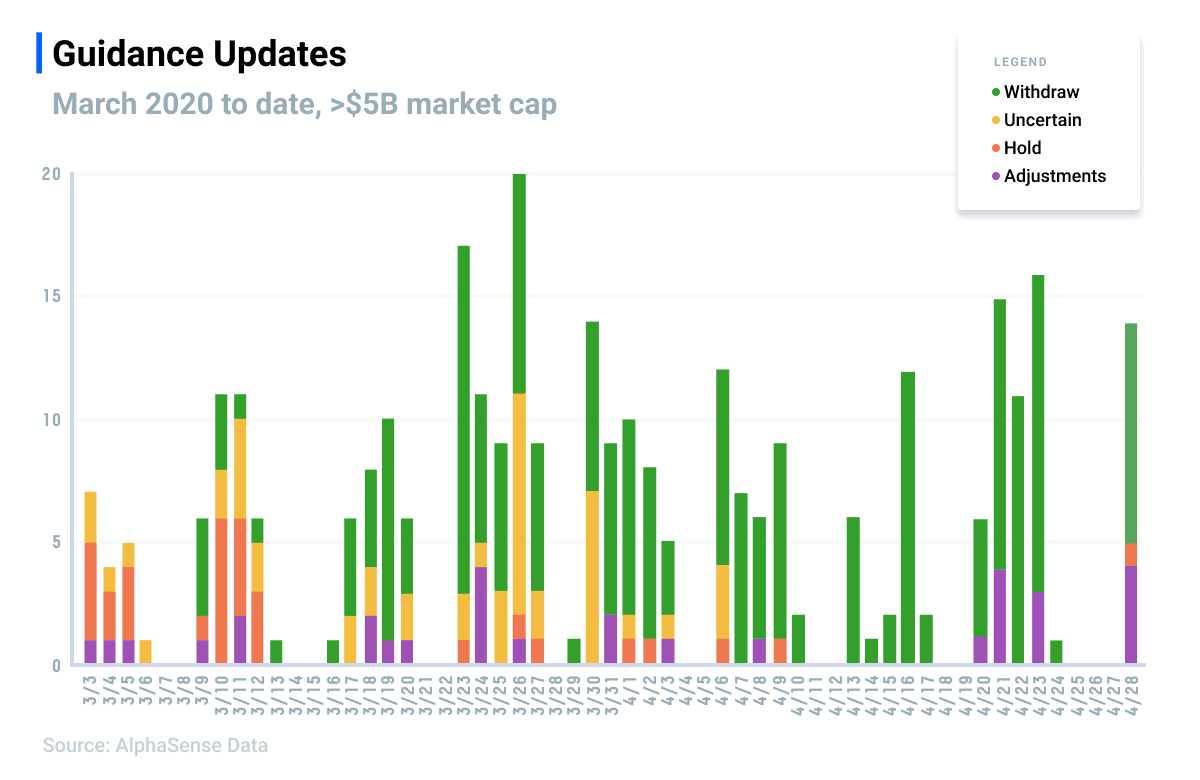

As COVID-19 spread rapidly affecting countries across the globe, company commentary on the virus’ widespread impact showed a drastic increase. What at first seemed to be an isolated issue, quickly started to affect every industry and management responses ranged from holding their guidance, to stating uncertainty and refusing to comment, or adjusting or withdrawing previous positions entirely. To understand which companies have been commenting on guidance and what positions they’ve taken overtime, take a look at company commentary we’ve compiled below.

- Companies have been withdrawing guidance since February with a huge spike beginning in mid-March

- The pace of commentary quickened on March 9th due to major airlines and travel sites pulling guidance within a few days of each other

- A surge in withdrawals occurred at the end of March heading into earnings season and the trend continues with new withdrawals surfacing each week as the Q1 season continues

