As the environmental, social, and governance (ESG) landscape continues to shift and change, its importance to company stakeholders—both consumers and investors—has only continued to grow. Recent studies show that almost 50% of millennial millionaires consider social factors in their purchasing decisions, and nearly 80% of investors consider ESG in their investment decision.

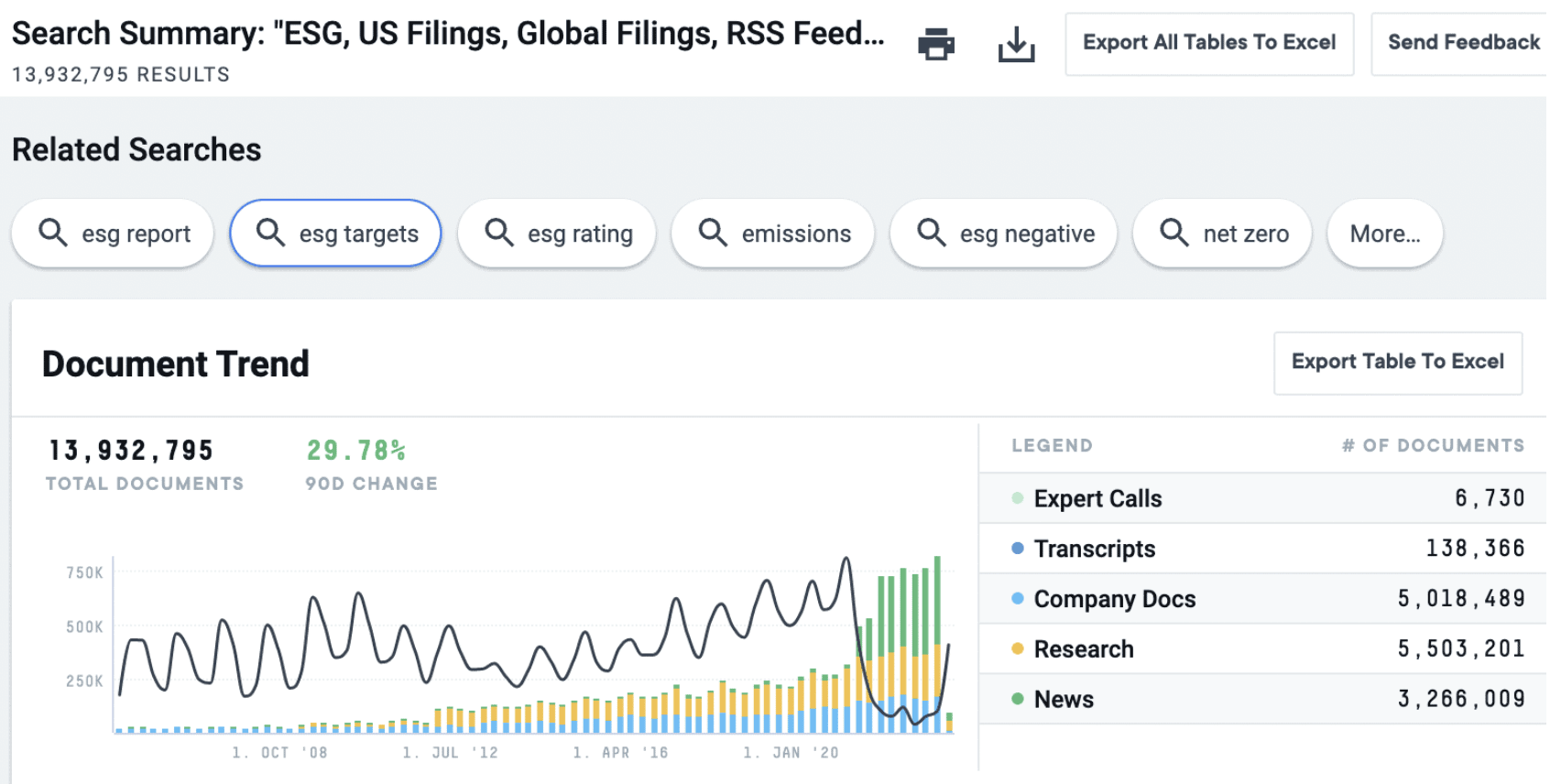

This continued focus on ESG is easy to see within the AlphaSense platform, as there was a noticeable spike in documentation for “ESG” during April of 2021. The coverage of ESG mainly grew due to its expanded coverage in the news with related events such as climate change legislation, social injustices resulting from state law restrictions, activist hedge funds against oil companies, and more. Since then, document uploads and coverage have remained steady.

