What Makes Our Due Diligence Solution Different?

The financial due diligence process is more complex than most traditional market research. It requires analyzing documents designed to showcase the best picture of a company and requires reading between the lines for the real story.

On the AlphaSense platform, you can lift the curtain to see what’s behind publicly-shared updates and reports. You can access quarterly call transcripts, broker research, expert interview transcripts, and other private company documents that provide a full 360 degree view.

At the same time, you can leverage advanced AI capabilities to pull out the most important insights across millions of documents, and receive alerts so you never miss out on new or crucial updates.

Below, discover the key steps for conducting financial due diligence, as well as how AlphaSense can simplify and streamline the process for you.

Conducting Risk Analysis

Analyzing potential risks and liabilities related to companies you’re interested in can be done quickly and reliably in the AlphaSense platform with pre-built searches that uncover the risk profiles of suppliers, competitors, and its peers.

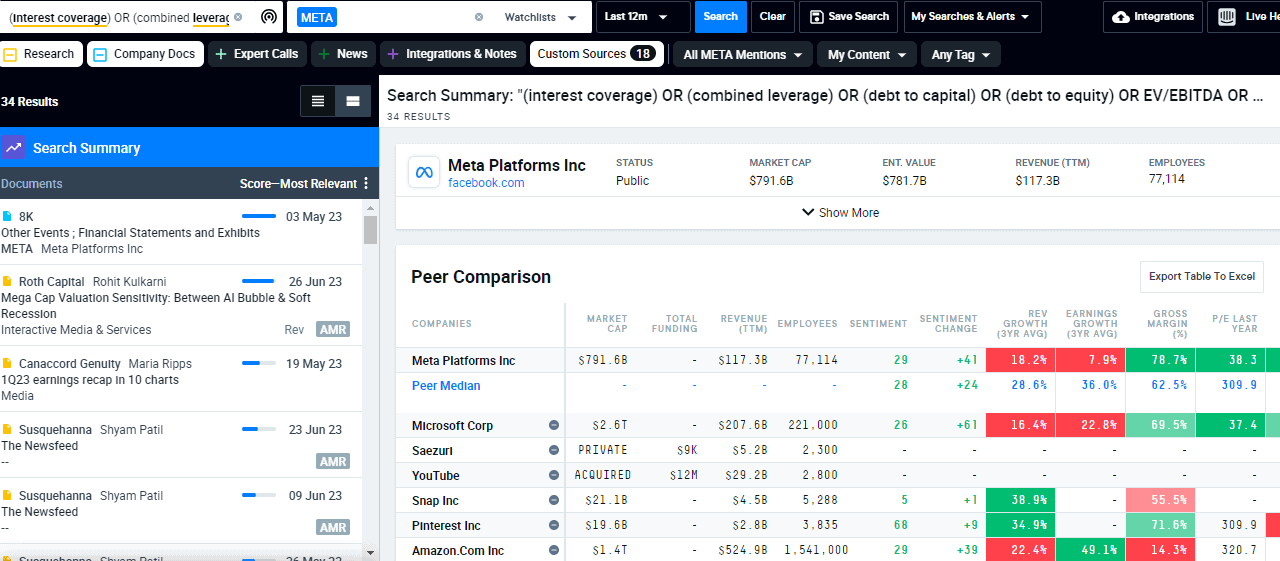

The example below shows the risk profile for Meta. AlphaSense instantly generates a complete list of relevant documents, highlights key financial metrics, and provides a peer comparison chart to show how Meta measures up next to other key players in its industry. This report is generated for any public company you search in the platform.

After you build and run your search, you can set an alert to get automatic updates about the company or group of companies. When new documents or updates are added to the platform, you’ll know right away and can add them to your due diligence file for continual and reliable monitoring.

Financial Modeling

You can leverage data from the AlphaSense platform to build financial models to calculate valuations, perform stress tests, and create debt repayment schedules in minutes by:

- Accessing Extensive Financial Information: Search a company’s ticker and run thematic searches across broker research to quickly find assumptions

- Performing Time Series Data Modeling: Filter by SEC filings to access income statements, balance sheets (and more), then drill down to see and export QoQ data for trend analysis

- Extracting KPIs: Filter by earnings calls and see KPIs highlighted in the insights panel. Click “Show History” to expand your view to all snippets related to that KPI over time

With easy export capabilities, you can then extract any data you find in the platform to Excel and utilize it as needed. You can expedite the process with Table Explorer, an AlphaSense feature that eliminates the need to manually spread financials, automatically calculates key metrics, and enables you to instantly validate your numbers by viewing the original source of each number with a single click.

