A drill-down of broker research shows how investors see the 2020 election. For more AlphaSense content, visit our Resource Center.

Wall Street has its eyes on the elections.

As the 2020 Presidential race approaches, investors are focused on the political jockeying to be ahead of the curve of outcomes. This time, the race will be more consequential than almost all in recent history: a highly unorthodox incumbent is facing an array of eclectic candidates in the democratic primaries. The policy implications in any outcome will likely be substantial.

We look to AlphaSense to surface chatter and insights about specific 2020 Presidential candidates.

Investors are Increasingly Pricing-In a Second Trump Term

The market’s view of the chances of a Trump reelection has surged recently. Throughout all of 2019 and January of 2020, markets viewed the chances of a Trump reelection no better than 50%, analysts at Macquarie note. Now, political traders have increased those chances to 55%.

One factor driving the shift in perception is Trump’s all-time high job approval rating of 49% in a recent Gallup poll. Trump may be benefiting from recent demonstrations of political acumen, such as the Phase 1 agreement with China and the approval of the US Mexico Canada Agreement (USMCA).

He has also benefited from his recent impeachment acquittal. President Bill Clinton, for example, saw his approval rating soar to a personal high of 73% following his impeachment. Further increasing Trump’s voter appeal are the recent Democratic struggles in the Iowa caucuses, along with the questionable traction for Democratic frontrunner Joe Biden, the analysts note.

Ultimately, Investors see a Trump reelection as bullish for the US dollar and stock market inflows. Expectations for lower taxes, regulations, and policy continuity are supporting this view.

Wall Street Sees Moderate Democrats as More Bullish than More Extreme Candidates

There are vast policy differences between the five Democratic frontrunners. Many analysts see Moderates (Biden, Buttigieg, and Bloomberg) as more bullish for the US dollar and equities because of fiscal policies and views on healthcare. Analysts at Societe Generale argue that Moderates have closer views to Republicans than Sanders and Warren.

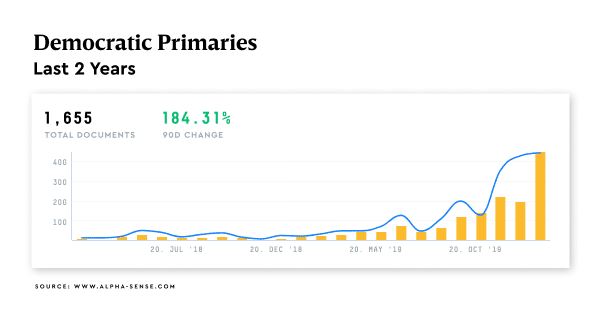

Broker research documents mentioning the Democratic primaries have grown as the race intensifies.

According to a Credit Suisse investor survey, if either Bernie Sanders or Elizabeth Warren become the Democratic Party nominee, some 96% and 87% of investors, respectively, believe that would have a negative impact on their investment thesis toward the Healthcare Services space.

The top five Democratic contenders for the nomination, meanwhile, represent an unusually diverse lineup and visions for the country. They range from a multi-billionaire to a self-described Democratic Socialist.

Mike Bloomberg

Despite his late entry, analysts at CLSA see Bloomberg as looming large over the entire Democratic field because of his vast war chest. Bloomberg is open to spending $1 billion to defeat Trump. And that goes beyond his campaign. If he can’t secure the nomination, he may redirect his resources and ground operation to other candidates. CLSA analysts see this is a potential tethering force for moderate candidates. If Bernie Sanders were to take the lead over Joe Biden, they speculate, then Bloomberg could use his resources to tilt the platform back towards the center.

Analysts see a Bloomberg presidency as among the most positive for stocks among Democrats. The implications of plans to cut prescription drug costs and raising corporate and very-high income taxes are seen as his most anti-growth ideas.

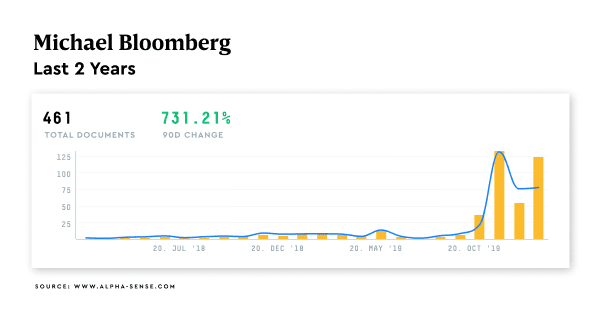

As Broker Research shows, Mike Bloomberg’s late entry into the 2020 Presidential Race caused a spike in mentions in late 2019. In early 2020, Bloomberg’s polling numbers started to skyrocket (as did his mentions.)

Bernie Sanders

Currently polling in the lead among Democrats, Sanders is the candidate that analysts see as most unfavorable for the dollar and stocks. Big-ticket spending promises like universal healthcare and expanded education are seen as deficit expanding and negative for the dollar. These policies are also seen as inflationary, and analysts see gold as a beneficiary of a Sanders presidency.

