2021 looks starkly different compared to 2020. While the world was beginning to shut down as it faced a global pandemic, we’re now seeing the blossoms of a post-pandemic world. Vaccinations have been deployed, restrictions and shutdowns have been reduced, and cases have dramatically fallen over the past couple of months.

But what does that mean for many of the world’s industries and companies? We decided to take a look at how companies are considering a post-pandemic world, whether recovery seems to be coming sooner than later, and discover key insights from several companies within the most-impacted industries.

Q1 2021 Discussion on Recovery, Vaccines, and Post-Pandemic

[these numbers reflect information from Jan 1st 2021 to March 22nd 2021]

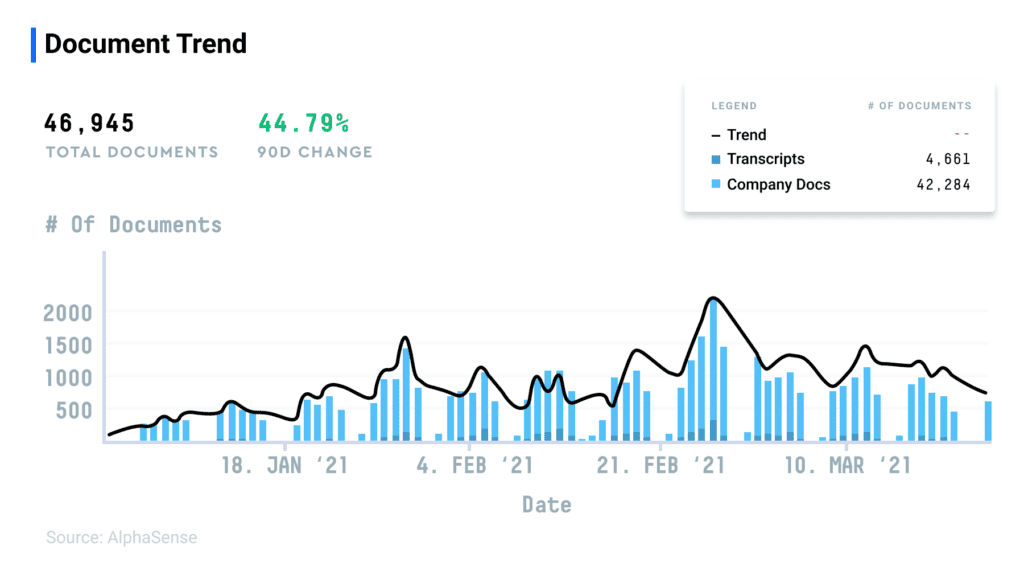

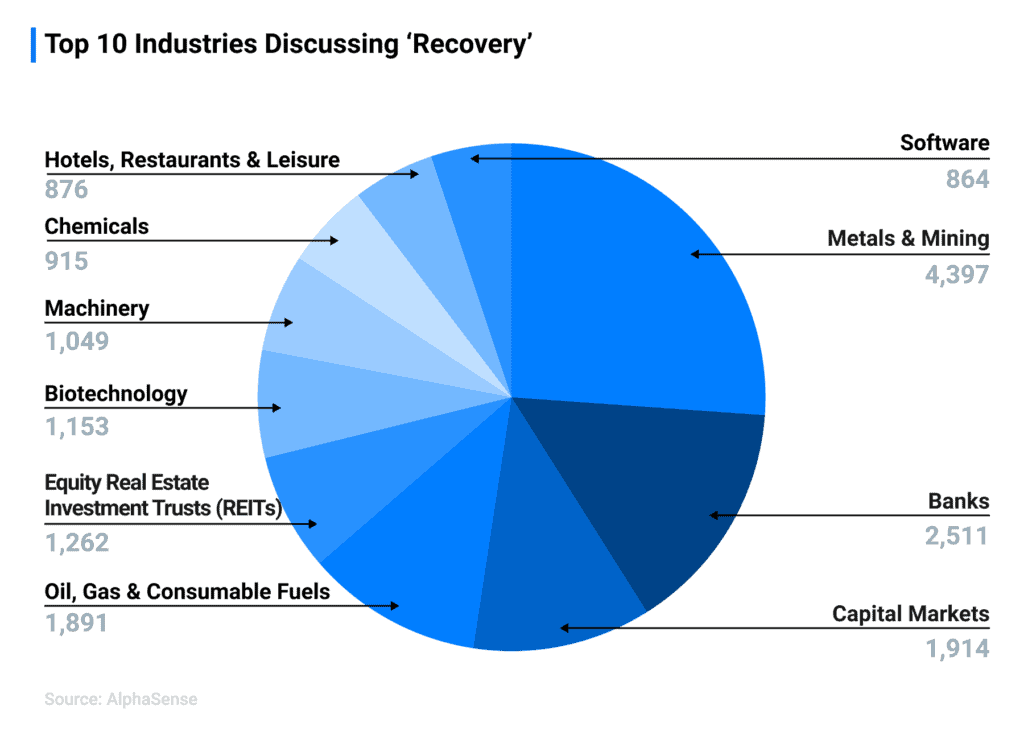

