Evaluating ESG Opportunities in the Energy Industry

Key ESG Metrics in the Energy Industry

Because there is no standardized disclosure for ESG reporting as of yet, energy companies disclose specific criteria and metrics that investors and stakeholders then use to evaluate them.

Common metrics energy companies use to track, demonstrate, and report on their ESG credentials include:

- Carbon footprint reductions

- Energy efficiency improvements

- Diversity in leadership and workforce

- Employee health and safety

They could also disclose their metrics around greenhouse gas emissions, low carbon, as well as energy, water, and land use. On the financial side, metrics relative to revenue, costs, assets, liabilities, and capital allocation could play a role as well.

Additionally, there are several voluntary ESG reporting metrics that energy companies can choose from—the most widely used are those issued by the GRI, SASB (Sustainability Accounting Standards Board), and GHG (Greenhouse Gas Protocol). Each of these has a different focus, from how a company impacts the world all the way to how ESG factors affect a company’s financial performance.

ESG investors must be able to evaluate these metrics and disclosures with a critical eye—due to lack of standardization—given how common it is for companies to inflate their ESG commitments, engage in greenwashing, or not practice total transparency about their practices. Hence, investors must be keenly aware of the most important metrics and disclosures for ESG benchmarking.

That is why it is crucial to have a market intelligence platform that aggregates all ESG content in one place and helps you quickly separate the meaningful insights from the irrelevant noise.

How AlphaSense Helps Evaluate ESG Opportunities

The current lack of standardization means many investors have to spend countless hours on manually parsing through multiple websites and outlets to find information on the ESG landscape and specific companies’ ESG performance.

The AlphaSense platform helps you spend less time on fruitless search and more time on strategy and analysis through our vast content universe and advanced AI search technology.

Check out our interactive tour to see how the platform does this in real-time.

First, we eliminate the need to toggle between multiple websites and sources by aggregating content across the four key perspectives of research into one single platform. These include:

- Company documents – includes ESG disclosures and documentations covering 26,000 companies, as well as company filings, press releases, and presentations

- Industry analyst reports – includes insights from top Wall Street analyst firms including Goldman Sachs, Bank of America, Morgan Stanley, and more

- Expert transcripts – includes 40,000+ first-hand perspectives from industry leaders, competitors, former employees, and customers on companies’ ESG strategy and key ESG metrics to consider

- Journalist/regulatory news – includes updates from reporting groups such as GRI and 145+ ESG-focused news and trade journals like Climate Wire, ESG Today, and ESG Investor

AlphaSense also provides exclusive insights you won’t find anywhere else by giving access to all the proprietary and premium content you need to effectively conduct your ESG research. With these exclusive sources, you can validate your findings and back your ESG strategy with crucial Wall Street and industry expert perspectives.

We have two proprietary and premium offerings:

- Wall Street Insights® – premier collection of aftermarket research from 1,000+ top global, regional, and boutique contributors, including Goldman Sachs (never before seen in an aftermarket research collection)

- Expert Insights – provides instant access to 40,000+ interviews with thought leaders, former executives, partners, customers, and other experts

Wall Street Insights® (WSI) accelerates and streamlines your research by helping you consume the industry analyst reports you need faster with our award-winning AI search technology. Furthermore, you never have to pay for information you don’t actually need because WSI allows you to consume and pay for individual pages of reports, and our Snippets allow you to view relevant takeaways of the document before you purchase the page.

All these content sets taken together enable you to gain the insights you need to identify, validate, and incorporate new opportunities.

Industry analyst research helps you understand market outlook and forecast for specific areas in the energy industry—such as carbon capture, green hydrogen, or renewable energy sources—so that you can identify the most high-return opportunities. Then, company documents and expert transcripts enable you to see the areas your peers and competitors are investing in. Finally, tracking news updates helps ensure you have a pulse on any regulatory updates and understand the ESG landscape within the energy industry.

Finally, our AI search features help speed up your time to insight and ensure that you are surfacing the most meaningful information for your research, as you scrawl across the content sets on the platform.

