Twitter (TWTR) comes into Q2 as a controversial stock: a new class of investors on the back of Elliott and Silver Lake involvement vs. a popular Tech specialist short.

Bears see estimates too high due to a weak advertising environment and execution issues. Further, the high profile security breach this week has analysts fearing a more significant step up in opex. There are benefits to scale – Facebook is spending multiples more than TWTR on security.

Bulls see an undermonetized platform. Management succeeded in turning around engagement metrics and now, with an activist on their back, turns their focus to monetization. Execution issues are fixable. The new ad stack is on the come up and subscription opportunities remain untapped.

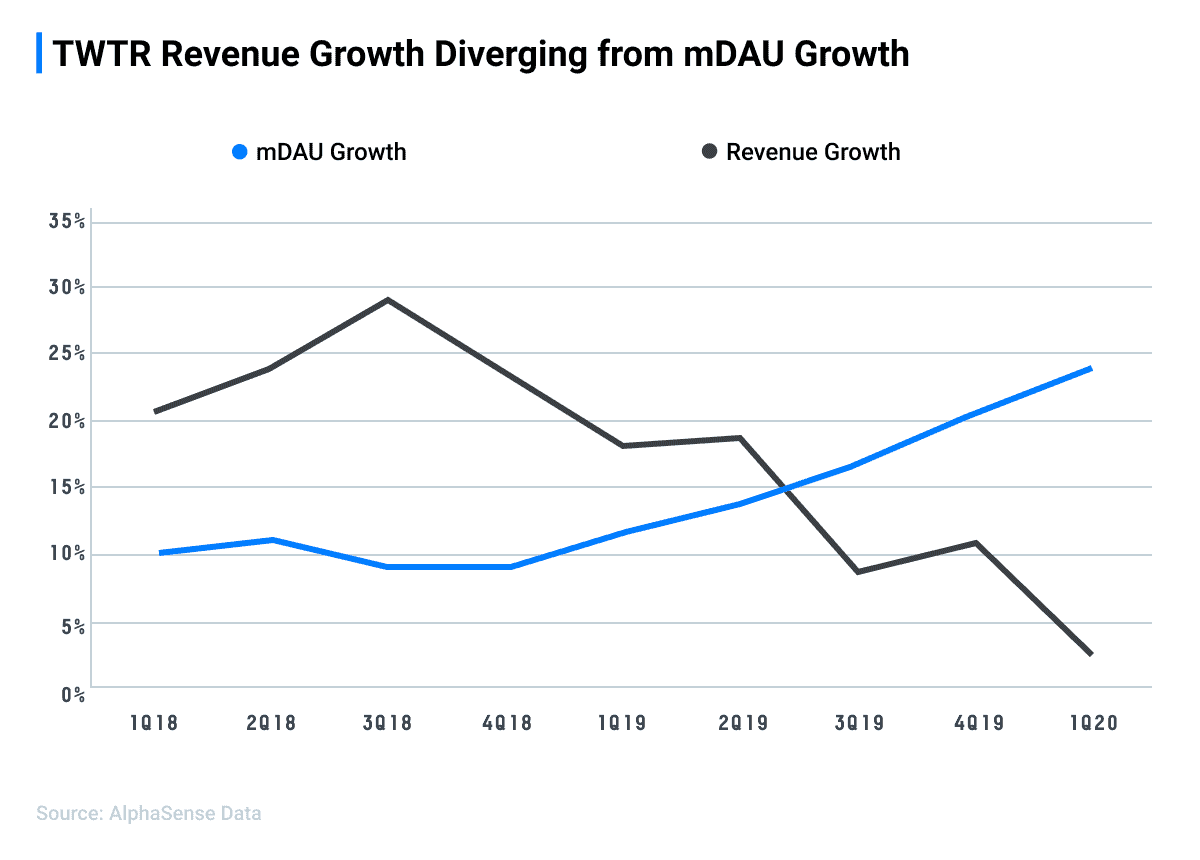

Revenue growth decoupling from user growth reflects execution issues with their ad server and the macro environment, with TWTR more brand dependent than peers.

