For anyone conducting financial research in today’s times, artificial intelligence (AI) can mean the difference between being on the cutting edge of your industry or lagging behind the competition. In a world where information is increasing at an exponential rate, why is it only getting more challenging to find the answers you are searching for?

Much like searching for a needle in a haystack by overturning every piece of straw by hand, manually researching is a tiresome, time-consuming, and likely futile undertaking. While the information is all there, so are natural human limitations. Analysts inevitably miss certain key data points or fail to draw critical connections between disparate data sources, fueling information overload and ultimately, FOMO over information found first by peers.

Enter: artificial intelligence.

Why is AI Helpful in Conducting Financial Research?

For financial services professionals, the sheer volume of information available is difficult to read, assess, and analyze in meaningful ways. When researching trends across multiple verticals, industries, and regions that often use different language or terminology to describe the same thing, it’s inevitable that key pieces of market-moving details fall through the cracks or are left undiscovered. This lack of complete, whole information impacts your ability to make swift, confident decisions.

With traditional legacy platforms, research looks like manually conducting individual queries and hoping you took all relevant keywords you needed into account. However, with the potential for thousands of variables, this puts you at risk of blindspots, aka crucial information that impacts ROI.

AI is critical for financial institutions to realistically leverage all of the data available to them, and AI search technology is already transforming the way financial research is conducted across the industry.

Related Reading: The Evolution of AI: Trends to Watch in 2023

How AI Supports and Elevates Financial Research

AI Can Sift Through Millions of Documents at Scale

Unlike a human, AI does not fall victim to exhaustion, nor does it miss any data points it is tasked with finding. But much like a human, AI is capable of picking up on subtleties in language and tone as it crawls across thousands of documents, picking up on pattern shifts over time.

For analysts, machine learning tools are invaluable for processing vast amounts of data and analyzing images like tables, charts, and research reports, while still delivering under deadline.

AI search technology can analyze millions of documents in seconds, delivering data back to the user in an organized fashion. By outsourcing data mining, analysts save hours on research, allowing them to spend more time on analysis and generating alpha.

