There’s a massive chip shortage is yet another market-impacting event this year. To summarize — semiconductor chips, used in everything from cars, intelligent fridges, smartphones, and computers, are complicated to make. There’s a shortage of materials that allows the few companies responsible for chip-making to create them. In addition, manufacturing these chips takes a long process and, thanks to COVID-19, supply-chain issues have caused delays and problems for manufacturers. Coupled with an increase in demand, this has created a shortage that is impacting many industries.

For a more comprehensive understanding of how these chips are created, check out this fascinating primer by Bloomberg.

The chip shortage is an urgent crisis across multiple industries

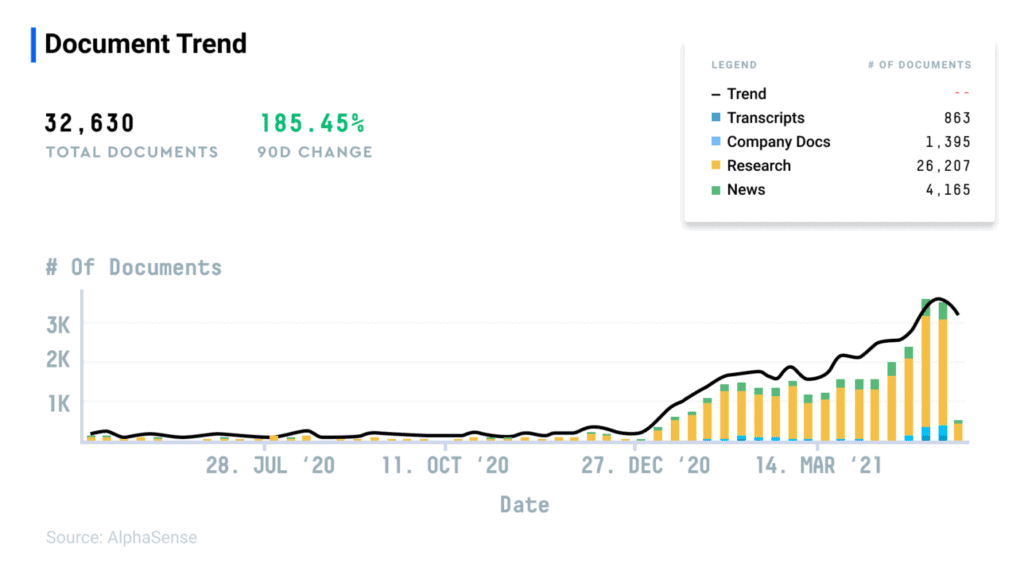

The chip shortage was hardly discussed until near the end of the year, where mentions of the chip shortage spiked and continued to increase through 2021. On AlphaSense, we found over 32,600 documents containing the phrase (and associated terms) “chip shortage,” “with the bulk of mentions occurring within the last three months, evidenced by the 185% 90-day increase.

