In 2018, over one million consumers left traditional cable television for streaming services. Within the first quarter of 2019, another 1.4 million subscribers joined Netflix, Hulu, and YouTube full-time.

While cord-cutting may be increasingly popular, apps like Quibi have found the marketplace to be competitive and volatile. The streaming service, which focused on smartphone-first, short-format content, went from a highly-anticipated disruptor to a failure within its first six months of launch. In its announcement this week that it would be shutting down, Quibi noted that its viewership (and advertising revenue) was lower than expected and that users failed to renew their three-month-free subscriptions.

Quibi’s failure starkly contrasts the success of its competitors. In the first half of 2020, Netflix added 25.9 million customers, while new platforms like Disney+ and HBO Max quickly gained traction.

Throughout 2020, executives have expressed a dichotomy: with COVID-19 shutdowns and stay-at-home orders, more people have joined streaming services. Simultaneously, established companies like Netflix were unable to create new content for their platforms despite massive budgets.

| Streaming Platform | 2020 Content Budget | # of Subscribers (Current) |

| Netflix | $16 billion | 195.15 million |

| Hulu | $3 billion | 35.5 million |

| Disney+ | $1.75 billion | 60.5 million |

| ESPN+ | N/A | 8.5 million |

| HBO Max | $1.5 billion | 8.6 million activated users

28.7 million eligible users |

| Amazon Prime | $7 billion | 150 million |

| Apple TV+ | $6 billion | 33.6 million |

| YouTube TV | N/A | 2.3 million |

| Peacock | $2 billion | 15 million “sign-ups” |

| Quibi | $1 billion | 1.5 million |

Q3 earnings proved difficult for Netflix and Disney in particular. Netflix, which had previously dominated its first half predictions, saw slight downturns in revenue and new accounts. Disney noted the same problem. With more consumers returning to work, and with COVID restrictions still cutting into content production, how will these streaming giants compete through the rest of 2020 into 2021?

Takeaways:

- In its Q3 earnings, Netflix missed Wall Street’s estimate of 3.32 million new subscribers, garnering only 2.2 million

- In its Q3 8K, Netflix noted that “Disney’s recent management reorganization signals that it is embracing the shift to streaming entertainment. We’re thrilled to be competing with Disney and a growing number of other players to entertain people.”

- Disney’s combined global reach of direct-to-consumer businesses at Disney+, Hulu, and ESPN+, now exceeds 100 million paid subscriptions.

- In its Q2 Earnings Call Transcript, Amazon executives noted that worldwide streaming video hours doubled year-over-year driven largely by Prime video

- HBO Max activations more than doubled in the third quarter to 8.6 million, though there’s a caveat: In its overall HBO Max number, AT&T rolls up all subscribers who are eligible to get it — even if they haven’t watched it.

It’s more important than ever to track industry disruption. Leverage AlphaSense to stay up-to-date on executive commentary and themes in technology by logging in or unlocking a free trial.

Netflix: The Streaming Giant

In its Q3 earnings, Netflix missed Wall Street’s estimate of 3.32 million new subscribers, garnering only 2.2 million. This miss comes after the streaming giant added 25.9 million customers in the first half of the year, largely driven by COVID and mandatory stay at home policies.

- Netflix posted revenue of $6.44 billion (up 22.7%) and earnings of $1.74 per share.

- Netflix reported 195.15 million paid streaming customers worldwide.

- Netflix has a budget of over $16 billion for new content in 2020, although production schedules have been

Q2 Earnings Call – July 20th, 2020

“We are the world’s leading subscription streaming entertainment service with over 192 million paid streaming memberships in over 190 countries enjoying TV series, documentaries, and feature films across a wide variety of genres and languages.”

8K – October 20th, 2020

This past quarter, we saw the debut of Comcast’s Peacock, which comes on the heels of the launch of HBO Max and Disney+. Disney’s recent management reorganization signals that it is embracing the shift to streaming entertainment. We’re thrilled to be competing with Disney and a growing number of other players to entertain people; both consumers and content creators will benefit from our mutual desire to bring the best stories to audiences all over the world.