With this newfound ESG demand from stakeholders and external factors, companies have started viewing it as a top priority and are beginning to implement better reporting around their ESG goals and overall performance.

However, there is currently no standardized reporting methodology, which makes ESG benchmarking a challenge. That is why it is crucial to have a market intelligence platform that aggregates ESG content into one place so you can efficiently perform your research and benchmarking. Below are the four steps to keep you ahead of the ESG momentum using AlphaSense.

Related Reading: 5 Steps to Building an Effective ESG Strategy

Step 1 – Aggregate All ESG Information in One Place

The current lack of reporting standardization means you need to manually parse through multiple websites and outlets to find information on a peer’s ESG performance, eating up valuable time that could be better used elsewhere.

In the AlphaSense platform alone, there are over 14.6 million mentions of “ESG” across all our aggregated content sources and perspectives, eliminating the need to hop from site to site. Everything you need to begin benchmarking is indexed and searchable within one platform.

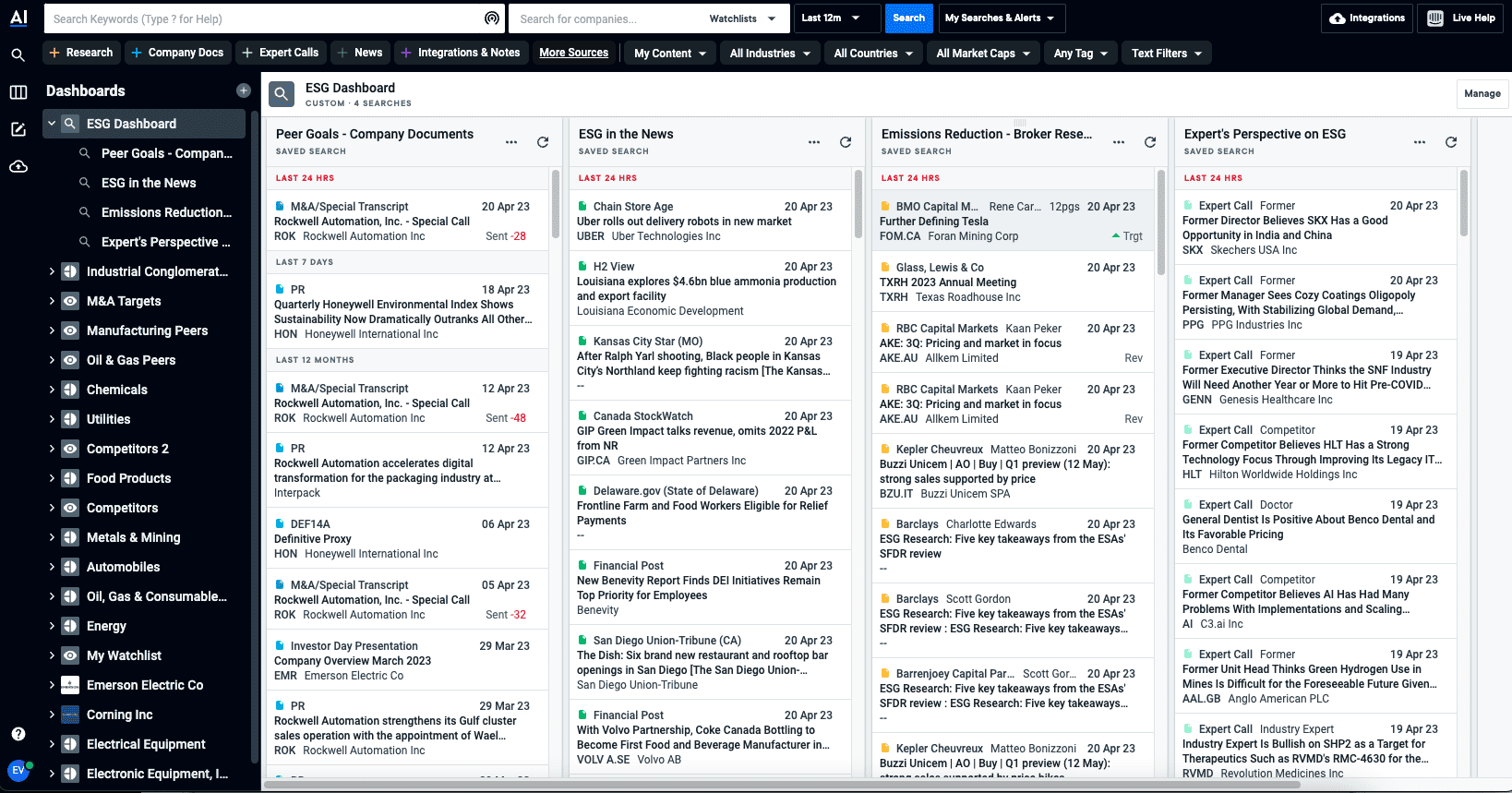

To ensure you stay up to date on all new developments, our dashboard tool automatically populates new content on the search topics that are most relevant to you, such as net zero emissions, DE&I, biodiversity, or data security. Content on the AlphaSense platform spans across the four key perspectives of research. Each of these perspectives offers valuable insights, and when used in tandem with one another, these content sets give you a complete picture of the ESG landscape:

