Water is a prominent topic in the rapidly evolving ESG/Sustainability field. I recently used AlphaSense to look for evidence of its current impact on traditional Investor Relations (IR) communications to the broader mainstream investment community.

Water is being presented and discussed with the investment community by companies across all cap sizes and sectors. However, a question to debate is whether these are discretely traditional SWOT disclosures, contemporary ESG/Sustainability discussions or an emerging blend.

Three key things piqued my attention:

- Water may be an untapped opportunity in ESG/Sustainability communications with investors

- Companies appear to be largely discussing water from a defensive communications position

- Water could be a differentiation within quite a few sectors to compete for capital and customers

How do you and your management team view water? How important is water to your company and investors? Where might your company use related IR ESG/Sustainability communications to compete?

Findings

Results from AlphaSense queries included limited evidence of attention to water in an ESG/Sustainability performance context in the IR presentations, press releases and earnings call transcripts reviewed. Below are a few of the examples found across this forum for IR communications:

- PepsiCo [$PEP] – presentation to Consumer Analyst Group of NY (CAGNY) Conference, February 18, 2016

“Similarly, our sustainability efforts are also producing greater productivity. Since 2007 we have improved water use efficiency by 20%, reduced packaging waste by 350 million pounds and significantly reduced our landfill waste. So that is the cost bucket.” - International Flavors and Fragrances [$IFF] – Q4 / FY earnings press release, February 10, 2016

“In 2015, we reached a series of sustainability achievements, including surpassing our initial 2020 water reduction goal of 25%, being recognized on the CDP Climate ‘A’ List, receiving ‘For Life’ social responsibility certification for Turkish Rose, Patchouli, Basil and Vetiver, and being first in our industry to join the Together for Sustainability sustainable sourcing initiative.” - Matador Resources Company [$MTDR] – Q4FY15 earnings press release, February 24, 2016

“The joint venture entity has disposed of over 5.5 million barrels of salt water since it began operations in January 2015, with a total savings to Matador of approximately $6.5 million in salt water disposal costs.” - Dean Foods [$DF] – Q415 earnings call, February 22, 2016

“On the sustainability front, we continue to make progress in reductions in our production facilities. On an annual basis, we drove a 1.3% reduction in kilowatt usage, a 1.9% reduction in natural gas consumption, and a 2.65% reduction in solid waste. We experienced a slight increase in water usage of 1%.”

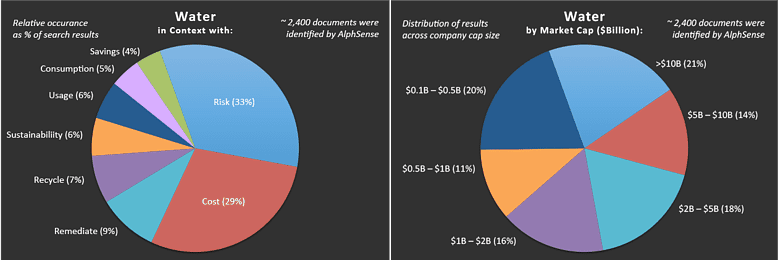

In general, I found that when water is mentioned, it mostly appears to be in traditional disclosure related to cost or cost reduction, or in boilerplate risk disclaimer language related to sustainable access and cost.

Given the prevalence of water in risk disclaimer language, it is fascinating that it is so rare to find specific discussion of water impacts in the body of IR communications.

Based on these findings, I saw little value in going through all the 10Ks, 10Qs or proxies that also came up in the query results, given the likelihood that a majority of the water references will be in disclaimer language. This is something you might do using AlphaSense on your own for a narrowed search specific to your sector or benchmark peer set.

Competitive Positioning

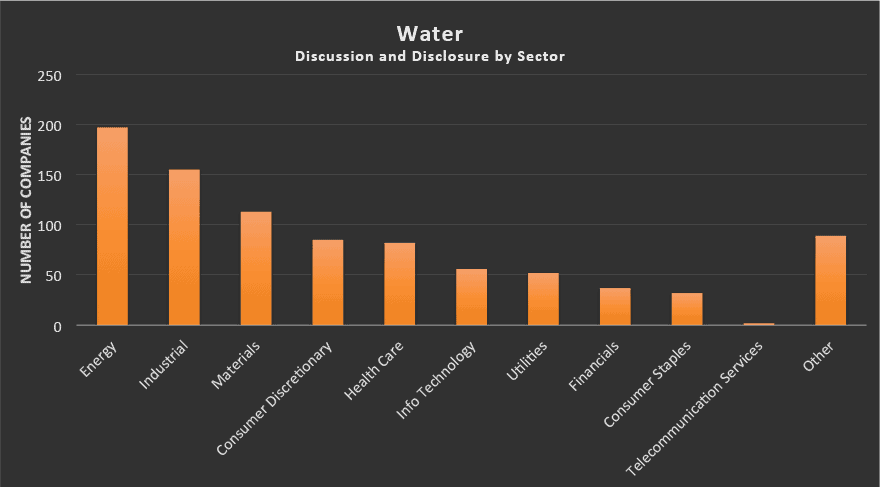

Query results show that water is addressed by many companies across all sectors and cap sizes; only Telecommunication Services had few results.