Q3 Earnings Call Transcript – October 20th, 2020

So retention remains well at very healthy levels, better than we were a year ago. Acquisition remains strong. So you’re just seeing some kind of a natural, kind of because of that pull-forward effect, some slowdown. But we don’t want to lose sight of the fact that to measure our business, it’s really not based on any single quarter of growth fluctuation. It’s really about — it should be measured in multi-quarter and multi-year trends. And so if you look at the past 3 quarters, year-to-date through Q3, we’ve grown by a little over 28 million members, which is more than we grew all of last year. So super healthy growth, and the underlying both top-line and bottom-line growth and retention trends in our business are healthy.

Disney: The Much-Anticipated Newcomer

This year, Disney began offering a package for users that combines its three services into one bundle for $12.99 per month, significantly reducing the cost of the three services combined for cord cutters. In its Q2 earnings, Disney noted that DIsney+ and Hulu significantly offset losses for the quarter from theme parks and resorts, theater closures, cruise line shutdowns, and decreased merchandise revenue.

When you look at Disney’s full portfolio of direct-to-consumer businesses at Disney+, Hulu, and ESPN+, its combined global reach now exceeds 100 million paid subscriptions. In Q4, Disney “expects [its] DTC segment to generate about $1.1 billion in operating losses, and [it] expects “the Q4 operating results of our DTC businesses to improve by approximately $100 million relative to the prior year quarter, driven by lower losses at Hulu and ESPN+, partially offset by our continued investment in Disney+.”

Disney +

- Disney+ intends to spend up to $1.75 billion on new content in 2020 and has a subscriber base of over 60 million people (within its first year of launching.)

- Despite its strong subscriber base, Disney+ daily viewers has declined for two consecutive quarters.

- In 2020, Disney+ launched much-anticipated content including Star Wars spinoffs and Hamilton.

- Disney+ will spend up to $1.75 billion on new content this year, and has built a subscriber base of over 50 million people within five months since launch.

- In April 2020, Disney+ launched Disney+ Hotstar launched on April 3, 2020 (as a conversion of the preexisting Hotstar service in India) and is included in the number of paid subscribers and average monthly revenue per paid subscriber. The average monthly revenue per paid subscriber for Disney+ Hotstar is significantly lower than the average monthly revenue per paid subscriber in North America and Europe.

The Walt Disney Company – Q3 Earnings – 10Q

In November 2019, the Company launched Disney+, a subscription based DTC streaming service with Disney, Pixar, Marvel, Star Wars and National Geographic branded programming in the U.S. and four other countries and has expanded to select Western European countries in the Spring of 2020. In April 2020, our India Hotstar service was converted to Disney+ Hotstar, and in June 2020, current subscribers of the Disney Deluxe service in Japan were converted to Disney+. Further launches are planned for Latin America in the fall of 2020, and Europe and various Asia-Pacific territories throughout calendar 2020 and calendar 2021.

Hulu

- Hulu has more than 33 million global subscribers, although a large chunk of them are on free subscriptions–generating ad revenue for the Disney-owned giant. This year alone, Hulu plans to spend over $3 billion on new content, while customer numbers rise steadily (+3 million last quarter.)

- Hulu, the company said in its fiscal third-quarter earnings report, now has 35.5 million subscribers to its on-demand service and live TV bundle combined.

- Hulu is still ⅓ owned by Comcast, and ⅔ owned by Disney. Hulu is currently valued at $27.5 billion.

The Walt Disney Company Q3 10Q – August 4th, 2020

On May 13, 2019, the Company entered into a put/call agreement with NBC Universal (NBCU) that provided the Company with full operational control of Hulu. Under the agreement, beginning in January 2024, NBCU has the option to require the Company to purchase NBCU’s approximately 33 % interest in Hulu and the Company has the option to require NBCU to sell its interest in Hulu, based on NBCU’s equity ownership percentage of the greater of Hulu’s then fair value or $ 27.5 billion.

