Economies throughout the world have seen demand weaken with the spread of coronavirus throughout the globe. As Q1 earnings season continues and the reports of losses grows, so does the list of companies suspending buybacks.

Amidst market upheaval, 99 large publicly traded companies have reported buybacks continuing into March, with many even quickening the pace of repurchasing nearing quarter close. Which companies are still buying their stock? Take a look at the list we’ve compiled below:

Takeaways:

- In March, the 99 companies identified repurchased a collective $33.21B with Alphabet, Apple and Microsoft accounting for 44.7% of the total buybacks with a combined $14.85B in buybacks in March

- 23 companies repurchased >1% of market cap within the month of March with Masco Corp repurchasing 4.07% and Synchrony Financial repurchasing 3.6% of market cap, respectively

- Delta, American Airlines and Southwest continued buybacks in March with American Airlines and Southwest repurchasing nearly $40M (representing .75% and 2.53% of their respective market caps) in March alone

AlphaSense’s AI technology picks up on nuances in human language found in SEC filings, event transcripts and thousands of premium business documents in real-time across the entire market, by industry, or watchlist. Start your free trial of AlphaSense now or login to your account.

For this analysis we looked at 10Qs of companies with a $5B market cap or greater

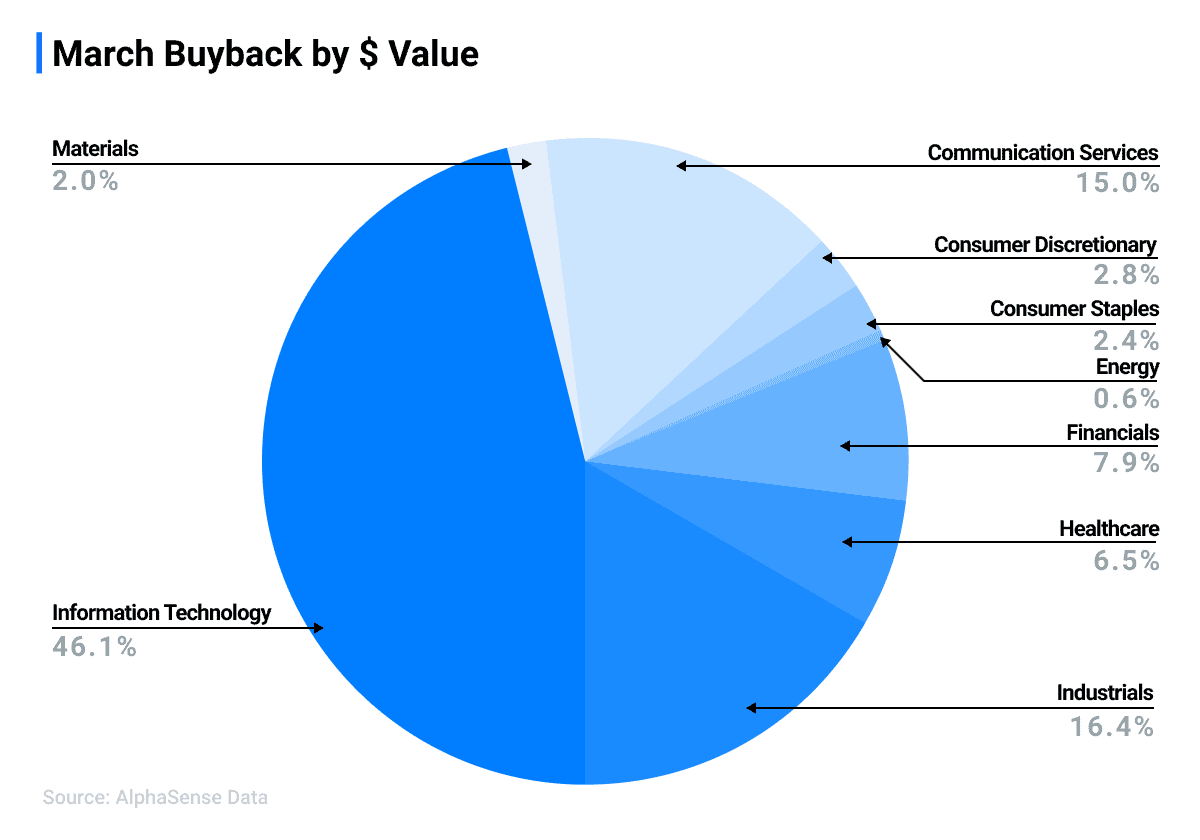

Repurchases from Apple and Microsoft led the Information Technology sector to dominate in terms of the total dollar value of buybacks in March, with the IT sector accounting for 46% of total value. Together, Apple and Microsoft’s buybacks account for 72% of repurchase dollar value within IT.

