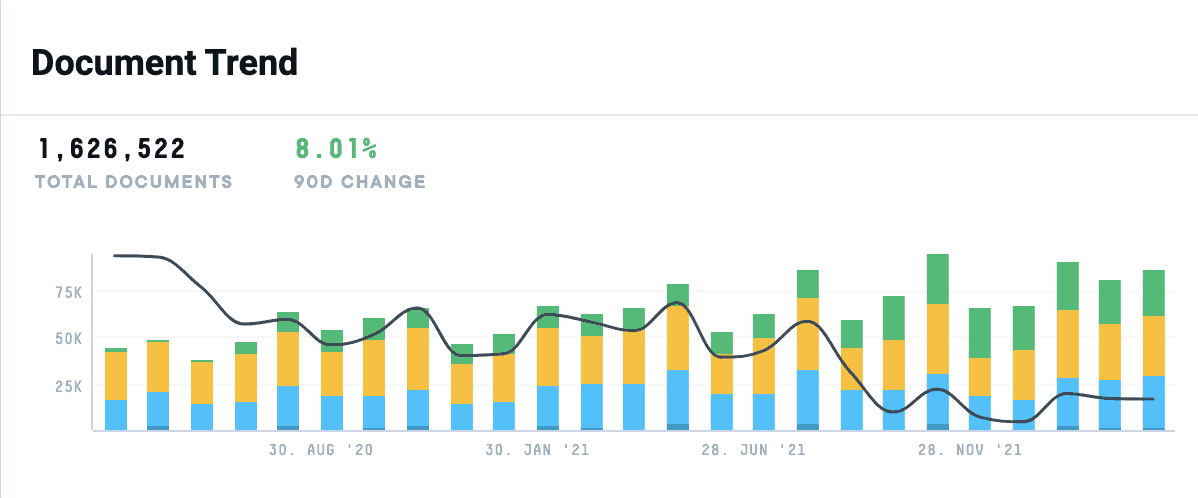

In a recent survey of CEOs, the third biggest barrier to long-term growth was the rise of non-traditional competitors. Similarly, when we search in AlphaSense around the negative impact of competition, consolidation, and mentions of market share loss, we find a steady and growing trend of documents.

The need to keep tabs on your competitor set, including existing and new ones, is clearly top of mind for executive leaders across numerous companies and industries. So how does one ensure they effectively keep a pulse on their competition?

Earnings season is a great time to look for nuggets of key information and insights sprinkled throughout earnings transcripts. But even with access to the transcripts, it can be difficult to know where to start first.

We’ve got six key questions to help you answer about your competitors for this earnings season – all from earnings events and documents within the AlphaSense platform.

Will a Company Succeed or Fail?

This is probably the most fundamental question you want to answer. Yet, this one can be the toughest without the right content sources.

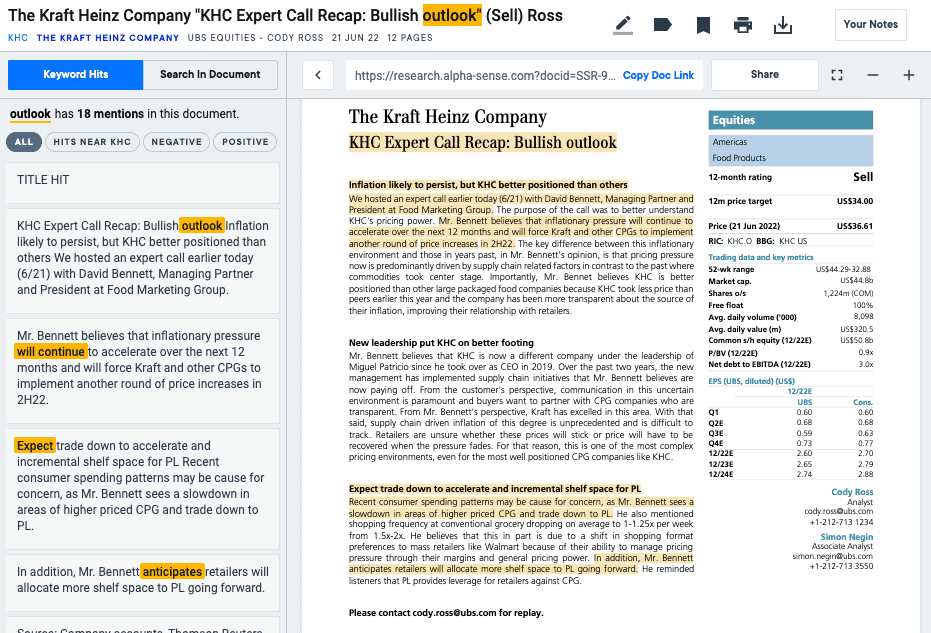

Fortunately, this question becomes much easier to answer with access to Wall Street Insights from AlphaSense. Performing a simple search for a competitor and filtering to broker research will provide a wealth of expert research on tap.