Industries Discussing Recovery

From January 1st to March 22nd, nearly 47K Company Documents included the word “recovery”, a 44.79% increase over the last 40 days. Out of these, 4,661 were event transcripts.

Top 10 industries with documents that contain the word “recovery”

Metals & Mining and Banking companies make up most of the companies discussing any kind of recovery. Below are the rest of the top 10 industries.

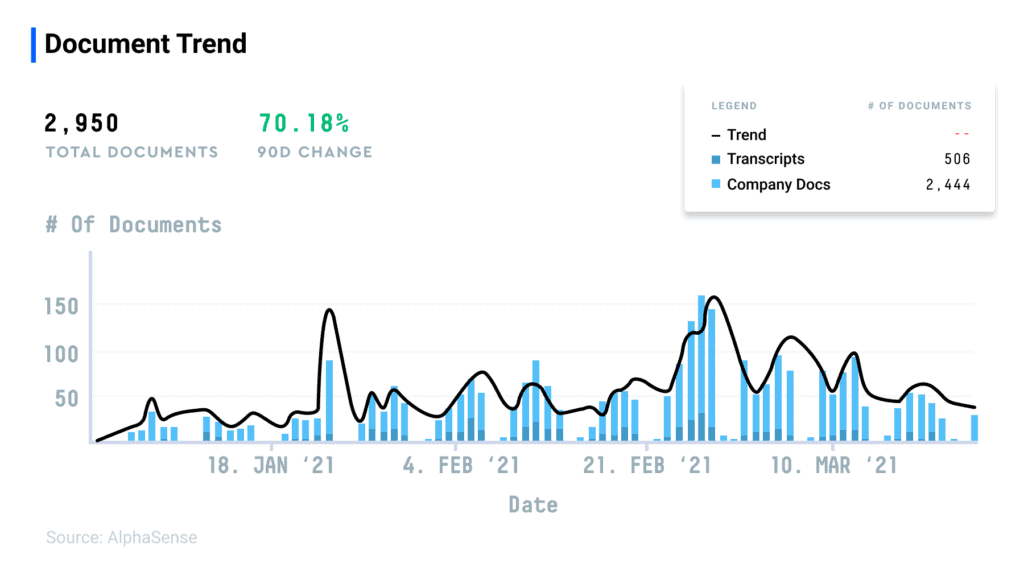

Recovery and Vaccines Are Closely Related

We also looked at the number of company documents that contain both the word “recovery” and “vaccine” (alongside vaccine-related terms– see our Smart Synonym video to learn more):

We observed over 2,900 company documents, a 70.18% increase over the last 40 days, signaling an increasing interest in the topic.