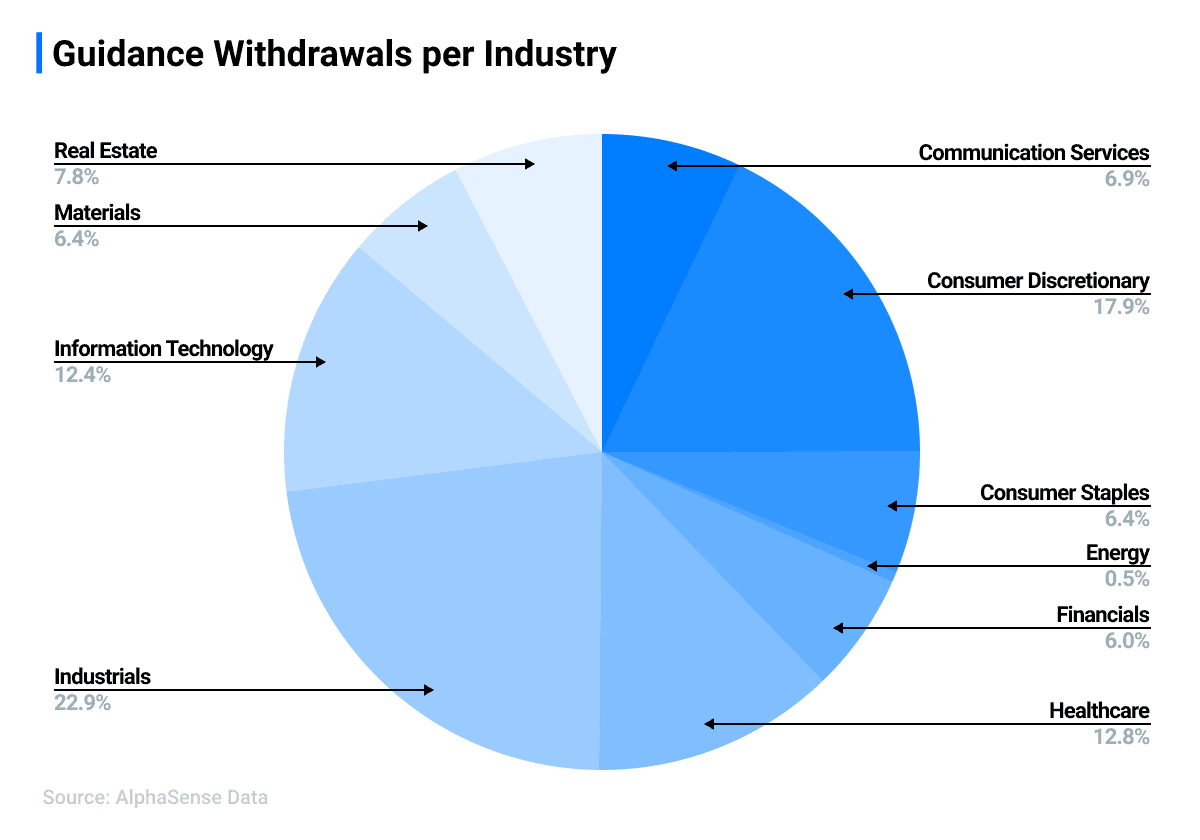

- Industrials companies provide services across every industry and represent the largest percentage of withdrawals at nearly 23%

- With stores closed, unprecedented unemployment and the beginnings of a recession with low consumer demand, Consumer Discretionary brands account for 18% of withdrawals

AlphaSense can track management commentary on guidance in real-time across the entire market, by industry, or watchlist. We expect this to be an interesting theme to track as Q1 earnings season continues. Start your free trial of AlphaSense now or login to your account.

Note: Adjustments status accounts for companies calling wider than normal guidance and commenting on lowered expectations without guiding to a certain range

