The Rise of ESG and Sustainability in the Boardroom and Beyond

View webinar

Environmental, social, and governance investing, also known as ESG investing, seems to be everywhere. The sharp increase in connectivity brought about by the rise of smartphone adoption over the past decade has served as a tipping point for ESG in the market. Social issues are more visible than ever and information accessibility is creating a general public that is more educated and aware.

With so much information being churned out, it can be challenging to filter out usable strategies for investors looking to enter the ESG market. Here are five quick ESG investing trends that we think will emerge or grow in the near future (and helpful strategies for ESG investors to consider).

Related Reading: 5 Steps to Building an Effective ESG Investing Strategy

Quick Takeaways:

- Information is more accessible than ever before, and the general population is more educated on ESG issues. As a result, companies must be authentic and transparent in their ESG efforts.

- Social issues have surged to the forefront of public discussion as the COVID-19 crisis and death of George Floyd have exposed systemic social problems in our society. It is critical for ESG investors to know the discourse on current social issues beyond what is on the evening news.

- Healthcare accessibility and affordability have been highlighted in the past year as the world coped with the COVID-19 pandemic, and its increased level of priority won’t end as we move toward a post-pandemic stage. Vaccines and evolving employee health benefits are two trending topics to watch.

The Trend: ESG Reporting Will Improve

Your Strategy: Seek Authenticity

As the emphasis on ESG continues to grow across industries, so too will companies’ desire to appear ESG-focused. But the best investments are made in companies whose ESG efforts are authentic and truly integrated into their mission and business model.

It’s important for both beginner and seasoned ESG investors to stay in the know about specific ways a company’s organizational efforts align with proclaimed ESG values as well as their level of transparency in data reporting to back it up. Fortunately, there are a number of great places to look: ESG rating companies like MCSI and Sustainalytics, investment firms that provide third-party assessments and score companies’ ESG performance and related risk, and many ESG-focused companies include relevant ESG reporting on their fact sheets, annual reports, and websites. Any difficulty finding data to support ESG-related claims is a definite red flag.

A deeper dive into the AlphaSense tool yielded more than 158,000 documents related to ESG reporting. Some examples:

- Third-party ESG reports from Morgan Stanley and Deutsche Bank tracking ESG trends and growth

- Self-reported data such as annual reports that contain specific sections for social responsibility, equality, the environment, and governance

- ESG scorecards that assess organizations based on specific criteria for environmental, social, and governance efforts

Transparency and visibility of ESG data reporting should only see an increase in coming years as consumer and investor demand for the information grows and consistent standardized requirements are put in place by regulatory entities to hold companies accountable. AXA Investment Managers put it succinctly in describing one goal of the new EU Taxonomy (Europe’s classification system for assessing sustainability-related activities) as to “protect private investors from so-called ‘greenwashing’ — where sustainability ambitions and language are not matched by action and outcomes.” (EU Taxonomy: a pathway to superior corporate sustainability, AXA Investment Managers, April 2021)

The Trend: Increase in Transparency Around ESG Strategy

Your Strategy: Align ESG Investments with Your Values

Human beings, investors included, are likely to better know and understand information that interests us and aligns with our core values and beliefs. If you’re an ESG novice, a good place to start is with companies you know and believe in. Given the movement of society as a whole toward ESG responsibility, it’s likely you’ll find high-potential ESG investment opportunities in areas you already know well.

With corporate ESG transparency on the rise, a quick browse of company websites should make it clear which companies are most worth a deeper look. A good example is Oasis Petroleum’s detailed ESG report; the report links throughout to their more customer-friendly sustainability webpage, which provides a detailed overview of the company’s sustainability commitment.

The Trend: ESG Industries Continue to Diversify

Your Strategy: Know Your Industry

It’s safe to say that ESG is climbing on the priority list for companies in just about every industry — but no two industries are completely alike. The good news? There’s a potential for a diversified ESG portfolio. The challenge? You’ll need to do your research.

Part of making smart ESG investments is understanding which issues are most prevalent and important to consumers and companies in a particular industry. Drilling down and getting specific in your research will make you better equipped to invest.

