The trade war between the United States and China has raged since 2018, impacting almost every industry and creating uncertainty on Wall Street. Ongoing trade war tensions were further heightened this year as the COVID-19 pandemic spread globally, leaving investors to speculate long-term economic impact.

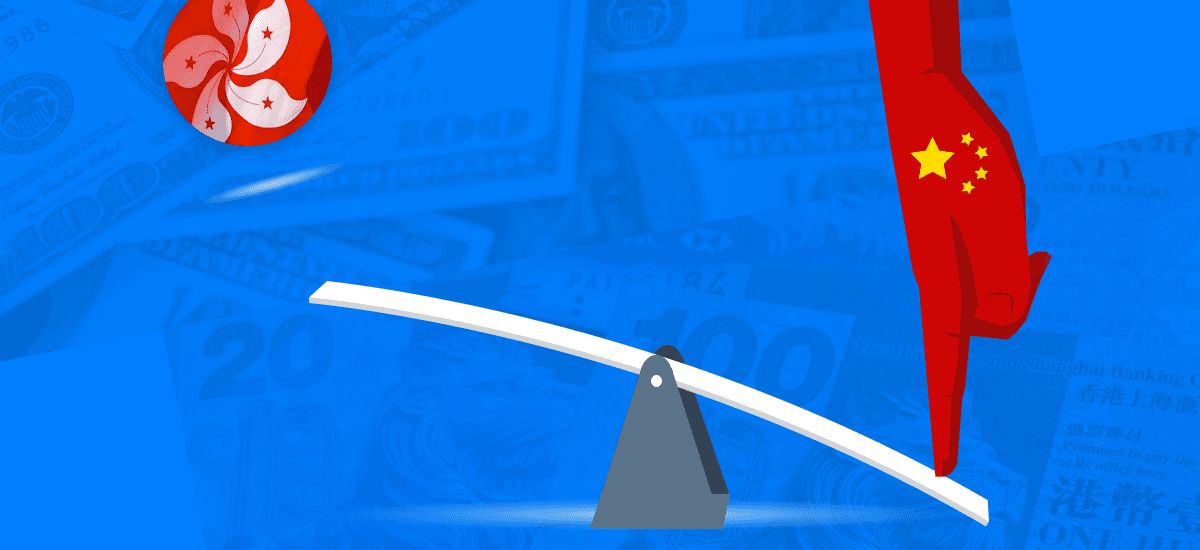

Throughout, Hong Kong has hung in the balance.

This week, U.S. stocks tumbled after U.S. Secretary of State Mike Pompeo commented that the United States no longer considers Hong Kong autonomous from China. Following the announcement, China’s national legislature approved a motion to draft a new law, constraining activity in Hong Kong. Not even a day later, President Donald Trump announced that he would strip away Hong Kong’s privileges with the United States, ranging from an extradition treaty to commercial relations, “with few exceptions.”

As one of the world’s leading financial centers, Hong Kong is the home to dozens of massive corporations and is the sixth-largest stock exchange in the world. For more than 20 years, China has governed the city as a semi-autonomous region with freedoms not available on the mainland.

Although a mass exodus of western companies is not yet anticipated, restrictions on Hong Kong may erase the original appeal to have them there in the first place.

Live Updates: We’ve pulled information from thousands of reputable news sources in AlphaSense, and will continue to update this story with company commentary as the impact unfolds. Here are the highlights:

- On May 26th, Secretary of State Mike Pompeo commented that the United States no longer considers Hong Kong autonomous from China.

- On May 28th, China’s national legislature approved a motion to draft a new law limiting activity in Hong Kong

- On May 29th, President Trump announced that he would begin taking steps to revoke Hong Kong’s favored trade status with the United States, in response to China’s controversial new security law that would effectively bar political protest in Hong Kong.

AlphaSense can track emerging trends in real-time across the entire market, by industry, or watchlist. We expect changes in Hong Kong to be an essential theme to follow as U.S./China tensions rise. Start your free trial of AlphaSense now or login to your account.

Baker Hughes Company (Market News – 5/29)

After President Trump said Thursday that he planned to hold a press conference on China on Friday without providing further details, the US stock market gave up its midday gains and ended lower in the final hour of trading.