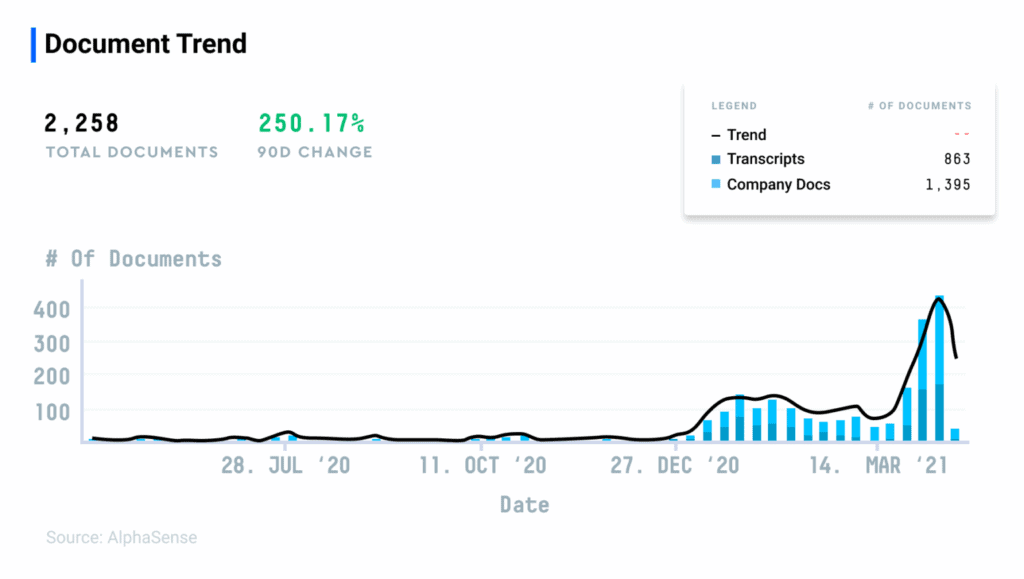

Across Company Docs, the mentions have risen even more dramatically. For example, we found 2,258 company docs referencing the chip shortage within the last twelve months. But the number of documents published has risen 250% over the previous 90 days.

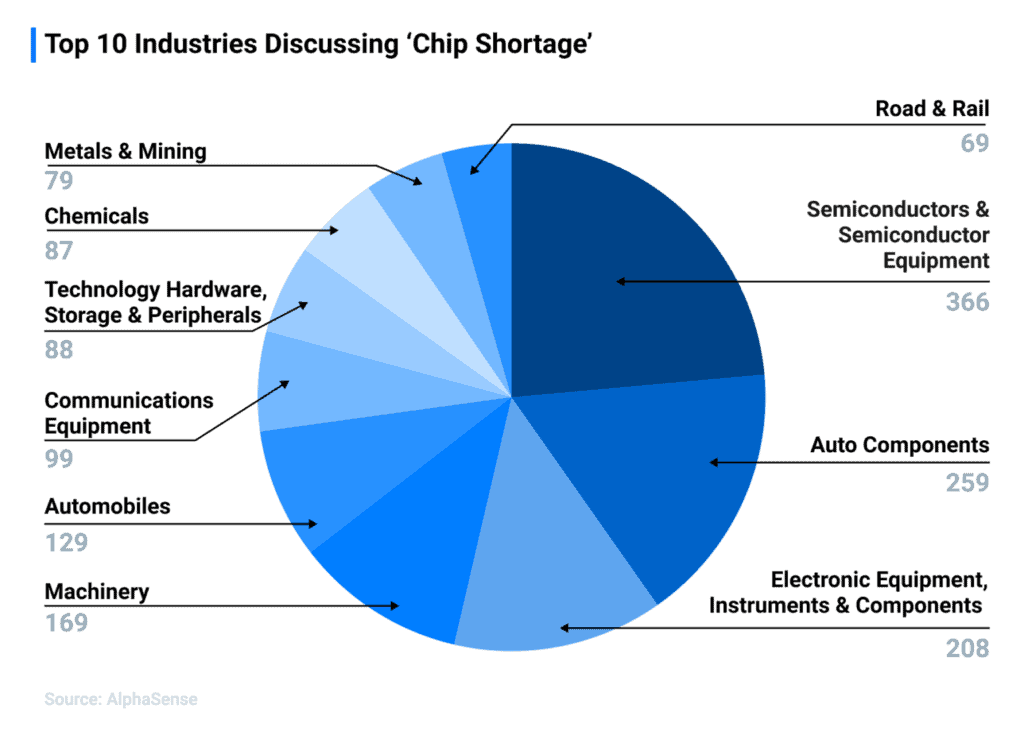

Among these documents, the following were the top ten industries that were most discussed.

To better understand how these industries are reacting to this chip shortage, we found critical insights across multiple documents from some of the largest companies most affected by this crisis.

Semiconductor & Semiconductor Equipment

MaxLinear Inc | 10Q Quarterly Report Q1 2021

Although the Company has benefited from increased demand for certain of our products from the work-from-home environment in the second half of 2020 and the first quarter of 2021, a sudden increase in demand for electronics containing semiconductor chips and stockpiling of chips by certain firms in China blacklisted by the U.S. has exacerbated bottlenecks in the supply chain, resulting in a global semiconductor chip shortage impacting the Company’s industry. Some chip manufacturers are estimating this supply shortage may continue into 2022. While these chip manufacturers are working to increase capacity in the future, and the Company is continuing to work closely with our suppliers and customers to minimize the potential adverse impacts of the supply shortage, such shortage may have a near-term effect on the Company’s ability to meet the increased demand on specific products and hurt its operating results beginning in the second quarter of 2021 which may continue into 2022.

