The Complete Guide to Conducting Competitive & Market Landscape Analyses

Get the guide

In a time when market volatility is top-of-mind for investors, analysts, and consumers, these preoccupations with economic instability consequently affect the fiscal performance of every industry. And while most experience financial setbacks from macroeconomic hardship, some take more of the brunt than others. This is especially true of the consumer packaged goods (CPG) industry, where Consumers-Staples in particular, has seen a dramatic shift in consumer behavior. Trade down–the act of buying cheaper brand goods as a way to save money–is behind almost every purchase, from household items to automobiles.

But what’s fueling this dramatic shift in purchasing power? How are sub-sectors adapting to this evolution of the market? What are top tier companies and manufacturers saying? How are they embracing this financial unpredictability? Using the AlphaSense platform, we took a deep look inside the conversations that are shaping today’s market.

The Forces Behind Trade Down in Consumer Packaged Goods

There’s no short-list of what is motivating consumers to be more conscious of their spending habits: international tensions (the Russia-Ukraine war) and domestic affairs (the potential U.S. Railroad Strike) that have directly caused global supply chains disruptions and thus, has stoked inflation further and rising prices on everyday commodities. With no end in sight for some of these macroeconomic happenings, trade down has become a means to survive surging prices–indicating that trade down is more than just a mere trend or revolution of the market, but an evolution to how consumers will continue buying in future fiscal years.

In McKinsey’s latest Consumer Pulse Survey, it’s evident that respondents have unified concerns that are shaping their buying patterns: while three-quarters of consumers are trading down across categories, 50% of respondents cited inflation as the reason for seeking less expensive alternatives and the other 43% cited concerns about the economy. And while price increases across the consumer packaged goods industry are nearly universal, consumers believe that certain sub-sectors have experienced significant price increases in comparison to others, with electronics, footwear, personal care, vitamins, and over-the-counter medicine being the main culprits of these misconceptions.

When it comes to how the CPG industry and its sub-sectors strategize in response to trade down, understanding the consumer’s perspective will be integral to pricing strategies and ultimately surviving in today’s volatile market.

CPG Sub-Sector Approaches to Trade Down

In the AlphaSense platform, we dug into how sub-sectors within the CPG-Staples industry are discussing trade down, looking over documents ranging from broker research to expert calls and company documents in order to gain a sense of what consumers and the like can expect from brands and retailers.

Beverages

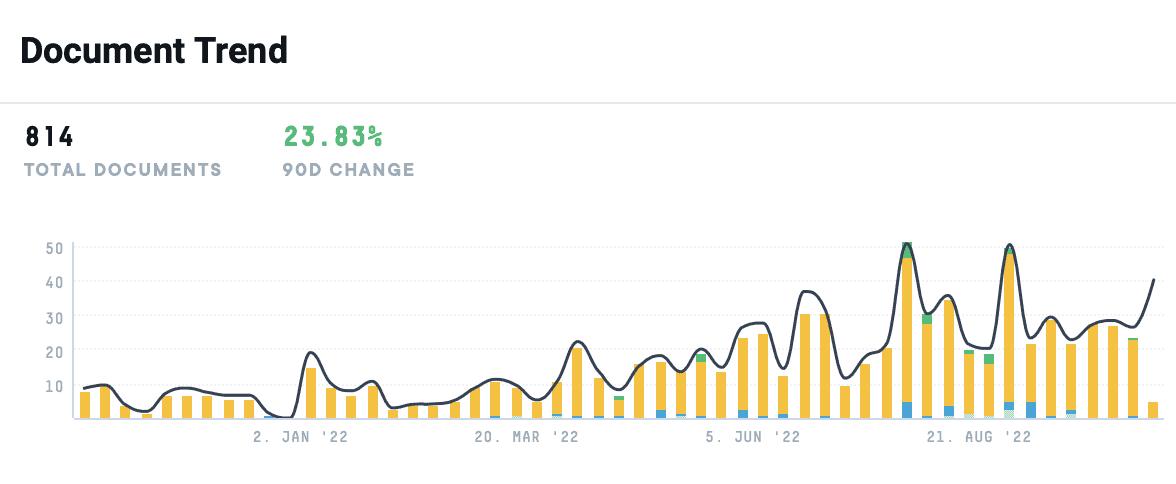

The AlphaSense platform shows that in the beverage industry (distillers and vintners, brewers, and soft drinks) trade down has been a popular topic amongst executives, with a 23.83% increase in documentation around the search term “trade down”.