NBCU’s interest will generally not be allocated its portion of Hulu’s losses as the redeemable noncontrolling interest is required to be carried at a minimum value. The minimum value is equal to the fair value as of the May 13, 2019 agreement date accreted to the January 2024 redemption value. At June 27, 2020, NBCU’s interest in Hulu is recorded in the Company’s financial statements at $ 8.1 billion.

ESPN+

- ESPN+ is now at 8.5 million subscribers, more than triple its level a year ago.

The Walt Disney Company Q3 10Q – August 4th, 2020

The average monthly revenue per paid subscriber for ESPN+ decreased from $5.33 to $4.18 due to the introduction of a bundled subscription package offering of Disney+, ESPN+ and Hulu beginning in November 2019 and lower per-subscriber advertising revenue. The bundled offering has a lower retail price than the aggregate standalone retail prices of the individual services.

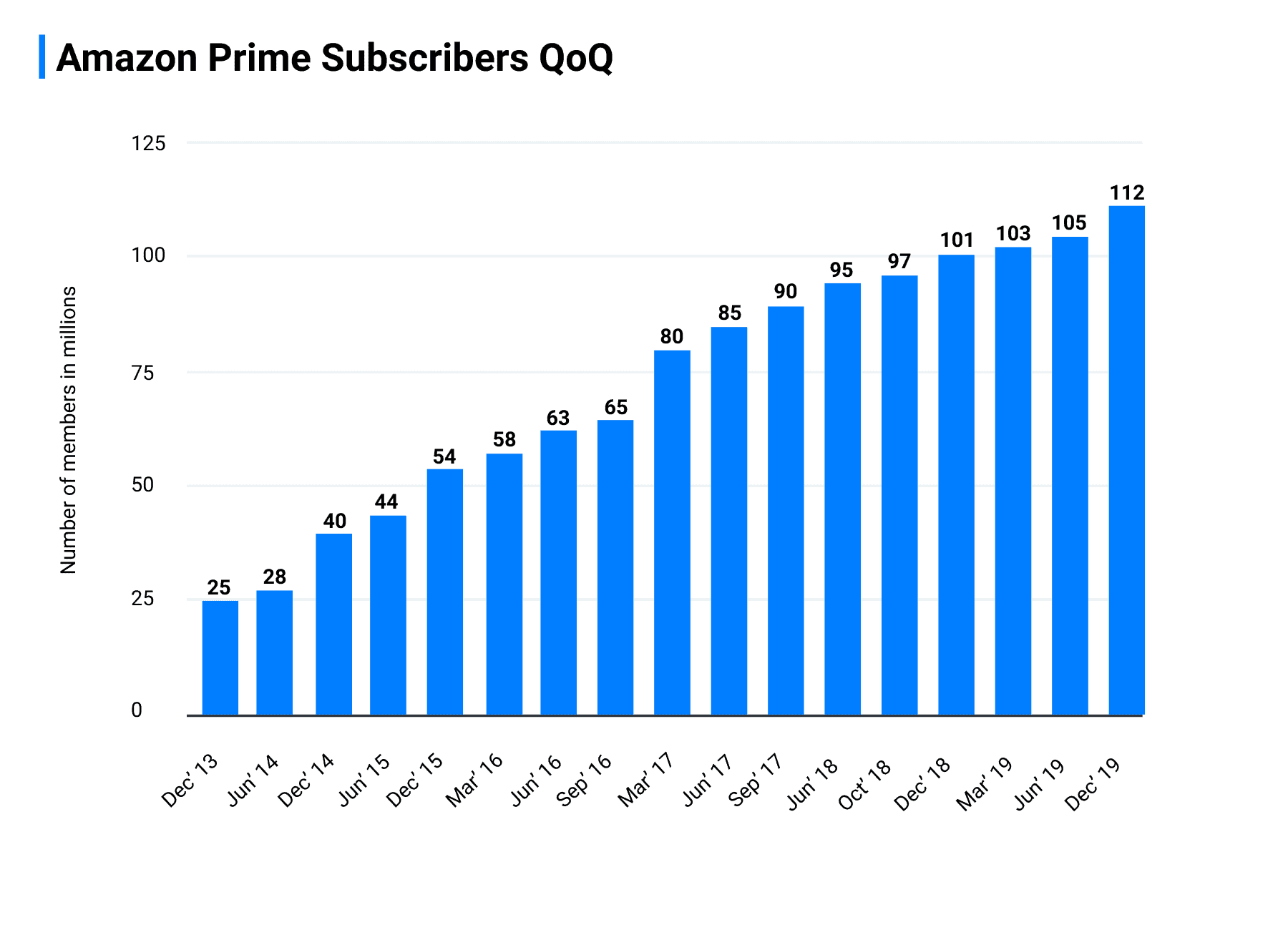

Amazon (Amazon Prime)

- Amazon Prime Video plans to spend $7 billion on content this year and boasts over 150 million subscribers worldwide.

- In its Q2 Earnings Call Transcript, Amazon executives noted that worldwide streaming video hours doubled year-over-year driven largely by Prime video

Amazon Prime video is intrinsically tied with Amazon Prime memberships – there are over 112 million Amazon Prime subscribers in the United States.

Amazon – Q2 8K – July 30th, 2020

“This year:

- Prime Video launched Watch Parties, a feature that enables Prime members to interact with each other via chat on a desktop while watching Prime Video content, including award-winning TV shows and movies.

- Prime Video introduced Prime Video Profiles, allowing customers to create and manage up to six profiles within a single account. Each profile offers individualized recommendations, season progress, and watchlists based on individual profile activity.

- Amazon premiered several Amazon Original series including Upload, from Emmy-winner Greg Daniels, Homecoming Season 2, Bosch Season 6, and Regular Heroes, a docuseries focusing on COVID-19 heroes. Additionally, Amazon premiered several Original movies including Selah and the Spades, The Goldfinch, The Vast of Night, 7500, and the family action-comedy My Spy, along with local Indian movies Ponmagal Vandhal and Gulabo Sitabo.”

