Macro themes dominated headlines in 2019. Here are the industries they impacted most and how companies grappled with them. Find out how to respond more intelligently to sector and company opportunities amid broad market sell-offs and surges.

Macro themes were major market movers in 2019.

Inflation, long-dormant during the shadow of the Great Recession, became a key variable again. Recessionary forecasts at the start of the year gave way to anticipation of more growth ahead, causing swings in long-term interest rates. Meanwhile, debates abounded about just how much the Fed would have to hike rates and whether it moved too quickly. Trade wars rocked markets, and investors looked for cues of escalation and deescalation to make decisions. The shape and pace of Brexit became a key economic variable.

The AlphaSense 2019 Macro Review looks beyond the headlines to analyze how these developments impacted industries and businesses more precisely. We identify each of the top sectors in each macro theme and examine how companies discussed it in their own words. We see which industry had the highest relevant documents in event transcripts over the last 12 months and identify key quotes that shed light on how industries reacted.

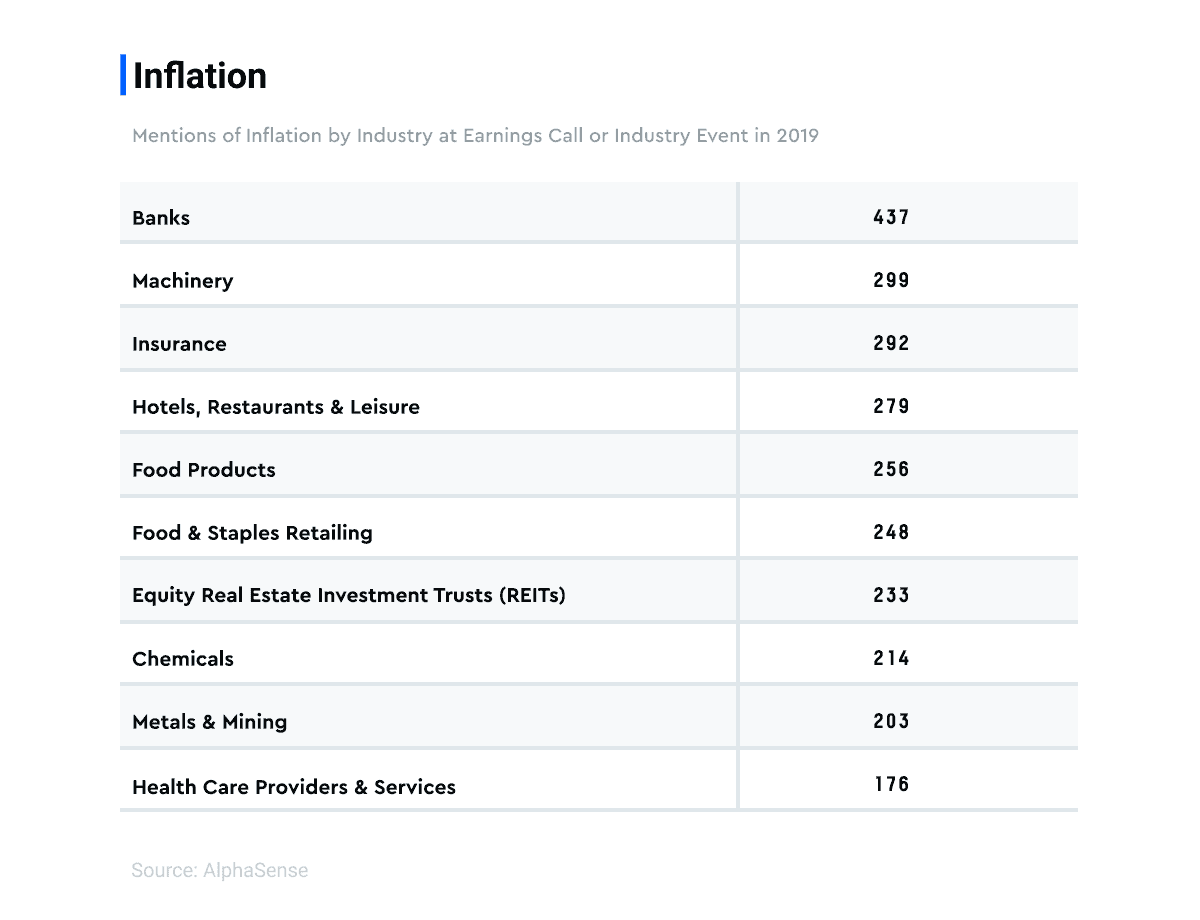

Inflation:

Just how much inflation is there — and where? That question was top of mind for investors in 2019.