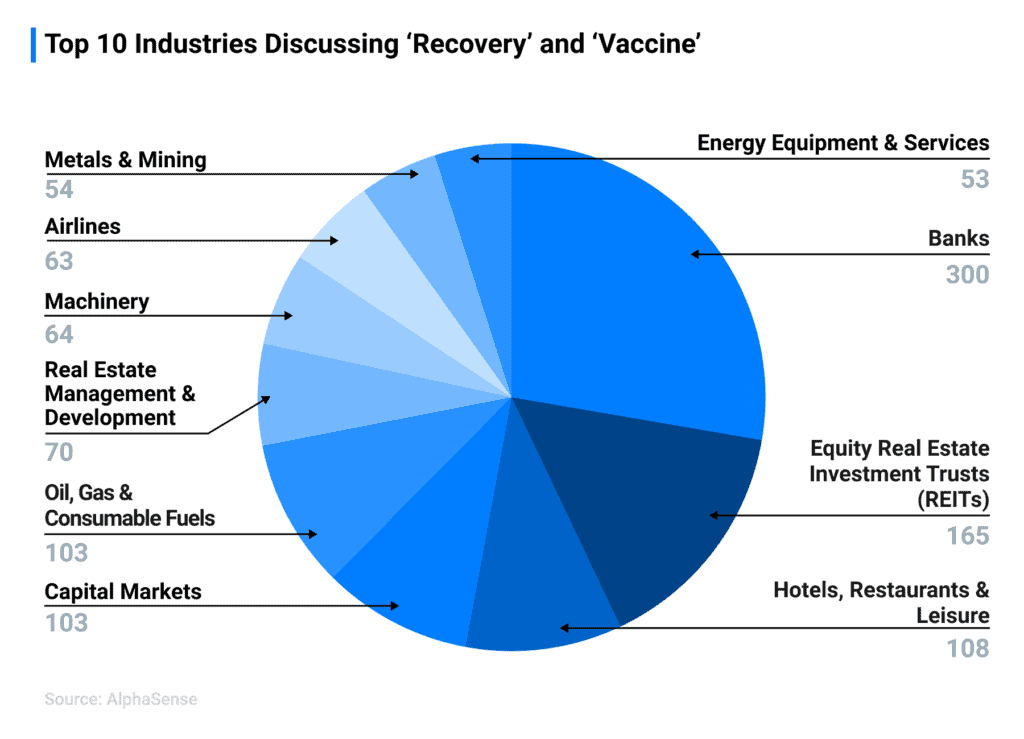

Top 10 industries with documents that contain the word “recovery” and terms related to vaccines

When looking at who’s discussing recovery alongside the vaccine, we see a different trends — Banks, REITs, and Hotels, Restaurants, & Leisure are among the most active industries.

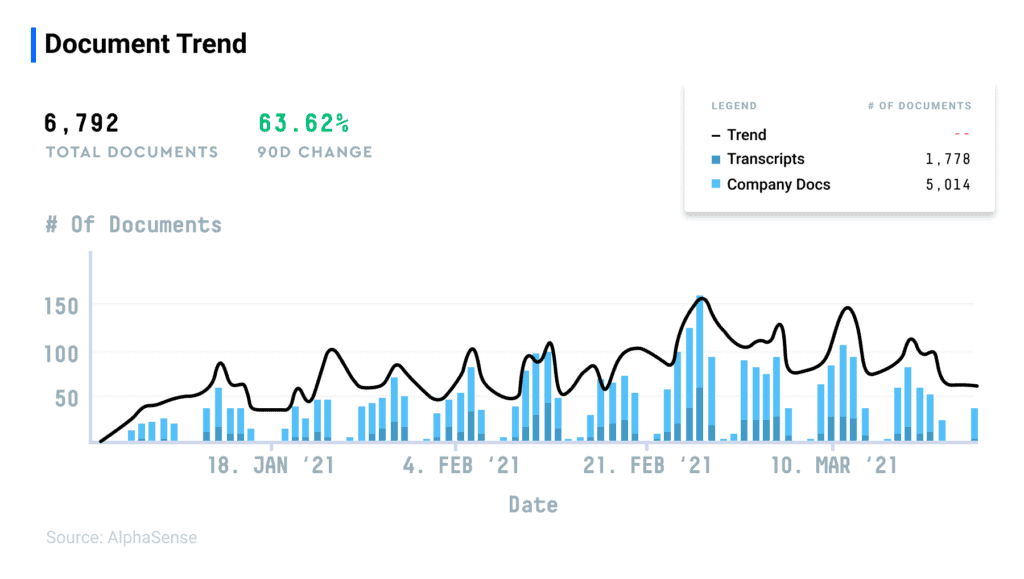

Post-pandemic Is Top of Mind for Many Companies

Over 6,700 company docs containing “post-pandemic” (or similar terms) were published, a 63.62% increase over the last 40 days.

