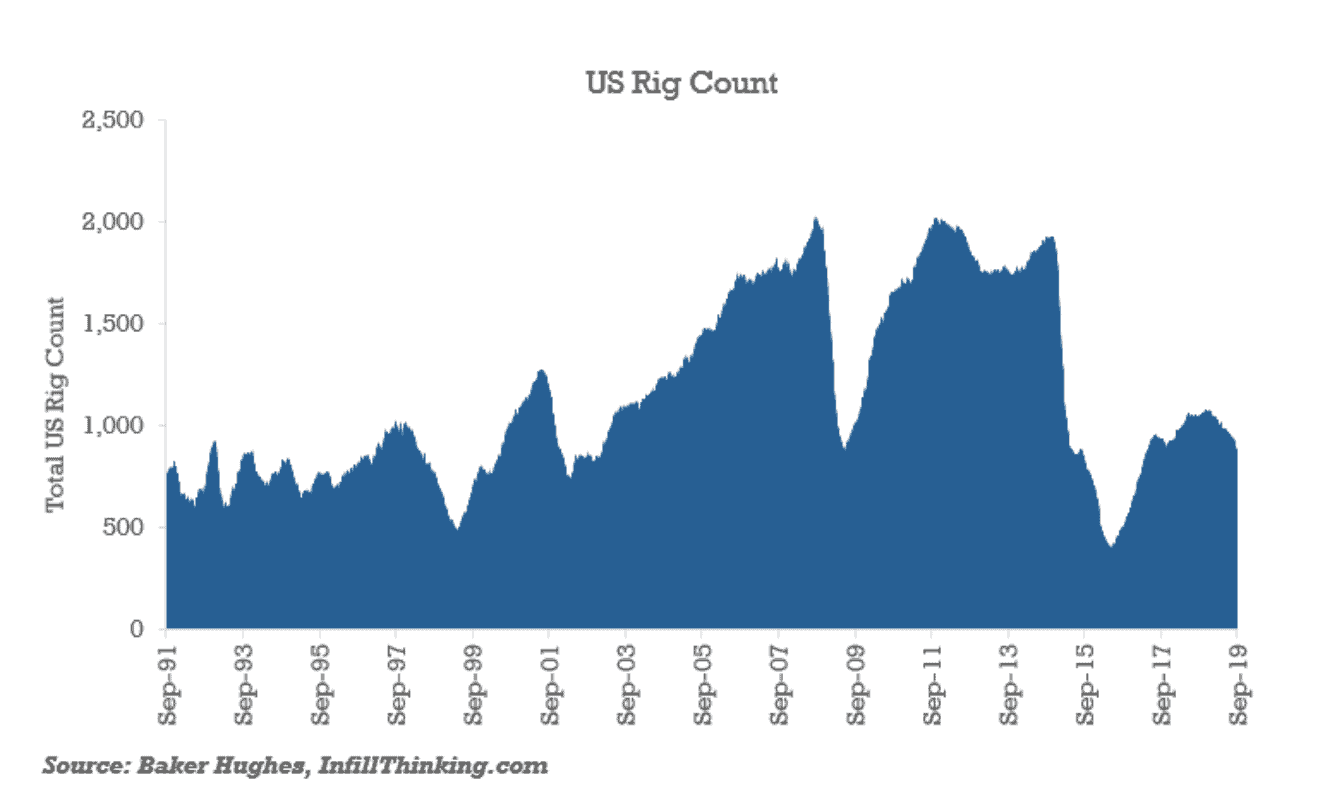

Every Friday, rain or shine, the United States rig count is published on the Baker Hughes website, tracking the number of rigs actively drilling oil and natural gas wells on US soil.

The United States rig count is traceable back into the 1940s, making it one of the longest running data series in the oil industry (exception oil prices, which are observable into the 1800s). The rig count tells the story of the ups and downs in oil business cycles.

For many years, rig count was the most closely followed metric for oilfield analysts trying to gauge conditions in the E&P and oilfield service sectors.

However, it has recently become trendy for analysts to downplay the metric’s importance.

