While Sanders’ rise has healthcare investors on edge, history suggests the volatility could be a buying opportunity instead.

The resilience of Joe Biden’s Presidential campaign may have been the highlight of Super Tuesday. Still, it’s the stark implications of a possible Bernie Sanders Presidency amid his strong momentum that is keeping many on Wall Street up at night.

Take Jeff Gundlach, the high-profile CEO of DoubleLIne Capital, who manages more than $150 billion. Gundlach warned in January that Sanders’ campaign presented the biggest risk for the year and that markets weren’t prepared. And he saw the market selloff last week as a sign of rising investor panic about Sanders’ chances — even as headlines blamed the spread of Coronavirus for the rout.

“If this stock market reversal is due exclusively to the virus, then why is United Healthcare down far more than [the S&P 500]?” Gundlach wrote in an email, pointing out that stress in the healthcare sector was due to Sanders’ repeated calls for an overhaul.

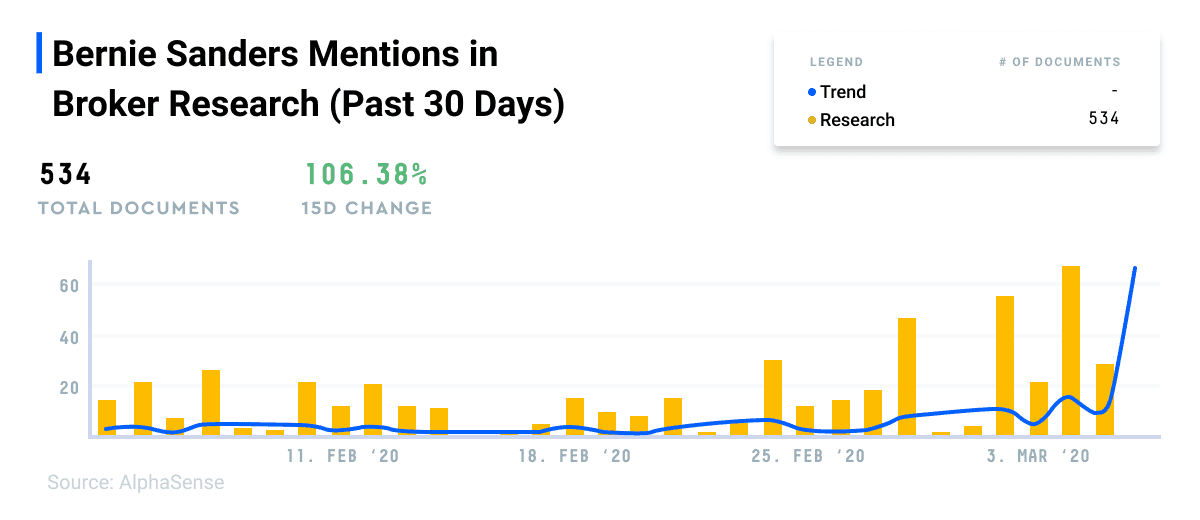

AlphaSense data backs up Gundlach’s intuition and shows the discussion around Sanders is climbing fast. Broker research documents mentioning Bernie Sanders are up sharply, registering a 39% change in the past 15 days. And his impact is being felt in the healthcare sector. Three out of the top five companies returned in search results are in the healthcare sector. And Health Care Providers & Services and Pharmaceuticals are two of the top five industries in search results.

Mentions of Bernie Sanders are surging in broker research as he continues to lead in polls and other Democratic candidates drop out.

Sanders’ rise and rhetoric may have already taken a toll on the healthcare sector, where some have commented that patches of underperformance can be chalked up to his growing popularity. A spike in his poll standing in mid-January, for example, coincided with managed care and hospitals to lose 9 percent over the following two weeks, compared with a drop of just 3% for the S&P 500, analysts at Mizuho note.

But the dour mood and volatility in the sector could present a buying opportunity instead.

Despite its growing discussion on Wall Street, for example, analysts at JP Morgan believe that in reality, M4A has an “extremely low chance” of passing Congress even in the event of a Sanders win. They cite a bulk of Americans not wanting it and a prohibitive cost as chief reasons. They also note that it will be met by strong lobbying efforts from employer-sponsor plans and Managed Care Organizations (MCOs).

But most importantly, the JP Morgan analysts note, the progressive and conservative/moderate Democrats in the House and Senate are too polarized to vote in favor of it. They see it as unlikely that Democrats could secure 100% party-line vote as they did when the Affordable Care Act was passed in 2010 in the Obama Administration.

Analysts at Mizuho, meanwhile, forecast a Republican-controlled Senate even in the event a Democrat were to win the Presidency. That would create the type of Gridlock in Washington that markets typically like. And history shows it tends to be especially good for the healthcare sector.

Mizuho analysts looked at the performance of the S&P 500 versus the S&P 500 healthcare sector index over the last 14 elections (including midterm and Presidential elections) since the 1992 Presidential election. They concluded that healthcare stocks historically outperform the S&P 500 (+14% versus +12%) they year after and trade at a higher forward one-year price-to-earnings multiple (17.7x versus 15.2x) than the market when there is joint control of Washington post-election.

The strong momentum behind the Sanders campaign is turning heads on Wall Street at a rapid pace. And the healthcare sector – where Sanders has promised sweeping changes – has been a particular concern for investors. But history shows that if Sanders prevails and Washington stays in gridlock, it could mean an outperformance for healthcare stocks instead.