“AlphaSense creates higher confidence and transparency in the research process and faster, data-driven decision making.” – Managing Director, Asset Management

Watch the video below for a more complete walk-through of financial modeling capabilities through AlphaSense:

How to Accelerate Your Financial Modeling Process | AlphaSense

Industry Due Diligence

To understand the complete financial implications of their investments, private equity firms and institutional investors must widen their scope beyond a single target company. It’s just as essential to comprehensively understand the business environments with which their target companies operate.

But this requires context, often in the form of qualitative industry commentary rather than quantitative data. In the AlphaSense platform, you can leverage AI-based capabilities like Smart Synonyms™, sentiment analysis, and Smart Summaries to ensure you’re able to capture these insights across structured and unstructured data sources.

Let’s dive into each of these features in more depth:

Smart Synonyms™

Smart Synonyms™ is the backbone of the AlphaSense search engine, using natural language processing (NLP) to expand keyword and thematic searches beyond exact-match documents to include all relevant results.

This means you’ll never miss an insight just because you didn’t enter a specific combination of keywords or a certain phrase. AlphaSense understands the intent behind your search and delivers the complete set of information or data needed for your analysis.

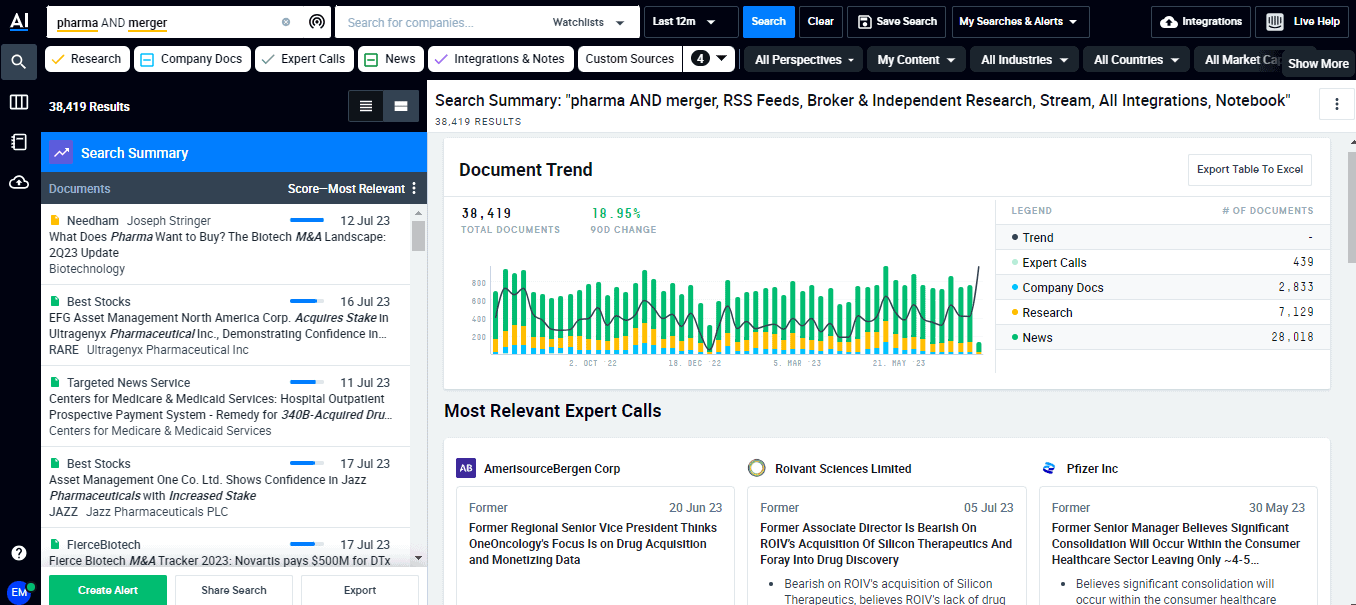

In the example below, we ran a general search for “pharma” and “merger”. In just the first few results, you can also see that AlphaSense delivered results for organically-related keywords like “acquisition,” “consolidation,” and “M&A deals.”