- Company documents – Understand how companies are talking about and reporting on all ESG initiatives with access to ESG disclosures & presentations covering 26K companies.

- Industry analyst reports – Understand ESG investments, outlooks, and company evaluations from the top Wall Street analyst firms, including Goldman Sachs, Bank of America, Morgan Stanley, and more.

- Expert transcripts – Gain first-hand perspectives on their ESG strategy, the cost of sustainability, and ESG market leaders with instant access to 28,000+ interviews.

- Journalists/Regulatory news – Stay ahead of new legislations and updates from reporting groups such as GRI, and 145+ ESG-focused news and trade journals like Climate Wire, ESG Today, and ESG Investor, to name a few.

Step 2 – Pinpoint Peers’ ESG goals With Company Documents

Now that we have all the relevant ESG information in one place, you can quickly benchmark peer performance and their focus areas to identify gaps and ensure alignment.

Benchmarking helps enhance your ESG ratings, which investors now consider in company evaluations. However, without an AI-based market intelligence platform, trying to find goals on peer websites can be very time-consuming. As we’ve mentioned before, standardization within ESG is still disparate. Even with CTRL+F, you may not know the exact terminology being used in their reports, resulting in critical research blind spots, like missing information. You can perform this task in half the time using AlphaSense’s AI search capabilities.

