All companies face the shared challenge of sustaining continued growth. Within many organizations, the responsibility of developing a growth strategy falls on the shoulders of Corporate Strategy (Strategy) and Competitive Intelligence (CI) professionals. Strategy teams generally concentrate on advising senior leadership, whether it’s entering new markets or formulating a company’s long-term strategy, while their CI counterparts focus on analyzing and monitoring the competition, their product pipelines and earnings. Both functions require these professionals to stay informed about the marketplace and its fluid dynamics by conducting research on existing and emerging players and trends across industries.

Equity research is a trove of in-depth thematic and industry-specific content

Equity research, which is another way to describe research reports published by analysts or strategists at brokerage and investment banking firms, is a key source of in-depth perspectives and insights from experienced specialists that allows Strategy and CI professionals to quickly ascertain what industry experts are saying about different companies and industries. The one prevailing issue that has limited Strategy and CI professionals from leveraging equity research in their workflows is access.

Historically, getting access to equity research for corporate professionals was difficult

Traditionally, access to equity research on a regular basis required a company to have an existing relationship with a specific brokerage or investment banking firm, and even then, would only provide access to the equity research of that one firm.

Using AlphaSense, Strategy and CI teams can search across research reports from over 1,000 brokers, all on one platform. Some ways that Strategy and CI teams can extract value from equity research include:

Insights from industry experts for Strategy professionals

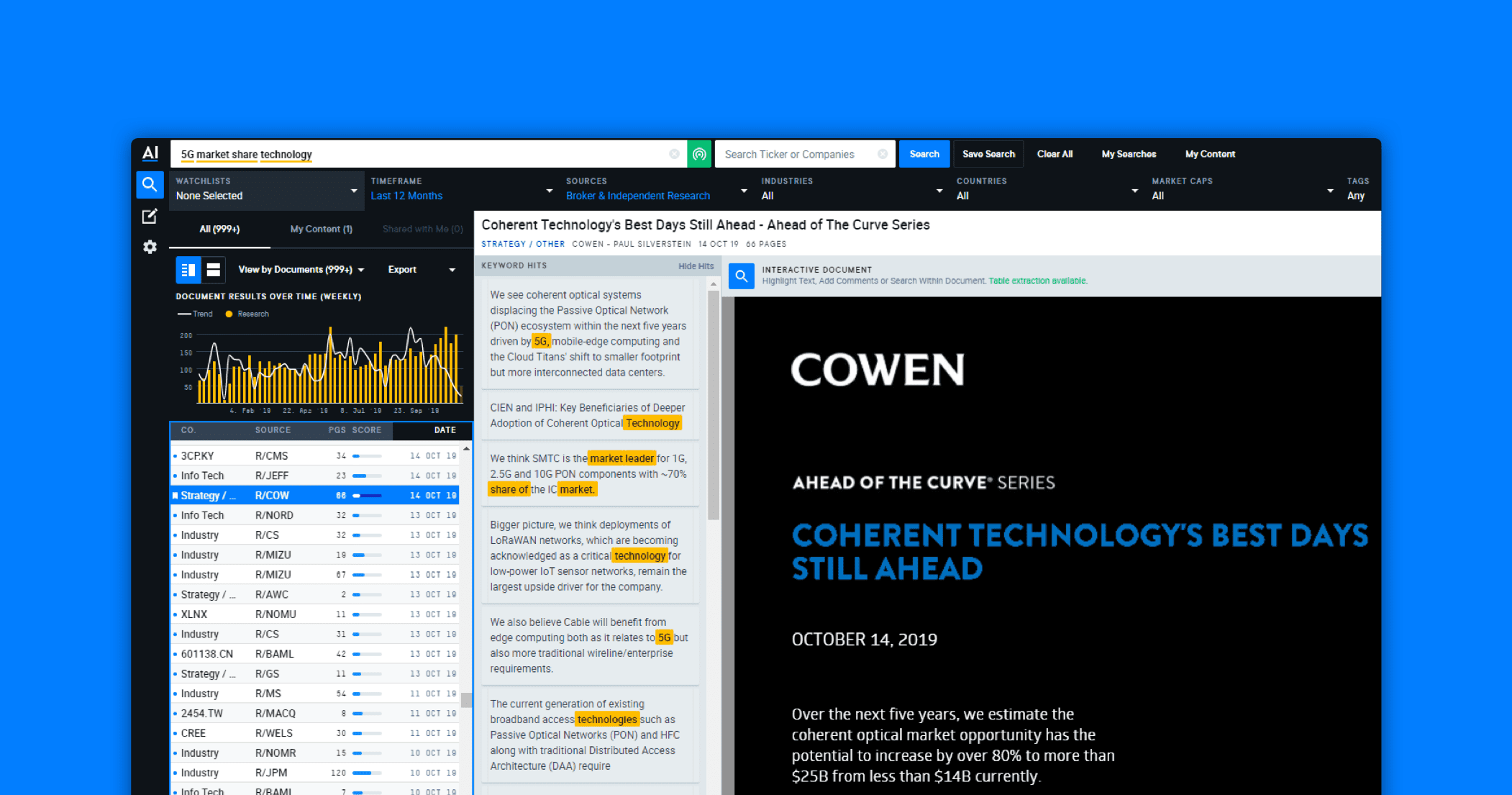

To develop growth strategies and drive strategic direction, Strategy teams need to identify and interpret trends that may transform industries over the medium- to long-term. As an example, a corporate planning strategist in the technology sector might want to analyze what others across various industries are expecting the 5G market to look like in the future. By limiting the content source to include only broker & independent research, the search for 5G market share technology in AlphaSense allows users to surface original content and insights published by Wall Street industry experts, filtering out the short-term “noise” that is often found in the news/media.