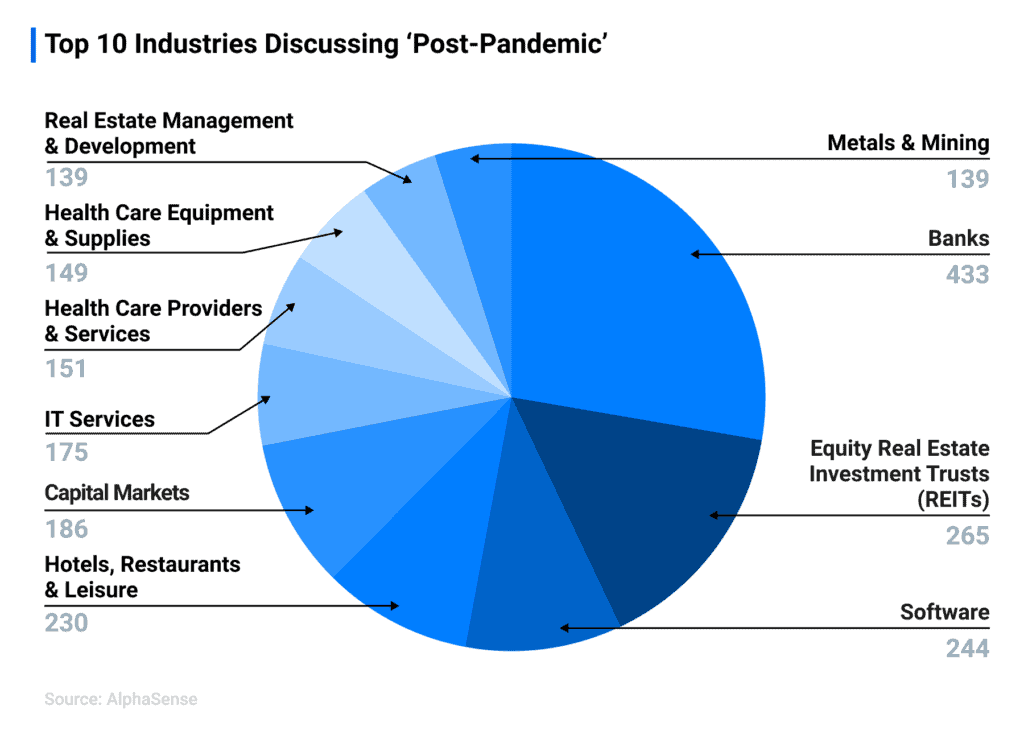

Top 10 industries with documents containing terms related to post-pandemic

On the topic of post-pandemic, our most active industries include Banks, REITS, and Software.

Key Industry Insights on a Post-Pandemic Future

We dug into some earnings call and event transcripts from the industries that were buzzing the most around their post-pandemic outlook to see what outlook, opportunities, warnings, and other key insights and takeaways are worth considering. To get a sneak preview of the entire document, click on the transcript link.

BANKS

Annie Lee | First Financial Holdings

Executive VP, IR Head, Head of Strategy Planning Department & Company Secretary, FY 2020 Earnings Call | AlphaSense Transcript

[answering a question regarding post-pandemic strategy, resource allocation given the new President, and the post-vaccination period]

“For us, we would like to revisit our niche market in U.S. or in Greater China, especially for China exposures. These 2 major continents both can help to generate [a] decent top line for us…starting from this year, we will be aggressively build[ing] up new assets toward these 2 areas that will help us to regain our past victory glory in this region that will help us to regain our momentum in the 2 overseas markets for this year. China and U.S.”

Noel P. Quinn | HSBC Holdings

Group CEO, Member of Group Management Board & Executive Director, Q4 Earnings 2020 Call | AlphaSense Transcript

“With respect to the commercial bank in the U.S. Actually, pre COVID, that was generating good returns both within the U.S. and when you add in cross-border referrals to other parts of the world, the inherent return from our Commercial Banking clients in the U.S. was strong. So I don’t think strategically, that is an underperforming business the way we have an underperforming business in Retail Banking in the U.S. It’s one [commercial banking] that we think can continue to generate good returns going forward as the economies normalize after COVID.”