| Company | Sector | Date | Status |

| 3M | Industrials | 4/28 | Withdraw |

| Alexandria Real Estate Holdings | Real Estate | 4/28 | Adjustments |

| Corning Inc | Information Technology | 4/28 | Withdraw |

| Iqvia Holdings | Healthcare | 4/28 | Adjustments |

| Merck & Co | Healthcare | 4/28 | Adjustments |

| Novartis | Healthcare | 4/28 | Hold |

| Pfizer | Healthcare | 4/28 | Adjustments |

| SiriusXM | Communication Services | 4/28 | Withdraw |

| TE Connectivity | Information Technology | 4/28 | Withdraw |

| Universal Health Services | Healthcare | 4/28 | Withdraw |

| UPS | Industrials | 4/28 | Withdraw |

| Waters Corporation | Healthcare | 4/28 | Withdraw |

| Yandex | Communication Services | 4/28 | Withdraw |

| Zebra Technologies | Information Technology | 4/28 | Withdraw |

| Verizon | Communication Services | 4/24 | Withdraw |

| Air Products and Chemicals, Inc. | Materials | 4/23 | Withdraw |

| Arca Continental SAB de CV | Consumer Staples | 4/23 | Withdraw |

| Discover Financial Services | Financials | 4/23 | Withdraw |

| Edenred SA | Information Technology | 4/23 | Withdraw |

| Eli Lilly | Healthcare | 4/23 | Adjustments |

| Gecina SA | Real Estate | 4/23 | Withdraw |

| Pool Corp | Consumer Discretionary | 4/23 | Adjustments |

| PulteGroup, Inc. | Consumer Discretionary | 4/23 | Withdraw |

| Renault SA | Industrials | 4/23 | Withdraw |

| SVB Financial Group | Financials | 4/23 | Withdraw |

| Unilever PLC | Consumer Staples | 4/23 | Withdraw |

| Verisign | Information Technology | 4/23 | Adjustments |

| W.W. Grainger, Inc. | Industrials | 4/23 | Withdraw |

| XPO Logistics, Inc. | Industrials | 4/23 | Withdraw |

| Akzo Nobel N.V. | Materials | 4/22 | Withdraw |

| Amphenol Corporation | Information Technology | 4/22 | Withdraw |

| ICON Plc | Healthcare | 4/22 | Withdraw |

| Ingenico Group SA | Information Technology | 4/22 | Withdraw |

| Ipsen SA | Healthcare | 4/22 | Withdraw |

| Kimberly-Clark Corporation | Consumer Staples | 4/22 | Withdraw |

| Knight-Swift Transportation Holdings Inc. | Industrials | 4/22 | Withdraw |

| O’Reilly Automotive, Inc. | Industrials | 4/22 | Withdraw |

| Quest Diagnostics Incorporated | Healthcare | 4/22 | Withdraw |

| Rogers Communications Inc. | Communication Services | 4/22 | Withdraw |

| Sun Communities, Inc. | Real Estate | 4/22 | Withdraw |

| Atos SE | Information Technology | 4/21 | Withdraw |

| Carlisle Companies Incorporated | Industrials | 4/21 | Withdraw |

| Chipotle Mexican Grill, Inc. | Consumer Discretionary | 4/21 | Withdraw |

| Dover Corp | Industrials | 4/21 | Withdraw |

| Emerson Electric | Energy | 4/21 | Adjustments |

| Entegris, Inc. | Information Technology | 4/21 | Withdraw |

| Equity LifeStyle Properties, Inc. | Real Estate | 4/21 | Withdraw |

| Hannover Ruck SE | Financials | 4/21 | Withdraw |

| HCA Healthcare Inc | Healthcare | 4/21 | Withdraw |

| Lockheed Martin | Industrials | 4/21 | Adjustments |

| Lyft Inc | Industrials | 4/21 | Withdraw |

| Philip Moris | Consumer Staples | 4/21 | Adjustments |

| Sartorious | Healthcare | 4/21 | Adjustments |

| Synchrony Financial | Financials | 4/21 | Withdraw |

| Talanx AG | Financials | 4/21 | Withdraw |

| Dupont de Nemours | Materials | 4/20 | Withdraw |

| Equifax Inc | Industrials | 4/20 | Withdraw |

| IBM | Information Technology | 4/20 | Withdraw |