Peer analysis for CI professionals

It is a key responsibility of CI teams to help their organizations gain and maintain dominance in their respective industries. To do so, CI professionals need to actively identify and interpret market trends, opportunities and threats so they can suggest actionable responses that will tackle existing and emerging competition.

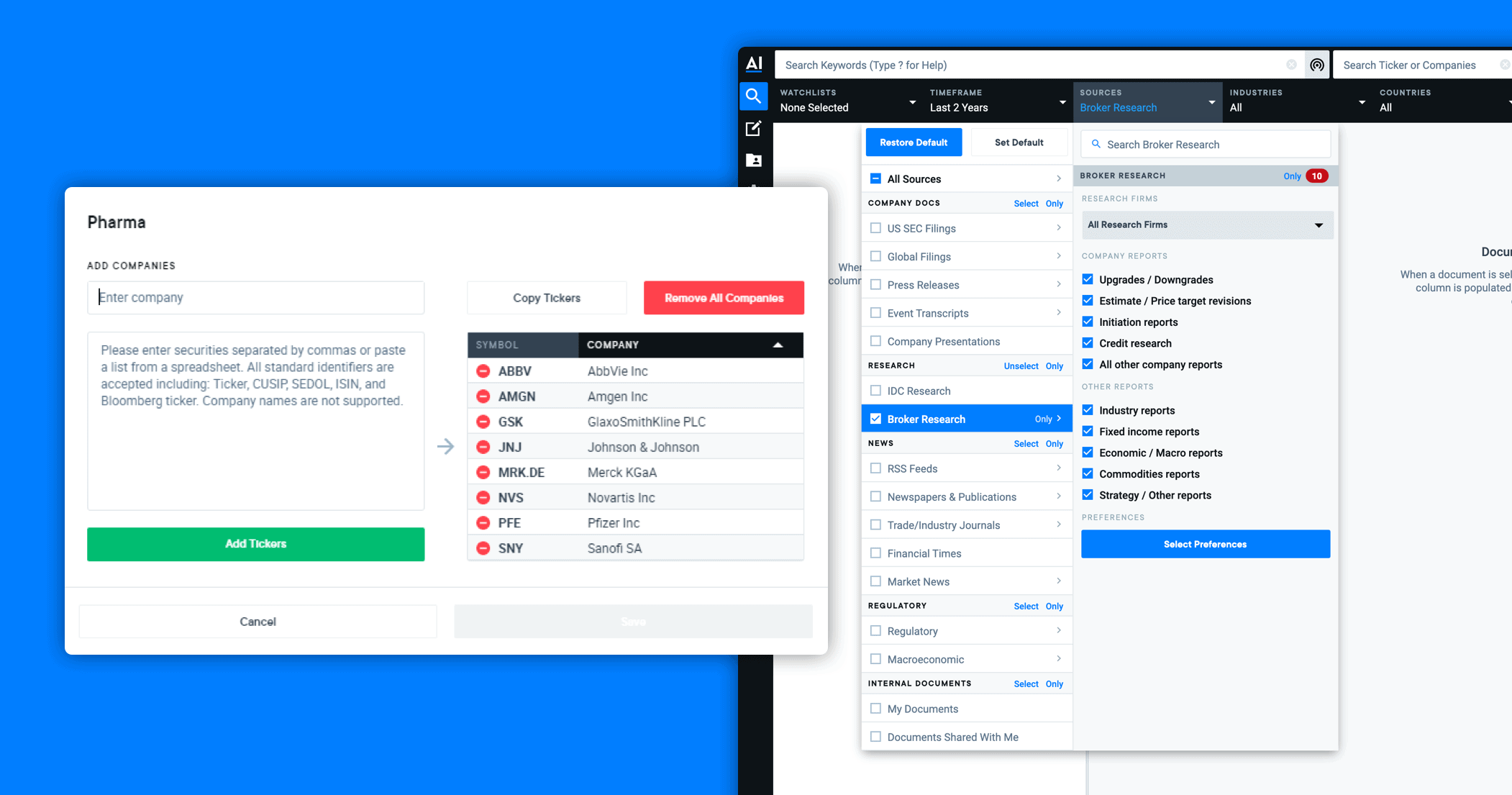

For instance, a CI manager at a pharmaceutical company needs to locate and analyze data and information on the trials and go-to-market pipelines of industry peers. To avoid missing timely news and updates about their peer universe, the CI manager can create a watch list of companies in AlphaSense and set up alerts to be notified each time a new investment research piece is published mentioning one or more of these companies.

Key benefits of the AlphaSense platform for Strategy and CI professionals:

- Easily find all relevant data points with a single search. Save countless hours by finding what is needed with pinpoint precision and the ability to sort by relevance with a single click.

- Derive recommendations and strategy from the insights of industry experts. Access to the timely reports and perspectives of the teams of experienced sell-side research analysts and strategists at over 1,000 global brokerage firms.

- Discover significant company events and reports by analysts’ actions. Quickly identify major reports such as initiations, rating upgrades/downgrades or estimate changes through intuitive tagging directly in the document result list.

- Streamline workflow to increase efficiency. Highlight, annotate and bookmark relevant content within documents, and create notes right on the platform using AlphaSense Notebook. Easily recall or share annotations and notes anytime, anywhere.

If you’re an AlphaSense client, log in here to explore our extensive equity research offering.

If you aren’t a current client, schedule a demo today to see the value of equity research at work in AlphaSense.