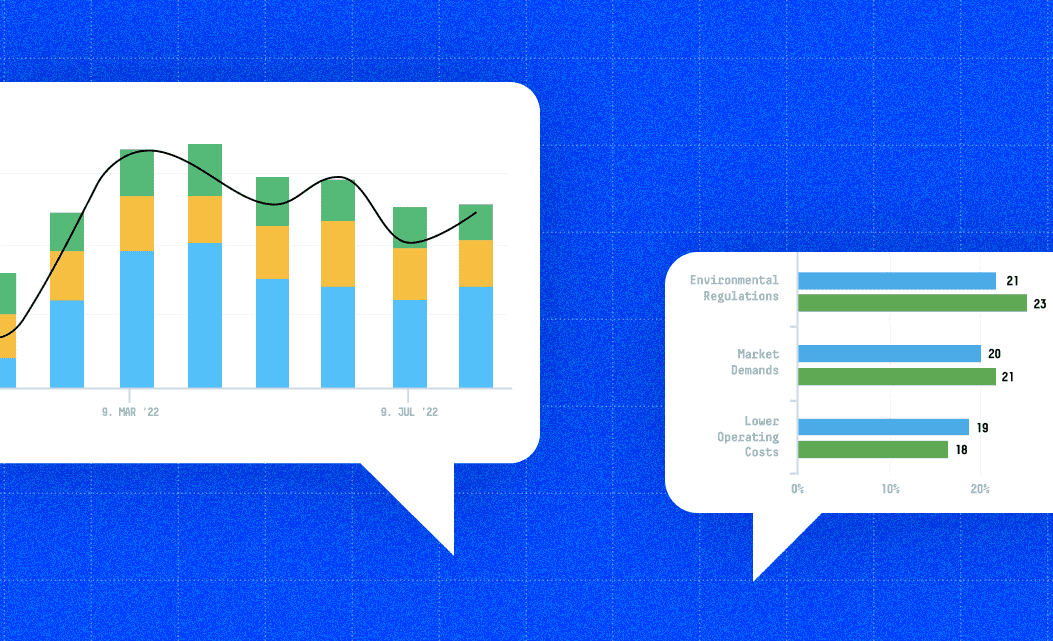

Despite the anxieties of the market, Q2 earnings season has turned out better than anticipated.

The number of companies that beat their Q2 consensus estimate lingered on the lower side relative to what we’ve historically seen in recent seasons, particularly during the pandemic. But despite falling short, the beats percentages are within the historical range, albeit towards the lower end of the spectrum.

Most importantly, the fear of negative guidance has yet to come to life. While a handful of companies guided lower, most of them either reiterated guidance or raised their outlook. In terms of revisions, Q3 estimates have come down but not in a way that is necessarily indicative of any major economic downturns.

In order to get a grip on the overarching trends and themes that prevailed over the Q2 2022 earnings season, we combed through hundreds of transcripts within the AlphaSense platform. By analyzing earning calls, quarterly reports, and other valuable company documents, we found five macrotrends that get to the heart of what major companies were facing this quarter and how they plan to handle these challenges.

Related Reading: How to Prepare for Earnings Season with Artificial Intelligence

Inflation

The U.S. government reported in June that consumer prices climbed a whopping 8.6 percent from the start of the year through May – the fastest rate of increase in decades. While consumers are facing the reality of food, fuel,and housing price increases, companies spent Q2 earnings calls grasping for solutions to inflation, forecasting how long this period might last, and what can be done to resolve it, both in the short-term and long-term.

As increased consumer demand heightens existing supply shortages, it is difficult to predict how long the price surge will remain. One thing is certain: the main way to combat it is through interest rate increases, cooling inflation via slowing the economy. But despite having a potential solution in sight, companies are feeling the anxiety of imminent inflation.

The big uncertainty, underlying uncertainty is inflation and what will the central banks do to control inflation. So that’s the second order impact of that. And because both those things are quite uncertain, the subsequent effect of that on — do you get a — right now, the market is split on whether you get a deep recession or you get high inflation. I mean, those are extremes, right?

– DBS Group Holdings Ltd | Q2 2022 Earnings Call

And while many companies are bracing for the potential pitfalls of inflation, many companies feel confident in their level of industry resilience, most notably those in the Consumer Staples Food & Staples Retailing industries.

Second, regarding inflation, we continue to work with our customers to pass through the majority of cost inflation. Interestingly, the relative price of eating out has been less impacted by inflation than the cost of food at the grocery store… When coupled with people’s desire to eat out, we believe that restaurants will once again prove resilient.

