the industry resets, more companies may decide to eliminate the dining room altogether to capitalize on longer-term off-premise trends. Also important to the operators of these ghost kitchens is having both hot and cold equipment that have common connectivity. We are actively increasing our focus on this important and growing market segment opportunity to establish Welbilt as the preferred supplier to ghost kitchens.

Amazon – TechCrunch – 5/21

“Customers have been telling us for some time that they would like to order prepared meals on Amazon in addition to shopping for all other essentials. This is particularly relevant in present times as they stay home safe,” an Amazon spokesperson told TechCrunch.

“We also recognize that local businesses need all the help they can get. We are launching Amazon Food in select Bangalore pin codes allowing customers to order from handpicked local restaurants and cloud kitchens that pass our high hygiene certification bar. We are adhering to the highest standards of safety to ensure our customers remain safe while having a delightful experience,” the spokesperson added.

Swiggy – HT Media – 5/18

The company said it has already shut several of its cloud kitchens – facilities that only cater to takeaway orders – temporarily or permanently.

“The biggest impact here is on the Cloud kitchens business, with many unknowns about volumes through the year. Since the onset of COVID-19, we have already begun the process of shutting down our kitchen facilities temporarily or permanently, depending on their outlook and profitability profile,” Majety told the employees.

Q1 2020 Amrest Holdings SE Earnings Presentation – 5/18

So we do know that the world will change, though, certainly post-COVID. Customer behavior has already shifted. And we think a lot of those lags will be here to stay. We were talking to China. China was going through something similar and seeing that their customer behavior has changed. So we do see that this will be — the crisis will be certainly a catalyst for us. And probably we’ll fast forward some of the trends earlier than what we thought. Certainly, we’ve seen an acceleration towards online food delivery. It was something we were well set up for with our portfolio of brands. And also around our shadow kitchen initiative and virtual brands, we believe we’re well positioned to handle this. In fact, our virtual brands that we mentioned — that we started at the end of last year, we’ve actually tripled the number of transactions, and we had to open up a second kitchen using somebody else’s restaurant to be able to handle that. So we see virtual brands as a way to go in the future and also the shadow kitchen initiative for us is still something we think is very important, especially with delivery being a focus for our customers.

Q1 2020 Wingstop Inc Earnings Call – 5/6

Answer – Charles R. Morrison: Well, many of those types of venues, notably the sporting, the sports stadiums, the casinos, malls, places like that have been closed down. So those — that’s where we’re experiencing actually restaurants that had to close because of this temporarily. However, it does reinforce our thinking around dark kitchens or cloud kitchens, as they’re called in some cases. And we’ve already been heading down that path, and we consider that a nontraditional location, but it certainly helps to confirm our thinking that restaurants without seats can be easily deployed in the Wingstop system and with great results. I’ve mentioned earlier, but we already have one in the U.K. That’s doing well. We have some planned here in the U.S. So a little more color on that will come in future calls. But we are excited about the opportunity of formats that have fewer seats.

Muscle Maker Grill, Inc. – PR – 5/6

Burleson, Texas, May 06, 2020 (GLOBE NEWSWIRE) — Muscle Maker Grill, Inc. (Nasdaq: GRIL) the parent company of Muscle Maker Grill & Healthy Joe’s, a fast-casual concept known for serving “healthier for you” meals, today announced that it has begun the construction phase at two of its five new delivery-only ghost kitchens to open in the downtown Chicago market. Both of the new delivery-only ghost kitchens are slated to open in early summer with the remaining three Chicago locations to follow soon after. The kitchens will feature menu items from both Muscle Maker Grill and Healthy Joe’s, a new brand that showcases oven toasted subs, hot topped salads and bowls. Healthy Joe’s fast-casual restaurant launched in Tribeca in November of 2019.

