The age of the electric car is upon us. That means that the demand for lithium batteries is here to stay, as the need for electric vehicles (EV) and energy storage grows with leaps and bounds. With the global supply chain stretched thin, leading private, state, and federal players are now doubling down on lithium mining, refining, and battery R&D and production.

All of this EV momentum has made the industry financially delectable. As a result, investors left and right has been doubling down on critical metals. During the first quarter of 2021, U.S. lithium miners raised nearly $3.5 billion from investors alone. Now the race is on to find a steady supply of lithium. However, the limited number of qualified lithium producers in the EV battery manufacturers’ supply chain has challenged the surging demand.

So, how does the U.S. plan to keep up?

Plans to build the domestic supply chain

In June, the Department of Energy (DOE) released a national blueprint outlining their plan to boost America’s ability to make lithium batteries. Right now, the U.S. is a relatively small player in the global battery industry.

On the current trajectory, the U.S. will produce less than half the projected demand for lithium-ion batteries for electric vehicles by 2028. “These projections show there is a real threat that U.S. companies will not be able to benefit from domestic and global market growth,” the blueprint says. “Our supply chains for the transportation, utility, and aviation sectors will be vulnerable and beholden to others for key technologies.”

A lack of strategy is what is holding the U.S. back. The DOE laid out priorities for federal investment in the technology over the next decade to right the ship. In the short term, they have suggested mandating recycling to harvest materials from old products. In the long term, the DOE wants to make lithium-ion batteries without cobalt and nickel.

The DOE plans to distribute$16 million towards community-driven pathways to clean energy, including loans for EV manufacturing facilities and deploying more large-scale energy storage at federal sites. In addition, newly released guidelines require federal contractors and grantees to manufacture the product they are researching and developing in the U.S.. All of this signals a broader push by the Biden administration to establish more domestic supply chains.

U.S. lithium mining in the Salton Sea

The majority of the U.S. demand for lithium is supplied by Australia, Argentina, Bolivia, and Chile. Amongst the four, Australia has the world’s largest lithium reserves, with the latter three Latin American countries accounting for close to 60 percent of the world’s resources.

Though the United States only produces about 2 percent of the global lithium demand, it’s not for lack of reserves. In southwest California, the Salton Sea holds enough lithium to supply 40 percent of the worldwide market, according to Eduardo Garcia, the California Assemblymember from Imperial and Riverside Counties. Garcia has pushed legislation forward that has triggered over $500 million worth of state and federal restoration and development funding for the Salton Sea and is a founder of a private-public partnership called the Lithium Valley Commission.

Gardai noted, “Each advancement and production efficiency brings us closer to achieving California’s groundbreaking emission reduction, electric vehicle, and clean air goals.”

energy, a sustainable energy company focused on lithium extraction, separation, recovery, and refinery technology, as well as solid-state battery storage, is working towards bettering lithium production methods. Through their unique extraction processes, they can recover 90 percent of the available lithium in a fraction of the time.

And the Salton Sea project is not the only lithium extraction project happening domestically. Lithium Americas, another mining development out of Nevada, will unlock $3 billion in lithium reserves beginning in late 2022. Aside from Nevada, mining projects are underway in Arkansas, North Carolina, North Dakota, Oregon, and Tennessee.

All eyes on Afghanistan

When the U.S. first invaded Afghanistan in 2001, the global economic landscape was virtually unrecognizable to how it looks today. Then, Tesla Inc. wasn’t a company, and the electric vehicle industry was not yet born. Now, both are at the cutting edge of advancements in high-tech chips and batteries made with a wide range of minerals.