This chart sums up both sides of the debate: lagging monetization is both reflective of the Company’s struggles but also the opportunity (to close the gap.)

This divergence is poised to blow out in Q2.

Analysts are expecting an acceleration in mDAU growth relative to 24% growth in Q1. The comparison is 300bps harder than Q1, but engagement is expected to continue to benefit from stay-at-home.

Revenue is expected to fall meaningfully – to down high-teens YoY (only a modest improvement from the down 27% ad revenue seen in 2H March.) The poor performance in relation to peers can, in part, be traced to their lack of Direct Response advertising. Rolling out their new Ad Server in Q2 and new Mobile App Download product later this year could be the catalyst to reignite revenue.

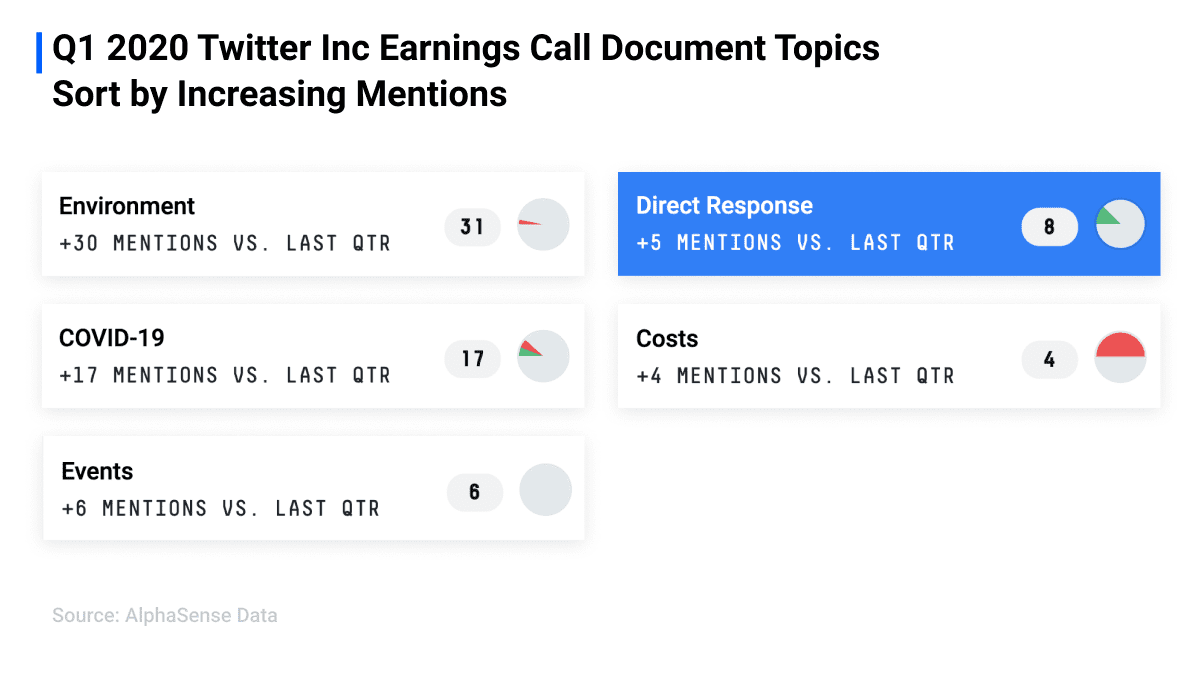

Source: AlphaSense. QoQ, mentions in Earnings Call Transcripts have increased for major themes such as COVID-19, Direct Response, Costs, Events, and Environment. To see these themes, login to AlphaSense or start a free trial.