Food delivery has grown into a significant industry and management expects the growth to continue as restaurants pivot in response to the COVID-19 pandemic and the popularity of delivery-only ghost kitchens. Muscle Maker Grill signed a ten-location agreement with a major delivery-only kitchen provider earlier this year, prior to the COVID-19 outbreak. The Company intends to increase its delivery-only ghost kitchen footprint in key major metropolitan markets as part of its non-traditional growth plans. The low cost of entry, reduced overhead, and quick buildouts are key factors in Muscle Maker’s strategy to open these non-traditional locations. In addition to ghost kitchens, non-traditional opportunities for the brand include colleges, military bases, airports and medical centers. Muscle Maker recently opened its sixth military location at Camp Elmore in March

FAT Brands – PR – 4/23

Chicago, April 23, 2020 (GLOBE NEWSWIRE) — NASDAQ: FAT. FAT (Fresh. Authentic. Tasty.) Brands Inc. (“FAT Brands” or the “Company”), parent company of Fatburger, Buffalo’s Cafe, Buffalo’s Express, Hurricane Grill & Wings, Ponderosa & Bonanza Steakhouses, Elevation Burger, and Yalla Mediterranean, today announced the Grand Opening of their first ghost kitchen, a delivery-only outlet, in Chicago.

“During a time of uncertainty in the restaurant space, ghost kitchens provide effective solutions for both restaurant owners and customers.” said Andy Wiederhorn, CEO of FAT Brands Inc. “Our franchisees currently operate over 20 virtual restaurants and we are confident that this new concept will serve as an additional way to service our customers.”

FAT Brands’ virtual restaurants differ from ghost kitchens in that they operate out of existing physical restaurant locations and provide a separate menu offered only via third-party delivery service providers. Ghost kitchens on the other hand, only prepare food for delivery and are not open to customers.

sbe – PR – 4/15

MIAMI, April 15, 2020 /PRNewswire/ — Sam Nazarian, Founder and CEO of sbe, the leading lifestyle hospitality company that develops, manages and operates award-winning global brands, today announced that recruitment has begun for 1,000 newly-created positions across the country for sbe‘s C3 (Creating Culinary Communities) subsidiary. As part of the opening of [food halls] and 138 ghost kitchens before the end of the year, C3 is hiring across the entire organization, including digital marketing, accounting, finance, development, construction, operations, and other functions in New York City, Los Angeles, Las Vegas, Miami, and San Francisco, with 50% of the positions in the greater Los Angeles area. These roles are part of a larger strategic plan for C3 that includes hiring up to 3,000 employees by the end of 2021 to meet the surging demand for food delivery services and provide employment support to the many communities in which it operates.