| JM Smucker | Consumer Staples | 4/20 | Adjustments |

| Vale SA | Materials | 4/20 | Withdraw |

| Vereit | Real Estate | 4/20 | Withdraw |

| Kansas City Southern | Industrials | 4/17 | Withdraw |

| Welltower | Real Estate | 4/17 | Withdraw |

| Abbott | Healthcare | 4/16 | Withdraw |

| Audi | Industrials | 4/16 | Withdraw |

| Barratt Developments PLC | Consumer Discretionary | 4/16 | Withdraw |

| Biomerieux | Healthcare | 4/16 | Withdraw |

| CDW | Information Technology | 4/16 | Withdraw |

| Encompass Health | Healthcare | 4/16 | Withdraw |

| KeyCorp | Financials | 4/16 | Withdraw |

| Porsche | Industrials | 4/16 | Withdraw |

| Sonoco | Materials | 4/16 | Withdraw |

| Uber | Industrials | 4/16 | Withdraw |

| Vici Properties | Real Estate | 4/16 | Withdraw |

| Volkswagen | Industrials | 4/16 | Withdraw |

| Camden Property Trust | Real Estate | 4/15 | Withdraw |

| Hubbel Incorporated | Industrials | 4/15 | Withdraw |

| Howmet Aerospace | Industrials | 4/14 | Withdraw |

| Agilent Technologies | Healthcare | 4/13 | Withdraw |

| Danaher Corporation | Healthcare | 4/13 | Withdraw |

| Dentsply Sirona | Healthcare | 4/13 | Withdraw |

| FIS | Information Technology | 4/13 | Withdraw |

| Mettler-Toledo International | Healthcare | 4/13 | Withdraw |

| Roku | Communication Services | 4/13 | Withdraw |

| Advance Auto Parts | Consumer Discretionary | 4/10 | Withdraw |

| Santander USA | Financials | 4/10 | Withdraw |

| Allegion | Industrials | 4/9 | Withdraw |

| Diageo | Consumer Discretionary | 4/9 | Withdraw |

| EPAM | Information Technology | 4/9 | Withdraw |

| FactSet | Financials | 4/9 | Hold |

| GE | Industrials | 4/9 | Withdraw |

| George Weston | Consumer Staples | 4/9 | Withdraw |

| Realty Income | Real Estate | 4/9 | Withdraw |

| Shaw Communications | Communication Services | 4/9 | Withdraw |

| Solvay | Materials | 4/9 | Withdraw |

| Heineken | Consumer Staples | 4/8 | Withdraw |

| Intuitive Surgical | Healthcare | 4/8 | Withdraw |

| Masco | Industrials | 4/8 | Withdraw |

| McDonald’s | Consumer Discretionary | 4/8 | Withdraw |

| SAP | Information Technology | 4/8 | Adjustments |

| Starbuck’s | Consumer Discretionary | 4/8 | Withdraw |

| Alcon | Healthcare | 4/7 | Withdraw |

| Ally Financial | Financials | 4/7 | Withdraw |

| Deutsche Post | Industrials | 4/7 | Withdraw |

| Henkel AG | Consumer Staples | 4/7 | Withdraw |

| Hologic | Healthcare | 4/7 | Withdraw |

| Communication Services | 4/7 | Withdraw | |

| Tractor Supply | Consumer Discretionary | 4/7 | Withdraw |

| Genuine Parts | Consumer Discretionary | 4/6 | Withdraw |

| Global Payments Inc | Information Technology | 4/6 | Withdraw |

| Henry Schein | Healthcare | 4/6 | Withdraw |

| HP | Information Technology | 4/6 | Uncertain |

| Origin Energy | Energy | 4/6 | Hold |

| Penumbra | Healthcare | 4/6 | Withdraw |

| Rolls Royce | Industrials | 4/6 | Withdraw |

| Sage Group | Information Technology | 4/6 | Uncertain |

| Smiths Group | Industrials | 4/6 | Withdraw |

| Thermo Fischer Scientific | Healthcare | 4/6 | Withdraw |

| Zimmer Biomet | Healthcare | 4/6 | Withdraw |

| Bae Systems | Industrials | 4/3 | Uncertain |

| Carrier | Industrials | 4/3 | Withdraw |

| Iqvia | Healthcare | 4/3 | Adjustments |

| RTL Group | Communication Services | 4/3 | Withdraw |

