Eye on the Future: Biggest Market Trends of 2022

Watch webinar

2021 marked a record-breaking year for mergers and acquisitions within the US, with a total value of deals reaching $2.6 trillion – nearly a 30% increase from the previously set record in 2015. For dealmakers, the crossing of this $2 trillion threshold last year provided promise for what could be expected from 2022, along with rising stock markets and an increasing number of SPACs looking to find merger targets.

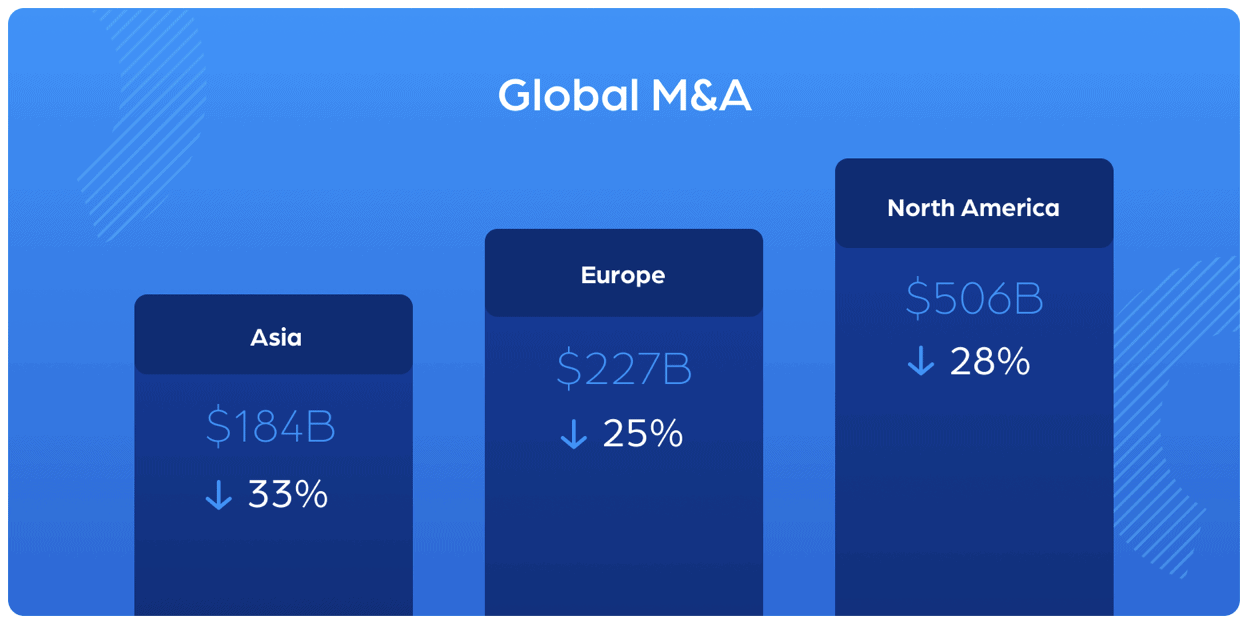

But Q1 of this fiscal year showed a significant decline in M&A activity, with only 5,000 deals being made, estimated to be below a trillion dollars. Moreover, deal values have decreased by double-digit percentage points across major business regions, including North America, Europe, and Asia. And even with preemptive warnings shared by market forecasters about this slow-down of activity, dealmakers are unsure of what to expect from the M&A market due to inflation and ongoing geopolitical tensions.

This unpredictability poses the question: will M&A sink or soar in 2022?

Using the AlphaSense platform, we unearthed what drove the M&A market last year to reach new milestones in deal valuation and why the first half of 2022 has shown slower activity so far.

What Made M&A Boom in 2021?

The highs that the M&A world experienced in 2021 can be attributed to the market setbacks brought on by COVID-19, the adoption of digital transformation, and the availability of corporate assets.

Technology and healthcare, both composing a large share of the M&A market, fueled demands that went unmet in 2020 when M&A activity plummeted due to the global financial fallout from the COVID-19 pandemic. The virus’s severity and longevity forced companies to invest in digital transformation, making the technology, media, and telecom (TMT) sector M&A’s most powerful industry. By the end of the year, TMT increased its global M&A activity by four percent and accounted for the six largest deals made in 2021.