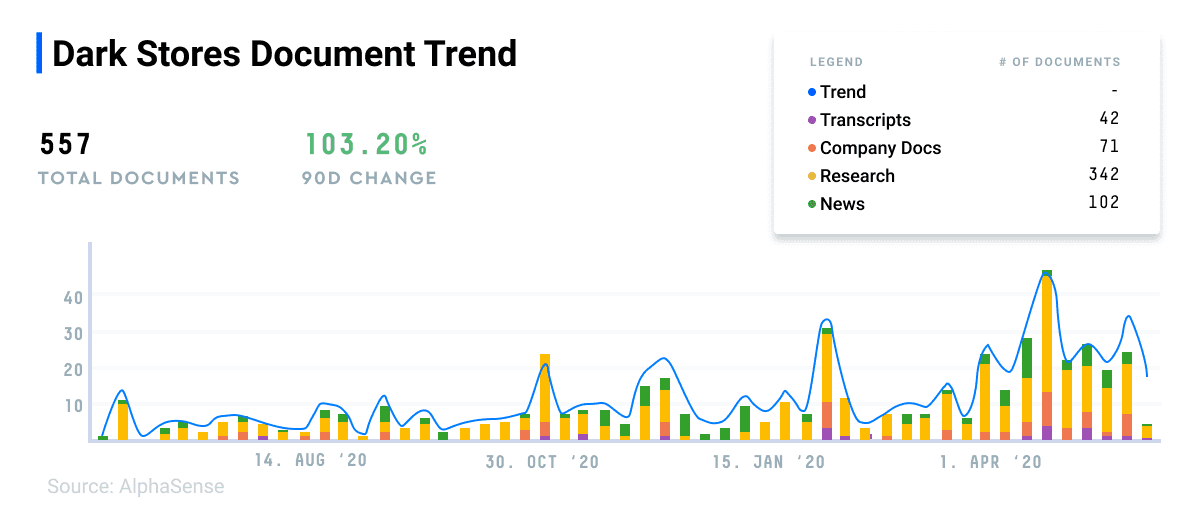

DARK STORES

Over the past 90 days, the document trend for “dark” stores has increased over 100%.

Wesfarmers Ltd Kmart Group Update and Expected FY20 Significant Items Presentation – 5/22

Answer – Robert G. Scott: Yes. I mean, to a degree, that was a necessity because of the spike in volume that we had. And also, we had reduced transactions in a number of stores over the — if you like, the peak of the coronavirus period in April. So that was why we decided to do the 3 dark stores as picking only to help us pick faster. And frankly, we didn’t have the foot traffic coming through those stores at the time. As things return to normal, I think the dark stores probably — there are options where we have a really underperforming store and we have a lease that’s left available. Outside of that, it’s a relatively expensive picking space. So I’d say it’s one of those tactical moves we’ll use from time to time, but I’m not sure it’s the long-term solution for picking for online.

X5 Retail Group NV To Discuss The Results, Strategy Update & Other Developments Relating To The Company’s Online Businesses Call – 5/20

You can see that our business model is about the assembly of the dark store. What is — basically, they are distribution centers 15,000 to 20,000 square meters, and we get orders from the app, from the website, then what happens. We have a certain area for the delivery. And then in the dark store, we have a picker and the pick range is quite high. And then the courier is sent to the client. And this is the most efficient both for the stocking up. And this is good because it ensures high efficiency of assembly and shipping, which is our duty at operating supermarket. And here, you can see what our dark stores look like. It’s similar to what you can find elsewhere. You can see that it is highly automated, and we have all the high automation systems with high availability and quality.

Q1 2020 Almacenes Exito SA Earnings Call – 5/18

So we are going to invest in that, in technology, in logistics, in people, in dark stores, in our relationship with Rappi, our partner, et cetera. So that’s the big, big, big priority that we are having today, and that has to happen very rapidly.

Q1 2020 InRetail Peru Corp Earnings Call – 5/18

But probably, people that started trying e-commerce will feel comfortable to continue supporting the significantly increasing trends in e-commerce after lockdowns end going forward. So that’s why we do intend to accelerate our capacities across the board. And that’s why we’re developing the logistics capacities we discussed previously in many distribution centers, additional dark stores and improving UX, UI, the checkouts in our e-commerce stages and so on in order to be able to multiply by 2 to 3x the sales of — the digital sales of our pharma formats as well.

Q1 2020 Distribuidora Internacional de Alimentacion SA Earnings Call – 5/18

Looking first at the short term. Our new operating model will be critical in ensuring we deliver a country-by-country rather than a top-down group approach. The corporate center will support and facilitate country response with a focus on ensuring information and best practice sharing across markets. In Spain, our improved operational capabilities allowed us to tactically increase online ordering capacity to meet customer demand during the lockdown, opening 13 new dark stores and taking on an additional 2,200 staff members.

Q1 2020 Brixmor Property Group Inc Earnings Call – 5/8

Answer – James M. Taylor: Yes. I think that the curbside pickup and delivery is something that’s here to stay. I think that the consumer adoption of it has been incredibly strong. And I think it’s also a profitable format for the grocers because the customer still carries the cost of the last mile. I think what the grocers have seen is also that their average basket sizes have increased markedly. So I think that you will see, to what you were alluding to, some of the store formats begin to change a little bit and also, the grocers looking at their footprints and designating more space within those footprints for micro-fulfillment.