By nature, each broker research report will include an overall outlook perspective and key reasons for the predicted success or failure. Instead of looking for that one single needle in a haystack (think CNTRL-F’ing across a dozen open tabs), you can focus your job on building a consensus or overall opinion based on the information you found in one central platform.

What is Driving Positive or Negative Performance?

This is similar to the overall outlook but is ultimately more focused on the here and now versus the future.

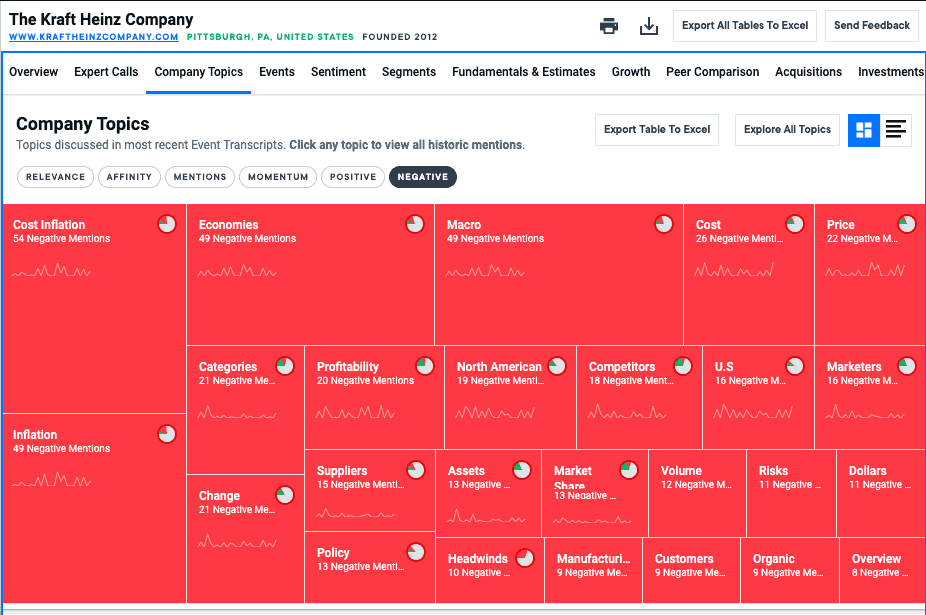

In AlphaSense, if you head to the Company Topics module, you can instantly see the trending topics for that company from the last round of earnings documents. Further, by filtering to positive or negative, AlphaSense’s AI uncovers what is driving positive or negative performance at the company level.

When I see something of interest, I can instantly see the historical context and see how the topic has been mentioned over many quarters.

What Are the Main Risk Factors for the Company?

Beyond reading through and digesting the analysis in broker research, it is equally important to understand directly from a company what they consider their main risk factors to be.