Sentiment Analysis

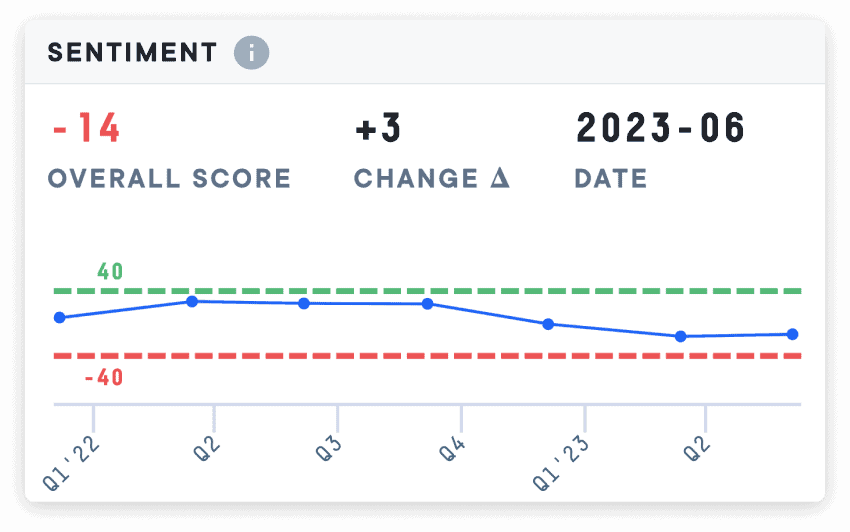

Sentiment analysis extracts the tone and nuance that exists behind the surface-level meaning of a document or set of sources. For analysts performing everyday due diligence, manual sentiment analysis would equate to days combing through reports and transcripts to extract nuanced meaning.

On the AlphaSense platform, sentiment is simple to decipher through color-coded text analysis and a sentiment score generated to quantify the qualitative results in a more objective way.