REIT

Robert F. Barton | American Assets Trust, Inc

Executive VP & CFO, Q4 2020 Earnings Call | AlphaSense Transcript

“A conservative balance sheet is very important to us. During this pandemic, our EBITDA has been challenged like others with exposure to retail and our hotel resulting in lower EBITDA. We believe that our high-quality portfolio in superior coastal West Coast locations will begin to return to normal post pandemic. And our expectation is that our net debt-to-EBITDA will begin working its way back down to 5.5% or less based on the corporate model that I’m looking at.”

Donald C. Wood | Federal Realty Investment Trust

CEO & Director, Company Presentation | AlphaSense Transcript

“Our priorities [are] completely focused on post-COVID. What were we going to do? Because as many of you who know me know, I believe that retail — that we are over retailed as a country. I still believe that, although there are sectors that there’s been pretty good adjustments that happened during COVID, that you need to be the consolidator in terms of your particular shopping center, your particular retail destination on the other side of this, the place of choice.”

SOFTWARE

Sharat Sharan | On24

Co-Founder, CEO, Q4 2020 Earnings Call | AlphaSense Transcript

“I do want to make — I also want to make one comment here, which I think is important. There is generally a tendency — when people think about the post pandemic…of thinking about the world being all physical events and physical trade shows going back to physical. I just want to highlight that the virtual conferences or the virtual trade show are less than 12% of our ARR. So that’s a small portion of our business. We have a much larger digital experience platform this [extends to] that has been doing very well pre-pandemic that we expect is going to continue to do well.”

Barak Eilam | NICE Ltd

Chief Executive Officer, Q4 2020 Earnings call – AlphaSense Transcript

“The pandemic itself accelerated certain trends, starting with the adoption of cloud, the shift of digital and the adoption of AI. And we don’t think it’s temporary. We think it’s a bit — the aftermath of the pandemic, those 3 things as well as others, but those 3 things will remain with us well after COVID will be out of the headlines. And that’s healthy for our business.”

HOTELS, RESTAURANTS, & LEISURE

Nathan Scholz, Domino’s Pizza Enterprises Limited,

Head of Government & Investor Relations, H1 2021 Earnings Call | AlphaSense Transcript

“We’re prepared for ongoing uncertainty…with COVID-19 into the calendar year 2022. We expect societal restrictions will continue to affect all of our markets differently, and the leadership team has outlined some of those to you today.”

“We have seen strong digital delivery growth, and COVID, as we see it, has brought forward the age of delivery. Carryout orders do remain challenging in many of our regions, but we also believe that these present an opportunity post-COVID-19 to rebuild those.”

Richard Darwin | The Gym Group plc

CEO & Executive Director, 2020 Earnings Call | AlphaSense Transcript

“…and if anything, why we think the investment case has been strengthened post-COVID. We see a great market opportunity that’s been strengthened as, post-COVID, some of our competitors have been weakened, and we absolutely believe that the low-cost part of the market will emerge as the dominant sector. Ours has always been a high-quality estate, but now we get the ability to take advantage of the easing of supply, better availability of properties at a time when, as we’ve demonstrated, we have low levels of gearing and are well set up to be able to take advantage of that opportunity.”

Methodology: How did we get this information?

AlphaSense is an AI-powered market intelligence platform that users leverage to surface key and relevant information and insights on any topic. The platform uses AI to make content type recommendations and group terms and words together so it knows to surface documents that are talking about the “vaccine” even if that term isn’t specifically used. The platform will also surface exactly where within a given document (such as an earnings call transcript), a topic is mentioned, leveraging its smart synonyms tool. We used AlphaSense to discover how many company documents were discussing various topics and extracted key insights from earnings call transcripts, all found within the AlphaSense platform.

To learn more about how COVID-19 impacted the global economy and the world’s sectors, check out our 2020 in Review report full of more data-driven insights.