The latest 2018 semi-annual ESG Trends Report (published as part of US SIF comprehensive tracking since 1995) reaffirms the compelling increase of ESG inclusion in mainstream investment decision-making.

As ESG inclusion becomes more widespread, corporate leaders are challenged to evaluate their own sustainability strategies to determine the best course of action for their bottom line. This blog takes a look at how corporations are addressing ESG/Sustainability, and related trends impacting the U.S. capital market throughout 2018.

ESG becoming more prevalent for investors

Total assets under management (AUM) involved have reached $12 trillion out of the $47 trillion U.S. capital market. This means that now 26 percent, or $1-in-$4 AUM, invested by U.S. institutional investors have ESG information needs to be able to weight their asset allocation priorities.

ESG/Sustainability A More Central Part Of Corporate Strategy

Sustainability is rapidly warranting a full comprehensive corporate strategy approach.

“Sustainability is embedded into every area of our business. It is not a bolt-on, it is every department’s responsibility.“ – Anheuser-Busch InBev[$BUD]

Opportunity costs continue to mount for companies still overwhelmed and watching from the sidelines. Take one focused step at a time and realize real ROI along the way.

One sector example:

“52% of fashion industry executives polled said ‘sustainability targets acted as a guiding principle for nearly every strategic decision they made,’ up 18 percentage points from last year. The study also showed that a heightened sustainability focus makes dollar sense: It translates to a positive impact on profit.” – 2018 Pulse of the Fashion Industry Report

Boards and management realize sustainability reporting in the U.S. is still largely voluntary, but pressure is recently mounting on the SEC to impose related disclosure regulation.

“Before outside voices shape the discourse, boards should set aside time to assess what issues are most relevant and fit best with the company’s long-term goals.” – JonesDay

AlphaSense Insights: Who Is Talking About ESG/Sustainability?

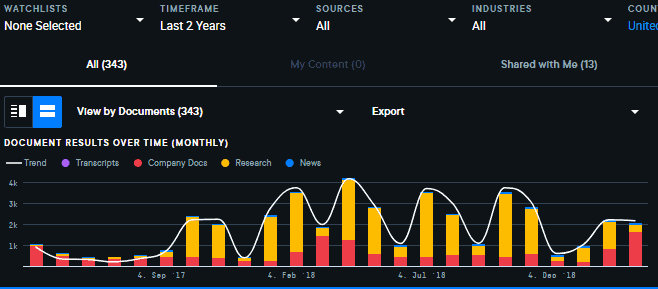

A quick use of AlphaSense to search on ESG AND Sustainability, all industries, all documents, U.S. only, shows increasing numbers of companies, including mid-cap and small-cap, commenting on ESG/Sustainability — a trend that had been mostly noted in mega-cap and large-cap companies.

For the recent 12 months, AlphaSense search results found a total of 244 companies across 10 sectors, and 465 documents — or two documents per company on average. Further drill-down on type of document is beyond the scope of research for this short blog, but it’s simple enough to do should AlphaSense subscribers wish to do so.

Making Sense Of Sustainability

At this stage in the maturity of ESG/Sustainability as a mainstream field, company boards and management teams should evaluate strategic prioritization of ESG/Sustainability for competitive positioning and financial return, regardless of company cap size.

Pamela Styles is principal of Next Level Investor Relations LLC, a strategic consultancy with dual Investor Relations and ESG/Sustainability specialties.