| Service Corp International | Consumer Discretionary | 4/3 | Withdraw |

| Beiersdorf | Consumer Staples | 4/2 | Withdraw |

| Bunzl | Industrials | 4/2 | Withdraw |

| Etsy | Consumer Discretionary | 4/2 | Withdraw |

| GoDaddy | Information Technology | 4/2 | Withdraw |

| National Grid | Utilities | 4/2 | Hold |

| Stanley Black & Decker | Industrials | 4/2 | Withdraw |

| Textron | Industrials | 4/2 | Withdraw |

| Transdigm Group | Industrials | 4/2 | Withdraw |

| Buoygues | Industrials | 4/1 | Withdraw |

| Continental AG | Industrials | 4/1 | Withdraw |

| Dollarama | Consumer Discretionary | 4/1 | Withdraw |

| Kinross Gold | Materials | 4/1 | Withdraw |

| Kroger Co | Consumer Staples | 4/1 | Hold |

| Lamb Weston | Consumer Staples | 4/1 | Withdraw |

| Masimo Corp | Healthcare | 4/1 | Uncertain |

| Shopify | Information Technology | 4/1 | Withdraw |

| T-Mobile | Communication Services | 4/1 | Withdraw |

| Wheaton Precious Metals | Materials | 4/1 | Withdraw |

| Conagra | Consumer Staples | 3/31 | Adjustments |

| Dollar Tree | Consumer Discretionary | 3/31 | Withdraw |

| Imperial Oil | Energy | 3/31 | Adjustments |

| McCormick | Consumer Staples | 3/31 | Withdraw |

| Munich Re | Financials | 3/31 | Withdraw |

| Quest Diagnostics Incorporated | Healthcare | 3/31 | Withdraw |

| Stryker | Healthcare | 3/31 | Withdraw |

| WPP | Communication Services | 3/31 | Withdraw |

| Xylem | Industrials | 3/31 | Withdraw |

| Abb Ltd | Industrials | 3/30 | Uncertain |

| ASML | Information Technology | 3/30 | Uncertain |

| Boston Scientific | Healthcare | 3/30 | Withdraw |

| CNH Industrials | Industrials | 3/30 | Withdraw |

| Domino’s Pizza, Inc. | Consumer Discretionary | 3/30 | Withdraw |

| Melrose Industries | Industrials | 3/30 | Uncertain |

| NetApp | Information Technology | 3/30 | Withdraw |

| Regency Centers | Real Estate | 3/30 | Withdraw |

| Restaurant Brands International | Consumer Discretionary | 3/30 | Uncertain |

| Smith & Nephew | Healthcare | 3/30 | Uncertain |

| The Crypto Company | Information Technology | 3/30 | Uncertain |

| Toro Co | Industrials | 3/30 | Withdraw |

| UPM | Materials | 3/30 | Withdraw |

| QBE Insurance | Financials | 3/29 | Withdraw |

| Brookfield Asset Management | Financials | 3/27 | Uncertain |

| Bruker | Healthcare | 3/27 | Withdraw |

| CenturyLink | Communication Services | 3/27 | Uncertain |

| EssilorLuxxotica | Consumer Discretionary | 3/27 | Withdraw |

| Molson Coors | Consumer Staples | 3/27 | Withdraw |

| TJX | Consumer Discretionary | 3/27 | Withdraw |

| Vertex | Healthcare | 3/27 | Hold |

| ViacomCBS | Communication Services | 3/27 | Withdraw |

| Western Union | Information Technology | 3/27 | Withdraw |

| Analog Devices | Information Technology | 3/26 | Withdraw |

| Caterpillar | Industrials | 3/26 | Withdraw |

| CSX Corp | Industrials | 3/26 | Uncertain |

| Dell | Information Technology | 3/26 | Withdraw |

| Dexus | Real Estate | 3/26 | Withdraw |

| EcoLab | Materials | 3/26 | Uncertain |

| FactSet | Financials | 3/26 | Uncertain |

| Fairfax Financial Holdings | Financials | 3/26 | Withdraw |

| Gaming & Leisure Properties | Real Estate | 3/26 | Withdraw |

| Huazhu Group | Consumer Discretionary | 3/26 | Uncertain |

| Infineon | Information Technology | 3/26 | Withdraw |

| Interpublic Group of Companies Inc | Communication Services | 3/26 | Withdraw |