– Sysco Corporation | Q2 2022 Earnings Call

The primary driver of the phasing of our second half result is the timing relationship between pricing and inflation. You will recall that inflation in quarter 1 was 15%, which advanced to more than 17% in quarter 2. We expect inflation to be even higher in quarter 3, largely driven by our green coffee positions.

Because we are getting the benefit of more pricing in our quarter 3 P&L, we expect to offset this incremental inflation to deliver EPS growth for the quarter. In quarter 4, we expect the rate of inflation versus the prior year to be roughly half the rate of quarter 3.

As a reminder, we will be lapping the significant spike in inflation we experienced in quarter 4 last year, and we will realize the full benefits of pricing already taken, which will enable us to offset inflation and deliver margin improvement in the fourth quarter.

– Keurig Dr Pepper Inc. | Q2 2022 Earnings Call

Labor Shortages

Throughout hundreds of Q2 earnings transcripts, labor, in a variety of capacities, is an overwhelming concern. Between higher wages, labor shortages, and plans to increase retention, companies have this macrotrend at the top of their priority lists.

And while labor cropped up as a pillar of Q2 earnings concerns, the reasons for its significance looks different cross-industry. Though COVID-19 is certainly one of the major reasons millions of people left their positions and never plan to return to in-office work environments again, there’s also been a massive shift in values leading to The Great Resignation. Workers are reconsidering their careers, how much they are paid and the flexibility they hold in their position, leading some to start their own businesses and even retire early.

Beyond a shift in worker values, immigration restrictions brought on by the virus exacerbated the growing labor shortage in the US, with the Census Bureau projecting one million new immigrants a year to below 300,000 in 2022.

Starting with the headwinds… The unprecedented labor situation has been the most challenging headwind to date as many different aspects contribute to the dynamic problem. We continue to experience staff shortages, with open positions for our clinic staff increasing from around 7,000 to over 8,000 at the end of the second quarter.

While we continue to deploy many strategies for recruiting, this compounds our training costs. And we are experiencing a significantly higher-than-normal staff turnover rate for those new hires, and this is adding to the churn. We are mitigating the resulting shortage wherever possible with either available contract labor, which comes at substantially higher rates, or internally by deploying overtime and additional shifts that also comes with a premium and adds to the strain on existing employees.

Scarcity of available labor and higher wage inflation is adding to our wage compression, along with sign-on bonuses.

– Fresenius Medical Care AG & Co. KGaA | Q2 2022 Earnings Transcript

And lastly, and perhaps most importantly, the availability of skilled labor is a real challenge across multiple industries right now. And we’re seeing it both at our suppliers and within our own shops. It takes time to hire and train new employees. It doesn’t just happen overnight, especially in certain areas such as much of our classified work.

– Raytheon Technologies Corporation | Q2 2022 Earnings Transcript

Labor costs for the quarter were 24.8%, an increase of about 30 basis points from last year. This increase was driven by our decision to take a meaningful step-up in wages last May, which is partially offset by menu price increases. In Q3, we expect our labor costs to be about 25% due to leverage from our menu price increases offsetting pockets of wage pressures across the country.

– Chipotle Mexican Grill Inc. | Q2 2022 Earnings Transcript

Tourism

Travel and tourism are officially back in business. In 2020, COVID-19’s financial impact on the tourism industry was substantial due to the restrictions airlines and certain countries placed on foregin visitors. According to a United Nations World Travelism Organization report, international tourist arrivals more than “doubled (+130%) in January 2022 compared to 2021 – the 18 million more visitors recorded worldwide in the first month of this year equals the total increase for the whole of 2021.” As people get back into the swing of travel again, it is unsurprising that hotels and vacation rentals are reporting accelerated growth in reservations and revenue.

Now early in Q2, strong guest demand exceeded our expectations. This is because guests in Europe and North America booked earlier than they have historically. Now given this earlier booking, growth rates compared to last year decelerated in May and June. And since the end of Q2, what we’ve seen is growth in nights booked reaccelerate from June to July as we enter peak travel season.

Second, guests continue to return to cities and cross borders. In previous quarters, we’ve talked about how we saw significant growth driven by surges in domestic travel as well as travel to rural destinations. Now these trends continue. But we’re also seeing guests returning to cities and crossing borders above pre-pandemic levels.

– Airbnb, Inc. | Q2 2022 Earnings Call

Let me begin by saying that we were very pleased with our financial results in the quarter on the back of a continued recovery in all markets and products and our expanding margins. We’ve seen strong consumer demand for travel this summer and are encouraged that travel remains a top spending area even as other parts of the economy seem to be showing cracks.

We posted our highest ever lodging bookings this quarter on the highest revenue and adjusted EBITDA for any second quarter. And we continue to further strengthen our liquidity with a strong free cash flow and the early redemption of an additional $1 billion of debt. We delivered these strong results despite the current macroeconomic backdrop and the limitations and disruptions we’ve seen in air travel around the world.