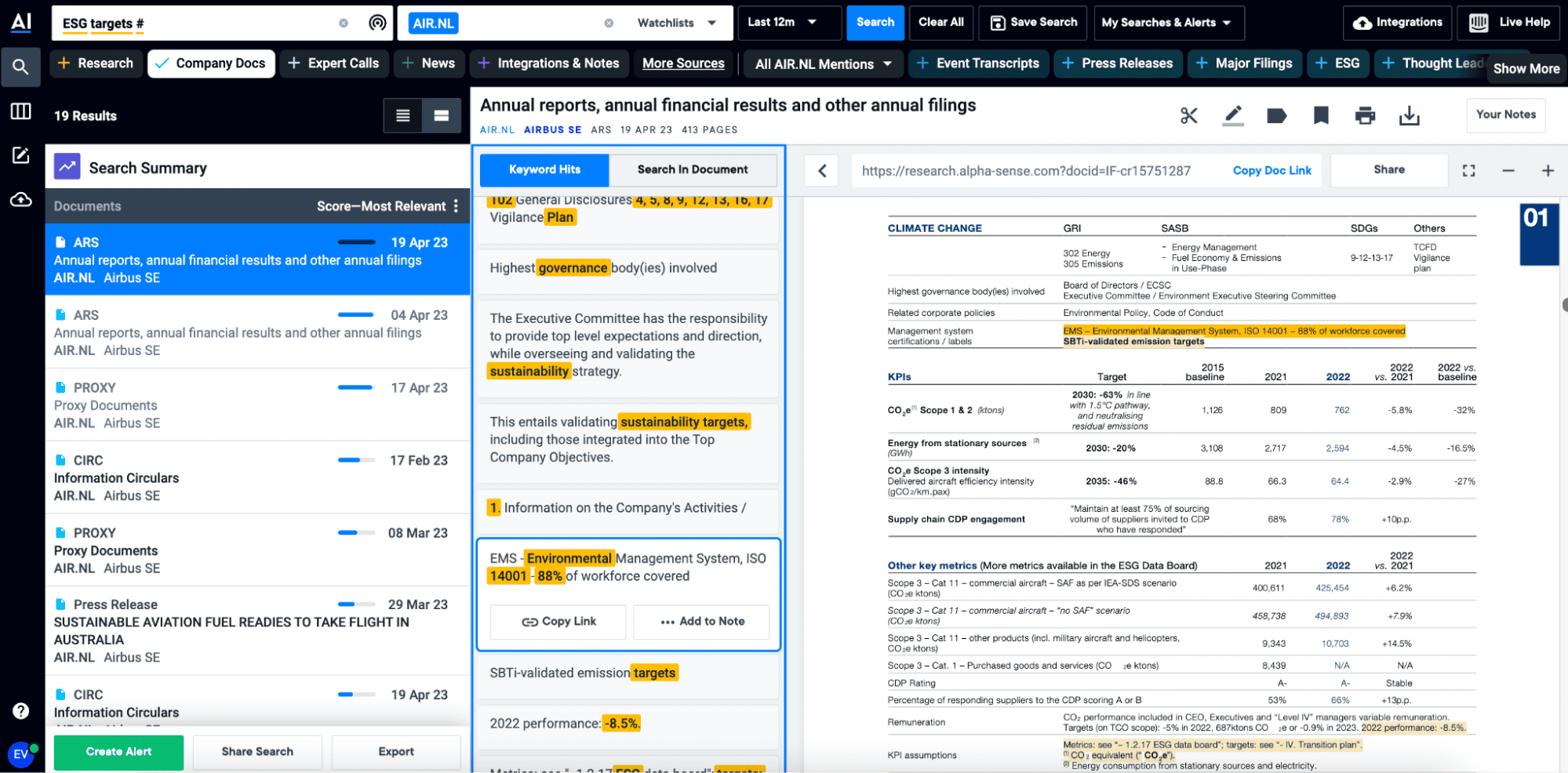

Want to find out Airbus’s goals? Let’s start by searching the keyword “ESG target #” coupled with the company ticker. In this instance, to get data straight from the company itself, it is recommended to filter for company documents. Once we have those three components, our AI search technology surfaces all relevant documents on Airbus’s ESG targets and any synonyms of our search term. Our Smart Synonyms™ technology recognizes variations in language, so you never miss critical information again. For example, ESG is underlined in yellow in our search, meaning it is a smart synonym. So not only does the platform find mentions of “ESG” but also “governance,” “sustainability,” and “environmental.”

“I’ve been starting with AlphaSense because it’s been picking up on everything. I’ve noticed I’m missing less [on topics] like energy consumption, diversity, inclusive practices, human capital management, and business ethics.”

– Governance and Sustainability Analyst | AlphaSense Customer Interview

By clicking on a snippet from the middle pane, you can quickly jump to that point in the document and see the entire table of Airbus’s KPIs regarding ESG. The first is on CO2 emissions, showing they intend to reduce them by 63% by 2030. Let’s dive further into that goal in step three.

Step 3 – Uncover the Strategy Behind Peers’ Goals with Broker Research

Broker research is an excellent source to understand a company’s intended approach to hitting its goals. Since investors have started including ESG criteria in their company valuations, Wall Street analysts now publish reports detailing how executives plan to achieve them. AlphaSense allows access to the only collection of Wall Street research that includes all global banks. Wall Street Insights®, our leading collection of equity research covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms, is indexed, searchable, and all in one place.