| Kion group | Industrials | 3/26 | Uncertain |

| Lear Corp | Consumer Discretionary | 3/26 | Withdraw |

| LKQ Corp | Consumer Discretionary | 3/26 | Withdraw |

| Lululemon | Consumer Discretionary | 3/26 | Withdraw |

| Magna International | Consumer Discretionary | 3/26 | Withdraw |

| MTU Aero Engines | Industrials | 3/26 | Withdraw |

| Novo Nordisk | Healthcare | 3/26 | Hold |

| Paychex Inc | Information Technology | 3/26 | Adjustments |

| Rogers Communications Inc. | Communication Services | 3/26 | Uncertain |

| Scout24 AG | Communication Services | 3/26 | Withdraw |

| South32 | Materials | 3/26 | Withdraw |

| Splunk | Information Technology | 3/26 | Uncertain |

| Telia | Communication Services | 3/26 | Uncertain |

| Ugi Corp | Utilities | 3/26 | Uncertain |

| Umicore | Materials | 3/26 | Withdraw |

| VMWare | Information Technology | 3/26 | Withdraw |

| Anhueser Busch Inbev | Consumer Staples | 3/25 | Withdraw |

| AvalonBay Communities | Real Estate | 3/25 | Withdraw |

| Federal Realty Investment Trust | Real Estate | 3/25 | Withdraw |

| McDonald’s | Consumer Discretionary | 3/25 | Uncertain |

| Mid America Apartment Communities | Real Estate | 3/25 | Withdraw |

| Nike | Consumer Discretionary | 3/25 | Uncertain |

| Omnicom | Communication Services | 3/25 | Uncertain |

| SunPower Corp | Information Technology | 3/25 | Withdraw |

| Whirlpool | Consumer Discretionary | 3/25 | Withdraw |

| Ablemarle | Materials | 3/24 | Uncertain |

| Agnico Eagle Mines | Materials | 3/24 | Withdraw |

| Ambev | Consumer Staples | 3/24 | Withdraw |

| Chevron | Energy | 3/24 | Adjustments |

| Elanco | Healthcare | 3/24 | Withdraw |

| GM | Industrials | 3/24 | Withdraw |

| IHS Markit | Industrials | 3/24 | Adjustments |

| Mastercard | Financials | 3/24 | Withdraw |

| PACCAR | Industrials | 3/24 | Adjustments |

| Square | Financials | 3/24 | Withdraw |

| Suncor | Energy | 3/24 | Adjustments |

| Airbus SE | Industrials | 3/23 | Withdraw |

| Applied Materials | Information Technology | 3/23 | Withdraw |

| Aptiv | Consumer Discretionary | 3/23 | Withdraw |

| Axel Springer SE | Communication Services | 3/23 | Withdraw |

| Bell | Communication Services | 3/23 | Uncertain |

| Best Buy | Consumer Discretionary | 3/23 | Withdraw |

| Coca-cola | Consumer Staples | 3/23 | Withdraw |

| Cummins | Industrials | 3/23 | Withdraw |

| Deere & Co | Industrials | 3/23 | Withdraw |

| Eli Lilly | Healthcare | 3/23 | Hold |

| Newmont | Materials | 3/23 | Withdraw |

| Saint-Gobain | Industrials | 3/23 | Withdraw |

| Thermo Fischer Scientific | Healthcare | 3/23 | Uncertain |

| Traton SE | Industrials | 3/23 | Withdraw |

| Information Technology | 3/23 | Withdraw | |

| Unibail-Rodamco | Real Estate | 3/23 | Withdraw |

| VF Corp | Consumer Discretionary | 3/23 | Withdraw |

| AT&T | Communication Services | 3/20 | Uncertain |

| BMW | Consumer Discretionary | 3/20 | Adjustments |

| Maersk | Industrials | 3/20 | Withdraw |

| RPM | Materials | 3/20 | Withdraw |

| Sysco | Consumer Staples | 3/20 | Withdraw |

| Burlington Stores | Consumer Discretionary | 3/19 | Withdraw |

| Cintas | Industrials | 3/19 | Withdraw |

| Darden Restaurant | Consumer Discretionary | 3/19 | Withdraw |

| Estee Lauder Companies Inc | Consumer Discretionary | 3/19 | Withdraw |

| Exact Sciences | Healthcare | 3/19 | Withdraw |

| Ford | Industrials | 3/19 | Withdraw |

| KDP | Consumer Staples | 3/19 | Adjustments |

| Ross Stores | Consumer Discretionary | 3/19 | Withdraw |

| Sonic Healthcare | Healthcare | 3/19 | Withdraw |

| Target | Consumer Discretionary | 3/19 | Withdraw |

| ConocoPhillips | Energy | 3/18 | Withdraw |

| General Mills Inc | Consumer Staples | 3/18 | Adjustments |

| GPT Group | Real Estate | 3/18 | Withdraw |

| Marriott | Consumer Discretionary | 3/18 | Withdraw |

| Sketchers | Consumer Discretionary | 3/18 | Withdraw |

| T-Mobile | Communication Services | 3/18 | Uncertain |

