The Formula to Net Zero: Decarbonization, Hydrogen, and the Energy Transition

View webinar

In today’s times, environmental, social, and governance (ESG) practices are ubiquitous in any company’s business strategy.

ESG centers on a more stakeholder-centric approach to doing business by focusing on ethical and eco-conscious corporate policies that reflect shareholders’ priorities and provide transparency to investing parties. The three pillars of ESG reflect a company’s commitment to environmental sustainability, social responsibility, and good governance.

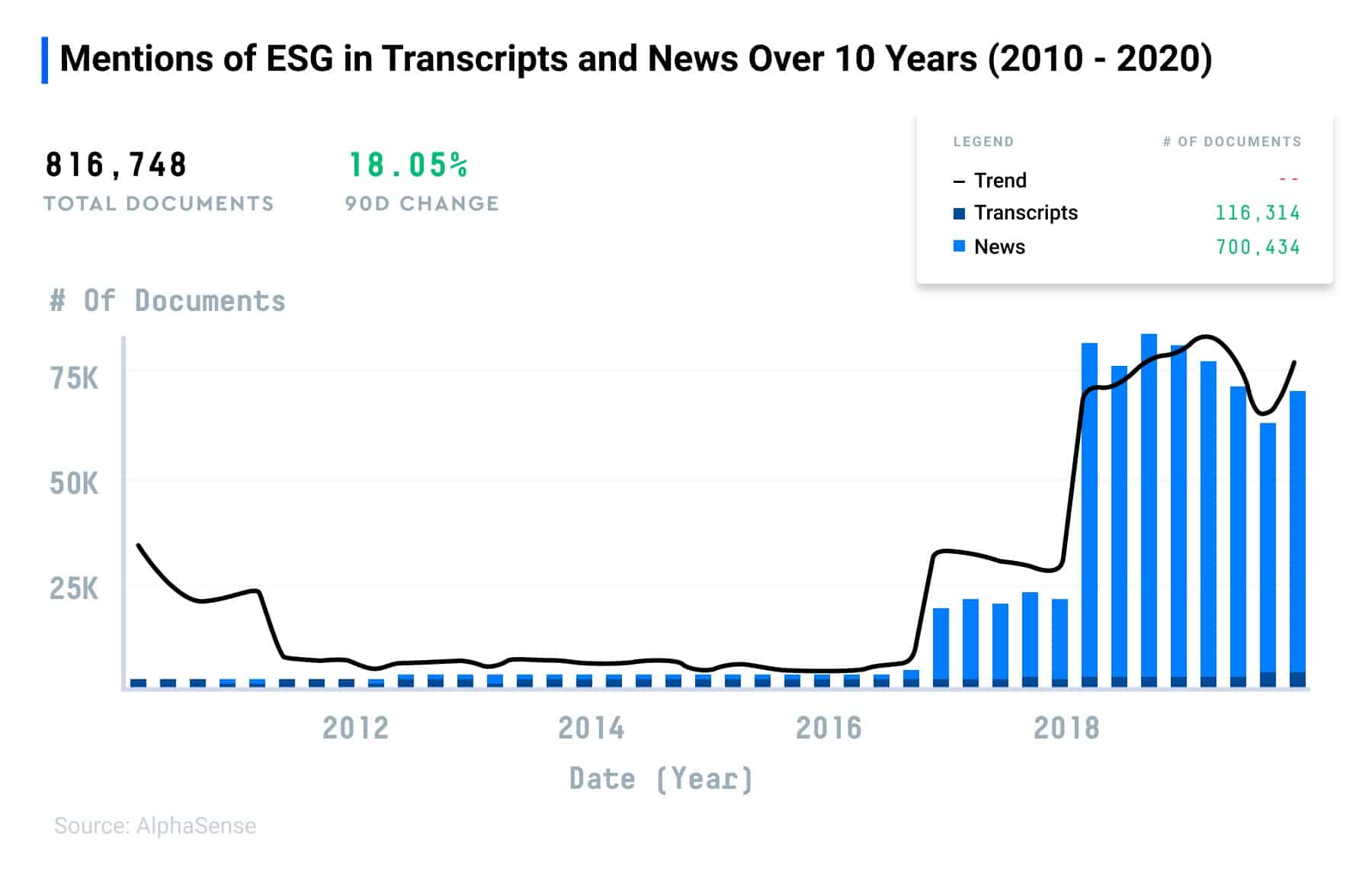

With social issues more visible than ever, climate change becoming an increasingly pressing concern, and more countries committing to the renewable energy transition, ESG is more than a passing trend.

Today, more and more investors are incorporating ESG into their investment and acquisition strategy. Yet the landscape is complex—anti-ESG sentiment has been on the rise in the past year, as a slew of companies that claimed to uphold ESG standards have been unable to validate or back up those claims.

In fact, there has even been speculation that fund managers are relabeling their products in an attempt to reap the rewards from the ESG movement without actually putting in the real effort. In the AlphaSense platform, documentation around ESG backlash is up over 70%, and investors are unsure whom they can trust.

