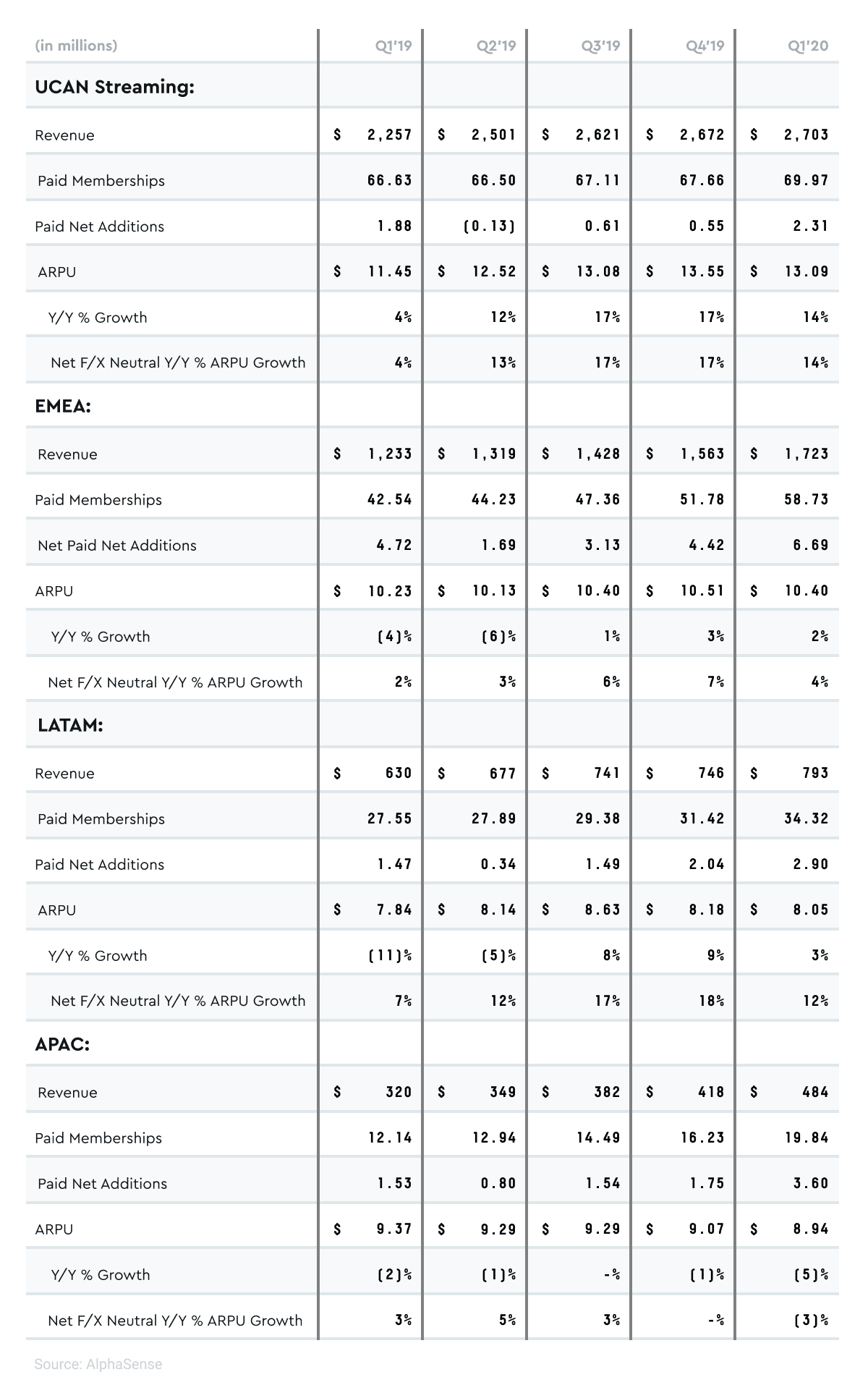

Netflix (NFLX) reported a blowout subscriber number Q1 ’20, adding 15.8m net adds versus its guidance of 7.0m and 9.6m in Q1’19.

While Q2 guidance was characterized as a “complete guess,” net add guidance of 7.5m was also meaningfully ahead of consensus, and nearly 3x the 2.7m added in Q2’19. Management did temper expectations by suggesting strong net adds in 1H at least in part reflected a pull-forward of demand. The conservative messaging on 2H, combined with the runup into the print, led to a muted stock price reaction to earnings.