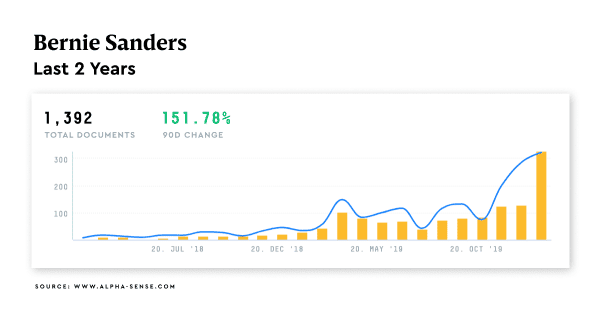

Bernie Sanders started campaigning for President in 2018; since then, his mentions in Broker Research have steadily grown. However, mentions spiked 152% in January 2020 as he became the frontrunner for the Democratic nomination.

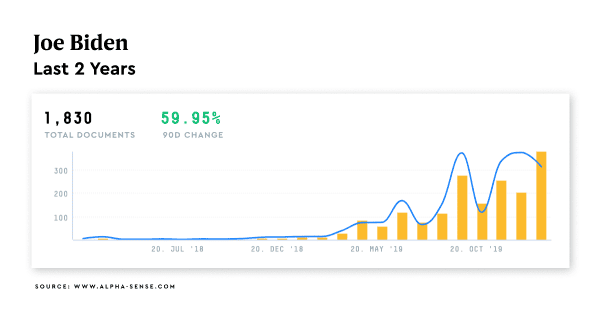

Joe Biden

Analysts at JP Morgan refer to Joe Biden as “Status Quo Joe,” and the moniker sums up investor sentiment towards the Democratic candidate. Investors see a Biden presidency as being the best for the dollar and equities of the established Democratic candidates (with Bloomberg being the wildcard). While he has seen his frontrunner status increasingly challenged, Wall Street would view an eventual nomination as the most priced-in scenario.

As his campaign increasingly lost momentum, mentions of Joe Biden in Broker Research began fluctuating throughout the end of 2019 into 2020.

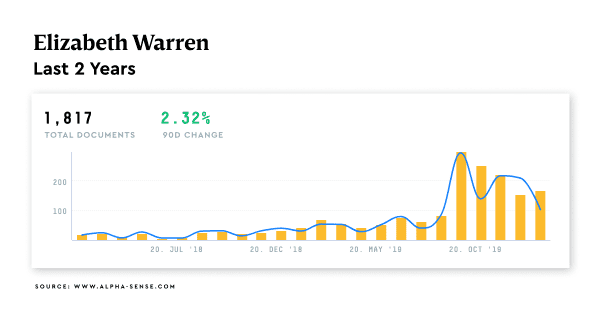

Elizabeth Warren

Elizabeth Warren has pledged that she would “sign an executive order that says no more drilling — a total moratorium on all new fossil fuel leases” offshore and on public lands on her first day in the White House. As a result, analysts in the energy Exploration and Production (E&P) sector see her as especially bearish for their sector. In fact, analysts at SunTrust Robinson Humphrey estimate the E&P group underperformed by 5% during a period in October following negative energy comments by Warren. While she has seen her prospects dip recently, analysts expect substantial E&P underperformance in a Warren presidency.

As Warren’s viability for the Democratic nomination diminished (late 2019), her mentions in Broker Research also decreased, particularly after the Iowa and New Hampshire caucuses (February 2020.)

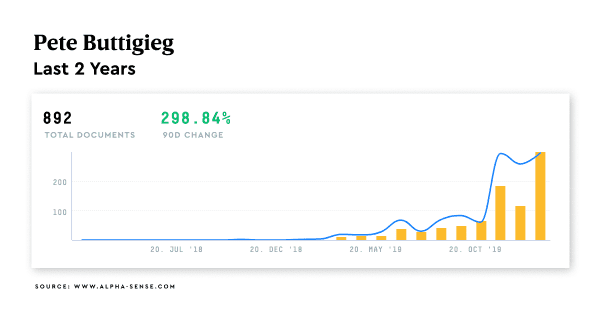

Pete Buttigieg

Pete Buttigieg has the least detail in his policy proposals of any leading candidate, according to analysts at Commerzbank, among others. They chalk this up to his newcomer status. Buttigieg’s most notable position may be on healthcare: While opposed to Sanders’ and Warren’s proposals for Medicare for All, he is advocating for a state-run scheme that competes against existing private health insurance companies. This “public option” would allow for a choice between private insurance plans and Medicare. The analysts note that the vagueness of plans makes it difficult to gauge sector-specific impact.

Despite little national awareness around Pete Buttigieg at the beginning of 2019, his popularity among the public has grown. After the 2020 caucuses, it was clear that Buttigieg was a viable contender for President, causing a spike in Broker Research mentions.

As a supercharged election cycle reaches a crescendo in the months ahead, investors will be watching the jostling closely. The election results will impact currency markets, sectors, and individual securities. And Wall Street’s sharpest analysts will hustle to read the tea leaves more precisely than their peers at every turn.

Interested in politics, finance, and culture? Follow AlphaSense Insights to learn more about Global Economic Slowdowns, the US-China Trade War, impacts of ESG/Sustainability trends, and more.