The sector that was most impacted — perhaps not unexpectedly given its interest rate-sensitivity and macro-orientation — was banks. “The impact from a possible reduction in interest rates on our net interest income and pension expense, combined with the inflationary pressures and continued investment in technology, provides headwinds, but we believe they are manageable,” Comerica Inc said on its third quarter earnings call.

But the machinery sector was second-most impacted and companies struggled to keep up with inflationary pressures that were exacerbated by the year’s trade wars. “We continue to leverage our business operating system across the enterprise to manage direct material, tariff-related and other inflationary headwinds,” Ingersoll-Rand PLC said in its earnings call.

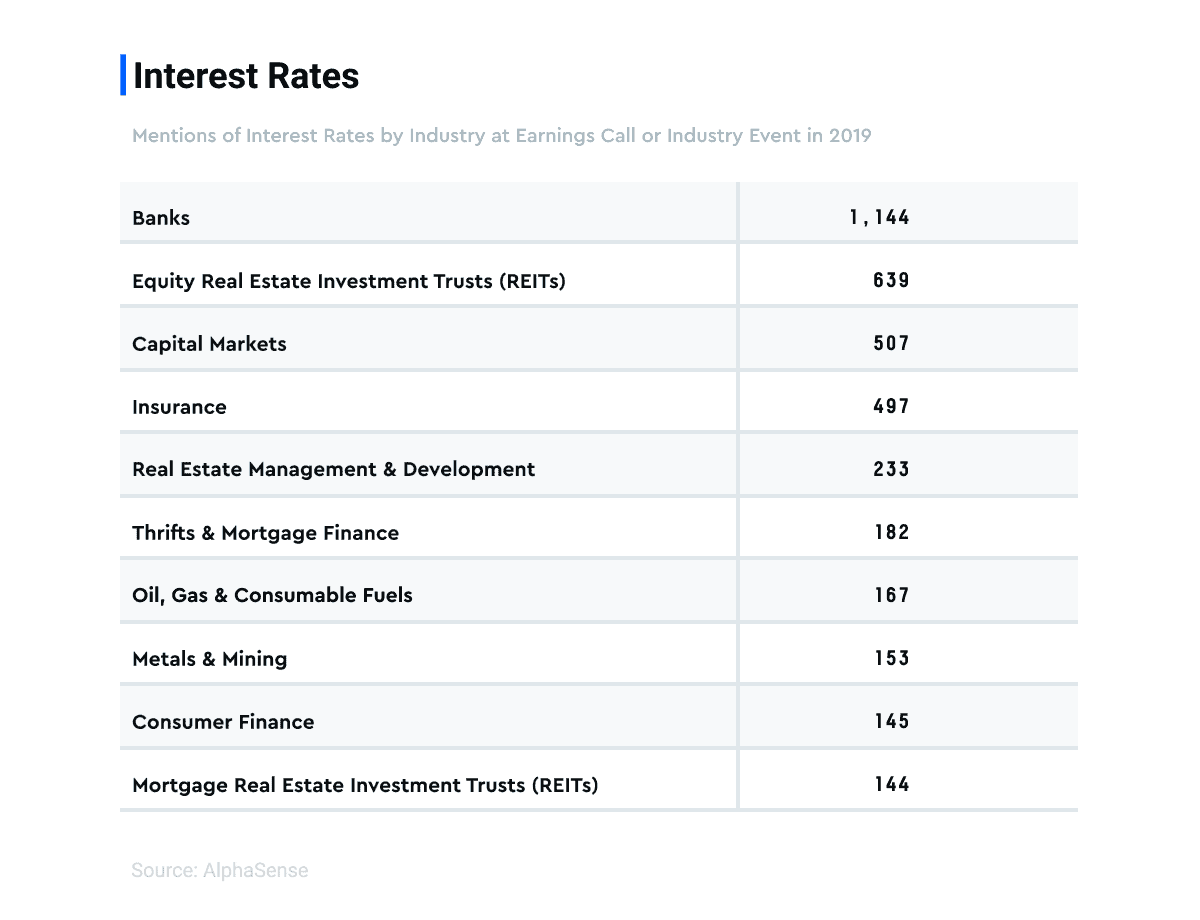

Interest Rates:

Some of the largest and most sophisticated financial institutions in the world struggled to forecast the direction of interest rates over the course of the year, as banks again topped the charts. “A year ago when we issued guidance, interest rates were in a different zone, and our guidance a year ago assumed 2019 would have interest rates above 3% if you use the 10-year U.S. treasury as a benchmark,” Prudential Financial Inc said in an earnings call.