Private equity (PE) involvement in M&A was initiated by corporate capital gains taxes that led to corporate assets to be put on the market. After suffering from a lack of funds in 2020 and activity due to the pandemic, PE firms saw an opportunity for growth through acquisition. As a result, in 2021, the value of PE transactions within the US rose more than 55 percent.

With the amount of dry powder in the private markets, M&A markets look to be staying active. Since 2021, PE firms have been sitting on $2.5 trillion in non-deployed capital, meaning that many will be ready to invest once they have a more clear understanding of the market. Many of these firms are waiting to see to what degree the markets recalibrate, similarly to how they reacted during the height of the pandemic. Private deals, for example, are a sweet spot for PE firms when public markets sell off. It wouldn’t be surprising for allocators, such as sovereign wealth funds, pension plans, and family offices, who handle M&A transactions in-house, to be in the market.

The Challenges for M&A in 2022

Today, M&A is shifting away from the more strategic, transformative acquisitions that defined 2021. Different market-moving events tend to shape the direction of M&A. Where 2021 saw firms seeking greater digital integration under the pressure of the pandemic, 2022 has a new set of events to calibrate around. The average deal shrank in Q1, and total deal volume continued to fall. After roughly 6,700 M&A deals in the first quarter of 2021, Q1 2022 saw less than 5,000, down from just under 6,000 last quarter. And activity is expected to shrink year-over-year in Q2, with a close eye on inflation, GDP growth, and central bank rate hikes. The shift in these figures QoQ is a direct consequence of the on-going geopolitical and supply chain issues that have directly impacted the economy.

Since the onset of the pandemic, companies across all industries have been searching for alternative supply chains due to trade tensions and COVID-19. Some companies have acquired suppliers, either outright or in joint ventures, that are closer to home or in more geopolitically secure locations to meet their needs. Others have waited for cases of the virus to lessen and allow top manufacturing countries to fulfill their backlogs.

China, the world’s largest manufacturer, has imposed government-mandated lockdowns to curb the country’s worst COVID-19 outbreak in two years. Consequently, their halted production of goods has slowed down their economic momentum, propelling the country’s central bank to introduce measures that encourage financial institutions to support government infrastructure initiatives. Russia’s invasion of Ukraine has also caused more issues for supply chains globally, driving inflation higher nationally and internationally. The Federal Reserve responded by raising interest rates, which has only fostered more uncertainty within the M&A market.

Global dealmaking has dropped significantly in comparison to 2021, with Asia showing a 33% decrease, Europe a 25% decrease, and North America a 28% in M&A activity. Though it is important to note, experts are saying this drop in percentages are no cause for concern, as they reflect numbers similar to 2019.

M&A Activity Reverting to Pre-Pandemic Levels

While M&A is showing signs of slowing down compared to last year, there’s still ample room for prosperous investment opportunities to be found. Economic headwinds may have stunted M&A activity in the first half of 2022, but lower valuations can bring opportunities for dealmakers to generate healthy returns.

For example, public-to-private transactions have increased by more than 50% in 2022 compared to the prior year period. PE now accounts for nearly half of all deal value — double the amount compared to five years ago. And, over a third of deal value is invested in TMT, which reflects the impact of digital transformation in driving deals and the continued trend of investing in ad technology.

Yes, larger, strategic deals are less appetizing since an economic contraction. The reality is that dealmakers could face a tougher financing environment due to higher interest rates. But this time of uncertainty does not mean key players should sit back and watch the market play out. “’Now is not the time to sit on the sidelines, but to reassess – even reset – M&A strategy,” says Brian Levy, Global Deals Industries Leader at PwC.” I fully expect to look back at 2022 as a pivotal moment where the successful dealmakers of tomorrow are determined by those who boldly execute on their M&A goals today.”

Against the ongoing backdrop of geopolitical uncertainty and COVID, the pharma and biotech industries continue to be challenged by growing market volatility and a tougher financing environment compared to previous years. Interested in learning about the shifts in M&A interest over time, and what’s most attractive today? Watch this briefing with Bank of America’s leading pharma and biotech analysts to hear their analysis and overview of M&A deals in the pharma and biotech sectors.