There are three primary reasons why many analysts have decided that the rig count is not as interesting as it used to be:

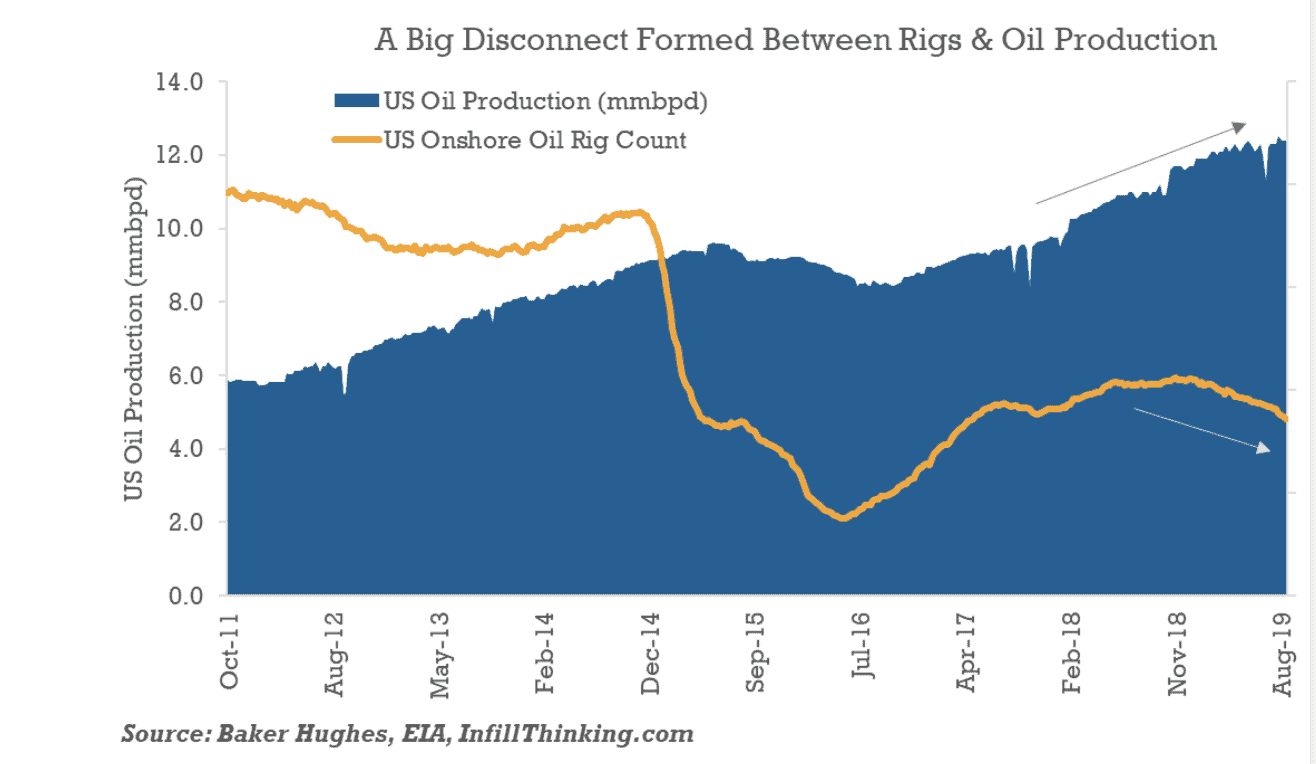

- US oil production has become more closely correlated with new drivers like frac sand volumes pumped and far fewer rigs are required to sustain US oil production than ever before

- Transparency and regular measurements of these new drivers are now widely available, so forecasting models are running off of drivers other than rig count

- The addressable market has moved away from drilling rigs in favor of hydraulic fracturing related well costs

At my research firm, our desk has faithfully published an in-depth analysis of every Friday’s Baker Hughes rig count release since we opened for business three years ago. Here are several reasons we still believe in the value of tracking this metric:

- Everything in oil and gas starts with the rig – the entire well lifecycle (including all the capital intensive activity and every drop of crude oil produced) comes behind the rig

- Ebbs and flows in the total rig count metric are still a good leading indicator for a variety of trends, and there is a ton of history to draw cross-cycle comparisons

- While it’s been trendy to shun the rig count for modeling purposes, a whole lot of folks that make business decisions in the oilfield still pay close attention to it

That said, even we have been tempted to shift our research bandwidth to other data sets. We spend the vast majority of our time on sand, water and logistics topics these days, but we still make time for our weekly rig count piece.