The volatility also took a toll on the second-most impacted sector – Real Estate Investment Trusts (REITs) – as companies struggled with prepayments and setting strategy. “The decline resulted from repayments of the underlying loans in addition to interest rate-driven fair value losses in the investment,” PennyMac Mortgage Investment Trust said in an earnings call.

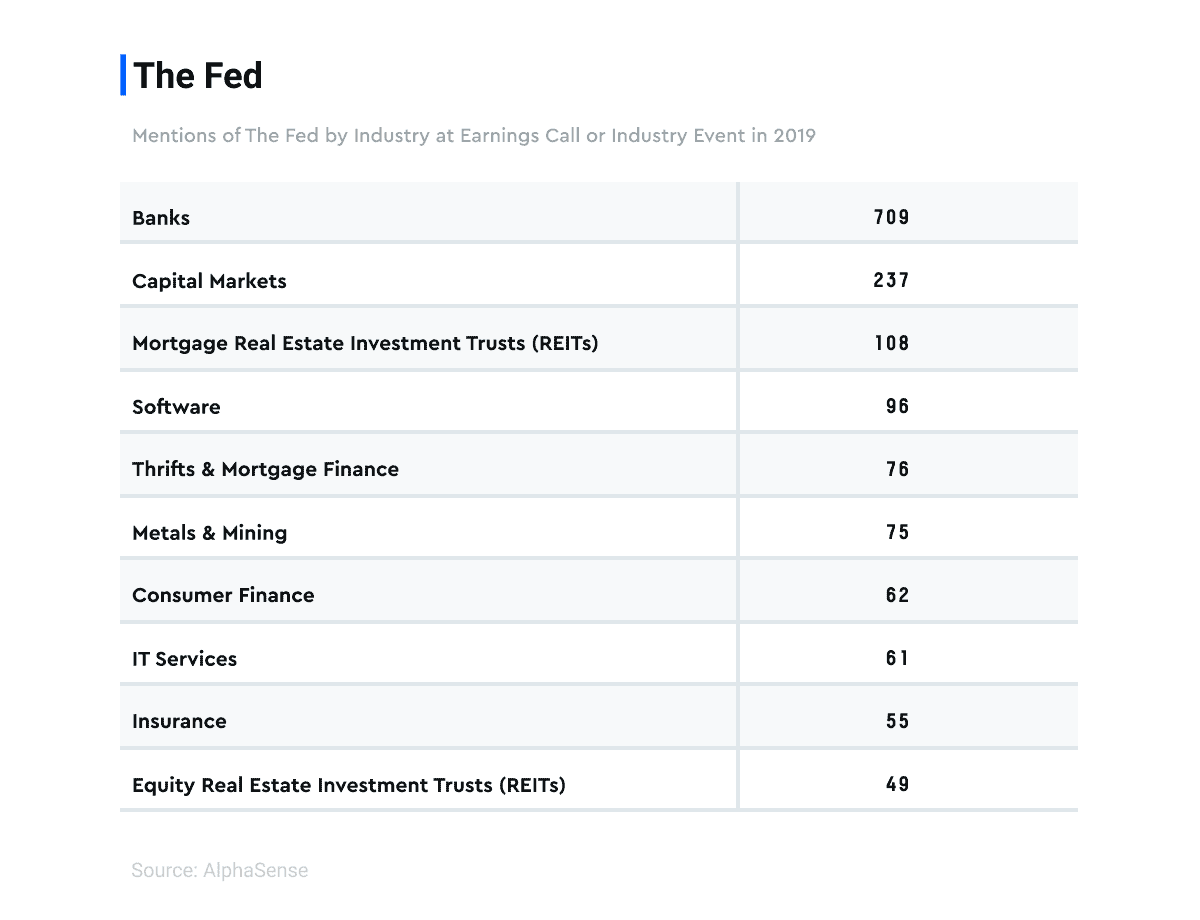

The Fed:

Nor could investors rely on previously-steadfast measures like Taylor Rule to gauge monetary policy. That’s because of the unusual backdrop: Start with a newer Fed Chief at the helm, and add to that unorthodox economic policy — near-full employment, but with heavily accommodative policy still in effect. This means investors had to read the tea leaves on personal and political dynamics as well. Banks were the most active and among the most reliant on handicapping guidance. “Well, we use the forward — the implied forward rates that have some — that have Fed rate cuts kind of baked into them on the short end of the curve,” First Internet Bancorp said in an earnings call.