That’s why it’s imperative for investors to rely on a market intelligence tool that provides a full 360 degree view on any ESG trend or related topic, from the perspectives of companies, journalists, analysts, and experts.

The AlphaSense platform is a key tool in the creation and execution of your ESG strategy, as it enables you to gain a full-scale understanding of how the ESG landscape is changing, who the major players are, and which key developments need to be on your radar—all before your competition.

Here are the five key steps to creating a winning ESG investing strategy, and how AlphaSense can help.

Related Reading: How Green Building is Transforming the Real Estate Industry

Look for Transparency and Authenticity

At this point, it is an unsurprising fact that not all companies that purport to abide by ESG standards actually do so. Organizations have been known to put out reformative plans with unrealistic ESG goals and falsified records to mislead investors, improve their ESG ratings, and up their stock value. Many companies have also taken the route of greenwashing—putting on an environmentally and socially-conscious front without taking any real beneficial measures.

This is why it’s so important to be aware of the specific ways a company’s organizational efforts align with proclaimed ESG efforts, as well as their level of transparency in data reporting to back up those claims. The AlphaSense platform provides access to a myriad of documents that help validate and vet companies’ ESG plans and scores.

The platform yielded over 430,000 documents related to ESG reporting, including:

- Third-party ESG reports from JP Morgan and Deutsche Bank tracking ESG trends and growth

- Self-reported company data such as annual reports that contain specific sections for social responsibility, environmental impact, and governance

- ESG scorecards that objectively assess organizations based on specific criteria for ESG efforts

You can also compare a company’s press release statements with what is said on their earnings calls, all on the AlphaSense platform, in order to quickly validate the verity of a company’s commitment to setting and reaching ESG goals.

Understand Your Industry

Because ESG is now top of mind for companies in every industry, there is an opportunity to create a highly diversified ESG portfolio. However, it’s important to do your research and understand each industry’s unique ESG focus, so that you can clearly separate the truth-tellers from the fabricators.

