As the Dow Jones plummets to its worst month in history as a result of the Coronavirus-led shutdown, some industries are showing signs of positivity.

The Dow Jones Industrial Average, S&P 500, and Nasdaq Composite all serve as a pulse on how markets are performing in aggregate. Another way to capture and measure that pulse is market sentiment.

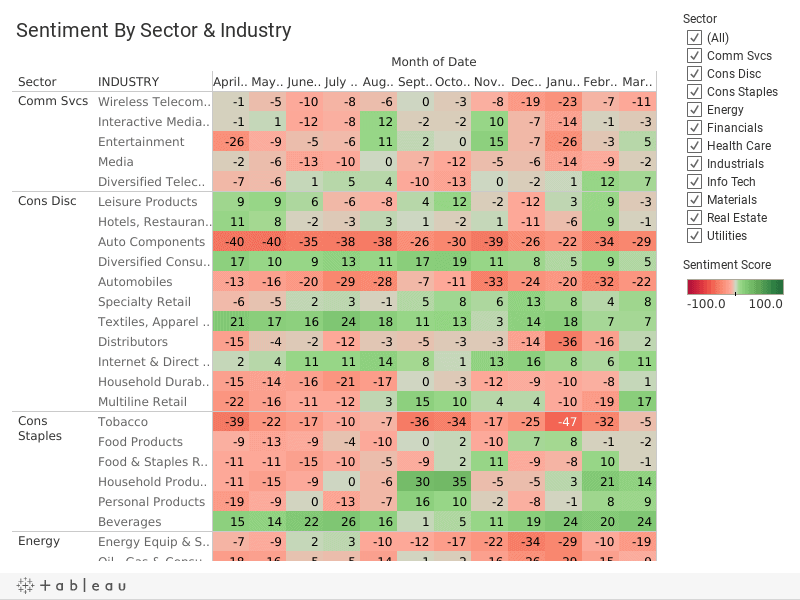

Using our ML model (trained on 10+ years of transcripts), we’ve analyzed and scored all corporate transcripts from the past 12 months. We measure management tonality — positive and negative — in transcripts to generate a sentiment score for each document, as well as an aggregate sentiment score for each company.

Below, we’ve aggregated those sentiment across all sectors and industries so you can reach your own conclusions. See the takeaways below the heatmap.

The data visualization below is best viewed on a desktop. (link)

var divElement = document.getElementById(‘viz1585168838024’); var vizElement = divElement.getElementsByTagName(‘object’)[0]; if ( divElement.offsetWidth > 800 ) { vizElement.style.width=’100%’;vizElement.style.height=(divElement.offsetWidth*0.75)+’px’;} else if ( divElement.offsetWidth > 500 ) { vizElement.style.width=’100%’;vizElement.style.height=(divElement.offsetWidth*0.75)+’px’;} else { vizElement.style.width=’100%’;vizElement.style.height=’700px’;} var scriptElement = document.createElement(‘script’); scriptElement.src = ‘https://public.tableau.com/javascripts/api/viz_v1.js’; vizElement.parentNode.insertBefore(scriptElement, vizElement);

Takeaways

1) The stock-up phenomenon helps multiline retail thrive

Across multiline retail companies in the S&P 500 sentiment is high at +42. Retailers selling essential quarantine goods like toilet-paper, hand sanitizer, and disinfectants will likely continue to thrive, though we anticipate some retailers like Nordstorm and Kohl’s will soon update their guidance to include the negative impact of COVID-19 in the coming months.

Dollar General (Q4 2019 Earnings Call)

