Can you feel it? The chill? It’s easy to be an optimist in the summer, but once you have to put a jacket on and hot cider starts smelling good, then the season has turned. It gets much harder to ignore the necessities, and those necessities come with price tags.

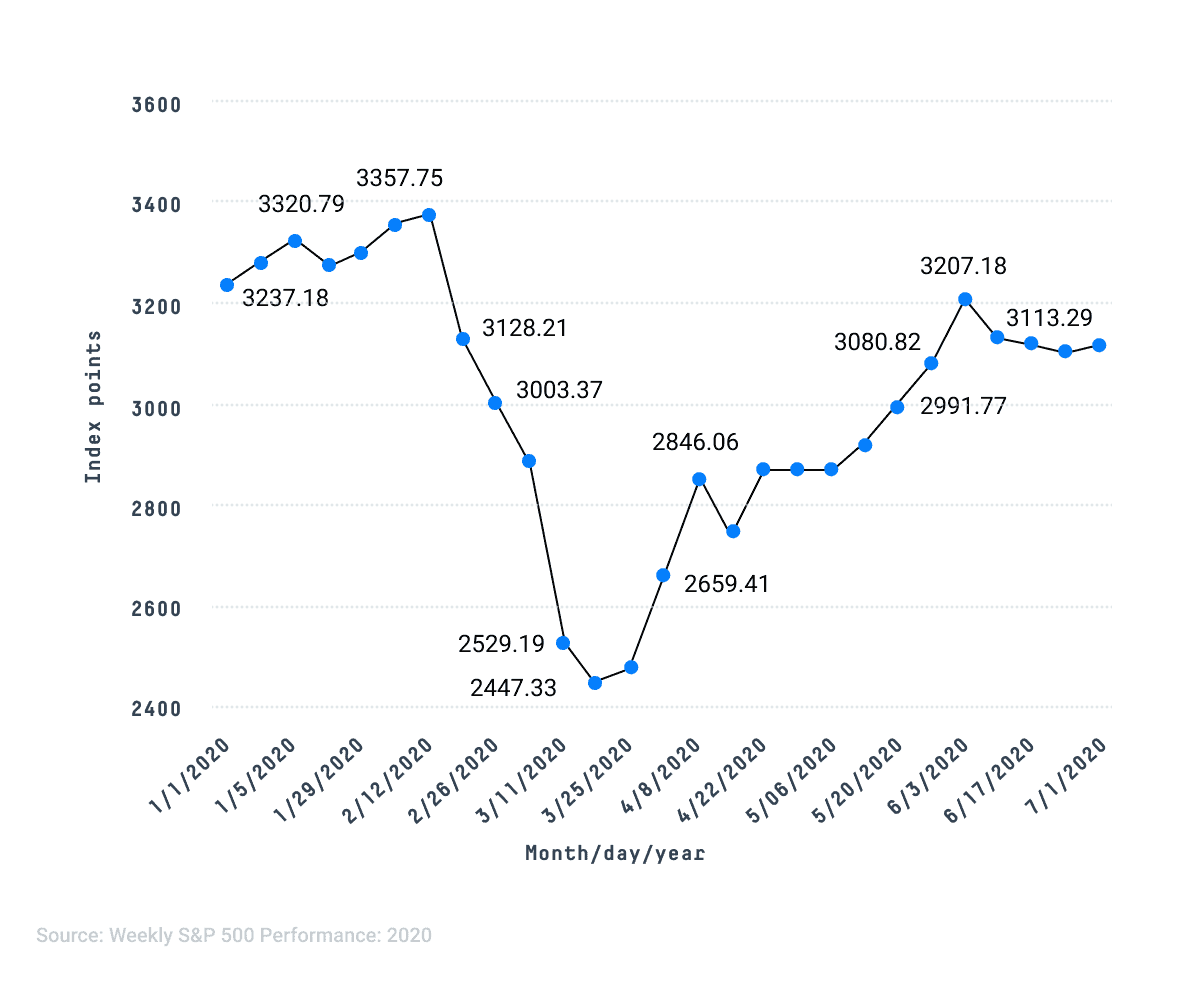

We had an opportunity for a V-shaped recovery, that is, one in which the recession ended almost as quickly as it began. But we blew it. Here in the greater New York City area, we buried 50,000 of our neighbors to buy the rest of the country 100 days to … do … something. But that would’ve taken more planning, leadership, regard for others, and willingness to sacrifice than we were equipped with. Today, as a result, we are far from that V-shaped recovery we hoped for.

Takeaways

- The stock market has flattened, and that’s as good as it’s likely to get for a while.