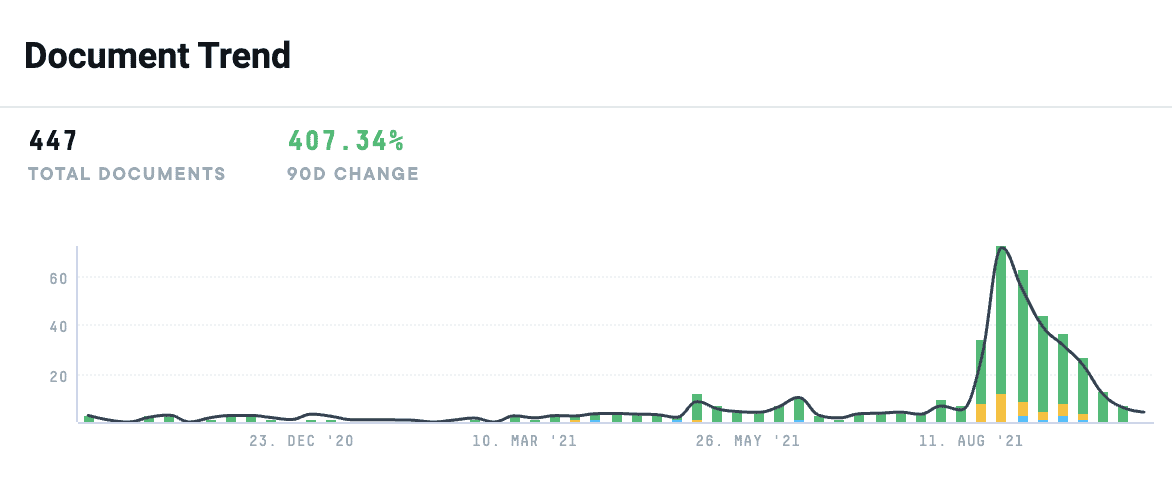

It’s no secret that Afghanistan is sitting on deposits estimated to be worth $1 trillion or more – more specifically, one of the largest lithium reserves in the world. A search for Afghanistan, lithium, and rare metals in the AlphaSense platform yields a surge in documents over the past 12 months, with an uptick over the last 90 days.

The current predicament boils down to one question: can anyone get them out of the ground?

China is the biggest country of interest in the Afghanistan mining conversation. Beijing is pushing an optimistic outlook, one that looks like the Taliban forming an inclusive government, allowing for a minimal level of fundamental human rights and eradicating terrorist elements that would traditionally want to oppose the U.S., China, India, or any other country. With U.S. withdrawal, Beijing can offer Kabul economic investment and political impartiality. In addition, China sees a prize within Afghanistan: infrastructure opportunities and the ability to build up industries, such as the untapped mineral deposits.

Much of this depends on what happens over the next few weeks. The U.S. maintains sanctions on the Taliban as an entity and can ultimately veto any moves by China and Russia. In addition, Washington has already frozen $9.5 billion in Afghanistan’s reserves, and the International Monetary Fund has cut off all financing.