Where I think we stand very well to benefit from that trend is both our relationships and market share with some of the grocers who are leading in that area, but also the low rent basis that we have and the flexibility, generally speaking, that we have in the format itself to accommodate those changes. I think that the other thing that this disruption has pointed out is actually the importance of the proximity to the customer, and flaws in the overall logistics pipeline that really get dealt with when you’re able to have a significant amount of inventory near where the customer is. So I think all of those things are going to accelerate some of the changes in the grocer format. I think we stand pretty well positioned, given our relationships with the grocers and importantly, given our low rent basis and the flexible nature of our assets.

Halfords Group PLC – PR – 5/6

As a provider of essential products and services to the UK public, we have remained open during the lockdown period. We currently have 325 retail stores open on a dark-store basis, where serving customers from the front of the store ensures our colleagues can operate in safe working conditions. We also have 346 garages open and 77 mobile vans operating. We have implemented additional safety measures across all sites to protect both our colleagues and our customers.

Q1 2020 Delivery Hero SE Earnings Call – 4/28

We are very happy with the dark stores that we’ve been launching. And I do think that our focus — and of course, every company have their focus, and I think that’s the right thing. We have our focus to deliver an amazing experience fast and easy to the door. We think that is a large enough focus, but not — but it is a focus. I think some players have a focus of doing everything. I think that’s very tough. And I think they are not very synergistic to do — driving people and delivering items. So therefore, we think that’s a way too big focus, and then other players are focusing only on food. Everyone is taking their own approach. Our belief is and our mission is what makes sense for us, and we believe that our customers are going to value us more over that

Q1 2020 Axfood AB Earnings Call – 4/28

So I would like to comment on our supply chain and the exciting plans we have here for the future. We continue to make good progress with our new automated logistics center outside Stockholm. As you can see on the picture, the groundwork is almost finished, and the overall project continue according to plan. We have now also signed a service agreement with WITRON to secure full functionality of this large facility. And in the quarter, we have integrated also our dark store operation in Gothenburg to cover also volumes from Hemköp and Willys together with Mat.se. And we also signed an agreement in Stockholm to double the warehouse space for our dark stores to secure the additional capacity that we clearly see a need of, particularly now in this quarter.

Full Year 2020 Seven & i Holdings Co Ltd Earnings Call – 4/10

While in-store sales have struggled, we have observed a change in the shopping habits of customers staying at home during this outbreak. The graph shows approximate year-on-year changes in mail order and delivery sales. We registered a significant increase in customers purchasing everyday necessities in bulk over the Internet and an increase in meal kit purchases. Seven Net Shopping registered an increase primarily in book and game sales, et cetera, from customers staying home. Regarding Ito-Yokado Net supermarket, we apologize for any delays in fulfilling customer orders. We have been able to fulfill nearly 100% of customer orders at Dark Store Nishi-Nippori which registered a year-on-year sales increase of 2.4% in February and 7.1% in March. We registered growth in meal kits, retort pouched foods and frequent used products. The e-depart store, Sogo & Seibu’s online shopping site, also continued earning our customers’ support and showed growth in cosmetics sales. Sales were up 0.1% year-on-year in February and 6.9% in March. The loft also saw sales growth in cosmetics, cooking appliances, et cetera. Akachan Honpo saw sales growth in disposable diapers, disposable wipes and milk and weaned foods. While this information cannot be found in the slides, Seven-Eleven Japan offers a net convenience store service in the Hokkaido and Hiroshima regions. This service has also shown very significant sales growth, and so has the 7NOW delivery service offered by 7-Eleven, Inc. which we offer at approximately 1,000 stores in urban areas in the United States. Delivery volume has increased between 50% and 100% to an average of 18 deliveries per store per day. We believe this outbreak will have a drastic and permanent effect on shopping habits, and we believe there is a need for businesses to anticipate and adapt to the type of changes I have just mentioned. We will promptly carry out a number of tests starting with last-mile initiatives and devise a management plan allowing the Seven & i Group to retain the support of our customers. The details for this plan will be announced in a timely manner.