Capital Markets companies were also on edge and discussed the Fed the second most. “Uncertainty during the quarter around the timing and magnitude of anticipated rate cuts by the Fed was also a contributing factor. As tariff threats lessened and the direction of rates became more apparent, we saw improved client activity, particularly late in the quarter,” Goldman Sachs Group said in an earnings call.

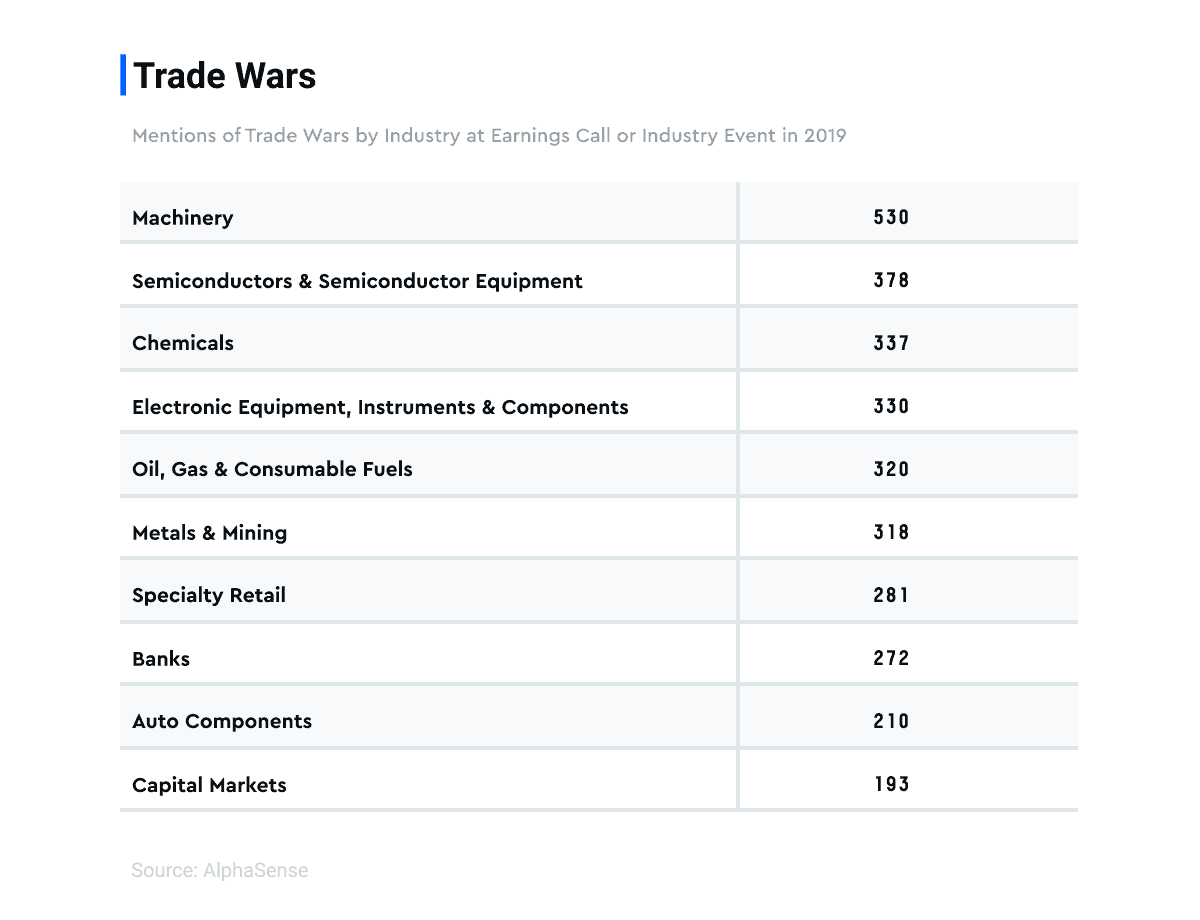

Trade Wars:

Add escalating – and deescalating – trade wars to the mix of what investors had to grapple with. As tariffs and rhetoric mounted, the Free Trade model that was often touted as a beacon by economists creaked. Major importers and exporters felt the impact the most.

In the highest-ranked Machinery sector, “The tariff-related headwind now includes the estimated impacts from List 4 China tariffs at 15%,” Stanley Black & Decker Inc said in an earnings call. “While the uncertainty began with US-China trade friction, the uncertainty has become global,” Microchip Technology Inc. said in an earnings call in the semiconductor sector.