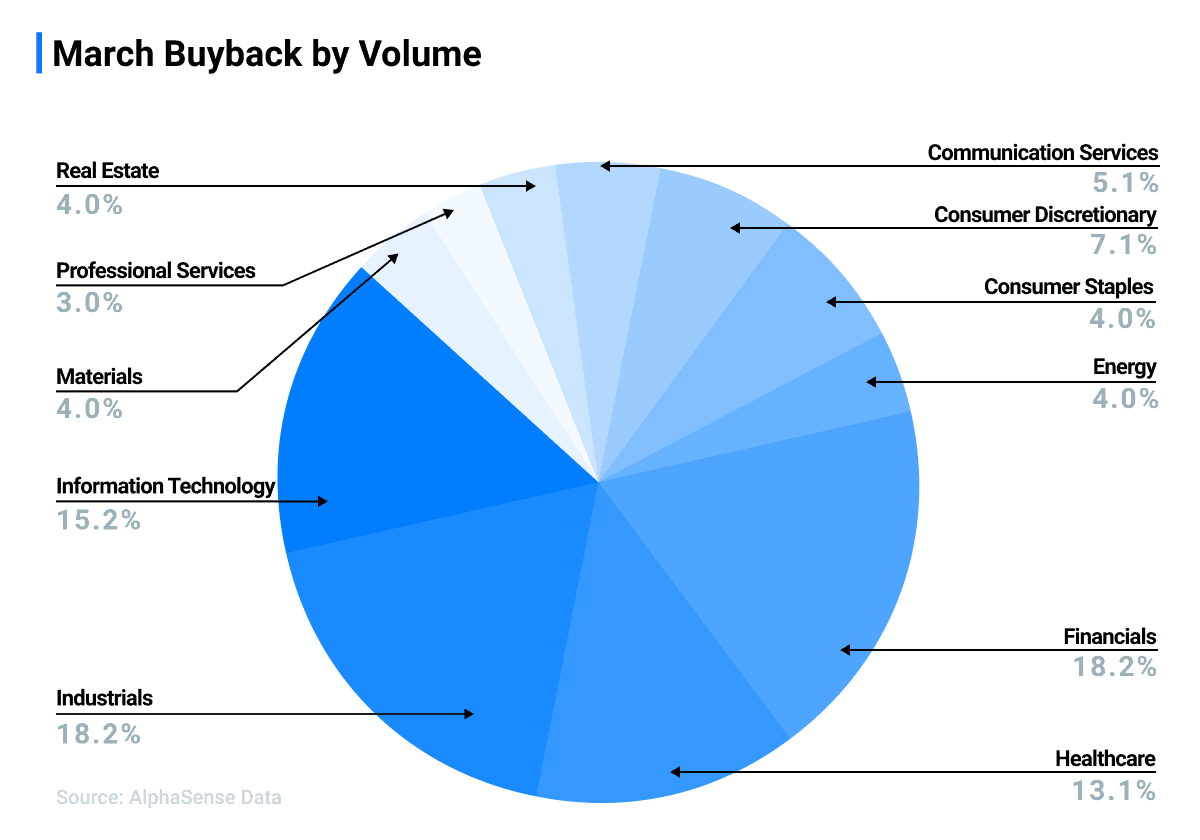

While IT represents a larger share of the total dollar value of buybacks in March, companies in the Financial and Industrial sectors are buying back more often than their counterparts in other industries, with the sectors accounting for 18% of the buyback volume, respectively.

| Company | Sector | Market Cap (in billions) | March Shares Purchased | March Share Price | Amount Repurchased in March (in billions) | % of Market Cap Repurchased in March (in billions) |

| Masco Corp | Industrials | $10.90 | 9,442,874 | $46.94 | $0.44 | 4.07% |

| Synchrony Financial | Financials | $12.30 | 16,817,253 | $26.36 | $0.44 | 3.60% |

| T Rowe Price | Financials | $26.30 | 7,100,681 | $103.33 | $0.73 | 2.79% |

| Southwest Airlines | Industrials | $15.90 | 7,879,876 | $51.12 | $0.40 | 2.53% |

| Cummins | Industrials | $24.10 | 3,500,000 | $156.90 | $0.55 | 2.28% |

| Cerner Corp | Healthcare | $21.10 | 5,139,129 | $68.08 | $0.35 | 1.66% |

| Service Corporation International | Consumer Discretionary | $6.70 | 2,290,566 | $40.90 | $0.09 | 1.40% |

| Zebra Technologies | Information Technology | $13.00 | 870,115 | $208.33 | $0.18 | 1.39% |