Earlier on Thursday, Chinese lawmakers approved a new national security bill for Hong Kong that has raised tensions with the US amid concerns that it will erode some freedoms in the self-governing special administrative region. Beijing blocked a Trump administration bid for a UN Security Council meeting on China’s new national security law.

Twitter (Top Stories – 5/29)

China threatens countermeasures over Hong Kong: The Chinese embassy in Washington accused the US, Australia, Canada and the UK of “foreign meddling in Hong Kong affairs” after the allies issued a joint statement condemning Beijing’s plan to implement a new security law in the territory. The UK, meanwhile, pledged to extend visa rights for British National (Overseas) passport holders to 300,000 Hong Kong residents. (FT)

Public BankGroup BHD (Annual Report – 5/28)

The operating environment for the banking sector in Hong Kong is poised to remain challenging with the prolonged US-China trade war and domestic social unrest. This has been further compounded by the economic fallout from the COVID-19 pandemic leading to rising unemployment rate, weakening retail sales and a slump in business activities. Despite these difficult conditions, the Public BankGroup’s operations in Hong Kong is expected to remain resilient as the Group will continue to manage risks prudently whilst striving to grow its retail and commercial banking as well as consumer financing businesses.

Financial Times (Wall Street erases gains after Trump sabre-rattling over China – 5/28)

The war of words between Beijing and Washington triggered the US market’s reversal. President Donald Trump said he would hold a news conference about China on Friday, which followed the National People’s Congress approving the proposal to introduce a new national security law on Hong Kong.

But Hong Kong’s Hang Seng index bucked the trend due to US-China hostilities, dropping 0.7 per cent on Thursday.

Elsewhere in Asia, China’s CSI 300 index of Shanghai and Shenzhen-listed stocks crept up 0.3 per cent on Thursday. Japan’s Topix index rose 1.8 per cent, while Australia’s S&P/ASX 200 climbed 1.3 per cent.

The onshore renminbi was 0.2 per cent firmer at Rmb7.1546 to the dollar after China’s central bank set the currency’s trading band against a stronger level than expected by analysts.

MSNBC (China’s New Security Law: Impact on Business and Investors – 5/26)

“If you’re part of the protest movement, you’re very concerned right now. It’s a sad day for political activists, for pro-democracy activists in Hong Kong,” he said.

But many of his clients are CEOs of global multinational companies, or major asset managers investing in mainland Chinese markets, who are likely to see little impact, he said.

“For those kind of clients they may see relatively little impact because the kind of legal disputes they get involved in, and where they take advantage of Hong Kong’s highly independent and high-quality judiciary, are not the kind of disputes where Beijing tends to intervene and wield its heavy hand because there are not any particular political implications to those disputes,” Wildau said. “For those groups, they can rest easier.”

“Even after this law, if enacted, Hong Kong is very likely to maintain the significant advantages it has enjoyed over the last several decades in the Asia Pacific region, compared to its would-be rivals like Singapore or Shanghai, as the main regional, business and financial hub,” he added.

Calamp (10K – 5/6)

Additionally, a substantial portion of our products, components and subassemblies are currently procured from foreign suppliers located primarily in Hong Kong, mainland China, Malaysia and other Pacific Rim countries. Any significant shift in U.S. trade policy toward these countries or a significant downturn in the political, economic or financial condition of these countries could cause disruption of our supply chain or otherwise disrupt operations, which could adversely affect our business.

Netgear Inc (10Q – 5/1)

In the recent past, various regions worldwide have experienced slow economic growth. In addition, current economic challenges in China, including any global economic ramifications of these challenges, may continue to put negative pressure on global economic conditions. If conditions in the global economy, including Europe, China, Australia and the United States, or other key vertical or geographic markets deteriorate, such conditions could have a material adverse impact on our business, operating results and financial condition. For example, during the second half of 2019, our APAC sales were dampened by a sudden economic downturn in the China/Hong Kong region due to the escalating trade war, Yuan depreciation and the unstable sociopolitical situation in Hong Kong. If we are unable to successfully anticipate changing economic and political conditions, we may be unable to effectively plan for and respond to those changes, which could materially adversely affect our business and results of operations.