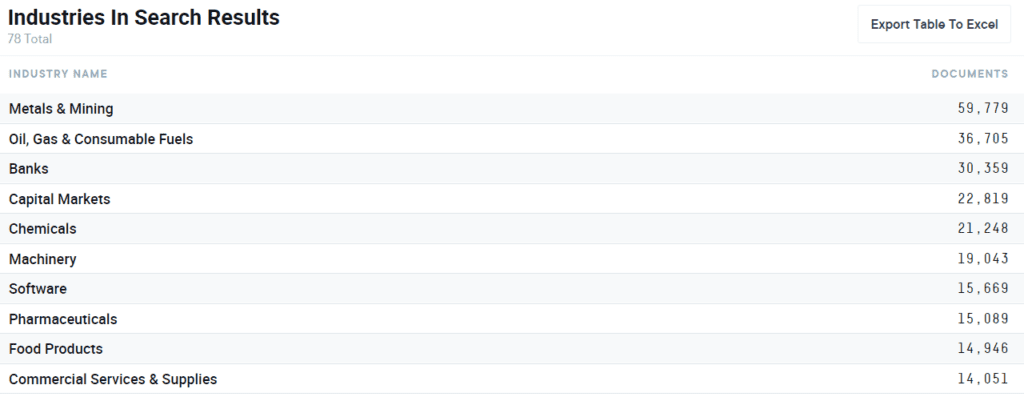

A look at the top twenty (of 78 total) industries represented in AlphaSense search results for “ESG” exemplifies the industry diversity in this area. Of note, all twenty are mentioned in more than 10,000 documents in the database. ESG issues shouldn’t be treated similarly across the board — do your research and know your industry before making a decision.

Industries represented in “ESG” search results on AlphaSense

The Trend: The “S” Grows in Importance

The Strategy: Focus on Emerging Social Issues

While the focus on social issues has been surging for several years, the COVID-19 crisis and the death of George Floyd have simultaneously exposed deep systemic social problems embedded in all corners of our society from healthcare to economics to law enforcement. This critical emphasis on social issues has resulted in a more politically vocal corporate culture, one where companies are not afraid to put a clear voice and financial support behind causes important to their business and customers — in 2020, Bank of America committed $1B to causes supporting social and racial equality efforts in and just last month U.S. Bank promised $60,000 in support to

Asian American and Asian Pacific Islander (AAPI)groups working to eliminate violent acts.

As an ESG investor, watching the evening news and tracking hashtag trends can be just as important as reading your go-to publications. Knowing what the most pressing issues are, which issues are emerging in public discourse, and which are being exposed by the crisis of the moment is important for identifying where to place your ESG investment now and in the future.

The Trend: Healthcare on the Forefront

Your Strategy: Look for Solution Creators

Inequality in healthcare affordability and access has been one of the issues most clearly highlighted by the pandemic over the past year. These are important issues to keep an eye on as the healthcare industry addresses them on the tail end (we hope) of the COVID crisis and plans to translate those strategies into the long term.

But health concerns won’t end with the return to the office or easing of public safety guidelines.

Continued efforts will need to be made in every industry to address employee mental health post-pandemic, vaccine availability and requirements, and flexibility policies in the case of COVID exposure or contraction. ESG investors should keep an eye on companies already addressing these issues and doing so in innovative ways.

A study led by Aon provides solid evidence for this likely trend. Mental health ranked #1 on issues mentioned by employees (ranked in the top 5 by 72% of respondents). An urges employers to consider health plan options that address this need and adapt to changing consumer behavior (the study also found that virtual doctor visits increased by 400% during the pandemic), suggesting a virtually-based plan with an “online primary platform that directs all care.”

Conclusion

ESG investing continues to grow and will only continue to do so in the coming years. As it does, companies will be held increasingly accountable for backing up their ESG commitments with data-driven results. Investors can contribute to that process by doing their own research on the authenticity of a company’s ESG promises prior to investing. At the same time, ESG investors should pay close attention to the public discourse on social issues as the ESG “S” climbs in importance, and monitor companies providing innovative, long-term healthcare solutions as we approach the post-pandemic era.