Competitive intelligence (CI) has evolved beyond simple website monitoring and social media listening. In today’s ever-shifting market landscape, companies need advanced tools that allow them to understand and track market trends and competitive activity in real time. This requires having access to premium and proprietary content sources that go beyond the publicly available, consumer-grade information that everyone else is monitoring, as well as using advanced AI search capabilities that filter through the noise and extract the most valuable and meaningful insights.

In this guide, you will learn:

- The components of effective competitive intelligence

- The benefits of competitive intelligence

- Steps for implementing a successful CI strategy at your organization

What is Competitive Intelligence?

Do you know what your competitors are doing? If not, you’re at a disadvantage. Competitive intelligence is the process of monitoring your competitors’ activities to gain an advantage in the market. Competitive intel can help you understand their strengths and weaknesses, as well as their plans for the future. Gathering competitive intelligence can help you make better business decisions and stay ahead of the competition.

When it comes to gathering CI, there are many ways to do so. Some organizations use secondary sources, such as industry reports, or conduct primary research through surveys or interviews. Others engage in competitive monitoring, which involves observing a competitor’s marketing communications, product launches, or website activity.

Once gathered, CI must be analyzed in order for it to be useful, which typically involves creating a competitive intelligence strategy. This strategy should identify business goals and objectives, as well as the information that is most relevant to those goals. It is essential to consider how the collected competitive intelligence will be used and shared within the organization.

CI is an important tool for any business that wants to stay ahead of the competition. Gathering and analyzing information about your competitors can give your business a critical advantage in the marketplace.

How does Competitive Intelligence Improve Business Strategy?

Competitive intelligence is essential for businesses to stay competitive in fast-moving markets. By providing valuable insights into competitors, market trends, and customer preferences, CI enables businesses to develop more effective strategies that ultimately lead to sustainable business growth and success.

Here are the key ways CI improves business strategy:

- Understanding the competitive landscape – Fully understanding competitors’ strengths, weaknesses, and market positioning, as well as who all the key players in the market are, enables businesses to identify areas where they can differentiate themselves or fill market gaps.

- Identifying emerging trends and opportunities – By monitoring competitors’ actions amidst industry trends, businesses can create strategies that allow them to capitalize on new opportunities, from adjusting pricing or product development to being first movers in a new market.

- Risk mitigation – CI helps mitigate risks in business strategy by helping businesses anticipate potential competitive threats and risks and create contingency plans to safeguard against catastrophic consequences.

- Monitoring performance – By keeping tabs on competitors’ performance, businesses can simultaneously assess their own performance and identify ways to maintain or improve their competitive position.

- Customer insights – By analyzing competitors’ customer interactions, feedback, and market share, businesses can find new ways to better meet customers’ needs and preferences through enhanced products, services, or marketing strategies.

- Enhanced strategic partnerships – CI can reveal potential strategic partners or collaborators in the field. Strategic alliances can amplify each business’s competitive advantage and create mutual benefits.

What are the Main Components of Competitive Intelligence?

There are four main components of CI:

- Competitive analysis

- Competitive benchmarking

- Competitive landscape analysis

- Competitive monitoring

Competitive analysis involves studying your competitor’s business in order to understand its strengths and weaknesses. This includes looking at their product offerings, pricing strategies, marketing campaigns, and operations.

Competitive benchmarking is the process of comparing your own business against your competitors in order to identify areas in which you can improve.

Competitive landscape analysis is a broad overview of the competitive environment in which your business operates. This includes industry trends, macroeconomic factors, and regulatory changes.

Competitive monitoring is the ongoing process of tracking your competitor’s activities and measuring their impact on your business.

What are the Benefits of Competitive Intelligence?