Recently, I asked our team to think long and hard about whether it was worth it to continue our rig count updates. To decide, we needed some empirical data on the relevance of rig count, and for that we quickly turned to Alpha-Sense.

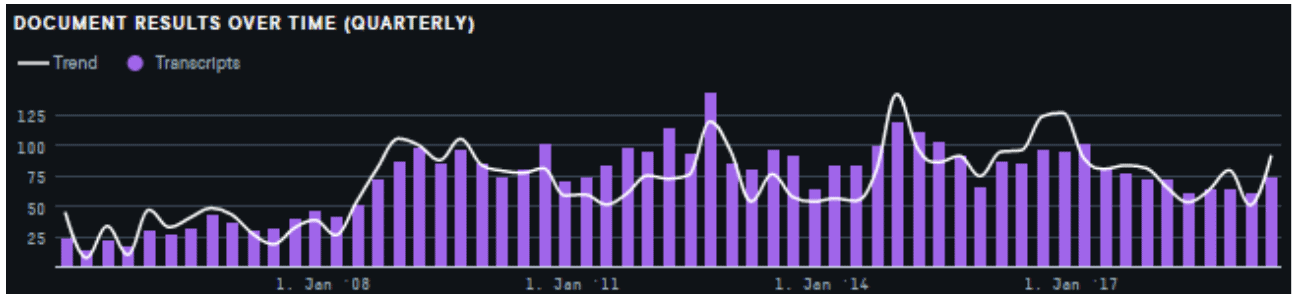

What we found about the resiliency of this time-tested metric was a bit surprising. While the analyst community started shunning rig count several years ago, the conversation about rig count among executives and investors hasn’t really died down much.

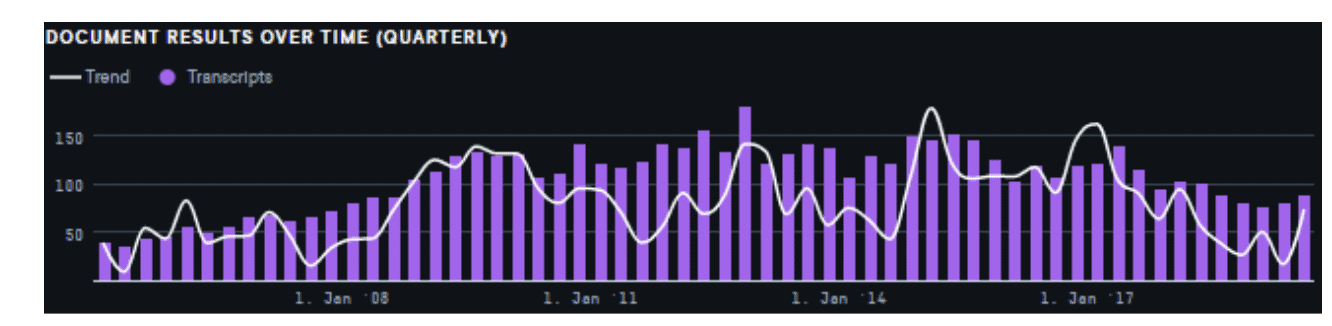

Here’s the result of an Alpha-Sense search we ran on the frequency of references to “rig count” on event transcripts in the US oil and gas industry. While clearly down off the spikes of interest, this exercise shows that mentions of the term “rig count” are about flat with levels two years ago and only down slightly from five years ago. Hardly going to zero!

A common synonym for rig count is “drilling activity” so we expanded the Alpha-Sense search to include both terms just to be sure we weren’t missing anything. The result does show a bit more of a downtrend, but probably not as much as the naysayers might expect.

So what’d we learn from all this?

Analysts may not be modeling their forecasts based on rig count any longer, but they still watch it. Energy CEOs still like to talk about rig count almost as much as they did when it was the driver of forecasting models. And the findings in the Alpha-Sense search results shown above give us resolve that it’s too early to put the rig count out to pasture just yet…