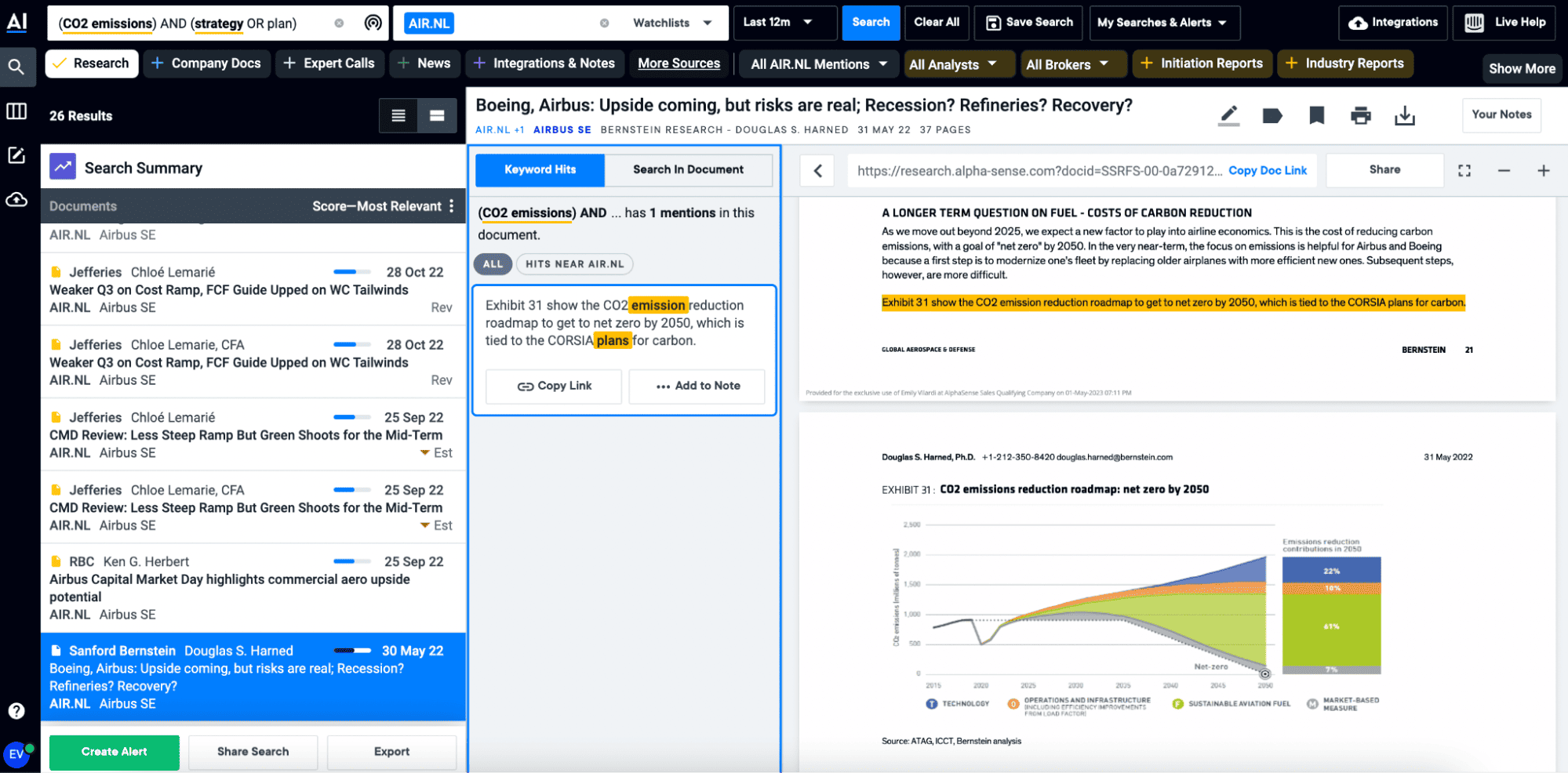

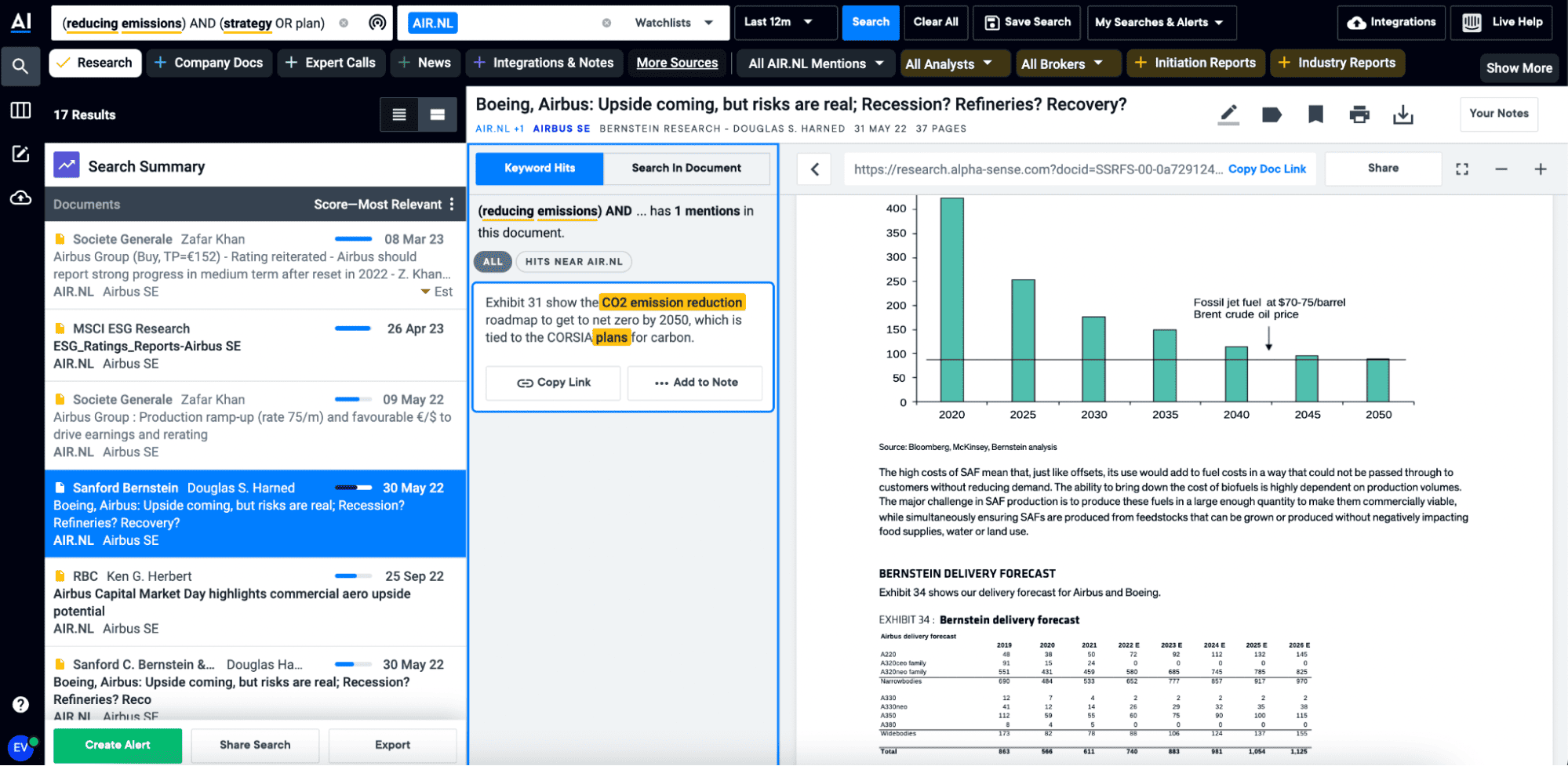

By searching across broker research on Airbus’s strategy to reduce CO2 emissions, we get a handful of analysts with reports on this topic. One in particular shows a graph of their roadmap to net zero by 2050—surpassing their original goal. The graphic shows that they will meet their goal through a combination of technology (22%), operations and infrastructure (10%), sustainable aviation fuel (61%), and market-based measures (7%).

Not only is broker research useful for getting into the details of strategy, but it allows you to get a detailed look at forecasts, market sizing, and outlooks. Scrolling beyond the emissions roadmap graph, the report also details these different tactics, including price forecasts for sustainable aviation fuel (SAF). When reading further on this tactic, it states that the price of SAF is well above their current fuel prices.

Having this key information, like price forecasts, allows you to understand and model financial implications to securely and confidently back recommendations. Broker research is also devoid of inflationary statements that companies tend to release about themselves in company documents. Since analysts are merely reporting on the market, they are immune to the bias of company documents, making their perspective crucial in creating a 360 degree of the ESG landscape.

Step 4 – Round Out ESG Research with Expert Insights

Now it’s time to add in primary research from former employees, competitors, partners, executives, or other industry experts. The Stream Expert Transcript Library in AlphaSense is a proprietary content set you can’t find in the public domain that provides firsthand, anecdotal commentary from those closest to the company or industry of interest. This content set gives instant access to tens of thousands of high-quality, searchable, proprietary expert transcripts covering multiple perspectives, industries, and markets.