The following are just a few of the advantages to using CI:

- Helps you identify opportunities that your competitors are missing and provides insights into your competitor’s strategies, allowing you to adjust your own plans

- Helps you anticipate changes in the marketplace and ensure you are prepared for them

- Helps you build better relationships with your customers by understanding their needs and preferences better than your competition

- Enables you to be much more proactive—rather than reactive—in your strategic decision-making, from mitigating risks to building strategic alliances to adjusting pricing, product development, or marketing strategies

However, there are also some disadvantages to using CI, particularly when you don’t have an AI tool that extracts key insights and helps you get the full picture of your competitive landscape. When done manually, it’s not only time-consuming and expensive to gather all of the necessary information for CI, but it can also be difficult to interpret this information correctly. And when interpreted incorrectly, CI can give you a false sense of security or lead you to make bad decisions.

When used correctly—and with the right tools in your arsenal—competitive intelligence can be a powerful way for businesses to gain an edge over their competition. Understanding the limitations of CI and its use in combination with other information sources will ensure that you are making the best possible decisions for your company.

Types of Competitive Intelligence

There are two main types of competitive intelligence—tactical and strategic. AlphaSense’s platform is ideal for both.

Tactical Competitive Intelligence

More focused on short-term aspects of competition, tactical CI involves gathering information on competitors’ current activities, such as product launches, marketing campaigns, pricing changes, and operational decisions.

These insights can be used to quickly react to competitive threats or opportunities. For businesses to remain agile, this type of CI is important, as it enables them to adjust strategies in real-time and be more proactive in maintaining or gaining their competitive edge.

Strategic Competitive Intelligence

More focused on long-term aspects of competition, strategic CI involves analyzing broader trends in the competitive landscape, industry dynamics, and macroeconomic factors to identify potential future threats and opportunities.

This type of competitive intelligence gives businesses a deeper understanding of their competitors’ capabilities, motivations, and priorities. Thus, strategic CI helps companies anticipate market shifts, plan for future scenarios, and develop proactive strategies to maintain or advance their competitive position. Strategic CI is critical for guiding high-level decision-making and shaping the overall direction of the business.

Steps for Effective Competitive Intelligence

Step 1: Align Your CI Strategy with Larger Objectives

A smart competitive intelligence strategy is built around the larger business objectives of your company. To accomplish this, you want to ask yourself two important questions: Who do you need to monitor, and why?

Let’s dive into each of these questions in more detail.

Why Do You Need Competitive Intelligence?

This is the first and most critical question you should ask yourself before you begin developing your actual competitive intelligence strategy. There are a lot of reasons a company might decide to start or enhance its approach to CI. Perhaps you are looking to inform your organization’s product strategy. Maybe you’re considering expanding into a new market. Or you might just want to learn more about a new technology one of your competitors is buying or building.

Whatever the reason, knowing the purpose behind your competitive intelligence efforts serves as your guide during the strategy development process.

What Do You Need to Monitor?

It’s impossible to closely monitor every competitor. To successfully maximize your ability to monitor every relevant competitor, categorize them into three levels:

- Broad awareness – This group can number in the hundreds.

- Substantial intelligence – This group should be around 50.

- Close monitoring – This group should be fewer than 20 but ideally between 5-10.

Your competitive set may include direct competitors, important market players, and high-potential new market entrants. Once you have your list of relevant companies and you sort them by the level of needed intelligence and/or monitoring, you’re better able to craft a plan you can execute on long-term.