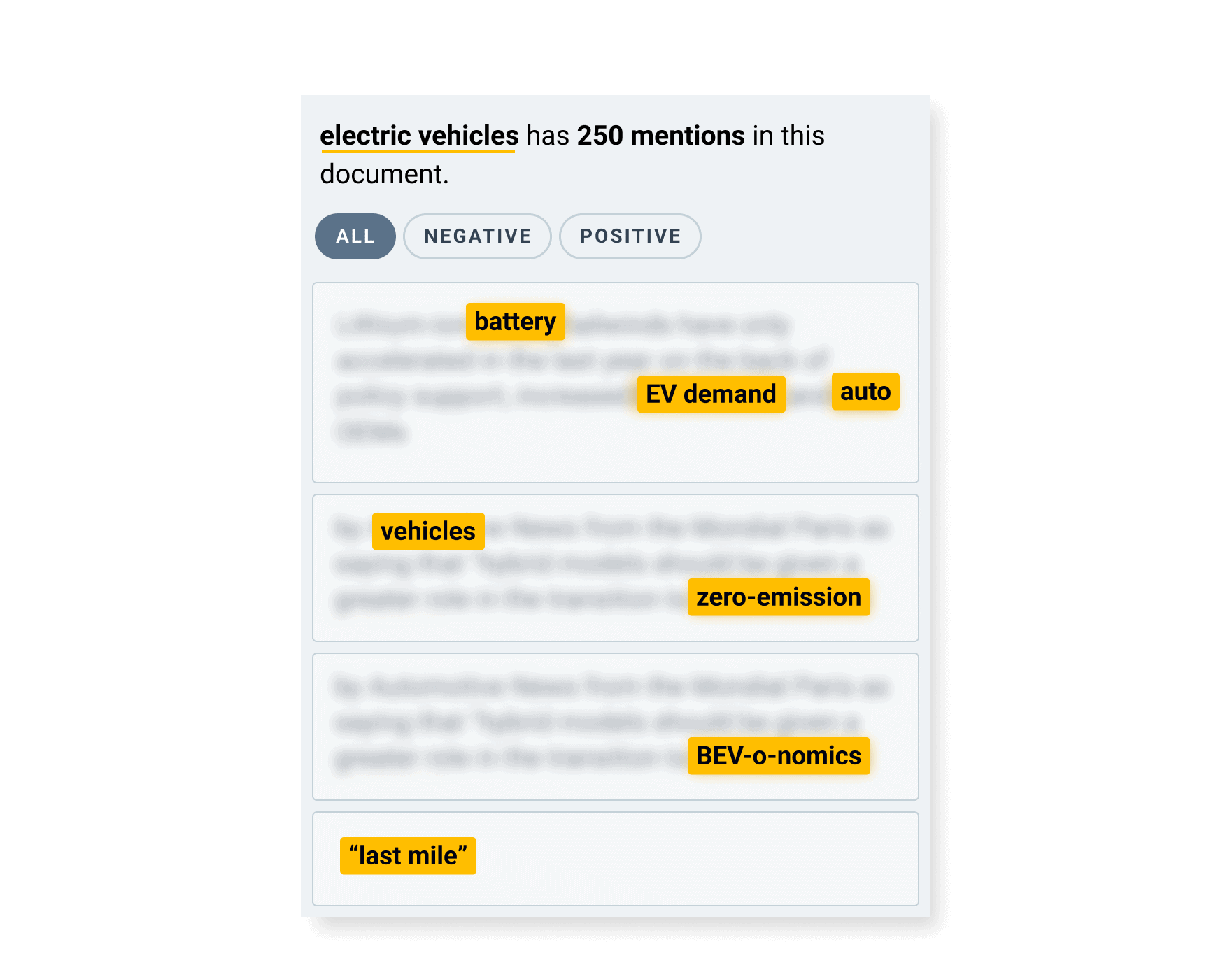

When you search any keyword in the platform, our Smart Synonyms™ technology immediately surfaces all relevant documents, as well as any synonyms of your search term. This feature automatically recognizes variations in language, so you never miss critical information in your search. For instance, searching “ESG” will also yield results for “governance”, “sustainability”, and “environmental”—all of which are pertinent to ESG evaluation.

Read more about how AlphaSense platform helps with ESG benchmarking in this post.

Building an ESG Strategy for the Energy Industry

Having a strategy for ESG investing is imperative, particularly as competition continues to grow in this space, and as certain companies keep making outsized, unverified claims about their ESG commitments.

With AlphaSense, you get access to all the most accurate and high-quality insights so you can create a winning ESG strategy—all before your competition.

Here are the key steps in creating your ESG strategy in the energy industry:

Prioritize Transparency

To avoid putting your trust in companies that engage in greenwashing or that make false claims about their ESG commitment, you need to verify that their organizational efforts align with their proclaimed ESG efforts and that they are transparently reporting on all relevant data.

The AlphaSense platform provides access to documents that specifically help vet companies’ ESG plans and scores, which include:

- Third-party ESG reports from JP Morgan and Deutsche Bank tracking ESG trends and growth

- Self-reported company data such as annual reports that contain specific sections for social responsibility, environmental impact, and governance

- ESG scorecards that objectively assess organizations based on specific criteria for ESG efforts

You can also use the AlphaSense platform to compare what a company is saying in their press releases to what they report in their earnings calls, in order to quickly verify their commitment to setting and reaching ESG goals.

Understand the Energy Industry

In order to identify the right ESG targets in the energy industry, you need a full-scale understanding of the industry—including key industry players, main areas of focus for companies, and executive sentiment on key topics.

Creating a search for “esg” and then filtering with the Oil and Gas/Energy industry yields all the useful information you need to fill in the gaps on your industry knowledge and pick up on the key themes and companies you should be aware of.

Additionally, combining our natural language processing (NLP)-based feature, sentiment analysis, with our years of aggregated earnings transcripts helps you not just identify key trends but go deeper into the C-suite sentiment behind those trends.

To read about how AlphaSense helped a midstream energy investor navigate earnings transcripts more efficiently and effectively than ever before, read this case study.

Track High-Level Macroeconomic Trends

As an investor, it is critical that you stay informed on key ESG issues and on how your companies of interest are discussing and responding to those issues. You also need to understand what issues are actually going to affect the market, and which are just passing fads.

For instance, let’s say you wanted to track how the Russia-Ukraine war was affecting the global energy transition. Using our powerful search and relying on the four key research perspectives, you can gain a 360-degree view of this topic and understand how exactly it could impact your bottom line. From there, you can also set real-time alerts for this topic so that you never miss a crucial update and can easily monitor the situation as it unfolds.