MKS Instruments | Q1 2021 Earnings Call

John T. C. Lee

President, CEO & Director

“…I would say, in general, Scott, if there are chip shortages or any commodity shortage, prices tend to move up just because of supply and demand. And I would say broadly; we see areas where that’s happening concerning electronic components. But really, it’s about trying to get the electronic components because, as a percentage of our bomb, our capacitor or resistor is not that large. So it’s all the other stuff that goes around it; that’s a bigger part of the bomb. So I think in general, there are going to be these pressures to increase prices while we have these shortages.”

Taiwan Semiconductor Manufacturing Co LTD | Q1 2021 Earnings Call

C.C. Wei

Vice-Chairman & CEO

“Our customers are currently facing challenges from the industry-wide semiconductor capacity shortage, which is driven by both structural increase in long-term demand as well as short-term imbalance in the supply chain. In addition, we are witnessing a structural rise in underlying semiconductor demand as the multi-year megatrend of 5G and HPC-related applications are expected to fuel strong demand for our advanced technologies in the next several years. COVID-19 has also fundamentally accelerated the digital transformation, making semiconductors more pervasive and essential in people’s life.

“In addition, the need to ensure supply security is creating [a] short-term imbalance in the supply chain, driven by supply chain disruption due to COVID-19 and uncertainties brought about by geopolitical tensions.

“…To address the structural increase in the long-term demand profile, we are working closely with our customers and investing to support their demand. We have acquired land and equipment and started the construction of new facilities. We are hiring thousand[s] of employees and expanding our capacity at multiple sites.TSMC expects [s] to invest about USD 100 billion through the next three years to increase its ability to support the manufacturing and R&D of leading-edge and specialty technologies. Increased capacity is expected to improve supply certainty for our customers and help strengthen confidence in global supply chains that rely on semiconductors.

“…The automotive market has been soft since 2018. Entering 2020, COVID-19 further impacted the automotive market….and our customers continued to reduce their demand throughout the third quarter of 2020. As a result, we only began to see [a] sudden recovery in the fourth quarter of 2020.

“However, the automotive supply chain is long and complex with its inventory management practices. It takes at least six months from chip production to car production, with several tiers of suppliers in between. TSMC is doing its part to address the chip supply challenges for our customers.

“In January of this year, TSMC announced that capacity support for automotive customers is our top priority. Since then, we have worked dynamically with our other customers [s] to reallocate our wafer capacity to support the worldwide automotive industry. However, the shortage further deteriorated due to the unexpected snowstorm in Texas and the fab manufacturing disruption in Japan. Nevertheless, together with our productivity improvement, we expect the automotive component shortage from semiconductor to be greatly reduced for TSMC’s customer by the next quarter..”

Auto-Components & Automobiles

ABC Technologies Holdings Inc. | Q3 Fiscal 2021 Results Press Release

The Company’s financial results were negatively impacted by disruptions and shortages in the supply of critical components and materials globally, primarily semiconductors affecting its OEM customer’s production, which was an indirect outcome of the COVID-19 pandemic and, to a lesser extent, specific weather-related shutdowns in the southern United States resulting in production interruptions in the resin supply base. Combined, management estimates these issues reduced revenue by approximately $40 million and Adjusted EBITDA1,2 by roughly $13 million for the Q3 Fiscal period. As a result, income would have been about $258 million, and Adjusted EBITDA would have been about $38 million for the quarter.

Magna International Inc | Q1 2021 Earnings Call

Seetarama Swamy Kotagiri

CEO, President & Director

“In terms of headwinds, the entire industry is experiencing supply constraints, in particular, a global semiconductor chip shortage. We expect the chip shortage to continue to have an impact throughout the year. In addition, supply issues, particularly in chemicals and resins, are driving higher commodity costs for us in the remainder of the year.”