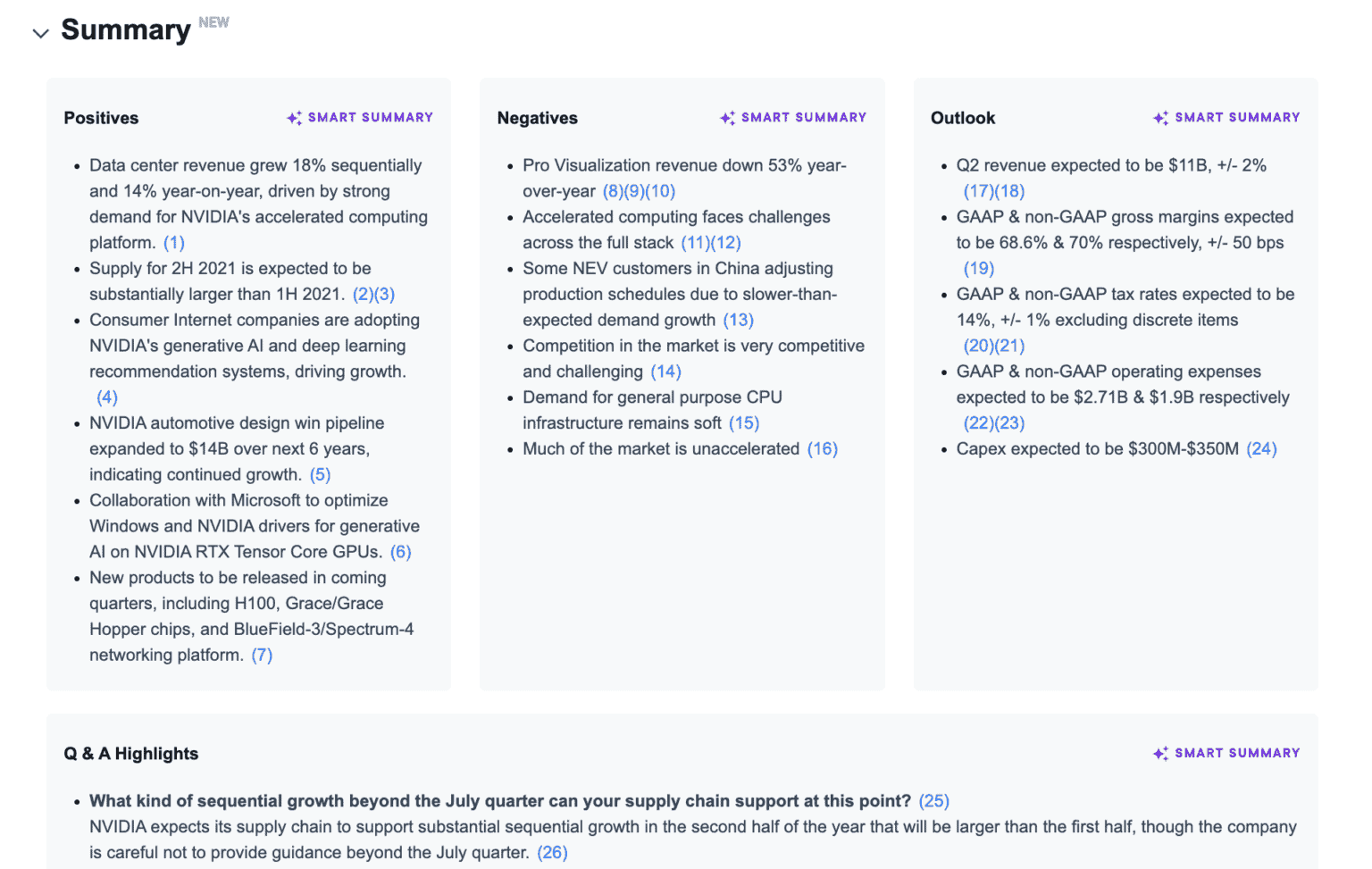

Smart Summaries

Unlike other generative AI (genAI) tools that are focused on consumer users and trained on publicly available content across the web, AlphaSense takes an entirely different approach. As a platform purpose-built to drive the world’s biggest business and financial decisions, our newest Smart Summaries feature leverages our 10+ years of AI tech development and draws from a curated collection of high-quality business content.

With Smart Summaries, you can glean instant earnings insights—reducing time spent on research during earnings season, quickly capture company outlook, and generate an expert-approved SWOT analysis straight from former competitors, partners, and employees.

Key Steps For Industry Due Diligence

The following are key steps in conducting industry due diligence, all of which AlphaSense can support you in.

TAM Analysis

The extensive library of leading real-time and aftermarket equity research within the AlphaSense platform gives you access to the big-picture insights you need before making an investment decision. It allows you to uncover key market-level metrics—including total addressable market—and stay a step ahead of your competitors to uncover new opportunities.

AlphaSense offers access to broker reports including company reports, industry reports, fixed income reports, economic/macro reports, and commodities reports—all sourced from leading research providers and analysts.Having access to these analyst insights allows you to be first to know of new opportunities in your market and equips you to accurately evaluate the viability of new potential deals—a critical capability for driving consistent growth in today’s unpredictable markets.