For major soft drinks and alcoholic producers like Coca-Cola and Pernod Ricard, the world’s second largest seller of wine and spirit, revenues appear to be unaffected, allowing C-Suite person to remain optimistic yet cautious for their performance in upcoming quarters:

“We have not yet experienced a very significant or significant pullback from the consumer,” says James Robert B. Quincey, Chairman & CEO of Coca-Cola Co., in a Q2 2022 Earnings Call. That’s not surprising to us at this stage. A typical recessionary pattern in past experience would be consumers initially stop buying high-ticket item, discretionary things. They then start saving on the lower-ticket items, and they trade down in categories which have weaker leader brands. So we tend to have some lead time going into a normal recession.”

However, while executives seem to believe that the recession will not affect their sales and industry, experts do share that alcohol does experience trade down:

“This category is recession-proof, which is great, but they do trade down,” a former Senior Manager of Data Science at Brown-Forman Corporation says in one our expert calls. With that being said, with that recession occurring, I would say, relatively in the context of the consumer today it was the one event that really built trust in generic brand products. People realized, “Oh, wait, I never really wanted to buy this less expensive generic brand, but it turns out I need to now and you know what? This is pretty darn good.”

Related Reading: Ready-to-Drink Cocktail Market: Key Insights and Trends

Food & Staples Retailing

The subject of trade down has been especially prominent within our expert calls for this sub-sector. Walmart, Dollar Tree, and Dollar General have significantly benefited from ongoing consumer trade down, as these retailers offer products at lower prices from cheaper brands. And while shoppers are forgoing their high-ender retailers to save money, even Walmarts is seeing consumers choose lower-priced products and non-branded products over branded, further relaying that price-point is a top concern amongst consumers.

“Obviously, with inflation, there’s a lot less disposable income for every customer,” a former Merchandising Director of Walmart Stores & Walmart.com says in one of our expert calls. “Walmart saw a lot of different customer activity stay within the four walls and not necessarily shift to retailers based on that. A lot of customers trade down within their own assortment–some customers trade down from branded goods to possibly non-branded goods. Inflation is definitely real and has hit the customer hard. Walmart also stated that they think they’ve gained a higher income individual, those shopping at Target, Dillard’s, Macy’s, TJ Maxx, maybe a more elevated retailer based on category now started shopping at Walmart to do that.”

Food Products

According to McKinsey’s report, the food product sub-sector is heavily affected by trade down–more than 75% of respondents in their Consumer Pulse Survey mentioned they would swap their favorite food brand for a lower priced private label brand, if prices were to increase by more than 15%. The same sentiment was expressed regarding pet food–51% of respondents are likely to change to a lower priced pet food brand.

Broker research sourced within the AlphaSense platform backs up all these claims, further saying that specific foods categories and pet food in general show to have the lowest trade down, despite price increases. More so, consumers seem to be embracing eating healthier–a trend that emerged during the onset of the COVID-19 pandemic, where consumers are more aware of what they are putting into their bodies to boost their health immunity and promote/maintain good health.

“The war in between Russia and Ukraine, the disruption in fertilizers and in packaged goods are several macro factors impacting the industry right now,” a former Latam Head of Consumer & Market Intelligence at General Mills says in one of our expert calls. “But even during these very hard moments, we need to change our packaging and bring concerns with health into the frontline [to appease consumers].”

Household Products

According to broker research surfaced in the platform, household products seem to be at greatest risk of being affected by trade down. Through various surveys, consumers shared they would pay more for both beverages and personal products over their household products. However, retailers’ price hikes on private labels should counter incentive for consumers to trade down from branded products such as Procter’s or Colgate’s.