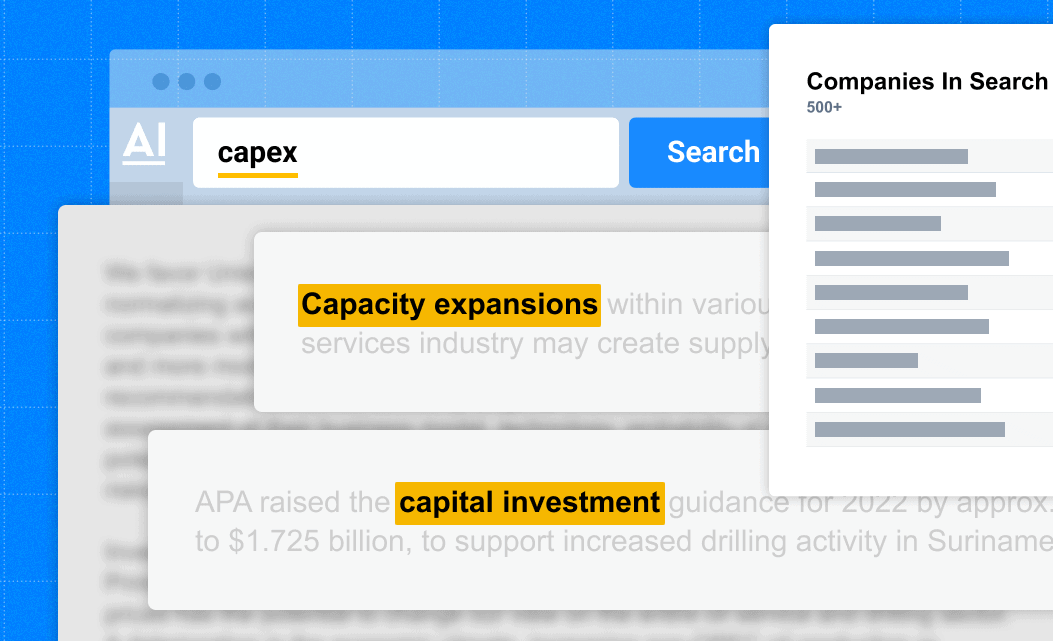

AI Expands Search Possibilities

Often, there is a natural variance in the language we use for a specific word. For example, the word “equities” is interchangeable with assets, securities, shares, or holdings in a search. Because of this variance, it is impossible to capture every relevant data source with a single keyword search.

Smart Synonyms technology, powered by Natural Language Processing (NLP) automatically expands searches to include synonyms for the search terms used. This significantly cuts down research time by eliminating repetitive searching and decreasing the possibility of missing important information because a particular keyword was left out.

“The beauty of AlphaSense is that it automates that process. You can search across a variety of sources in parallel and then the AI will surface the best matches based on your search query.”

– Howard Mason, Payments Analyst at RenMac.

Related reading: Renaissance Macro (RenMac) Case Study

AI Helps Generate Ideas

With artificial intelligence, you can filter out unnecessary noise and zero in on key insights from peers, competitors, and the market. You can also quickly see trends and patterns that show what the most relevant topics are, who is talking about them, and whether the sentiment on the topic leans positive or negative. Armed with this knowledge, you can uncover buried information and pick up on market shifts long before your competitors who aren’t using AI.

“When [knowledge professionals] see something impactful, [they] can make decisions with clarity and confidence, which leads to some real business insight if [they] lead the company down the right path. With [machine learning], they are saving time from grunt work and instead are thinking and generating ideas, catching risks early, reacting to them, and knowing their customers better. What this leads to are better business outcomes.”

– Jack Kokko, CEO and founder at AlphaSense

AI Helps Reduce Blindspots

The amount and speed at which unstructured data is being published increases the risk of overlooking critical information. Even when entire teams are assigned to collecting, analyzing, and distributing information related to a particular initiative, manual processes risk oversight.

AI research platforms mitigate this risk by aggregating multiple content sets, sorting for relevancy, and using NLP and other smart search capabilities to extract the most relevant and important information in one centralized place.

Market volatility has become the new normal, which is why it is important to have a continued understanding of emerging trends and the ability to observe and forecast them. With AI, you can have confidence that you are truly getting the full 360 degree view of each market-moving event. You can even take it a step further and set up smart alerts on your platform to ensure you are always aware of impacts to your industries, companies, or topics of interest.

Could AI Eventually Replace Human Analysts?

While AI is great at automating repeatable tasks at scale and executing tirelessly on the specific functions it is programmed fortran, it can never replicate the human ability to synthesize knowledge, create context, and pull nuanced insights from hard data.

AI tools are one-dimensional and single-focused. Machine learning algorithms are typically optimized to do one thing very well, and when trained effectively, do that one thing better and faster than people can. But even though machines are capable of learning tasks, they don’t understand the why behind them..

Ultimately, humans are more creative and have a more dynamic approach to knowledge processing, which can bring richer context, deeper analysis, and more nuanced insights to research in a way that AI cannot.

Forward-thinking firms are training their analysts to utilize AI tools to enhance research processes and insights. Instead of eliminating the analyst’s job, AI is supporting their role and their potential to contribute strategically and create more opportunities to make actual decisions within a firm.

Uplevel Your Financial Research with AlphaSense

There’s a reason AlphaSense is rated #1 in Financial Research and trusted by the world’s top firms. Combining award-winning AI search technology with the most extensive collection of public and private content sources, AlphaSense enables you to increase your productivity, expertise, and impact, while helping your company stay on the leading edge.

Start your free trial at AlphaSense today.

Learn how AI is shaping the future of investment research and how to leverage AI to cut down on research time, generate revenue, and mitigate risk for your company with our downloadable whitepaper.