Last week, AlphaSense sat down with Ricky Goldwasser, US Healthcare Services Analyst at Morgan Stanley, to discuss how digital services such as telehealth and telemedicine will transform healthcare.

The COVID crisis, being a public health care crisis, exposed flaws and weaknesses in the healthcare system that have forced institutions to change the way that they operate. And the National Healthcare Emergency altered the behavior of regulators, governments, hospitals, suppliers, healthcare providers, and also individuals. The most profound change is in regulation.

Since the beginning of COVID, analysts have noted unprecedented flexibility to meet urgent needs. CMS has shown remarkable flexibility–from changing telehealth reimbursement to expanding frontline workers’ role, while the FDA has been accelerating diagnostics’ approval. These new regulations could accelerate new business models and pave the way for tech entrance.

Before COVID, telehealth reimbursement was in the low-to-single digits. According to surveys, almost 84% of virtual care patients used telehealth for the first time in March. Physicians before COVID were set in their ways and very skeptical–there were inconsistent reimbursement models, an inability to practice medicine across state lines, and lack of easy-to-use technology that’s HIPAA-compliant.

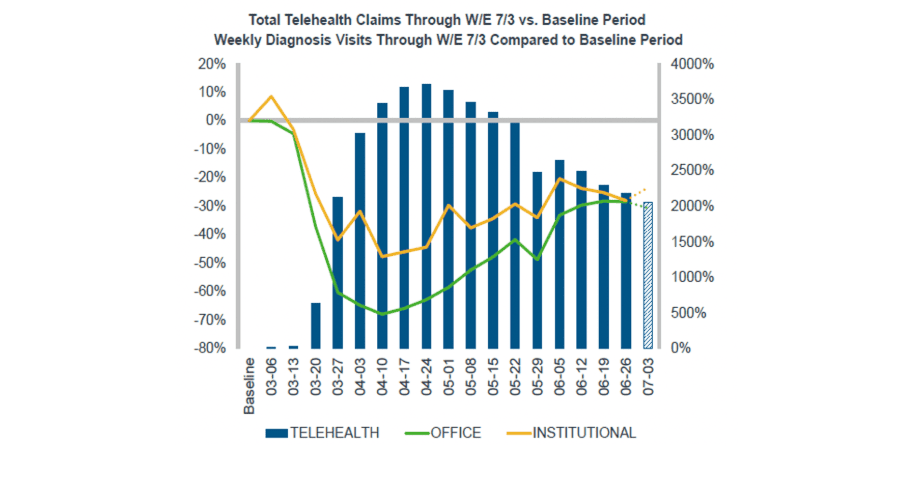

Source: IMS Data, IQVIA data: Telehealth Adoption Surged in April/May Normalizing in June to-date

On the reimbursement side, by mid-March, CMS expanded Medicare telehealth coverage to be reimbursed under the physician fee schedule, at the same amount as in-person services. Reimbursements or payments doubled from $15 for virtual check-in, to as much as $76, which is in line with physician visits. By the end of March, Medicare added 85 services that can be provided via telehealth, so they expanded the scope, as well as the reimbursement, and they also, in March, allowed doctors to care for patients across state lines via phone, radio or online communication, without having to be physically present.

COVID provided an opening for telehealth to become a part of the standard of care, becoming a standard feature of the electronic medical record when we go to a more normalized environment. So, in the past, telehealth was viewed as an urgent care solution, a transaction, in the future, telehealth is becoming, or currently, and in the future, telehealth will become more integrated into the workflow, starting with primary care, and then with opportunities to expand into adjacencies.

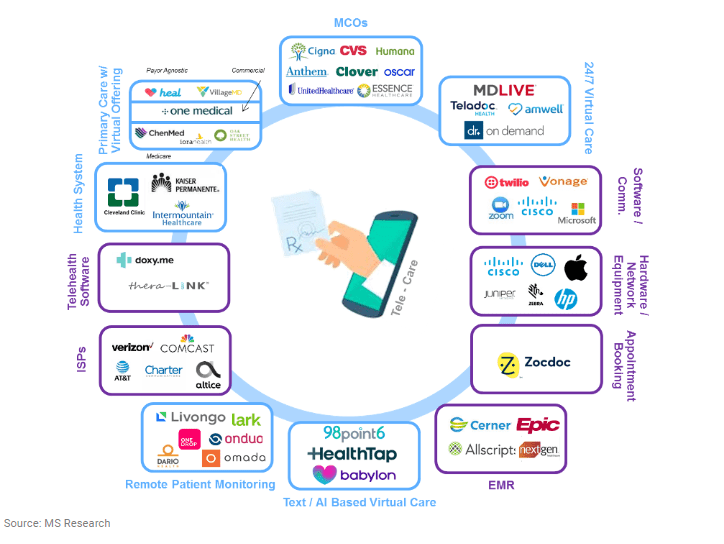

Telehealth providers who currently do not have access to the workflow, or to patients’ medical records, or are not part of the growing evolution to telehealth could be marginalized over time. Becoming an integrated part of the healthcare system expands the number of participants and opportunities, as the market evolves from a business model that’s centered on urgent care, to a digital marketplace.

Broader, longer-term implications are most profound around the managed care area, where the use of telehealth can help direct how members get care in select networks, and over time resulting in lower health care costs and even lower premiums.

Goldwasser also covered limiting factors for healthcare in a post-Covid world. To read the full report (or to read more Morgan Stanley research) login to AlphaSense, or start a free trial. To access the full webcast, please explore our Expert Briefing Series.