– Expedia Group, Inc. | Q2 2022 Earnings Call

Speaking of the air travel disruptions mentioned in the above Expedia Group earnings transcript, transportation for travel, specifically air travel, experienced the lowest levels of demands since the 1950s–forcing airlines to ground planes indefinitely and cut down on their crew sizes. To add salt to the wound, airlines are struggling to find or retain workers due to demands of higher pay–salary and shortage of talent being industry issues that existed before the pandemic. The conflict has resulted in thousands of canceled flights and protests from airline pilots.

And just a couple more thoughts on hiring and training. As travel demand began to rebound last year, our first step was to rebuild and restart our hiring machine, and we had staffing shortages and bottlenecks throughout the organization from recruiters to the front line to supporting positions… The majority of these hires will be to cover our published schedules and capacity plans this year, but we also intend to build some buffer so that we’re ready to resume growth in the near future, and then get ahead of our spring and summer of 2023 staffing needs with a more seasoned workforce.

We’re still being impacted by COVID illnesses and a higher level of inactive employees. Our sick rates are still elevated in some of our work groups. So we believe that it’s just prudent to build some staffing cushion and buffer in the aviation environment that we all find ourselves in. And none of that is unique to Southwest.

– Southwest Airlines Co. | Q2 2022 Earnings Call

The industry worldwide is facing unprecedented operating challenges as it emerges from pandemic-related restrictions. In Canada, we have gone from a near 2-year shutdown of air travel back to capacity levels close to 80% of 2019. We prepared well ahead of 2022 for a surge in travel demand. We prudently planned and adjusted our capacity as the summer approached. As much as we shared our customers’ excitement to see them return to air travel, in the face of surging demand we might have otherwise tried to capture, we stuck to our plan and managed our schedule conservatively. But despite all the planning, the increased traffic has created difficulties for all participants in the air transport system, a situation that we’re seeing around the globe.

– Air Canada | Q2 2022 Earnings Call

Russia-Ukraine War

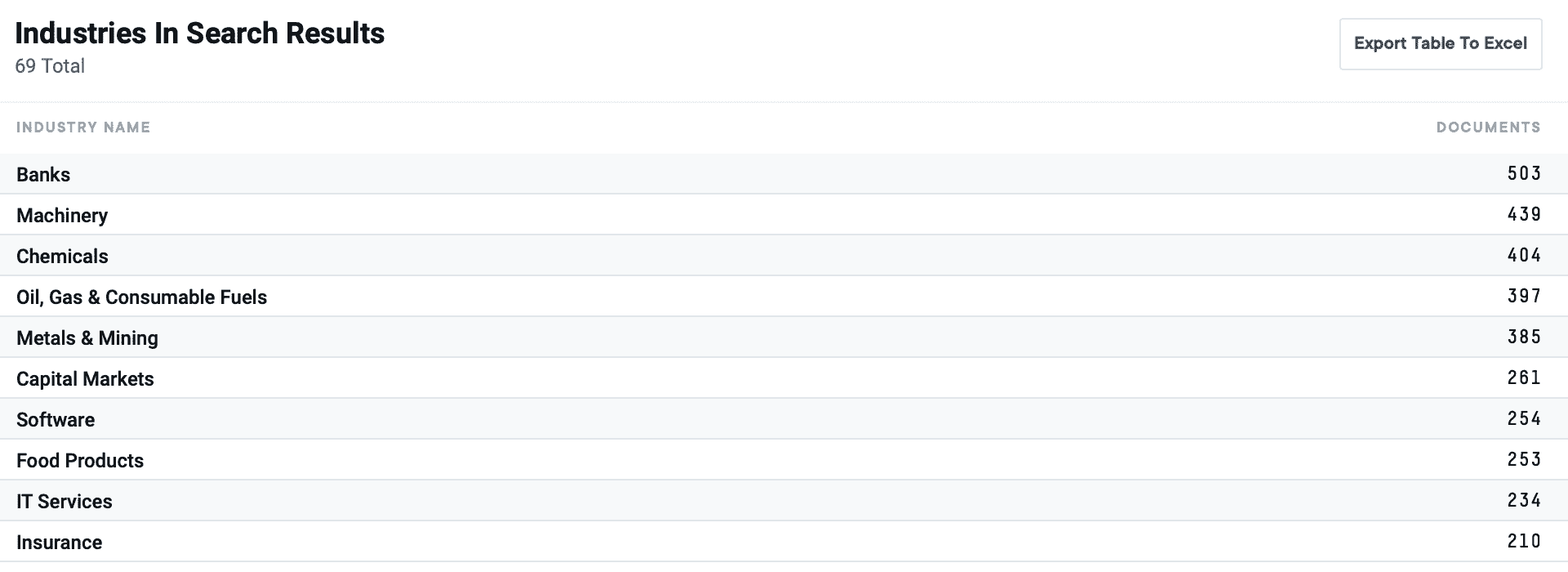

With the Russian invasion of and aggression towards Ukraine having little end in sight, companies across virtually every industry have skin in the game with concerns. Among those that mentioned the conflict, the top three are: banks, machinery, and chemicals.