Analyses show that broad trade-down isn’t happening yet, given that private label volume share is still below 2019, when consumers were trading up. Major manufacturers of household products continue to see favorable price elasticities relative to historic elasticities, but are still keeping an eye on any unexpected changes in consumer behavior–so far, most changes in fiscal reporting have been projected or expected, according to various earning reports.

Personal Product

As the personal product industry comes to realize it can greatly benefit from a trade down, more brands are embracing pricing, marketing, and communication strategies that make them desirable by consumers, in relation to their higher-end competitors. e.l.f. is a prime example of a personal product brand taking advantage of their leaner price points.

“What e.l.f. is doing from a PR perspective and marketing perspective is very unique in the beauty space,” a former Cosmetics Senior Director of Sales at e.l.f says in one of our expert calls. “They are attracting a ton of different consumers and demographics. Like I said, one moment they’re talking to the gamers, the next moment, they’re on TikTok, the next moment, they’re doing stuff with Women’s Wear Daily. It’s crazy how they reach and just how much marketing they’re doing to all. It wasn’t just the lower-income consumer that was buying e.l.f., roo–different demographics, age ranges, income level, everything.”

Tobacco

Private equity research suggests that rising economic pressures will particularly affect low income consumers within the tobacco industry, with cigarette consumption to decrease and trade down to lower priced brands projected. Firms believe consumers will shift their tobacco purchases from multi-pack toward single-pack purchases, especially among discount smokers. Brand loyalty will also be prominent within the tobacco space, as research indicates that consumers were more likely to stick to their preferred brand regardless of price in the

tobacco category compared to other categories.

Beyond Costs to Boost Profitability in 2023

The unfortunate reality for CPG leaders? New year, same struggles. Many CPG companies surveyed in Deloitte’s 2023 Consumer Products Industry Outlook are still encountering workforce, supply chain, and inflation obstacles.

While labor shortages have improved with more than four in 10 companies (42%) reporting higher-than-normal voluntary attrition, supply chain challenges persist. More than six in 10 (62%) CPG executives are expecting challenging supply chain issues in 2023, and more than half (52%) are shortening their supply chains to de-risk. Which, consequently, means that record-setting prices will persist, as 80% of CPG companies are planning further price increases over the year.

Even though the high prices are bumping up revenue, 56% of executives expect sales growth to be an issue for this year, especially with consumers changing their spending habits in search of better value. Less than half (48%) of executives think they can get away with raising prices without materially affecting demand.That’s why changing customer behavior is a prioritization for 80% of the surveyed CPG companies, with 93% focusing on changing consumer demands. But it’s the profitable growth companies that are making the most effort to adopt solutions that help them better adapt.

Compared to other CPG companies, Food Industry Executive believes that profitable growers are more likely to:

- Invest in direct-to-consumer channels (93% vs. 42%), technology to improve customer and employee engagement (86% vs. 50%), and personalization of the customer experience (86% vs. 54%).

- Take creative approaches to business transformation, such as pursuing vertical integration (68% vs. 32%) and investing in divestitures and portfolio optimization (66% vs. 44%), invest more in marketing and advertising (79% vs. 30%) and prioritize expanding by acquisition (48% vs. 21%).

- Invest in ESG reporting (83% vs. 50%), prioritize increasing the company’s positive impact on society (76% vs. 50%), and invest in diversity, equity, and inclusion (75% vs. 47%).

How Can You Prepare For the Future?

Despite the pandemic coming to an end, consumer behavior continues to ever-evolve and shift amongst the economy weakening and inflation persisting. Investing in a market intelligence platform is potentially the most strategic thing you can do to prepare for the challenges of a volatile market. Not only can a platform help you track shifts in consumer preferences and behavior through access to premium content sources, it also allows you to observe the moves your competitors are making and evaluate market landscapes for potentially new opportunities.

If you’re looking for a leg up, upgrading your market intelligence research techniques is a top priority. With AlphaSense, we help users cut through the noise with our proprietary AI search technology. Premium features like Smart Synonyms and Sentiment Analysis allow you to take the lead in your respective industry and amplify your ability to conduct competitive and market landscape analyses – in less time and with less of a headache. Get our latest white paper, The Complete Guide to Conducting Competitive & Market Landscape Analyses, to learn more.