Step 2: Optimize Data Gathering

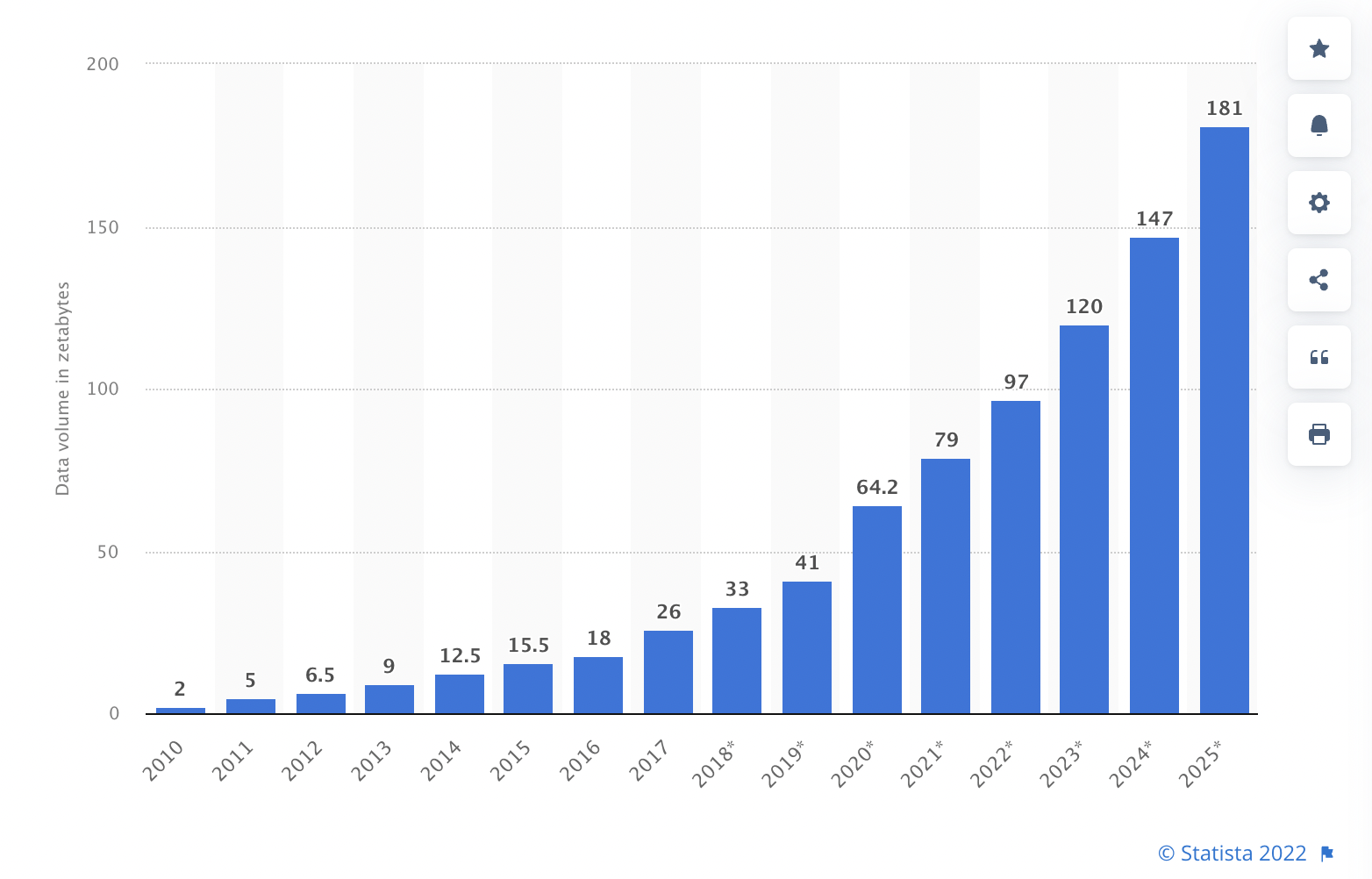

The number of zettabytes of data is expected to reach 181 by 2025. Sorting through data at this volume to locate and analyze the information we need is impossible without the help of AI and machine learning. But the real trick is to learn how to utilize these tools to efficiently gather competitive intelligence data.

Automation

Automating your data gathering as much as possible not only creates more internal efficiency, it also ensures you never miss an important update. There are four tactics you can incorporate to quickly up your efficiency game:

- Set up automatic alerts for companies and topics you’re monitoring.

- Sign up to receive marketing materials from your competitors.

- Create a list of important events (conferences, trade shows, etc.) and set calendar reminders on the dates they occur.

- Set monthly and quarterly reminders to check out competitor earnings calls and reports.

Generative AI

Unlike other consumer-grade generative AI (genAI) tools trained on publicly available data, AlphaSense takes an entirely different approach. Our industry-leading suite of generative AI tools is purpose-built to deliver business-grade insights and leans on 10+ years of AI tech development.

Our Smart Summaries tool allows you to glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees.

