The debate over the future of minimum wage rate hikes on both state and federal levels is poised to be a continuing issue of importance as both companies and lawmakers grapple with best course of action and potential economic outcomes ahead of the 2020 election season.

More than 20 states have or are planning to increase minimum wage rates by the end of 2019, some as part of a longer-term wage hike plan with incremental raises year-over-year. On Capitol Hill, a new bill was introduced into the House to incrementally raise the federal minimum wage to $15/hour by the year 2024.

If the bill passes, it still has to face a Senate vote. But as the minimum wage debate comes back into the spotlight, it can be anticipated as a platform issue for Democratic hopefuls eyeing nomination in the 2020 presidential race, and set the stage for evolving economic policy that could impact employers for years to come.

Mitigating minimum wage regulations is an ongoing cost-of-labor concern for companies. According to a recent poll from CNBC, 85 percent of CFOs from the North American region cited labor costs as one of their biggest expenses into 2019.

The largest economic debates over minimum wage regulation is potential impact on employment, and a growing shift towards investing in automation to offset rising costs. During earnings season, companies with large minimum wage labor forces should anticipate how to discuss these issues with analysts, and understand how other industry leaders are addressing challenges.

How are companies talking about minimum wage today?

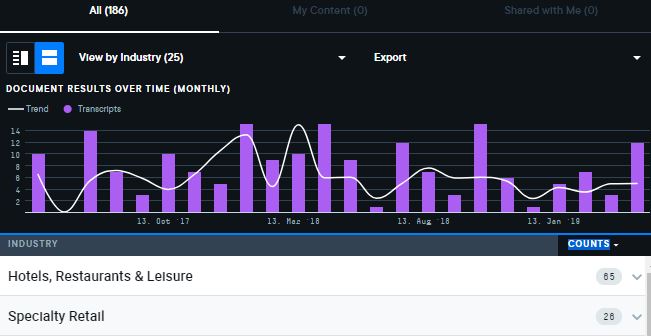

AlphaSense data shows volume of conversations surrounding minimum wage typically skew within the hospitality and retail industries, which account for a large percentage of minimum wage workers across the United States.

Within these two industries, factoring in changes in minimum wage policy can also help inform potential shifts in corporate strategy, identify risk, and maximize efficiency.

For example, Dunkin’ Brands shed light on minimum wage challenges for its franchises in 2018:

“It is an increasingly challenging environment for retail and restaurants. Value wars among QSRs fighting for market share, minimum wage increases and low unemployment, these are all realities our franchisees are seeing and feeling in the business.”

Zumiez, a clothing retailer, also noted changing wages as a concern in their Q4 ‘18 earnings call:

“…What you hear most retailers talk about, minimum wage increases and wage inflation and shipping costs. So those are going to be our biggest 2 challenges. So we have a lot of initiatives in place to try to minimize those impacts. Localization and the way we handle online fulfillment is one of them. As is how we schedule, how we plan, where we put our best salespeople. All of those things are initiatives that are out there for us right now.”

Some larger retailers have viewed raising minimum wage as competitive advantage when attracting talent. For example, in Q4 2018, Amazon CEO Jeff Bezos announced a company-wide initiative to raise minimum wage to $15/hour. In contrast, Amazon is also known to invest heavily in automation, posing unique questions for future plans for how the company views its workforce.

Given Amazon’s influence, a reverse search using AlphaSense data reveals a handful of Q4 ‘18 calls discussing Amazon’s move — including direct mentions from General Motors and Walgreens asserting their position on the issue in light of the news. (For a closer look, log into AlphaSense here, or request a demo).

Banks, industrials, and real estate firms are also discussing the potential impact of further increases to the minimum wage. In April 2019, Bank of America announced plans to gradually raise minimum wage to $20/hour in an effort to invest in its workforce. On the other hand, realty leaders discussed issues with offset hotel revenues due to increases in labor costs, and a shift to strategic localization to maximize revenues.

Making sense of the minimum wage debate

Minimum wage policy is poised to affect different industries in different ways. Companies are reacting with different strategies to mitigate the issue for the best possible outcomes. Ultimately, the long-term question remains as to whether impacted businesses will be able to pass the increased cost to the consumer, or structure costs in a way to balance out new expenses.

Understanding how companies are reacting to changes, and discussing the issue with analysts on earnings calls, can help inform evolving company strategy and competitive intelligence as policies change over time.