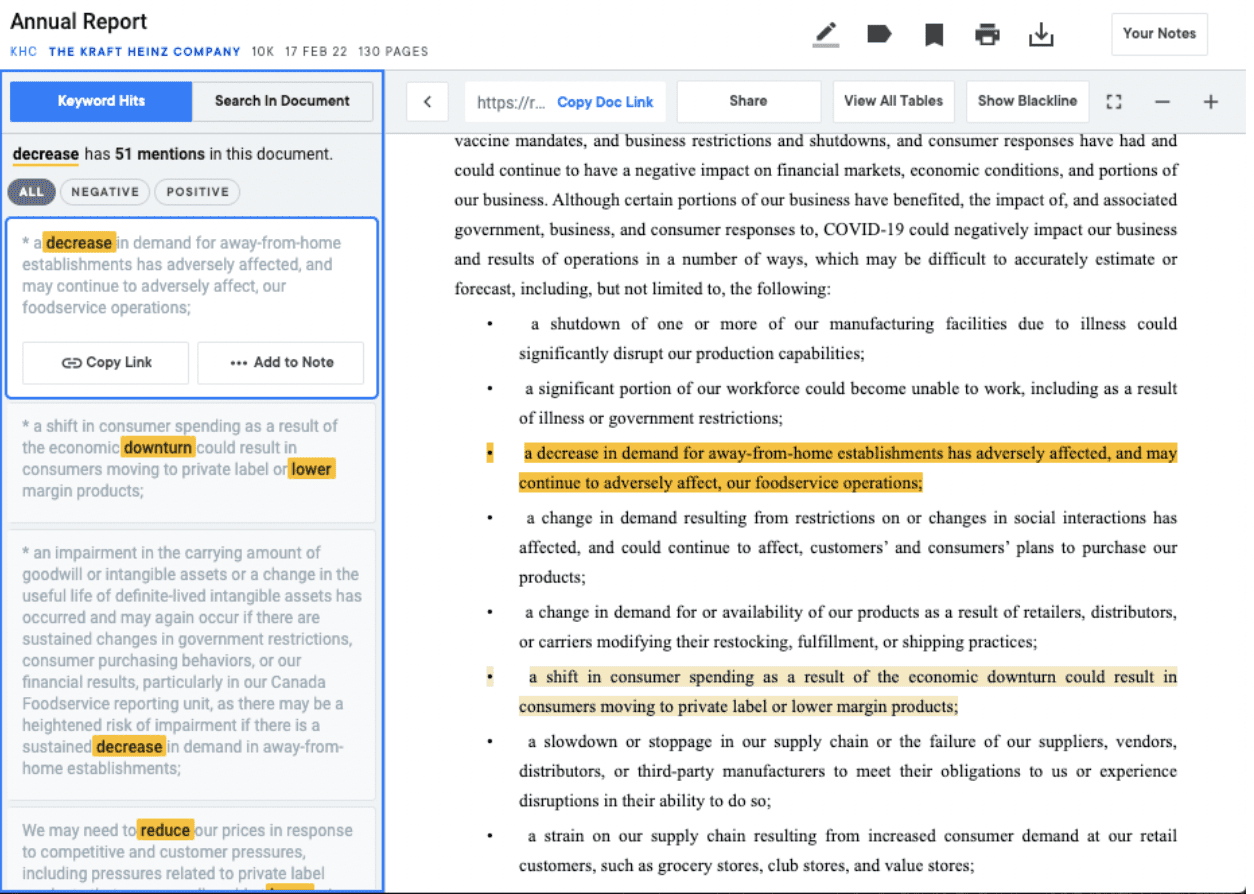

Fortunately, public companies are expected to submit quarterly updates on their business dealings to the SEC or other similar organizations across the globe. These regular updates, called 10Qs and 10Ks in the United States, are fairly standard in what information they contain, making them predictable sources of useful information.

In AlphaSense, you can easily focus your search on specific sections, like “Risks” for example. This immediately shows you a transparent view of what the company is facing.

How Successful is the Go-to-Market Strategy?

Every company has a go-to-market strategy underpinned by specific strategies and tactics that help it launch products and/ or services in order to compete in certain geographic markets. With AlphaSense, you can quickly figure out what is (and is not) working for those companies.

From a company profile page in AlphaSense, you can quickly identify the key segments of revenue breakdown. This might be by geography and/ or product line. You can immediately get an overall view of the business and where revenue streams are currently being driven from.