Four Voices Framework

Competitive intelligence professionals can fall victim to following the establishment set forth, and getting stuck in the traditional way of doing things. Luckily, we’ve come far since the days of purely monitoring social media and websites to infer strategy and insights.

Well-rounded competitive intelligence requires the inclusion of varied perspectives on any given company or industry. Professionals that have the edge over their competition are incorporating the four perspectives.

As the name implies, there are four important perspectives in the data you gather. They are:

- Voice of the Company – What do a company’s documents (i.e. presentations, press releases, financial statements, marketing materials, reports, etc.) say?

- Voice of the Analyst – What do Wall Street analysts say about a company’s outlook?

- Voice of the Expert – What do those with firsthand knowledge (former employees, competitors, clients, etc.) of the company say?

- Voice of the Journalist – What is the news saying about this company?

It’s important to keep in mind throughout the data gathering process that monitoring private companies may not be as straightforward as public ones. This is mainly because they’re not held to the same reporting standards or required to disclose the same level of information.

Utilizing a competitive intelligence platform can be immensely beneficial for accessing as much information as possible about private companies since it is often not available to the public.

Step 3: Analyze Effectively

Effective data analysis enables you to pull the most important insights from your competitive intelligence data and make them actionable for your organization. A critical best practice to this end is to build processes that allow for regular (daily, weekly, monthly, annual, etc.) analysis.

When establishing a process, you can utilize frameworks for organizing and analyzing data that align with your company’s current goals and larger business objectives. SWOT and PEST frameworks are two widely used and powerful tools for leveraging data to determine your company’s position in the marketplace.

A SWOT analysis helps you identify your own internal strengths and weaknesses, as well as external opportunities and threats. They’re helpful for startups navigating new entries into the market and for established companies launching new initiatives, pivoting strategically, or performing a competitive landscape analysis.

A PEST analysis helps you identify political, economic, social, and technological factors that may impact your business performance. They’re helpful for any company looking to understand how their decisions and/or strategy will fit with unavoidable real-world factors.

Utilizing frameworks and identifying key data points relevant to your strategy keeps your data analysis organized, manageable, and powerful over time.

Beyond these two frameworks, companies often perform ongoing trend analyses for particular topics, products, companies, and more. On the AlphaSense platform, users can track document trends that show how often specific companies or topics are being mentioned over time.

Step 4: Report Consistently

Competitive intelligence data is only as powerful as you make it. For this reason, it’s essential to report on your findings consistently, leverage data to inform key stakeholders, and build strategies that align with your current competitive landscape. The key here is to consider how to make data digestible for stakeholders who are unlikely to sift through all the details themselves.

Create a Broad Presentation, Then Drill Down

What are the most important insights for everyone to know? Include those in a broad presentation. Then highlight specific insights most relevant for different stakeholder groups, and tailor the data you share to each group.

Make it Visual

Using visual data representations, such as charts and graphs, not only makes data more digestible but also more powerfully communicates changing trends. Other visual components that can be effective include images (product photos or logos) or short videos (news clips or interviews). Visuals break up text and numerical data and highlight important takeaways for your stakeholders.

Tell a Story

It’s no secret that telling a story keeps stakeholders more engaged in what your data has to say. As you create a report or presentation, look at your data from this perspective. What story is it telling? Make sure it’s evident in the way your data is presented (the order of your slides or the specific data points you chose to focus on).

Make it Actionable

Company leaders want to know why the data is important. A significant part of that is knowing the action it spurs going forward. As the presenter, think about what actions are required to leverage your competitive intelligence data to its highest potential. This could be several things, from a pivot in marketing strategy to reprioritizing product offerings.

Competitive Intelligence in Action

A competitive intelligence strategy is only as effective as the tool you are relying on. AlphaSense is equipped with the premium content sets—company documents, broker research, news, and expert calls—and advanced AI search technology that will help you stay ahead of the curve and continue to outpace your competition.

Learn more about how AlphaSense supports corporations in their CI workflows:

See how AlphaSense compares with other competitive intelligence platforms:

Experience the AlphaSense difference. Start your free trial today.