Later this year, Disney will launch its streaming service, Disney+, a prime competitor to the incumbent streaming service leader, Netflix.

As cord-cutting continues unabated and classic TV models are now under pressure, Disney sees the need to catch up and enter the streaming market properly. And with Disney’s latest move to take over operational control of Hulu, they seem to be picking up speed.

Due to Netflix’s overwhelming popularity and international reach, it is obvious that Disney doesn’t want to arrive with just a metaphorical knife to what is already a relatively heated gunfight. And it’s not just Netflix – Amazon Prime and others also want to have a say in the growing market.

Ultimately, Disney’s massive $71 billion acquisition of 21st Century Fox is what really counts here. Disney is acquiring film franchises such as X-Men, Deadpool, and Avatar. Disney’s TV presence will also increase.

Disney has a strong vertical position in the market, and the amount of new content the company will control after the acquisition is going to help when launching its new streaming service. The effect of the Disney acquisition is also material. Disney/Fox was projected to control 40 percent of all box offices in mid-2018.

Netflix vs. Disney: A side-by-side comparison

While Netflix has been busy building up its own content library and acting as a studio of sorts as it outspends its streaming rivals, Disney has a significant head start here and more so with the acquisition.

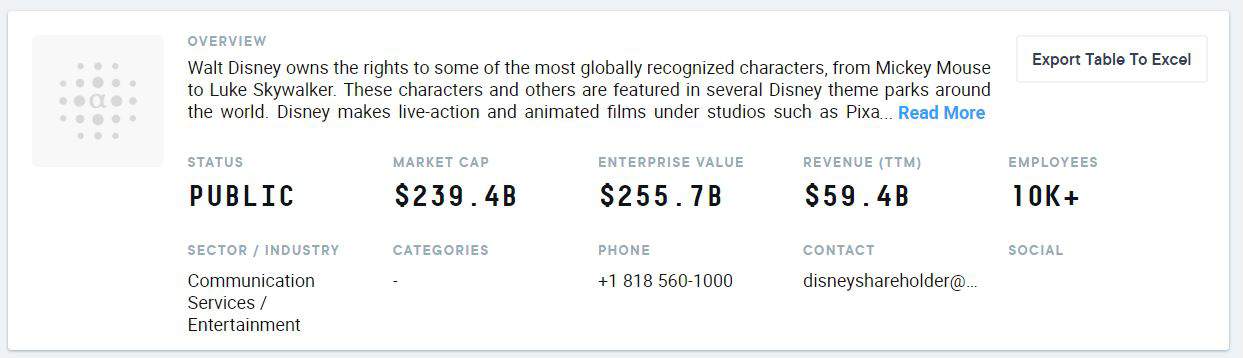

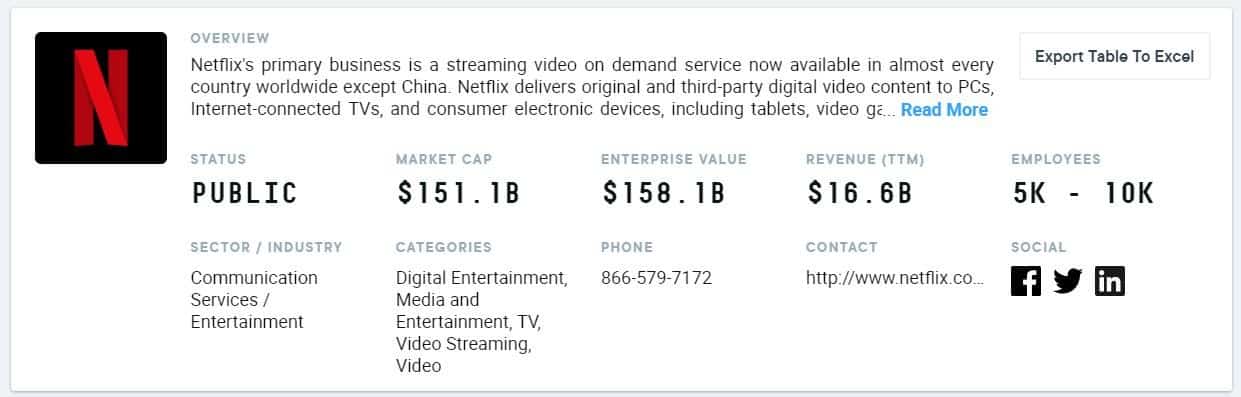

Financially, Netflix is also nowhere near Disney, which is an EBITDA (and FCF) behemoth, as can be seen using AlphaSense below:

While the two companies now have comparable enterprise value, the cash flow generation is light-years apart. This could prove costly to Netflix if Disney is able to starve other services of its premium content. Disney already announced that it will alter licensing agreements with Netflix, which could put pressure on Netflix to further spend on original content.

If we agree that we are now in the late-stage of a bull cycle, Netflix financing could become a potent question. On the other hand, Netflix might have an advantage over Disney in terms of focus and flexibility.

Competition heats up

The bottom line is whether Disney will be able to eat into the Netflix subscriber base. Disney can only call their new venture a success if they put pressure on subscriber growth of other streaming services, like Disney+ and Hulu.

In any case, it is interesting to see that yet another new technology (streaming) is slowly succumbing to old business models. Whether Disney will dwarf Netflix or not, streaming services are now becoming your regular TV stations among which consumers decide what ‘channel’ they want to watch. The old king (TV) is dead – long live streaming.

Jan Svenda is an independent equity analyst focused on the U.S. Small/Micro-cap space. He searches for long ideas trading around Net Current Assets Value (NCAV) and for short ideas which showcase a significant potential for aggressive or manipulative accounting.