Vincent Joseph Galifi

Executive VP & CFO

“Our assumptions for light vehicle production have been lowered for North America, reflecting the ongoing impacts of the semiconductor shortage and increase in China as a result of continued strong production.”

Volkswagen AG | Q1 2021 Earnings Call

Arno Antlitz

Group CFO

“…COVID continues to have an impact on our society, on ourselves, and our business. At the same time, the shortage of semiconductors had put added pressure on the whole industry….We have managed COVID and the semiconductor restrictions well so far. However, we still have limited overall visibility on the financial impact of the semiconductor shortages. Therefore, while we expect a more difficult Q2, we still see a good chance to recover a significant amount of the vehicles lost in the second half of the year.”

Herbert Diess

Chairman of Management Board & Group CEO

“SAIC was probably most hit by the shortage of semiconductors in the group. So that is why we see — and there were also write-downs, which we had to make for some of the assets from former projects. So let us know recovery for SAIC within the following quarters.

“...semiconductors are becoming more relevant for our industry year-by-year basically as the car becomes an Internet device, you can imagine, and the amount of semiconductors we have in the car is growing every year, and it’s also to differentiate the vehicles to have the suitable semiconductors. The right semiconductor design is critical for the car’s performance and connectivity and primarily for autonomous driving. So we get into more direct contact with semiconductor manufacturers on the design side. That’s a continuous process. And we are, for sure, in the crisis mode, talking directly to the — I would say, the first tiers than the second tiers of the semiconductors, let’s say, the NXPs, Infineon’s and even to the foundries, which at the end where the bottleneck happens at TSMC and the other foundries Stuttgart.

“So this dialogue is established. We are directing — contacting, and it will increase over the years. For the current crisis, I would differentiate two aspects. In the next quarter, we see our two incidents: [the] failure of 2 or 3 semiconductor plants in the U.S. because of winter storms and one fire that broke out in the Renesas plant. Two of those plants — of those four– were dedicated 100% to automotive, which is what we currently are seeing on the horizon, and that’s going to hurt because as the pipeline runs empty, now that’s going to break the industry. You hear the figures from all over the world.

“The rest is a general shortage of semiconductors because of the fast growth of the Internet of Things, IoT, which primarily uses the same technology, 54-nanometer technology as the automotive industry. And there, we have a constraint. We are working on that with the big suppliers with Infineon, Intel, worldwide to ensure that we get more capacity for the coming years, but there is the investment required. Investment in that kind of technology is not the general investment, which is currently executed. Most of the investment in semiconductors goes into 9-nanometer, 5-nanometer processes.

“So we have to make sure that we switch faster from, let’s say, the old technologies into new technologies. We are working out a comprehensive plan with all the semiconductor manufacturers to make sure that we get our future growth expectations, let’s say, guaranteed with the semiconductor supply. But it’s hard work, and it will take time.”

Ford Motor Company | Q1 2021 Earnings Call

James D. Farley

President, CEO & Director

“The semiconductor shortage and the impact to production will get worse before it gets better. We believe our second quarter will be the trough for this year.

“…As you would expect, we’re committed to learning from this crisis to be a much stronger company. So we’re taking this opportunity to revamp our supply chain to eliminate vulnerabilities down the road. This is especially relevant as we consider semiconductors, battery cells, and other commodities critical to modernization and transformation.

John T. Lawler

VP & CFO

“The vehicle incentive portion is based on the number of vehicles awaiting sale and dealer inventory and the expected incentive per unit, and both of those fell in the quarter due to the supply disruption.

“Now we do expect the working capital and the timing differences to normalize as the semiconductor supply is restored, as dealer stocks rebound and incentives return to more normal levels. And we believe this process will take several quarters and will most likely extend into 2022.

“…So we’ve updated our outlook to include the expanded impact of the global chip shortage, and the Renesas fire largely drives that. While the situation is a significant headwind, we have definitive actions to address a full range of potential outcomes. So we now expect to lose about 50% of our planned Q2 production, an increase from the 17% loss in Q1, making Q2 the trough for our performance this year.”

To get ahead of your competitors and understand what key themes, disruptions, and market-impacting technologies are on the horizon, join us for The Edge of Disruption, an exclusive virtual series with HSBC. Register here.