“The things we are certain of is the Internet is growing. It’s a bigger part of people’s lives, thankfully. And the people want entertainment. They want to be able to escape and connect, whether times are difficult or joyous. That’s pulling up. We’ve had an increase in subscriber growth in March. It’s essentially a pull-forward of the rest of the year. So our guess is that subs will be light in Q3 and Q4 relative to prior years because of that. But we don’t use the words guess and guesswork lightly. We use them because it’s a bunch of us feeling the wind, and it’s hard to say. But again, will Internet entertainment be more and more important over the next 5 years? Nothing has changed in that.” Netflix (4/21 – Q1 2020 Earnings Call)

Originals continue to drive the business with Tiger King: Murder (64m viewers), Love is Blind (30m), Spenser Confidential (85m), and Money Heist (a projected 65m). Netflix will be without two of their biggest series in Q3 this year (Stranger Things and Money Heist), which leads to tougher comps compared to Q3’19. This, along with the pull-forward from coronavirus, explains management’s “current guess” that 2H net adds will be lower YoY.

“Hopefully, progress against the virus will allow governments to lift the home confinement soon. As that happens, we expect viewing and growth to decline. Our internal forecast and guidance is for 7.5 million global paid net additions in Q2. Given the uncertainty on home confinement timing, this is mostly guesswork. The actual Q2 numbers could end up well below or well above that, depending on many factors including when people can go back to their social lives in various countries and how much people take a break from television after the lockdown. Some of the lockdown growth will turn out to be pull-forward from the multi-year organic growth trend, resulting in slower growth after the lockdown is lifted country-by-country. Intuitively, the person who didn’t join Netflix during the entire confinement is not likely to join soon after the confinement. Plus, last year we had new seasons of Money Heist and Stranger Things in Q3, which were not planned for this year’s Q3. Therefore, we currently guess that Q3’20 and Q4’20 will have lower net additions than last year due to these effects.” Netflix (4/21 – 8K)

ARPU was a bit light of expectations as coronavirus led to a strengthening of the USD, especially relative to Latam currencies. Despite the ARPU pressure, NFLX reiterated its 16% GAAP Operating Margin guidance for 2020.

Management also relieved some concern over production pauses leading to a gap in content by explaining a less-understood aspect of their business–they shoot far out relative to the industry–which means their 2020 slate is mostly set.

“Yes. Well, the one thing that’s maybe not widely understood is we work really far out relative to the industry because we launch our shows all episodes at once. And we’re working far out all over the world. So our 2020 slate of series and films are largely shot and are in post-production remotely in locations all over the world. So — and we’re actually pretty deep into our 2021 slate. So we’re not — we aren’t anticipating any moving — moving things around. And to give you some examples, The Crown, in its fourth season; our big fourth-quarter animated release, Over the Moon. These are shot productions in our — in the finishing stages right now to release later this year as planned. So we don’t anticipate moving the schedule around much and certainly not in 2020.” Netflix (4/21 – Q1 2020 Earnings Call)

As a result of pausing production (as well as scaling the business), Free Cash Flow burn will meaningfully improve to under $1bn from prior guidance of $2.5m and 2019 levels. FCF materially improving with an unchanged 2020 slate gives investors a directional proof point in the Company closing the gap between FCF and EPS in the long run. That said, they did allude to 2021 potentially being a step back in the path to cash breakeven as they re-ramp production.

“With our productions currently paused, this will shift out some cash spending on content to future years. As a result, we’re now expecting 2020 FCF of -$1 billion or better (compared with our prior 2020 expectation of -$2.5 billion and -$3.3 billion actual in 2019). This dynamic may result in more lumpiness in our path to sustained FCF profitability (as, prior to the pandemic, we had been planning for annual improvement in FCF). However, there has been no material change to our overall time table to reach consistent annual positive FCF and we believe that 2019 will still represent the peak in our annual FCF deficit.” Netflix (4/21 – 8K)

NFLX cemented themselves as one of the biggest beneficiaries of coronavirus, but as Reed said, it’s mostly just accelerating the multi-year secular shift towards streaming.

Looking for the data? Here’s a quarterly breakdown pulled directly from Netflix’s 8K Appendix, dated April 21, 2020:

Looking for more Earnings Season content? Visit our Insights section for more.