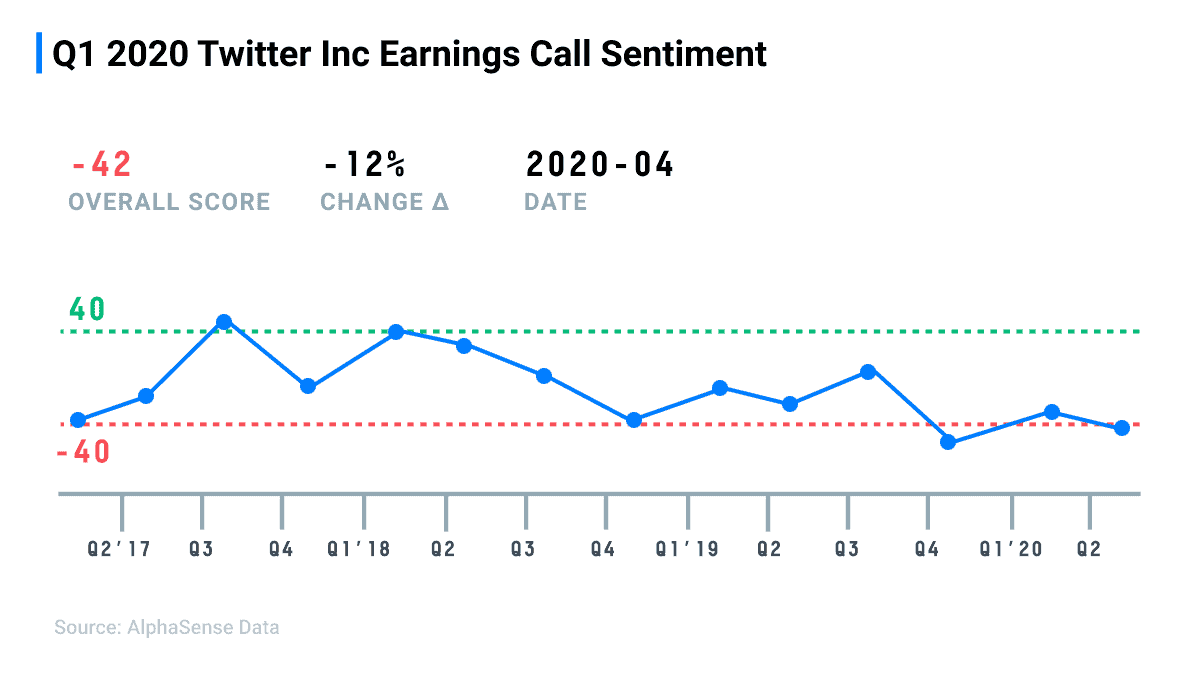

Source: AlphaSense. QoQ, Twitter’s overall sentiment in their Earnings Calls has fluctuated throughout the years. Although not at its lowest sentiment score, current Sentiment for Q2 2020 remains at a -42. To see more Sentiment Scores, login to AlphaSense or start a free trial.

Here’s what TWTR said about this in their Q1’20 Letter:

“Our second ad priority is direct response advertising, beginning with our next-generation Mobile Application Promotion (MAP) ad format. We recently began pilot testing portions of our improved offering with a few advertisers, with plans to expand the test over several phases. We see a path to driving more direct response advertising on Twitter in 2020 and beyond through this work on MAP and by increasingly helping people on Twitter benefit from a more personalized experience. An improved MAP and more direct response ad formats would increase our addressable market, with more access to advertising demand that may be more resilient through an economic downturn, while building on our strengths in helping brands launch something new and connect with what’s happening.”

Pulled from Twitter’s Q1 2020 Letter to Investors

We’ll be looking to hear updates on:

- Subscription – is TWTR planning to build out subscription products on top of the free product?

- Security – ramp in security infrastructure on the back of last week’s breach?

- New Ad Server – what needs to happen from here to get DR advertisers on board? MAP 2.0 rollout?

- mDAU trajectory

- Event Calendar – how much revenue can swing in / out of 2H based on sports? How should we think about the impact of political spend?

Suggested reading from AlphaSense:

If you are interested in preparing for Twitter’s Q2 2020 Earnings, login to AlphaSense, or start a free trial.

- JPMorgan and Morgan Stanley on the potential for TWTR Subscriptions:

- Cleveland on how TWTR ad spend has progressed through the quarter:

- GS on tracking user trends

- Twitter’s most recent conference transcript

- Bernstein Upgrade