Earnings preparation — like every financial forecasting task — was upended by the arrival of the COVID-19 and subsequent 2+ years of market unpredictability. Even as we emerge from the pandemic and look to the future, it’s clear that the nature of earnings research and analysis has permanently changed.

Agility is now a priority. Quarterly research leading up to reporting deadlines is no longer enough. Firms and analysts now need access to tools that give them ongoing, real-time insights and the ability to perform research with speed and accuracy — and at scale.

For context, consider the following: 90% of all data has been created in the past two years. The large majority of that data is unstructured, and unstructured data doubles every 24 months. The sheer volume of data that exists on any given topic, industry, or company has made manual analyses not just impractical, but impossible.

In the sections that follow, we’ll look at important insights from AlphaSense’s webinar series, The Future of Earnings. We’ll consider the challenges analysts are facing that make the need for intelligent market research tools an imperative, and proprietary features and benefits of AI offers to level-up research capabilities to meet today’s competitive demands.

The Future Perfect: Tackling Earnings

There is a two-pronged challenge analysts experience today as it relates to the massive amount of data that exists for earnings research. First, they need a practical and reliable way to get through it all. Second, they must have the ability to identify and extract the most relevant data for their specific initiatives.

It’s not just about crunching numbers, either. Analysts are closely tracking metrics, looking at QoQ changes, and seeking notable commentary that indicates future performance potential. They’re looking for meaning behind numbers to create a foundation for investment decisions, due diligence reports, financial models, and other important strategic initiatives.

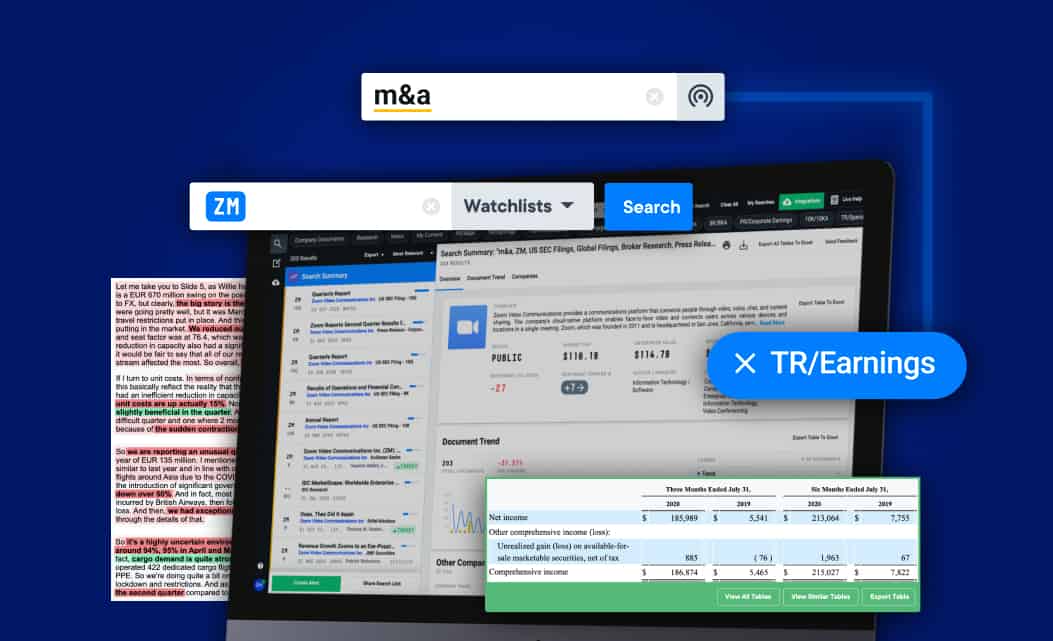

AI advancements in market research platforms have made it possible for users to do this at unprecedented speed and scale. Theme extraction algorithms use natural language processing (NLP) and topic clustering to identify and summarize key concepts from thousands of documents, all within a single search.

Advanced sentiment analysis can differentiate and isolate the most positive and negative commentary from documents, while smart synonym technology can identify the relationships between important themes to provide a big-picture view of important trends and topics.

Perhaps most importantly of all, users can rank themes and topics according to their priorities and preferences, meaning their research results are tailored specifically to gather insights that are aligned with their unique needs.

These features have resulted in extreme efficiency gains and the ability for clients to create their own competitive edge with customized research design.

Introduction to Earnings Workflows

As hyperagility continues to be the top demand for firms and analysts across industries, they must find ways to transform research from a quarterly task to an ongoing process — one that offers a continuous flow of insights.

The benefit to strong earnings workflows is that analysts are always in the know, rather than faced with the task of getting up to speed each quarter. Even with advanced business intelligence tools in place, there are steps analysts must take to put workflows in place. There are critical features that enable this:

- Alerts – Notify you of new mentions for important keywords, companies, or topics you follow

- Watchlists – Allow you to perform thematic searches across a group of companies important to your research

- Saved searches – Reduce the time it takes to access dashboards you use frequently

- Recommended reads – Lists curated by with documents most relevant to you based on past research

These capabilities have become even more critical in a research environment where macro trends are increasingly important to individual industry and company performance. During the pandemic, for example, analysts needed to widen their lense outside of traditional industry topics to evaluate how larger factors (such as shutdowns or stimulus funds) make an impact.

Automating research also ensures you’re maximizing ROI on available data, and that you never miss new or last-minutes updates in a fast-changing reporting environment.

Advanced Earnings Workflows

In 2022 and beyond, it is important for professionals to go beyond foundational AI workflows to achieve the highest levels of advanced research capabilities. Platform features now expand on smart search and NLP in ways that eliminate the need for multiple searches and curate the most important information in a single place:

- Smart synonym technology automatically expands search terms to include related keywords and phrases

- Tonality of sentiment analysis that determines whether a document, phrase, or sentence was more positive or negative

- Uniquely designed algorithms analyze datasets based on financial language (rather than more general language found in news- or social media-based datasets)

This level of sophisticated analysis creates the opportunity to pinpoint even the most nuanced and granular insights that may be business-critical — all without relying on subjective analysis of the researcher to decide what’s important.

Tomorrow’s Analyst: Automation and the Future of Knowledge Work

Going forward, the ROI of earnings research and other knowledge work will depend wholly on the researcher’s ability to harness the power of AI. But this doesn’t just mean access to big data and, although important, it’s about more than just speed and scale.

AI search platforms deliver what forward-thinking organizations are calling X analytics — the ability to find links between data sources and a wide range of data formats, many of them unstructured, to create small and wide data that is hyper-relevant, accurate, and diverse.

Gartner predicts that by 2025, 70% of organizations will shift toward this type of data to access insights that make them better equipped to navigate the fast-changing markets of the future. Companies that don’t achieve these capabilities by adopting the right technologies will before long be hard-pressed to keep up.

To access the full insights mentioned in this article, watch The Future of Earnings webinar series.