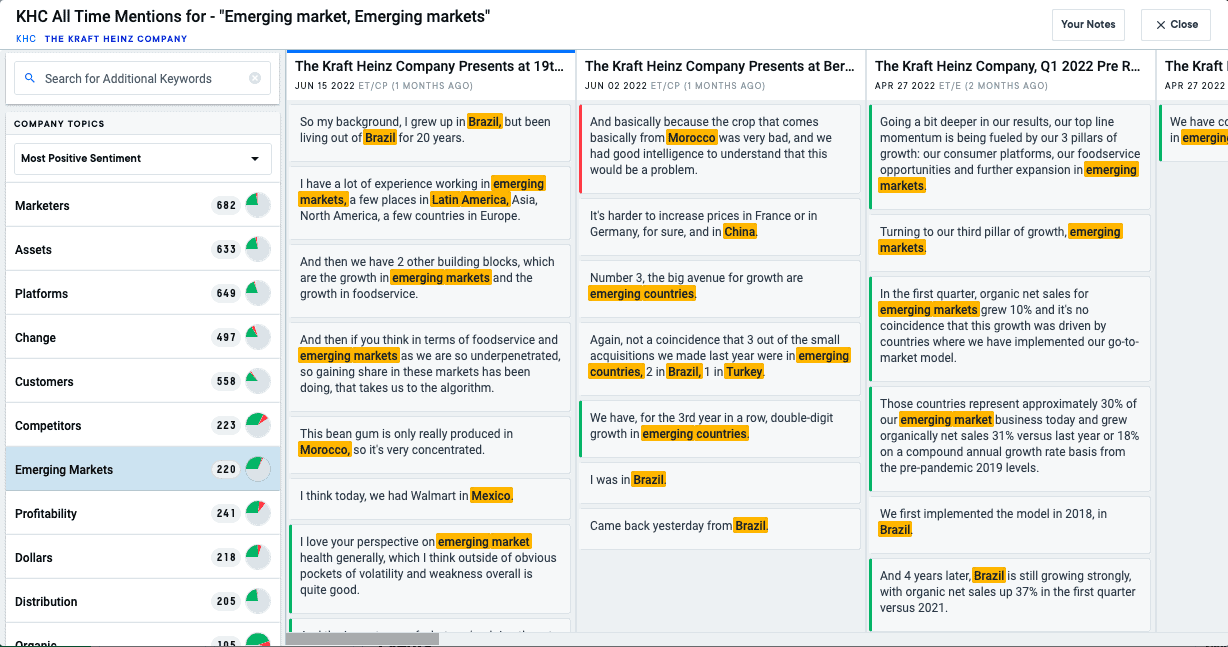

Heading back to the Company Topics module, you can dive even deeper and see if any products or geographies are specifically called out in earnings (i.e. driving positive or negative performance). Filtering by affinity (i.e. topics which are unique to the company) gives a clear picture of any significant product line mentions. I can then use other filters like the momentum and positive and negative filters to check for mentions of any geographies.

When I find something interesting in the Company topics module, I can click through to see details of how the topic is discussed in the most recent earnings documents, as well as the historical context from past quarters. This allows me to see the evolution and driving factors for why something is or is not performing well.

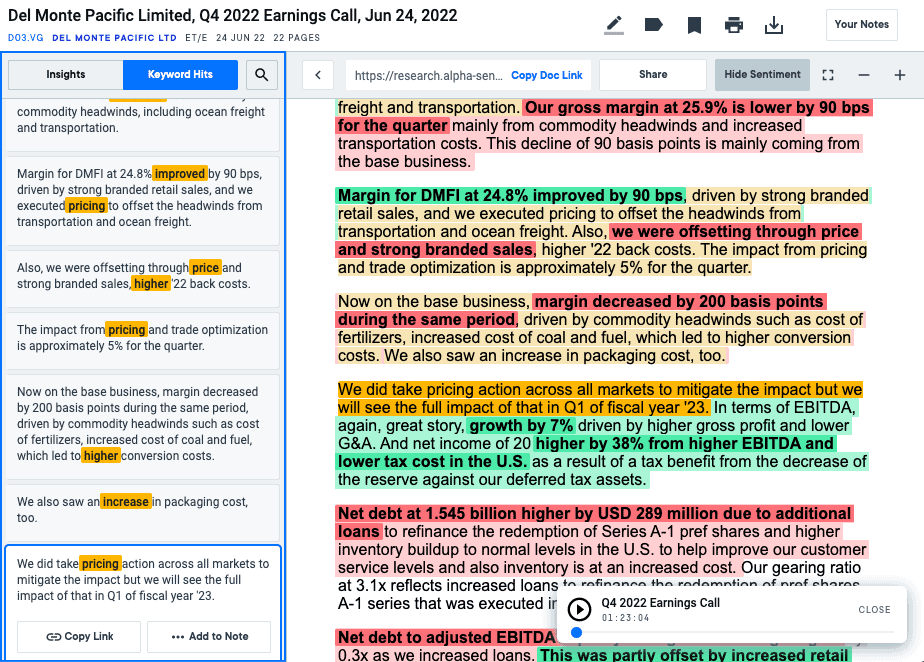

Occasionally within broker research, you might find incredibly useful insights and data around pricing – either mentions or information around the impact of pricing changes or details on the pricing itself. By searching around the keywords, you are able to immediately see if these topics are mentioned by a company or a group of companies.