Amazon – Q2 Earnings Call Transcript –

We continue to see high Prime member engagement throughout the quarter. Prime members shop more often with larger basket sizes. Worldwide streaming video hours doubled year-over-year driven largely by Prime video.

AT&T (HBO Max)

- At launch, HBO Max announced a $1.5 billion content spend for 2020. Combined, HBO channels have over 35 million subscribers globally.

- HBO Max activations more than doubled in the third quarter to 8.6 million, though there’s a caveat: In its overall HBO Max number, AT&T rolls up all subscribers who are eligible to get it — even if they haven’t watched it. With total “activations” of HBO Max at 8.6 million, that means 70% HBO’s existing subscribers who have access to HBO Max for no extra charge still have not signed in to use the super-size streaming service.

- As of the end of September, HBO and HBO Max subscribers in the U.S. together reached 36 million, exceeding the company’s initial year-end target of 36 million. The numbers show HBO/HBO Max combined had a net gain of about 1.7 million subscribers in Q3.

Q3 Earnings Call Transcript – October 22, 2020

HBO Max continues to scale. We’ve overperformed on our initial target of 36 million domestic HBO Max and HBO subscribers for this year. All of this is before we launch our AVOD product in the U.S. next year and before we begin our international deployment of HBO Max, also planned for next year.

Apple (Apple TV)

- Launched with a $6 billion content budget for 2020.

- With a $6 billion content budget, Hollywood’s biggest names, and hundreds of millions of potential customers, Apple TV Plus launched in November 2019 with an ambitious goal: create Apple’s own HBO. But a little over six months later, Apple TV Plus is barely a part of the streaming conversation.

Quibi

- Quibi launched with a $1 billion content budget and had a slow start in April, at launch, it only had 3.5 million downloads and 1.3 million active users.

- Quibi announced on October 20th, 2020 that it would be shutting down after a short 6-month stint in the streaming market