Banks are keeping a close eye on the conflict between Russia and Ukraine and preparing for potential economic sanctions or cyberattacks.

As we have started this year with a hope that the pandemic would fade away and countries would gradually open up, service activity would kick into the growth alongside with manufacturing activity, yet I think has changed dramatically since February 24 when Russia and Ukraine war started.

And actually, there are 2 main messages in my talk today. First, the global economy is facing with the major headwinds of Russia and Ukraine war and potential more aggressive policy tightening in advanced economies. This would limit upside growth going forward.

– The Siam Commercial Bank Public Company Limited | Q2 2022 Earnings Call

Nevertheless, we did have a serious IT incident in Sweden that affected our customers. To make sure this does not happen again, we are improving our IT change management. The geopolitical situation has raised the cyber threat level in all our 4 home markets. We are cooperating with relevant authorities and are allocating extensive resources to keep our systems resilient and resistant.

– Swedbank AB | H1 2022 Earnings Call

Ukraine and Russia are large-scale exporters of goods central to the global economy, and the ongoing warfare has already derailed supply chains for major industries. Essential commodities that many sectors rely on are no longer guaranteed, forcing suppliers to reconsider how they can acquire the supplies they need to meet their end users’ demands.

As the strain on materials continues to grow in this conflict, the monetary deficit brought on by this shortage will inevitably induce a financial crisis not only for Ukraine and Russia but global manufacturers and distributors.

This has been a year of extraordinary supply chain challenges and input cost inflation. The situation was difficult before but the war in Ukraine brought this to a whole new and unforeseen level.

– Nestlé S.A. | H1 2022 Earnings Call

Energy

There are a few industries that have proven to be catalysts for positive reporting during this earnings season but one stands out among the rest: the energy sector. The energy sector is one of the only two sectors in the S&P 500 with stock price gains year-to-date.

According to Zack’s Investment Research, estimates have gone up for the energy sector. This positive revision trend is par for the course, as the energy industry benefits from the Russian-Ukrainian war, pushing demand for and interest in energy solutions all around the world. And while the future of the Energy Industry is uncertain, companies are reporting largely positive remarks.

Pembina continues to observe steady volume growth on key systems and a positive outlook for additional future growth is being informed by a number of factors, including the sound financial position of Pembina’s customers, price strength across all commodities in Pembina’s value chain, the quality of the WCSB formations, such as the Montney and the Duvernay, the development of LNG facilities on Western Canada’s West Coast, the expansion of the Trans Mountain pipeline and potential growth and diversification within Alberta’s petrochemical sector.

Overall, Pembina’s outlook for meaningful medium-term volume growth in the WCSB remains unaltered and is being supported by customer commitments and contracting success and is materializing in prospective future growth projects.

– Pembina Pipeline Corporation | Q2 2022 Earnings Call

Our second quarter operational and financial results were very strong. While the market has clearly been a factor, our results reflect our focus on the fundamentals as well as plans and investments we put in motion several years ago and stuck with through the depths of the pandemic.

They also reflect the outstanding work of our teams across the world to operate our facility safely at high utilization levels, which drove needed production and throughput. We are proud of their commitment to supplying the energy and products the world needs and delivering on our strategic priorities.

Increased production, higher realizations and aggressive cost control generated strong earnings and cash flow.

– Exxon Mobil Corporation | Q2 2022 Earnings Call

On the Downstream side, we had a strong quarter. Well, good execution, reliable operations, high refinery utilization, and I’m talking generally now, U.S. West Coast and Gulf Coast, good cost control, and we’re able to capture the margins in the marketplace. We had a slight benefit in the second quarter because the Richmond turnaround was deferred. So it was a little bit less of an impact than what we had guided to on the first quarter call. And timing effects really weren’t a driver, right, timing is more of the absence of timing effects that you saw.

In terms of these markets, they’re volatile right now. I mean, we’ve seen margins come off from where they were before. In the second quarter, we saw a demand response.

– Chevron Corporation | Q2 2022 Earnings Call

Looking to follow the top 35 organizations across seven industries and see how they stacked up this Q2 2022 earnings season? Bookmark our earnings tracker for key themes, trends, and insights from their individual earnings transcripts.