As the broader markets reel with panic over COVID-19 economic woes, the US oilfield has been dealt an even tougher hand.

Not only are US oil producers highly exposed to revenue loss in the virus fall-out, but they are also dealing with another black swan event at the same time.

Here is the US oilfield’s two-headed black swan:

- Saudi Arabia has engaged Russia in an all-out price war

- COVID-19 is crushing oil demand as travel fuel consumption rates are plummeting with hundreds of millions of travelers and commuters now sheltering in place

Together, these two unpredictable developments have forced US oil prices to crash from $63 per barrel in January to only $20 per barrel in March. Moreover, the state of the US oilfield was not strong coming into this unprecedented time. A US oilfield downcycle had already begun before March 2020, and we previously projected that US oil and gas investments were poised to decline 11% using AlphaSense document searches prior to this new situation. The spending cuts are obviously deepening now.

Alone, either of these black swans would have dealt a massive blow to the US oilfield. Together they are catastrophic, leaving the US shale industry in a severe predicament that will put many weaker firms out of business. Even the strongest will be highly challenged to survive – this is the point in this oilfield downturn where things get Darwinian.

Here are three mind-numbing examples of the US oilfield fall-out:

- My research firm, Infill Thinking, outlined a new base case expectation that US hydraulic fracturing activity will fall 50% by April or May from levels in early-March (pre-crash). Unthinkable two weeks ago, this was our base case last week, and now it seems optimistic this week.

- Halliburton’s stock fell by 80% in one month. As of this writing, it had hit a low near $4.50/share. Meanwhile, the company has $12/share of debt.

- The combined market caps of three leading publicly traded frac sand producers totals $180mm, which is less than the cost of just one of the local sand mine built during 2018. Their debt outstanding on the other hand totals $3.2bn.

The oil price crash could not come at a worse time because shalers are already grappling with negative sentiment from the sustainable finance trend, diminished access to capital markets, and abysmal natural gas / NGL pricing.

A wave of restructuring is now almost certain to be followed by a wave of mass consolidation as scale will be more critical. These trends (restructuring and M&A) were already underway, and the oil price crash is likely to accelerate them.

The Industry Is Responding Swiftly & Severely

We’ve been using AlphaSense to monitor the industry’s response to this crisis situation. And it’s been breathtaking. Oil producers are slashing their budgets at an unprecedented clip.

Screening the US oil industry in AlphaSense, there have been 45 separate press releases in just the past 7 days that have mentioned the word “capex” (or one of the smart synonyms that AlphaSense associates with this word).

Sorting through the list generated by AlphaSense, most of these press releases disclose budget cuts, dividend reductions, and hedge position updates (or some combination of these).

See the search here

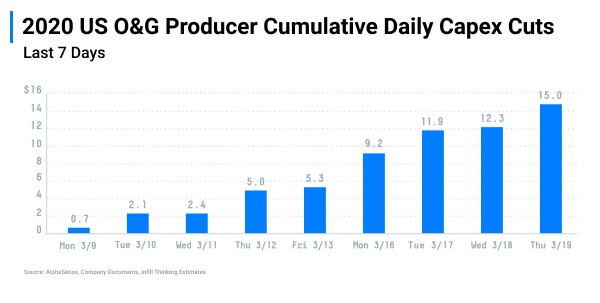

Since “Black Monday” – what we are calling Monday, March 9, 2020, when Saudi sent oil prices down 30% – US oil producers have sucked $15bn of spending out the industry’s investment plan for 2020. E&P spending (which is the addressable market for the oilfield service industry) is now pointing down about 40% from 2019 levels, and new budget cuts are piling up by the day. Using AlphaSense searches, here is the cumulative daily tally of spending reductions.

The beginning of my career as an O&G industry analyst coincided with the beginning of the shale revolution. And never in my career have I seen a reaction this swift and severe. I think it’s fair to say that this is the swiftest correction in shale history, mainly because of the compressed timing of the two-headed black swans coupled with the fact that the industry was already financially strained coming into this latest leg down.

In addition to tracking capex budget reductions, we are also using AlphaSense to keep up with frac crew and rig releases, identifying more than 100 wellsite shutdowns (which is likely just the tip of the iceberg as private operators aren’t disclosing their reductions).

Public oil producers are communicating big pullbacks to investors. The biggest frac crew release comes from Diamondback on Thursday, March 19, when they announced they are giving their 9 frac crews a “minimum one-month break” after which they will only bring 3-5 back to work.

In the first phase of the oil price collapse, E&P (Exploration and Production) companies initially shifted from managing their business annually to managing it quarterly. Now they are literally managing it job-to-job.

This producer behavior will make a HUGE dent in US oil production, and we expect contraction in barrels produced to begin early in 2Q20 and continue for at least the rest of 2020. If the contraction trend lasts long enough, it will begin to support oil prices and clear the decks for the next upcycle.

Until then, we’ll be keeping close tabs on the industry’s unprecedented contraction in these unprecedented times.