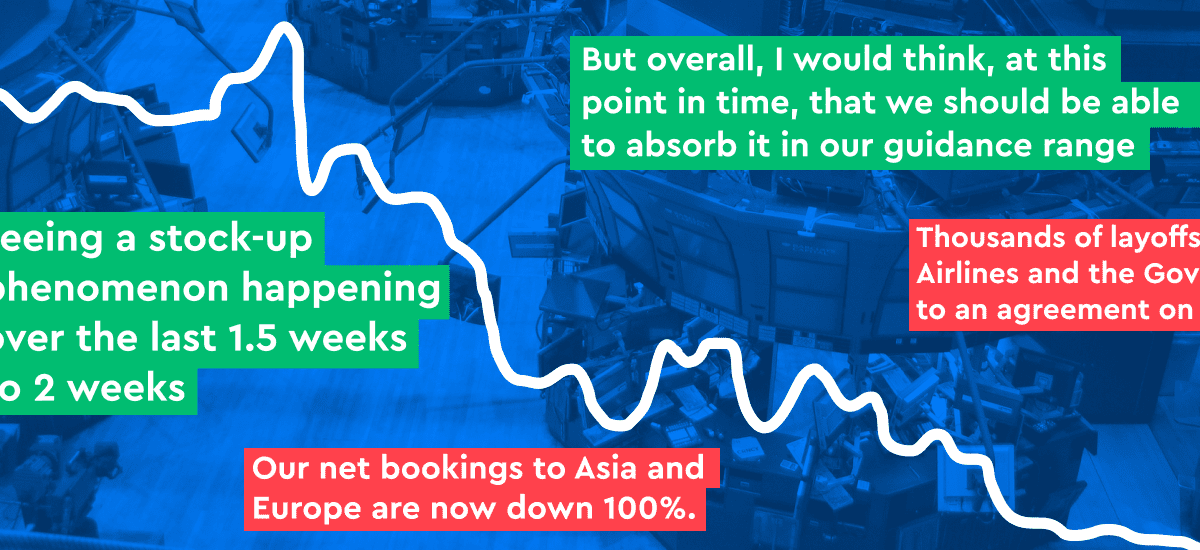

“Yes, Rupesh, we are, like probably other retailers, seeing a stock-up phenomenon happening over the last 1.5 weeks to 2 weeks, accelerated into this week a little bit more. So we’re continuing to watch that closely. I’m really proud of our store teams with the additional volume, how they’ve taken care of our customers and our supply chain teams making sure that we have stock in the store for those customers that come in. It is our hope, as we move through this, we’re able to satisfy the customer need as they continue to shop with us. We’re watching it closely as well because like most stock-ups, there’s always a backside to this. So we’re watching that as we continue to move through the next few weeks with the hope that this virus will diminish over time. And obviously, we’ll see the back end. But we’ll keep everybody posted as we move forward. Our goal internally here, again, is to ensure we deliver for our core consumer.”

2) Lower utilization of ambulatory healthcare services may affect outpatient segments

The outlook for inpatient care companies in the near term is negative, with concerns mounting on the tradeoff between higher utilization because of COVID-19 related admissions and fewer patients being admitted for elective surgeries which produce a higher amount of revenue per admission. Inversely, ambulatory care services may decrease significantly through Q2 as new policies prohibit citizens from seeking out non-emergency healthcare services.

Cardinal Health (Barclays Global Health Conference 03/10)

“And it’s not only affecting supply ability and supply cost. It’s also hard to understand the exact impact on demand. You could argue — are people going to have — is there going to be more procedures? Could people be in a hospital for this? Or are the people going to stop doing elected? It’s just really hard to understand what the — more midterm because I don’t think this will be a long-term issue. But the more midterm issue will be on demand as well as on supply. But taking all that into account, at this point in time, I don’t see why we couldn’t absorb it into our guidance range. The impact on the segments might be a little different, maybe a little less on Pharma, a little more on Medical. But overall, I would think, at this point in time, that we should be able to absorb it in our guidance range, but again, I’ll reserve the right because it definitely is changing hourly”.

3) Staying at home = a need for more household products

Similar to the multiline retail industry, the household products industry, at a sentiment score of +14, is staying afloat with “panic buying” driving online and in store sales. Now that some supply chains in China are beginning to return to normal levels, there is potential for household products to rebound in APAC,.

Reynolds Consumer (Q4 2019 Earnings Call)

Question – Jason M. English: …I appreciate the comments on coronavirus and the impact you’re seeing. The other area where we’ve seen coronavirus and the consternation impacting is commodity trends. We have a little less near-term visibility into what your commodity basket is doing, so I was hoping maybe, to begin with, you can enlighten us on what you’re seeing in terms of input costs.

Answer – Lance Mitchell: Jason, it’s really early days of what we’re seeing from commodity costs as a result of coronavirus. Our forward guidance is based on what we’ve seen to date. And our — we believe that, if the current prices that we are seeing remain at this level or decrease, there’ll be some modest tailwind for our earnings going forward.

4) Airlines are no longer flying high

From Feb. to Mar. sentiment decreased by 19 points for Airlines. Within the Industrials sector, it’s the largest drop in sentiment compared to all other industries. Specifically, United has said it expects to only fill 20 -30% of seats which falls below the 84% of seats that it sold throughout last year, and less than half the roughly 65% of seats that an airline needs to sell to just break even. Thousands of layoffs may occur if the Airlines and the Government can not come to an agreement on a bailout package. Both the FAA and the European Union have temporarily suspended their ‘use it or lose it’ rule to curb the number of ghost flights.

United Airlines (JPMorgan Industrial Conference)

“Our net bookings to Asia and Europe are now down 100%. Net bookings include new bookings minus cancellations. In this situation, however, gross bookings, which are just new bookings before netting out cancellations, are probably the best measure of true demand. Our gross bookings in the Pacific are down about 70%, so there are still some bookings occurring even in the Pacific region. In Europe, our gross bookings are now down about 50%. Domestically, we’re currently seeing net bookings down about 70% and gross bookings down about 25%. While those numbers are encouraging compared to international, we’re planning for the public concern about the virus to get worse before it gets better.

Don’t miss critical insights: Sign up for a free trial or login here.