Spotify had one of the most eventful quarters across internet. By signing podcast deals with Joe Rogan, Kim Kardashian, and DC Comics, after The Ringer in late Q1, Spotify changed the debate: they now have their fixed cost business to scale over their global subscriber base. Like early days NFLX, SPOT seems to acquire content without attracting bidding wars from big tech – allowing the Company to build an early lead with biggest names in podcasting. Despite Spotify’s stock price doubling in Q2 as investors began to see the parallel to Netflix and expectations on terminal margins rose, NFLX remains >4x the Enterprise Value of SPOT.

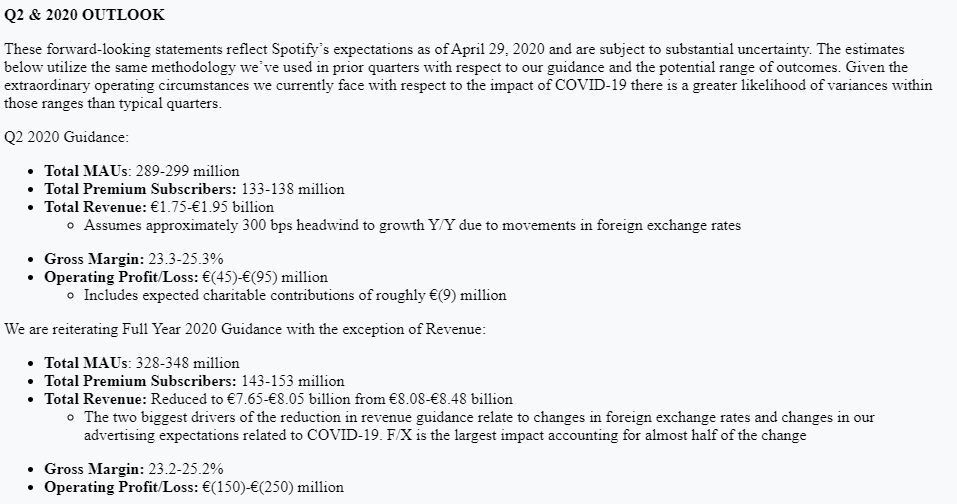

In Q2, investors are expecting ~6m Premium net adds to 136m subs, in-line with guidance of 133-138m. While this is down from 8m net adds in Q2’19, Spotify would still be on track to add as many subscribers in 2020 as 2019 based on 1H performance – before getting a likely boost in 2H from launching new markets (Russia and South Korea) as well as the Joe Rogan podcast.

Total MAUs are expected to be up 28% YoY to 298m, which implies 12m net adds, down from 15m in Q2’19. Total Revenue is expected to grow ~15% YoY, with 27% growth in Premium Subs, ARPU -8% YoY driven by FX and mix shift towards international and family plans, and Ad Revenue -8% (sharply decelerating from +17% in Q1, due to COVID-19). Gross Margins are expected to be 24.8%, down slightly from 26.0% in Q2’19 due to podcast investments and weak advertising revenues.

There are two primary legs to the long term margin expansion story. Podcasts seem to have hit an inflection point in both engagement and content acquisition. On September 1, Joe Rogan podcast goes exclusive to Spotify. This will give investors the first glimpse of whether podcast content will drive subscriber growth (if Rogan can’t, who can?)

Here’s what Daniel Ek said about Podcasts in Q1:

“Answer – Daniel G. Ek: Yes. I mean, overall, just to up-level, it was about a year ago since we announced our shift from the music to audio-first strategy. At that place, we were about 0.25 million or so in our podcast catalog.We’ve grown that by 3x to over 1 million podcasts now. We were a small player in podcast, but we’re now more than #1 in more than a dozen markets and growing very fast in the markets where we’re not #1. So we’re feeling pretty good about that.

In terms of user behaviors, what we are seeing is that podcast users are more engaged overall. They do listen to more music as well. And in terms of some of our Originals & Exclusives, we are seeing some pretty good progress. We’re still learning how to best market those shows, whether it all-out exclusives, whether it’s windowing. So we’re experimenting a bit with that. We’re experimenting with how to market these shows, too. I suspect that will be down to different audiences and consumption behaviors of those audiences. You should expect that to play out in 2020 of more experimentation, but we’re definitely doubling down based on the early signs that we’re seeing.

And I think in — as related to more acquisitions, we keep on doing more deals and podcasts based on what we’re seeing. So if the macro environment means that there will more advantageous deals to be done, we will for sure look into that.”

The second leg of the stool is Spotify’s 2-Sided marketplace. This narrative also received a boost this quarter as 1) Billboard reported Spotify’s Marquee Ad service was seeing >20% CTRs in beta, and 2) Spotify, finally, signed their UMG deal. The commentary from the press release on the UMG agreement was notably positive for the potential of the 2-sided marketplace.

We’ll be looking to hear updates on:

- Trajectory of GMs with label deals now behind them

- Podcast strategy: how should we think about spend on exclusive content, and how does Spotify plan to monetize (sub acquisition, podcast ad tools, price increases?)

- 2-sided marketplace – update on run rate, trajectory, and what we should expect from in terms of new ad formats

- What impact does the Company expect from Joe Rogan on Q3 / Q4 subs?

Prior Quarter Guidance:

Suggested Reading:

- Barclay’s on Spotify’s Podcast strategy

- Morgan Stanley on the $400 Bull Case

- Suntrust Takeaways from Management Meeting

- ThirdBridge call with Apple Podcast Former

- Last earnings call transcript