| Qualcomm | Information Technology | $88.20 | 15,279,000 | $75.38 | $1.15 | 1.31% |

| eBay | Consumer Discretionary | $31.70 | 12,665,693 | $32.28 | $0.41 | 1.29% |

| Cincinnati Financial Corp | Financials | $11.30 | 1,490,330 | $97.44 | $0.15 | 1.29% |

| First American Financial | Financials | $5.20 | 1,702,646 | $38.64 | $0.07 | 1.27% |

| Carlisle Cos | Industrials | $7.00 | 700,000 | $124.63 | $0.09 | 1.25% |

| Honeywell | Industrials | $100.40 | 7,729,326 | $158.20 | $1.22 | 1.22% |

| Graco Inc | Industrials | $7.40 | 2,064,830 | $43.58 | $0.09 | 1.22% |

| Omnicom Group | Communication Services | $13.10 | 2,333,890 | $67.50 | $0.16 | 1.20% |

| Lam Research | Information Technology | $37.10 | 1,568,000 | $281.60 | $0.44 | 1.19% |

| MSCI | Financials | $28.00 | 1,313,482 | $248.79 | $0.33 | 1.17% |

| Fidelity National Inc | Financials | $7.80 | 3,100,000 | $28.40 | $0.09 | 1.13% |

| Texas Instruments | Industrials | $106.50 | 10,925,981 | $102.74 | $1.12 | 1.05% |

| Halliburton | Energy | $9.70 | 7,388,038 | $13.56 | $0.10 | 1.03% |

| Celanese Corp | Materials | $10.20 | 1,229,670 | $85.41 | $0.11 | 1.03% |

| SEI Investments | Financials | $7.80 | 1,652,000 | $46.62 | $0.08 | 0.99% |

| Sherwin Williams | Materials | $48.70 | 925,000 | $484.19 | $0.45 | 0.92% |

| Idex Corp | Industrials | $11.90 | 851,823 | $125.20 | $0.11 | 0.90% |

| Cheneire Energy | Energy | $11.50 | 1,968,384 | $50.80 | $0.10 | 0.87% |

| CSX Corp | Industrials | $50.70 | 7,038,164 | $61.49 | $0.43 | 0.85% |

| Pultegroup | Consumer Discretionary | $7.60 | 2,098,385 | $30.50 | $0.06 | 0.84% |

| Apple | Information Technology | $1,000.30 | 31,158,000 | $265.27 | $8.27 | 0.83% |

| Whirlpool | Consumer Discretionary | $7.00 | 477,000 | $120.97 | $0.06 | 0.82% |

| Discover Financial | Financials | $13.20 | 1,733,628 | $61.90 | $0.11 | 0.81% |

| American Airlines | Industrials | $5.30 | 2,335,805 | $16.96 | $0.04 | 0.75% |

| Intel Corp | Information Technology | $254.00 | 36,200,000 | $52.11 | $1.89 | 0.74% |

| SiriusXM Holdings | Communication Services | $25.90 | 29,243,680 | $5.56 | $0.16 | 0.63% |

| Principal Financial | Financials | $10.00 | 1,349,175 | $45.19 | $0.06 | 0.61% |

| Waters Corporation | Healthcare | $11.60 | 347,000 | $192.78 | $0.07 | 0.58% |

| Crown Holdings | Materials | $8.70 | 1,038,821 | $48.24 | $0.05 | 0.58% |

| Verisign | Information Technology | $24.40 | 772,000 | $179.09 | $0.14 | 0.57% |

| Syneos Health | Healthcare | $5.90 | 600,000 | $53.38 | $0.03 | 0.54% |

| Maxim Integrated Products | Information Technology | $15.50 | 1,599,000 | $50.90 | $0.08 | 0.53% |

| Fair Isaac Corp | Information Technology | $10.20 | 184,837 | $288.46 | $0.05 | 0.52% |

| Cognex Corp | Information Technology | $9.90 | 1,215,000 | $42.01 | $0.05 | 0.52% |

| Pilgrims Pride Corp | Consumer Staples | $5.50 | 1,465,695 | $19.04 | $0.03 | 0.51% |

| Northern Trust Corp | Financials | $17.10 | 1,112,215 | $76.68 | $0.09 | 0.50% |

| AMPHENOL CORPORATION | Information Technology | $27.30 | 1,477,278 | $91.49 | $0.14 | 0.50% |

| Charter Communications | Communication Services | $116.00 | 1,246,396 | $437.05 | $0.54 | 0.47% |

| Lockheed Martin | Industrials | $108.80 | 1,453,821 | $350.37 | $0.51 | 0.47% |

| Intercontinental Exchange | Financials | $49.80 | 2,718,000 | $85.42 | $0.23 | 0.47% |