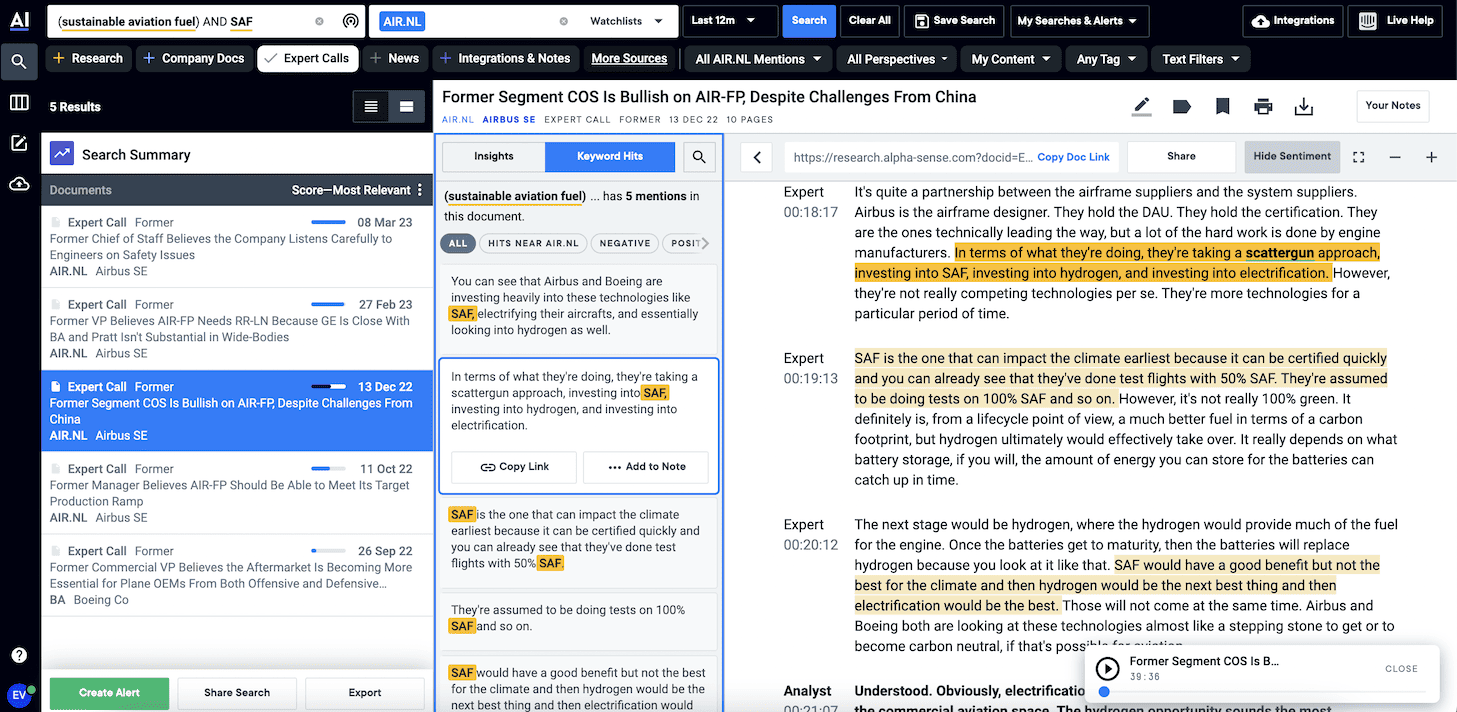

Let’s continue on the topic of SAF to see what the experts have to say about it. According to our search within expert call transcripts, five interviews have information on this particular keyword.

The screenshot below is from an interview with a former Chief of Staff, Corporate Venture at Airbus. At one point during the conversation, they are asked about sustainable innovation. In response, the COS states that their strategy is a scattergun approach, investing in SAF as well as hydrogen and electrification. He goes on to share that both Airbus and Boeing are the leaders in the industry and will use each of those investments as a stepping stone to get to carbon neutral—starting first with SAF, then hydrogen, and finally the optimal state of electrification.

Start ESG Benchmarking with AlphaSense Today

ESG is no longer a nice to have—it is now a necessary piece of criteria that both investors and consumers are incorporating into their purchasing decisions. Today it is challenging to research and benchmark performance due to the lack of standardization, so business professionals are turning to AlphaSense, as seen from the customer quote below:

Our platform enables teams to spend less time manually searching for potentially fruitless information and more time conducting deeper analysis and crafting more confident strategies. With our AI search technology, you can easily benchmark ESG goals and evaluate peer strategies to stay on the leading edge of your industry

Start a free trial of AlphaSense today.