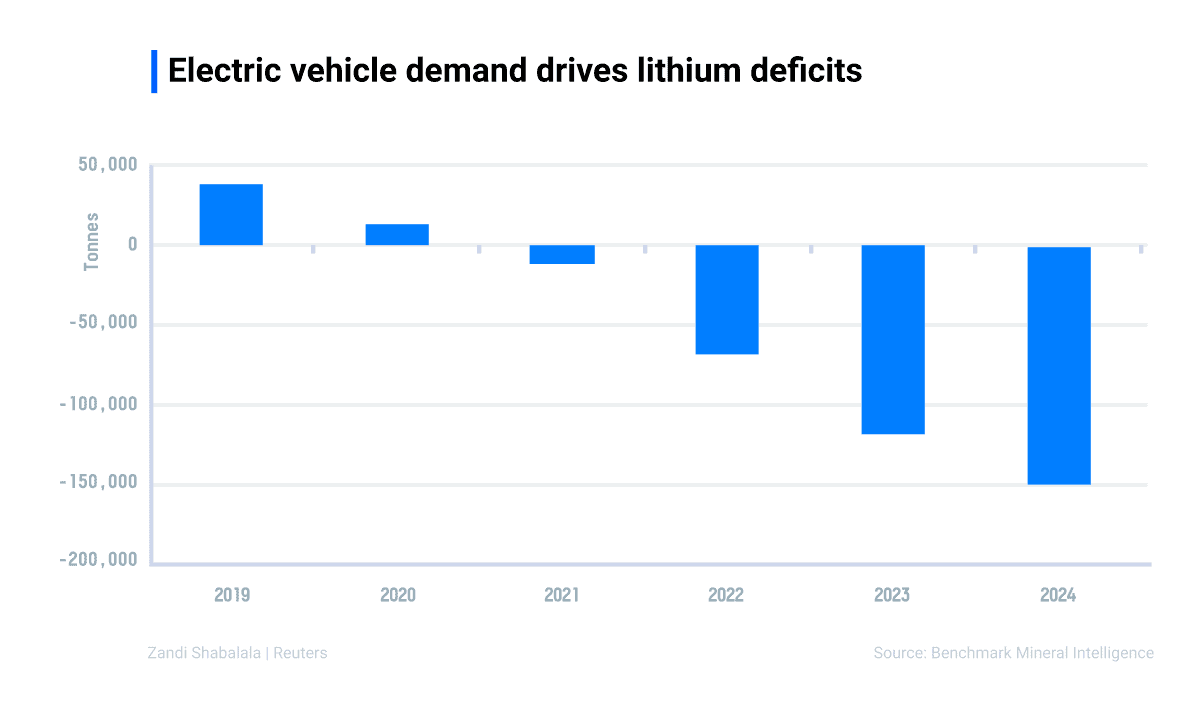

Kabul’s fall to the Taliban comes at a critical point for the battery-materials supply chain. Lithium pAs a result, producers are looking to invest in more upstream assets to get ahead of a potential future deficit.

Ford Motor Co. goes electric

Mounting competition from Tesla and pressure from environmentalists have pushed the automotive industry toward research and development and investment in electric cars. The first to sense that future explosion in EV demand is Ford Motor Co., which recently pledged to spend $30 billion to shift toward electric vehicles.

They are taking giant steps into the EV market with three new battery factories, an electric truck plant, and 11,000 new jobs to support their efforts. They are projecting that 40 percent of their sales will be electric by 2030. In addition, they have formed a partnership with South Korean battery cell provider SK Innovation. The entire project will cost approximately $11 billion, with Ford shouldering $7 billion of the cost — the most significant single investment in Ford’s history. The assembly and battery plants will be located in Tennessee and Kentucky, continuing Biden’s push to bring supply chain and manufacturing back into the domestic sphere.

“I think,” Ford Executive Chairman William C. Ford Jr. told the New York Times. “And those who aren’t are going to be left behind.”

The battery disposal dilemma

Ultimately, it will take a while until the market for lithium batteries reaches its full potential, mainly in part due to the durability of these batteries. Current EV batteries will outlive the vehicle. When old EVs are scrapped, the batteries are not usually discarded or recycled. Instead, they are reused for less-demanding applications. Researchers in the field believe that this current battery dilemma holds EVs to an impossible standard in terms of the impact of their batteries. There is an insistence on reasonable solutions instead of perfect ones, not to say researchers shouldn’t work aggressively on solving battery disposal.

The International Energy Agency (IEA) published a report back in May that included a road map to achieve global net-zero emissions by mid-century, citing electric transport as a critical impact. Confidence in this initiative shows that policymakers, researchers, and manufacturers feel that EV and EV battery disposal challenges are entirely solvable.

Interested in learning more about the root causes of global supply chain disruptions? Want to know what supply chain trends are here to stay? Watch Morgan Stanley’s Senior Airlines & Transportation Analyst, Ravi Shanker in, Analyzing the Weakest Links: Is the Supply Chain Squeeze Here to Stay?