| Idexx Laboratories | Healthcare | $23.70 | 427,182 | $233.00 | $0.10 | 0.42% |

| Anthem Inc | Healthcare | $70.80 | 1,135,798 | $261.46 | $0.30 | 0.42% |

| DR Horton | Consumer Discretionary | $17.80 | 1,778,760 | $41.38 | $0.07 | 0.41% |

| Alphabet | Communication Services | $917.80 | 3,225,000 | $1,170.86 | $3.78 | 0.41% |

| Pegasystems | Information Technology | $6.60 | 299,000 | $79.88 | $0.02 | 0.36% |

| Mondelez International | Consumer Staples | $73.00 | 5,043,655 | $51.82 | $0.26 | 0.36% |

| Northup Gruman | Industrials | $55.10 | 625,975 | $313.11 | $0.20 | 0.36% |

| The Hershey Co | Consumer Staples | $28.00 | 526,138 | $155.08 | $0.08 | 0.29% |

| Microsoft | Information Technology | $1,004.00 | 18,203,465 | $153.78 | $2.80 | 0.28% |

| Lennox International | Industrials | $7.10 | 84,507 | $233.90 | $0.02 | 0.28% |

| Cadence Design Systems | Information Technology | $22.90 | 967,095 | $61.85 | $0.06 | 0.26% |

| Fastenal | Industrials | $20.70 | 1,600,000 | $32.54 | $0.05 | 0.25% |

| Entegris Inc | Information Technology | $7.60 | 411,514 | $46.37 | $0.02 | 0.25% |

| Illumina | Healthcare | $46.80 | 424,000 | $277.01 | $0.12 | 0.25% |

| Franklin Resources | Financials | $9.20 | 1,147,744 | $19.36 | $0.02 | 0.24% |

| American Express | Financials | $77.40 | 1,835,465 | $100.37 | $0.18 | 0.24% |

| Starbucks | Consumer Discretionary | $89.80 | 3,139,273 | $64.22 | $0.20 | 0.22% |

| Delta Airlines | Industrials | $17.40 | 738,722 | $46.99 | $0.03 | 0.20% |

| Kimberly Clark | Consumer Staples | $47.20 | 714,900 | $129.88 | $0.09 | 0.20% |

| Johnson & Johnson | Healthcare | $395.30 | 5,031,134 | $142.96 | $0.72 | 0.18% |

| Amgen Inc | Healthcare | $140.60 | 1,184,327 | $201.66 | $0.24 | 0.17% |

| Intuitive Surgical | Healthcare | $60.60 | 191,639 | $521.83 | $0.10 | 0.17% |

| Iqvia Holdings | Healthcare | $27.20 | 400,000 | $110.53 | $0.04 | 0.16% |

| Rockwell Automation | Industrials | $22.80 | 228,719 | $155.83 | $0.04 | 0.16% |

| PepsiCo | Consumer Staples | $183.60 | 2,100,000 | $128.00 | $0.27 | 0.15% |

| The Carlyle Group | Financials | $13.50 | 837,491 | $22.33 | $0.02 | 0.14% |

| Chipotle Mexican Grill | Consumer Discretionary | $24.50 | 48,069 | $624.00 | $0.03 | 0.12% |

| Colgate-Palmolive | Consumer Staples | $60.30 | 1,031,036 | $67.36 | $0.07 | 0.12% |

| 3M | Industrials | $89.90 | 723,676 | $140.55 | $0.10 | 0.11% |

| The Hartford Financial Services Group | Financials | $14.70 | 313,165 | $47.72 | $0.01 | 0.10% |

| Communication Services | $553.60 | 2,100,000 | $166.71 | $0.35 | 0.06% | |

| Eli Lilly | Healthcare | $148.00 | 601,000 | $137.87 | $0.08 | 0.06% |

| Paycom Software | Information Technology | $15.00 | 39,555 | $203.14 | $0.01 | 0.05% |

| Prologis, Inc | Real Estate | $65.90 | 539,000 | $64.66 | $0.03 | 0.05% |

| Markel Corp | Financials | $12.50 | 5,212 | $1,139.90 | $0.01 | 0.05% |

| American Tower Group | Real Estate | $105.00 | 213,352 | $211.45 | $0.05 | 0.04% |

| Brown & Brown | Financials | $10.40 | 70,548 | $34.86 | $0.00 | 0.02% |

| Masimo Corp | Healthcare | $11.50 | 11,652 | $154.09 | $0.00 | 0.02% |

| Centene | Healthcare | $38.60 | 12,000 | $53.05 | $0.00 | 0.00% |

| Dow Chemical | Materials | Not listed | 2,028,919 | $36.97 | $0.08 | NA |