- Counter-cyclical sectors – Consumer Staples, Industrials, Utilities – should prove more resilient.

- There are also opportunities in Health Care, Information Technology and even the highly cyclical Consumer Discretionary sectors.

First look at August

Going on the thesis that the recession will be with us for some time, it might be instructive to stick with non-cyclical or, better yet, counter-cyclical equities. That means bypassing a smattering of opportunities in the Consumer Discretionary sector and concentrating on Consumer Staples. The Household Products industry leads that sector, with Church & Dwight (CHD: $96.33) and Clorox (CLX: $236.15) being among the most likely winners based on recent performance and current analyst sentiment.

Betting on Industrials is also as-you-do if you’re expecting a prolonged recession. The best-known and highest-valued of the analysts’ favorite names in that sector is the conglomerate 3M (MMM: $150.11). Utilities are also a familiar defensive play and, during this particular contraction, it’s the multi-utilities – as opposed to pure-play gas, electric or water – that are leading the pack. If we were to pick one name, it would be National Grid (NGG: $59.11), a British company with a widely traded ADR.

Health Care is also insulated from the economic cycle, as recent run-ups in the Biotechnology and Life Sciences Tools & Services industries suggest. There’s still plenty of room for growth, though for such Health Care Providers and Services plays as Patterson Companies (PDCO: $26.56) and Health Care Technology plays as NextGen Healthcare (NXGN: $14.62).

In Information Technology, there’s an array of options across all industries, particularly the surging Technology Hardware, Storage & Peripherals, where Super Micro Computer (SMCI: $30.31) and Seagate Technology (STX: $45.17) make their homes. Still, the lagging Communication Equipment industry, featuring such companies as Netgear (NTGR: $30.75).

But let’s cycle back to Consumer Discretionary a moment. We must acknowledge that, no matter how close the recovery isn’t, people are nesting. That’s good news for D.R. Horton (DHI: $66.16) and other homebuilders, as well as for Household Durables plays such as Kickstarter-launched bedding company Purple Innovation (PRPL: $24.37) and Internet & Direct Marketing Retail purveyors such as pet-friendly Chewy (CHWY: $52.49).

Aside from all that, we remain open to possibilities in the Communication Services and Materials sectors, as described in this space last month. We remain equally unconvinced of investment theses in Energy and Financial Services.

July wrap-up

The Bureau of Economic Analysis’s initial estimate of second-quarter gross domestic product final estimate of first-quarter gross domestic product shows an economy that contracted at a 32.9% annualized rate. It’s as if a dime has been sucked out of every dollar in every wallet in America.

For the week ended July 25, seasonally adjusted initial unemployment claims hit 1,434,000, 12,000 higher than the previous week’s level. The 4-week moving average was 1,368,500 and climbing, according to the Labor Department.

The S&P 500 not only kept rising, but accelerated, adding 5.64% on a total return basis in July. The CBOE VIX market volatility index closed the month at 24.46, a decline – declines are good – of 19.62%. This was all driven by strong 2Q earnings, but let’s see how strong 3Q earnings are if Washington keeps dithering over additional economic support.

Over the course of July, the yield on the benchmark 10-year U.S. Treasury note declined from 0.563% to 0.533%.

Oil prices improved 1.63% in July, as West Texas Intermediate crude steadied, far short of its breakeven point. Gold surged 10.84% as it continued to gain velocity, ending the month at $1,994 per ounce.

Foreign exchange markets have been frothy as of late. The euro and British pound improved +4.7% and 4.9% respectively against the U.S. dollar, while the Japanese yen fell 1.9%. Cryptocurrency went on another tear – we’ll see how long this one lasts or how high it goes – with Bitcoin gaining 24.3%, ending July at $11,368,

Meanwhile, even the Federal Reserve is having its Black Lives Matter moment, just as it has to deal with more purely macroeconomic issues than any central bank has ever had to deal with.

“Do you know how many Black economists work at the Fed?” blogged Claudia Sahm, the institution’s former principal economist. “One out of 406. Economics is a disgrace.”

This follows sentiments expressed in June by regional Fed President Raphael Bostic – the first African-American in that position – who threw his support to protesters responding to what he described as “the burden of unjust, exploitative, and abusive treatment by institutions in this country.” The Atlanta Fed leader published a thought-provoking article on his bank’s website, invoking “both a moral and economic imperative to end these unjust and destructive practices.”

William Freedman, MBA, writes about finance and technology. He serves on the board of governors of the New York Financial Writers’ Association.

For more expert analysis, head to our resources page. To access company documents, including SEC filings, earnings call transcripts, and more, unlock free trial access to AlphaSense or log into your account.