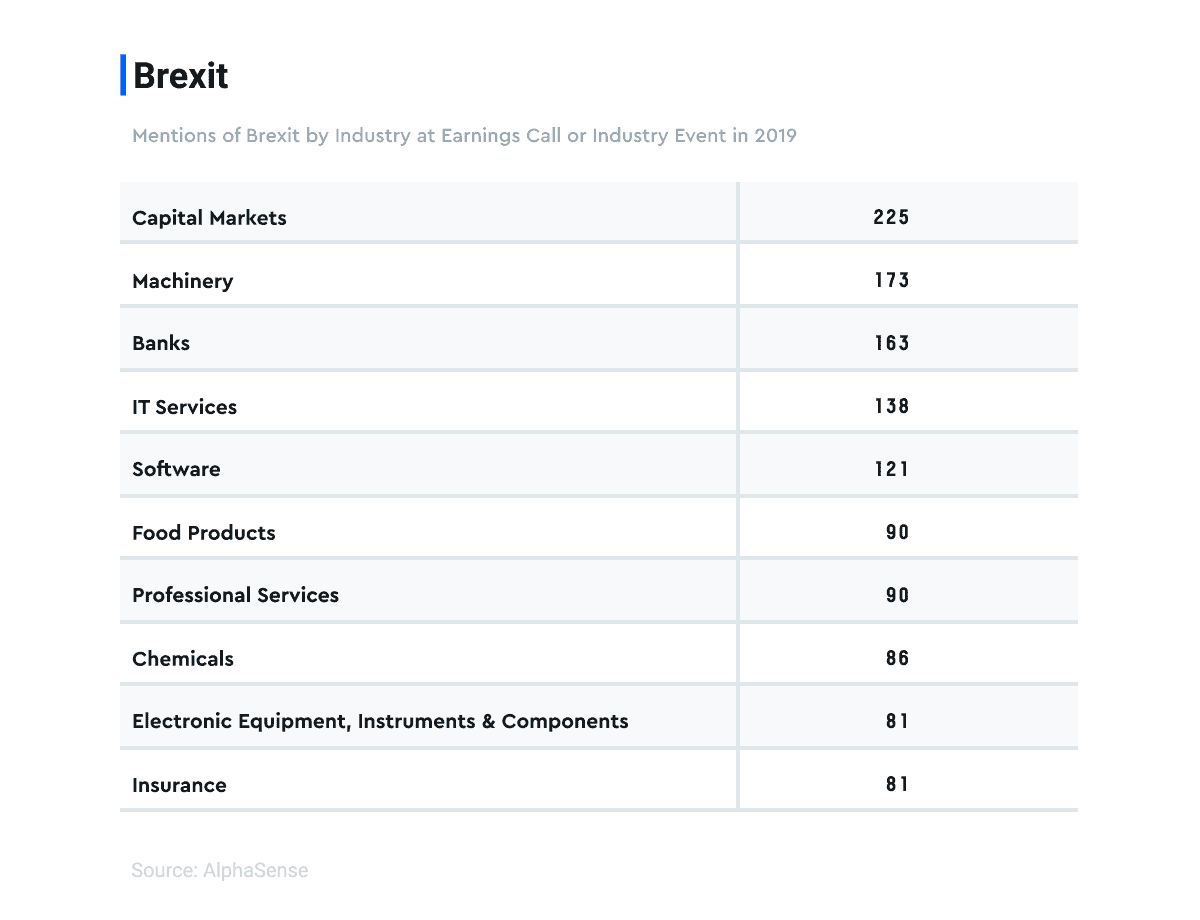

Brexit:

And then there was the ever-changing nature of Brexit. Those companies dependent most on the macro outlook like in the Capital Markets took the brunt and ranked the highest. “The environment in the U.K. continues to be very challenging, uncertainty over Brexit, regulatory changes and tougher competition,” Banco Santander SA said in an earnings call.

Those planning for import-export logistics like Machinery also felt the impact and were mentioned the second most. “While economic growth has showed — slowed a bit and elevated Brexit uncertainty is evident in the back half of the year, we continue to see the overall heavy-duty truck market as flat at high levels this year,” CNH Industrial NV said in an earnings call.

Macro themes often moved markets wholesale in 2019, causing both broad surges and sell-offs. By having a better understanding of the sector-specific impact of themes, investors will be in a better position to take advantage of sector and company opportunities amid wider market moves in 2020 and beyond.

Interested in learning more about AlphaSense? Browse our library of whitepapers and blog posts or request a demo with one of our qualified product experts. Discover how our accounts for Corporates and Financial Firms differ, and how to leverage our AI-powered platform to stay ahead of the curve.