How are Key Companies Dealing with an Industry Trend?

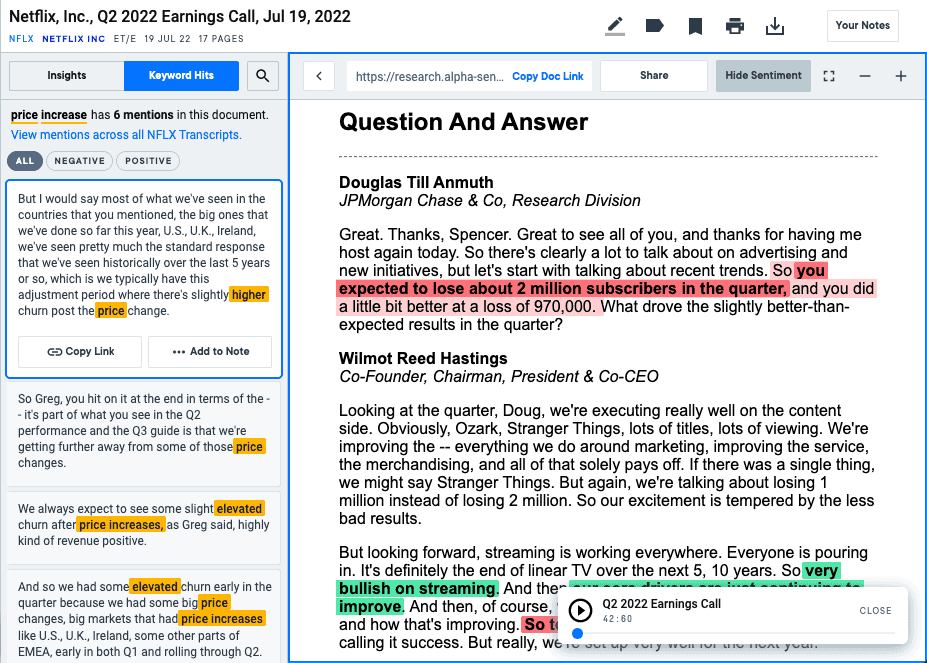

To answer this specific question, we will run a combined keyword (i.e. the key industry trend) and ticker search and specifically filter for earnings documents and transcripts. This pulls back all mentions from the company around a specific topic, revealing details on how they are talking about the topic and if the sentiment around the mentions is positive, negative, or neutral.

If, instead of a specific company, I want to see how every other company on a specific watchlist or even just how all companies overall are talking about a subject, I can perform a search removing a specific company from the results.

What Topics Worry the Analysts About the Company’s Future Outlook?

On earnings calls, company executives come prepared to speak about the company’s performance. And equally crucial are the analysts who cover the company for research purposes or because they heavily invest. Analysts are vested in ensuring their worries or expectations align with the company and the level of current or future performance.

Noting the analyst questions and answers can give you a strong indication on which elements the company is noting as causing the analysts to doubt or worry about the outlook. This is definitely worth paying attention to if, say, for instance, several analysts repeat the same question or continue a line of questioning – an indication of deeper concern.

Ripe with hidden gems, this is arguably a best-kept secret of earnings transcripts because it can give you a sense of how successful the company might be around a specific topic. For example, let’s say the company has had issues with its supply chain. In response, they announce a new strategy to combat the issues. If analysts repeatedly question the executives on the strategy and press for more details, it could indicate that the company will ultimately fail in solving the issue. Thinking even further down the line, this could cause customer delivery issues – likely something you and your team would want to keep tabs on.

In AlphaSense, finding the questions (and answers) from an earnings transcript is much simpler than the heavily manual ways your competitors are searching through them (if they are even utilizing them at all). An AI-powered search engine supercharges your ability to hit on the right questions without wasting time. It is as simple as heading to the More Sources menu and under Earnings Calls, selecting to search in the question and answer section.

Earnings calls, and the associated documents, are a goldmine of competitor information. Answering these six questions can give you insights, and an edge, and arm your teams with a clear pathway to out-competing your competition.

Find out why Merz knew that AlphaSense was the right fit for their research needs after one earnings season with the platform.

Want to accelerate your earnings workflow today? Watch this quick video on how you can use AI to automatically extract key themes, compare changes QoQ, and identify shifts in strategy — all within AlphaSense.