| Tapestry | Consumer Discretionary | 3/18 | Adjustments |

| Baxter | Healthcare | 3/17 | Uncertain |

| Capri | Consumer Discretionary | 3/17 | Uncertain |

| Lam Research | Information Technology | 3/17 | Withdraw |

| Ramsay Healthcare | Healthcare | 3/17 | Withdraw |

| Rea Group | Communication Services | 3/17 | Withdraw |

| Ventas | Real Estate | 3/17 | Withdraw |

| Southwest Airlines | Industrials | 3/16 | Withdraw |

| Expedia | Consumer Discretionary | 3/13 | Withdraw |

| Broadcom Inc | Information Technology | 3/12 | Withdraw |

| CVS | Healthcare | 3/12 | Hold |

| Gap | Consumer Discretionary | 3/12 | Uncertain |

| Parker-Hannifin | Industrials | 3/12 | Hold |

| TransUnion | Industrials | 3/12 | Hold |

| Ulta Beauty | Consumer Discretionary | 3/12 | Uncertain |

| Boston Scientific | Healthcare | 3/11 | Hold |

| Cigna | Healthcare | 3/11 | Hold |

| Dupont de Nemours | Materials | 3/11 | Hold |

| Hilton | Consumer Discretionary | 3/11 | Withdraw |

| Huntington Bancshares | Financials | 3/11 | Uncertain |

| Mettler-Toledo International | Healthcare | 3/11 | Uncertain |

| Moody’s | Financials | 3/11 | Adjustments |

| Sherwin Williams | Materials | 3/11 | Hold |

| Urban Outfitters | Consumer Discretionary | 3/11 | Uncertain |

| Visa | Financials | 3/11 | Adjustments |

| Western Union | Information Technology | 3/11 | Hold |

| American Airlines | Industrials | 3/10 | Withdraw |

| Anthem Inc | Healthcare | 3/10 | Hold |

| Delta Air Lines Inc | Industrials | 3/10 | Withdraw |

| Global Payments Inc | Financials | 3/10 | Hold |

| Honeywell International Inc | Industrials | 3/10 | Hold |

| Kroger Co | Consumer Staples | 3/10 | Uncertain |

| Laboratory Corp. Of America Holdings | Healthcare | 3/10 | Hold |

| Reynolds Consumer Products | Consumer Staples | 3/10 | Uncertain |

| Royal Caribbean | Consumer Discretionary | 3/10 | Withdraw |

| The Cooper Companies Inc | Healthcare | 3/10 | Hold |

| Westinghouse Air Brake Technologies | Industrials | 3/10 | Hold |

| Bookings Holdings | Consumer Discretionary | 3/9 | Withdraw |

| Host Hotels | Consumer Discretionary | 3/9 | Withdraw |

| Interpublic Group of Companies Inc | Communication Services | 3/9 | Hold |

| JetBlue | Industrials | 3/9 | Withdraw |

| PerkinElmer | Healthcare | 3/9 | Adjustments |

| Vail Resorts | Consumer Discretionary | 3/9 | Withdraw |

| Trivago | Consumer Discretionary | 3/6 | Uncertain |

| Advanced Micro Devices Inc | Information Technology | 3/5 | Hold |

| Burlington Stores | Consumer Discretionary | 3/5 | Uncertain |

| Equifax Inc | Industrials | 3/5 | Hold |

| Marvell Technology | Information Technology | 3/5 | Adjustments |

| PayPal | Financials | 3/5 | Hold |

| Align Technology Inc | Healthcare | 3/4 | Hold |

| Brown-FormaN | Consumer Staples | 3/4 | Adjustments |

| Dell | Information Technology | 3/4 | Uncertain |

| Home Depot | Consumer Discretionary | 3/4 | Hold |

| Agilent Technologies | Healthcare | 3/3 | Hold |

| Cummins | Industrials | 3/3 | Uncertain |

| Qorvo | Information Technology | 3/3 | Adjustments |

| Ross Stores | Consumer Discretionary | 3/3 | Uncertain |

| Target | Consumer Discretionary | 3/3 | Hold |

| Thermo Fisher Scientific | Healthcare | 3/3 | Hold |

| United Rentals | Industrials | 3/3 | Hold |

| Analog Devices | Information Technology | 3/2 | Hold |

| Fidelity National Information Services | Information Technology | 3/2 | Hold |

| Hyatt | Consumer Discretionary | 3/2 | Withdraw |

| Microchip Technology | Information Technology | 3/2 | Withdraw |

| Microsoft | Information Technology | 3/2 | Adjustments |

| Nutanix | Information Technology | 3/2 | Adjustments |

| Whirlpool | Consumer Discretionary | 3/2 | Adjustments |

| United Airlines | Industrials | 2/24 | Withdraw |

| Hormel | Consumer Staples | 2/20 | Hold |

| Apple | Information Technology | 2/18 | Adjustments |

| MGM | Consumer Discretionary | 2/12 | Withdraw |

| Yum Brands | Consumer Staples | 2/6 | Adjustments |