This week, AlphaSense sat down with Jim Egan, Co-Head of Securitized Research at Morgan Stanley, to discuss life after Covid, focusing on housing tailwinds.

Egan began by pointing out that the current environment is a single-family vs. multi-family story–by that, he does not mean ownership vs. rentership, but rather, means that single-family housing is the beneficiary of the Covid area due to rising rates of remote work and large populations fleeing densely populated cities.

According to Egan, Morgan Stanley thinks about housing through the lens of a four-pillar framework. Each of these pillars entered the pandemic with varying degrees of strength and weakness and Covid is having disparate effects across each.

- Demand for shelter

- Supply of shelter

- Affordability of housing

- Mortgage credit availability

Demand for shelter

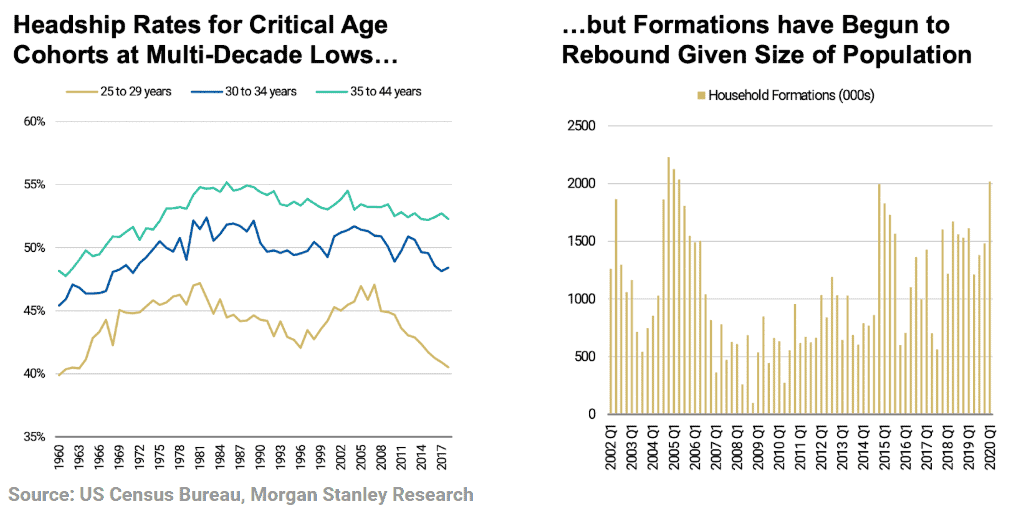

Before the pandemic hit, cohorts in the 25-29-year-old and 30-34-year-old ranges were already at multi-decade lows. Despite this statistic, analysts at Morgan Stanley believe that homeownership can increase in a post-Covid world over the next five years, particularly as more and more people shift to a remote work environment.

Household formations, and therefore demand for shelter, could experience a lull in the current recession. That said, the demographic dynamics that had us poised in ownership and rentership over the next 5 years remain intact. When we look to forecast formations, one of our key metrics is headship rates or the share of a cohort in a specific population that had their own household.

Affordability of housing

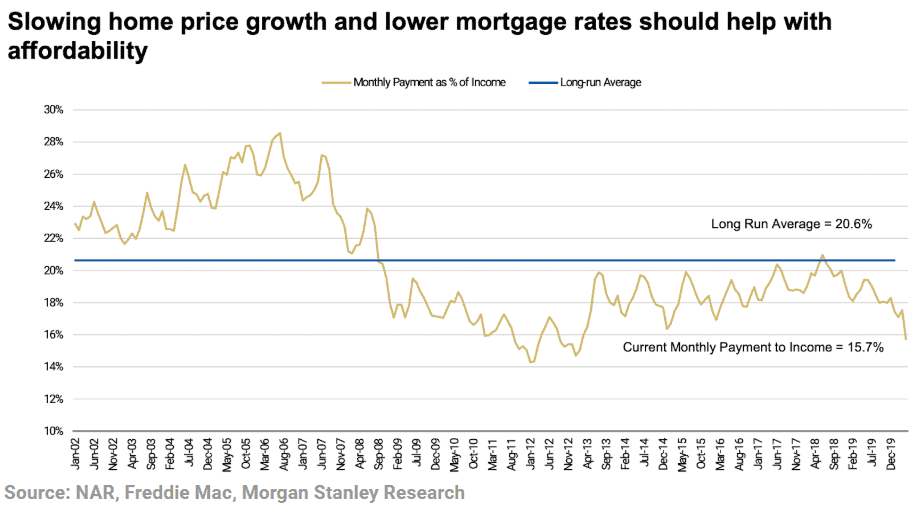

We believe that the rate of home price appreciation is going to slow over the next 12 months before it begins to re-accelerate in the latter half of 2021 This, combined with a predicted extended period of lower mortgage rates, leads to home prices that look more affordable than they have in the past 7-8 years.

This doesn’t take into account the progress being made in the FinTech front. One of the longer-lasting impacts from Covid-19 is the acceleration of ways to reduce closing costs and expedite closing timelines for the homeowner, which, according to Egan, means that homeowners may respond faster to lower mortgage rates and will have more opportunity to leverage the equity in their home, plus, a lower barrier to entry means that closing costs might be reduced.

Egan also covered housing demand, single-family demand, and credit availability in a post-Covid world. To read the full report (or to read more Morgan Stanley research) login to AlphaSense, or start a free trial. To access Jim Egan’s full webcast, please explore our Expert Briefing Series.