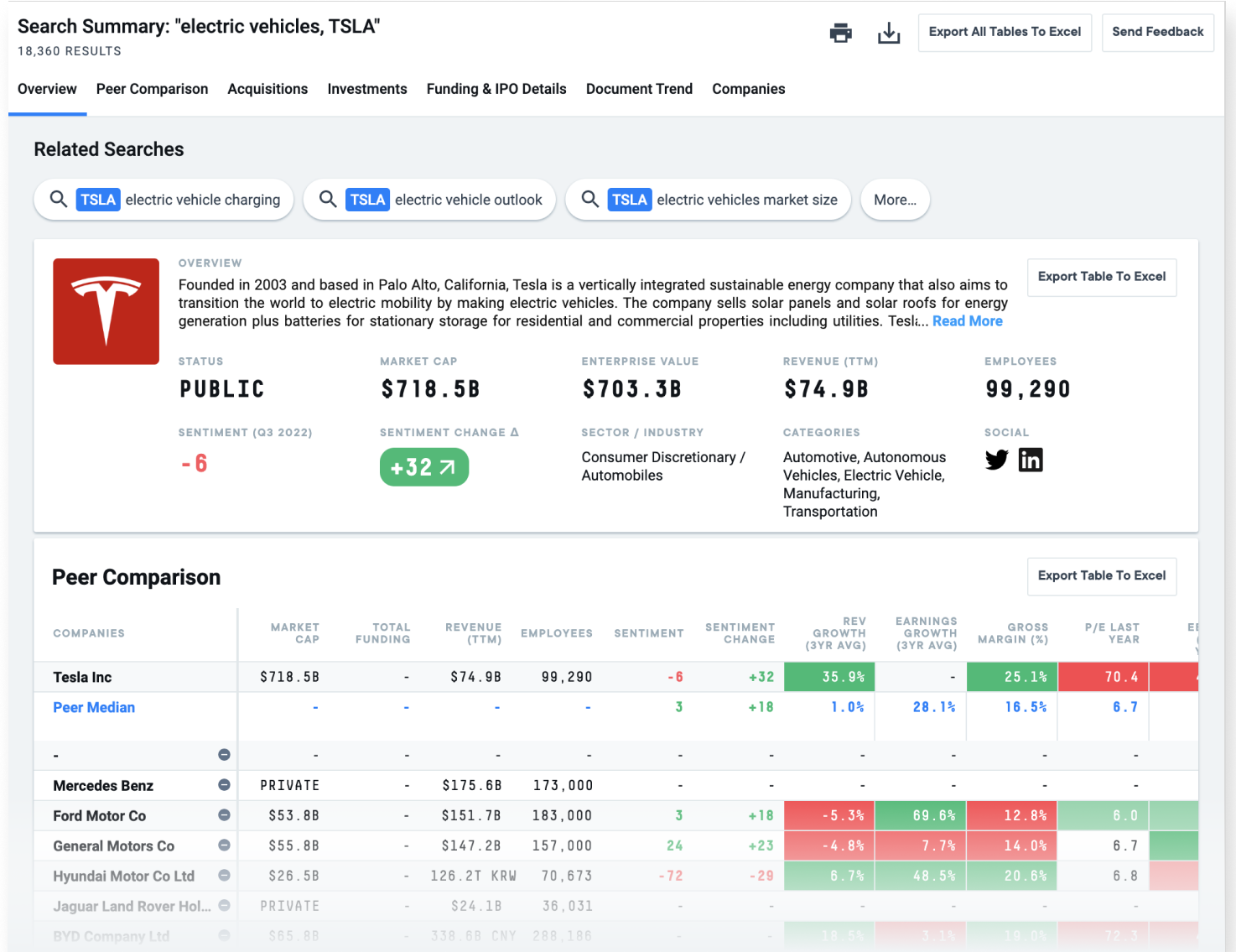

Proper Market Sizing

AlphaSense search summaries include all the financial data you need to appropriately size the market for your investment—including market cap and total revenue for all the key players in a given sector.

You can also customize the time windows you need to view to see the market size and share trends over time in order to better inform potential forecasts.

Industry Benchmarks

These comprehensive market views combined with industry reports available in AlphaSense allow you to quickly see how target companies stack up to industry standards and identify gaps and opportunities in their market.

Company Overview

Company tearsheets in AlphaSense provide an in-depth look into any company, including current news, financial records, news mentions, reports, regulatory updates and more. Automated alerts make it easy to ensure you get every new update so your due diligence stays current.

Additionally, company reports written by the industry’s top brokerage firms detail companies’ financial history, revenue trends, profitability, debt levels, liquidity, and more.

Credit History

Historical information in a company’s search summary within the platform typically includes the company’s financial statements, as well as news or press releases detailing funding rounds, history with other banks, acquisitions, and other key business transactions that impact their investment value, cash flow liquidity, and growth potential.

Current Company and Industry Challenges

Every deal comes with challenges. The important thing is to know them ahead of your decision and be confident you’re equipped to transform those challenges to growth in the future. The unmatched combination of qualitative and quantitative due diligence you can perform on the AlphaSense platform gives you the complete context you need to analyze potential challenges and evaluate how they’ll impact your decision.

Reputational Risk Analysis

A company with a poor reputation is one that comes with greater risk in an investment scenario. Sentiment analysis can give you an initial snapshot of how a brand is perceived and highlight where you need to drill down for more nuanced analysis, while automated alerts quickly let you know when an event occurs that could impact the reputation of your potential investment.

Management Analysis

Management analysis is challenging without access to a research platform like AlphaSense. No matter how deep you dig on financials and even public qualitative assessments, you can’t really capture the culture, communication styles, leadership qualities, and business relationships related to a company without firsthand access.

In AlphaSense, documents like earnings calls and expert interview transcripts give you a complete view into any company to help you decide if it’s a viable investment. And since Alphasense Expert Insights provides exclusive expert insights only found on our platform, you can get ahead of your competitors and be more proactive with your strategy.