The depth and breadth to which water is discussed by all of these companies across all available communications is beyond the scope of available research time for this blog post.

Water is already a focus of sustainability reporting and competitive positioning for companies communicating to stakeholders in the ESG/Sustainability field, within which mainstream institutional investors are a growing presence. According the latest update, 81 percent of the S&P 500 companies published sustainability reports in 2015. Company management, IROs and investors might want to take a look at the Global Reporting Initiative (GRI) G4 Reporting Guidelines for key performance indicators relating to water that could be helpful in expanding IR communications and discussions.

Some pundits are saying that, “water is becoming the new carbon.” As you consider your company’s competitive IR communications opportunities related to water, you might want to monitor emerging discussions.

Approach

My initial query began with a general search for water references by companies in the United States, Canada and Europe over the last two years, but there were too many query results to work with. I then narrowed my queries to 90 days and just U.S. companies, using that as the basis for all subsequent word and cap size query combinations. This approach limited the documents in my review to a manageable number and provided a snapshot of where things stood at the start 2016, as a baseline for forward-focused communications planning. I would note there is noise in the raw data charts, because it was impossible to quickly take out companies that are water or systems flow providers. However, it does not appear to bias general observations; I looked past providers to focus on companies that are water users.

In Practice

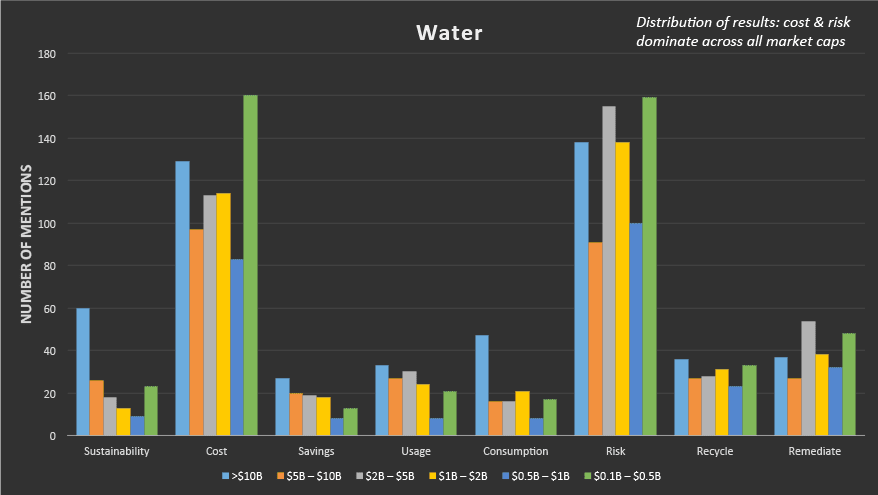

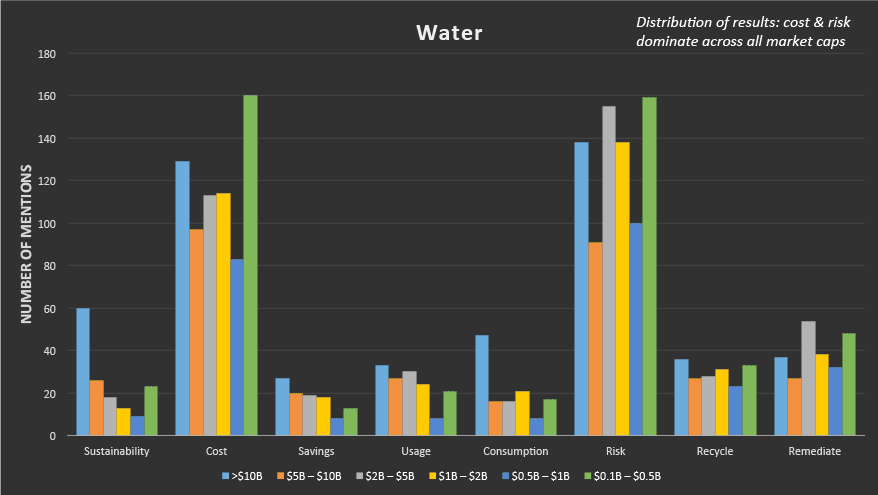

The scope of this review included queries of U.S. companies for the last 90 days with the search specifics:

- Water AND [8 words]. I looked at water by association with eight accompanying words: sustainability, cost, savings, usage, consumption, risk, recycle and remediate.

- Market capitalization sizes of companies were broken down by: >$10B, $5B – $10B, $2B – $5B, $1B – $2B, $0.5B – $1B and $0.1B – $0.5B.

Water references identified in the search results clearly bifurcated into SEC filings (10K, 10Q, proxy) and “free form” IR disclosure documents (IR presentations, press releases, transcripts).

Pamela Styles is principal of Next Level Investor Relations LLC, an Investor Relations consultancy with dual IR and ESG/Sustainability specialties.