While headlines are leaning positive given the vaccine rollout in countries like the US, Israel, and the UK, not every country has had the privilege as the pandemic continues to affect dozens of nations. India, for example, has experienced a sudden spike in coronavirus cases, demonstrating the speed at which a virus can wreak havoc on a country and their medical resources.

The crisis has led to an oxygen shortage– hospitals are at capacity, and they’re strained to treat those with COVID-19 infections. HFDC Bank, in India, recently announced that they had converted three of its training centers into isolation facilities. Even the US, other countries, and the private sector have pledged resources and assistance in hopes of remedying the situation as quickly as possible in a country with a population of over 1.3B people.

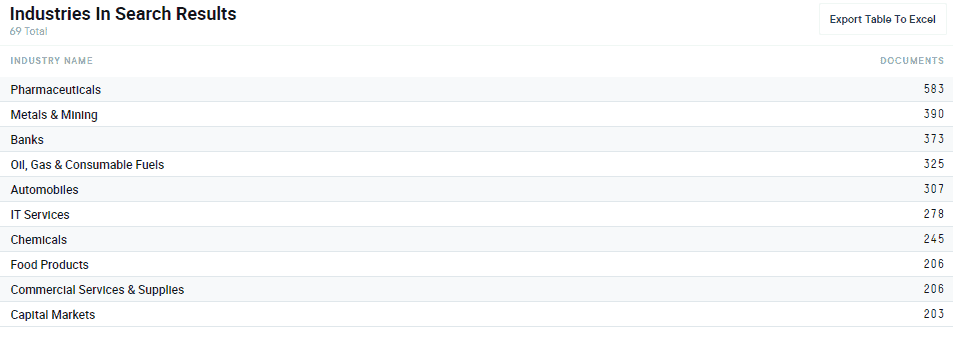

However, the impact, timing, and how soon we’ll see beneficial results are yet to be determined, and there will be global ramifications given how severe the crisis is in India. On AlphaSense, we found over 15K documents over the last 30 days (as of 4/27/21) mentioning India and COVID-19 (search link available here for AlphaSense users), and the volume is increasing. In the previous 15 days, there has been a 35% increase in documents, with pharmaceutical, metals & mining, banks, and oil, gas, & consumable fuels being the most discussed industries.

How companies are reacting to India’s rise in coronavirus cases

Below, we’ve found several vital transcripts and company documents that shine a light on how companies and industries have started to feel an impact given the pandemic’s relentless comeback.

Freudenberg Group | Press Release – Outlook | Document Link

For 2021, Freudenberg once again expects a generally challenging overall economic environment. However, following a significant downturn in the world economy in 2020, mainly because of the spread of COVID-19, economic growth is expected to recover in 2021.

Despite the challenges of working in India, German companies are still wildly convinced of the long-term Indian opportunity. Its young, well-educated, connected population and its evolution as an IT and R&D powerhouse for global players. “India is the youngest-connect-democracy” in the world and is increasingly being considered a preferred partner in manufacturing across industries, with companies realizing that India is more than a consumption market but is also a manufacturing and R&D hub that allows foreign companies to create and export products to other needs in this region.

While Ease of Doing Business, transparency, and e-governance has shown considerable improvement, skills development and technical training need further investment. However, it will probably take a few years to reach the pre-crisis level. Moreover, the geopolitical and economic uncertainties faced in 2021 are especially severe. One significant uncertainty is the further development of the COVID-19 pandemic and its effects on the global economy and the markets of the Freudenberg Group, especially in the automotive industry.

EBIX | Annual Report | Document Link

Our revenue from our gift card business grew significantly during the COVID-19 pandemic. However, it may not continue at that level after the lockdowns are lifted as the risks of the pandemic decrease.

During 2020, our revenue from the payment solutions offerings in India (primarily prepaid gift cards) increased by more than $200 million years over year to approximately $256 million, a 590% year-over-year growth. The increased demand for prepaid gift cards in India was primarily due to: (i) COVID-19, which has facilitated increased online and electronic commerce due to restrictive lockdowns in 2020; (ii) changes in regulations by the Reserve Bank of India related to debit cards, which has shifted demand in the market towards prepaid gift cards; and (iii) the Company’s increased marketing efforts around the prepaid gift card business. However, there can be no assurance that this level of revenue will continue once the lockdowns are lifted and economies begin to open back up from the effects of COVID-19 or if new regulations are adopted that impact the use of gift cards or debit cards.

RAMCO Systems LTD | Annual Report | Document Link

Estimation of the future impact of COVID-19 on its operations

The lockdown scenario the world over have put tremendous pressure on global business activities, including ours. As a result, prospects are thinking twice about committing to a new Business, which would impact order booking and revenue. In addition, travel restrictions, including international travel, have created hardships by the inability to meet the prospects for new Business, the existing customers for delivery of the projects, etc.

To mitigate the impact, the Company has been taking various cost reduction measures. However, the estimation of the future implications of COVID-19 could not be predicted and quantified at this juncture as we continue to bear the brunt of the outbreak.

Opera LTD | Press Release – Q1 Financial Results | Document Link

…In particular, Nanobank’s location in India has seen process impacts of the local COVID-19 resurgence affecting both Nanobank staff and its external audit team, resulting in significant delays in completing all required processes.

United Breweries Ltd | Annual Report | Document Link

The outbreak of the COVID-19 pandemic in India had caused significant disturbance and slowdown of economic activities. The Company’s business operations have also been significantly impacted by interruption of production, supply chain, etc. Recently, there has been a surge in the spread of COVID-19 in India. As a result, various state governments have imposed restrictions ranging from night/weekend curfew, including the closure of malls, restaurants, and other public places, to contain the spread of COVID-19.

BIC (Societe) | Interim Report | Document Link

“While we continue to navigate through a challenging trading environment effectively, we remain cautious for the balance of the year due to uncertainties related to the pandemic, particularly in Latin America and India. However, with our Horizon plan serving as our North Star, I am encouraged by the direction that we are taking and the capabilities we are building throughout our organization that will drive accelerated profitable growth.” – Gonzalve Bich, Chief Executive Officer.

//

The Stationery category continued to be strongly affected by ongoing school and office closures and evolving consumer shopping habits. Latin America, Africa, and India, with traditional trade highly impacted by the pandemic, remained the most brutal hit.

Sibelco | Financial Report 2020 | Document Link

We saw a sharp drop in sales to the steel market as the pandemic led to the idling of blast furnaces throughout Europe and, to a lesser extent India.

//

Tile manufacturing was severely hit by COVID-19 lockdown restrictions in Italy, Spain, and India, resulting in losing the equivalent of one month’s worth of sales in each country. Sales in engineered stone also fell as producers significantly reduced stock from March onward.

How to support

With more than 110 team members in Pune and Mumbai, AlphaSense has also been affected by this tragedy. Our hearts go out to our India team, their families, and the entire community affected by this aggressive resurgence. Given the urgent crisis and its direct impact on our team members in India, AlphaSense has contributed $5,000 to the Oxygen for India program, intending to help purchase 20 oxygen cylinders. We encourage those who can contribute to do so as well.