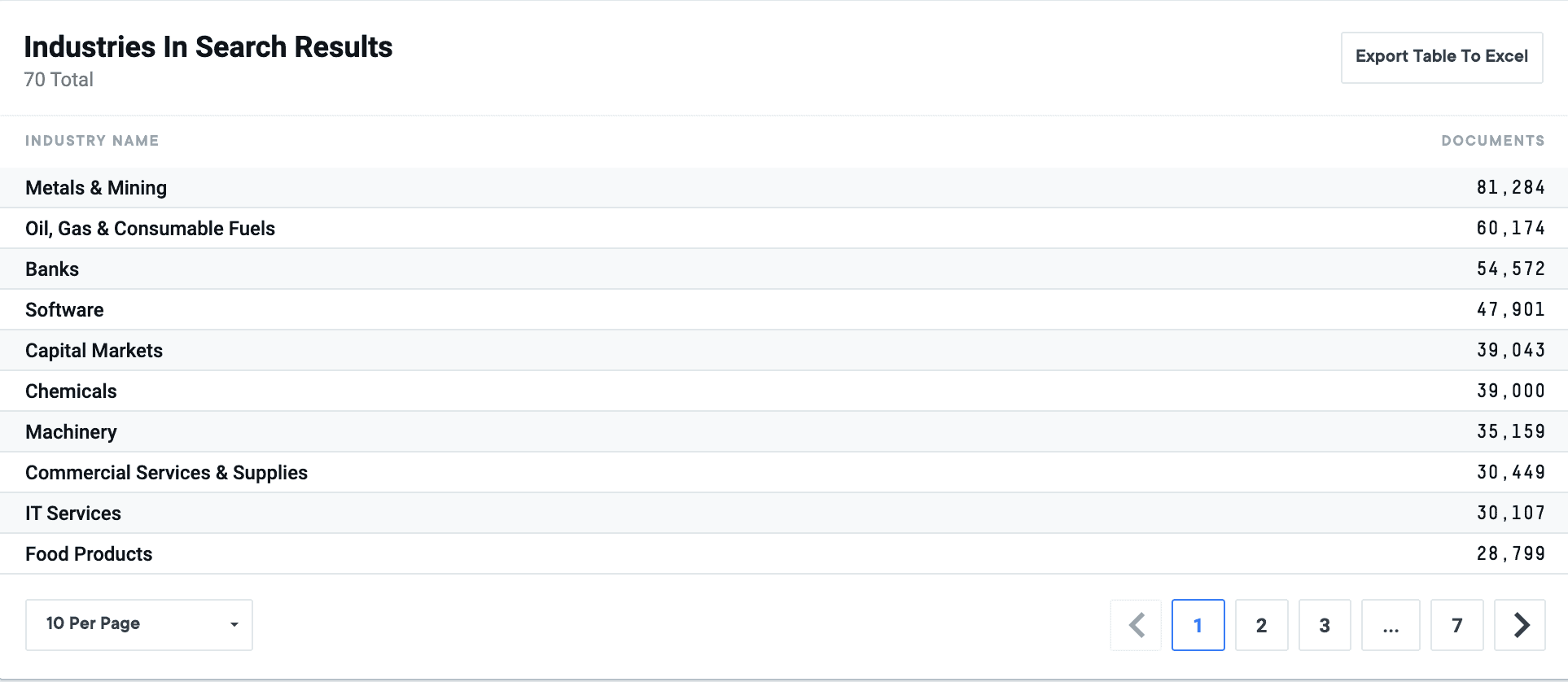

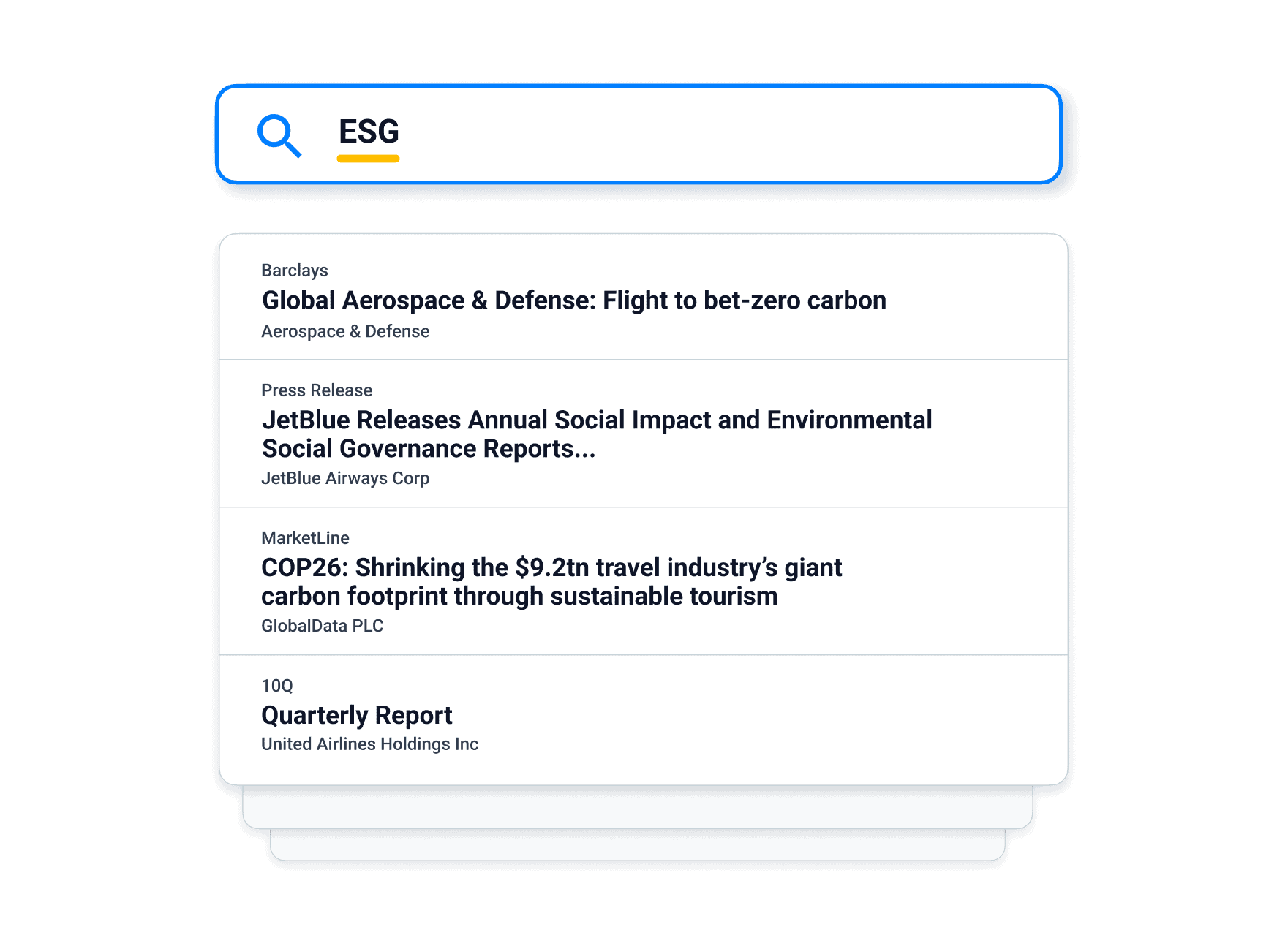

With AlphaSense, you can see the top industries associated with the search term “ESG” (as well as its synonyms) and then do a deeper dive into each to uncover the top areas of interest for each industry. As the below platform screenshot illustrates, the current top three industries focused on or discussing ESG are metals & mining, oil gas & consumable fuels, and banks.

Additionally, you can use AlphaSense’s AI search technology to gain insight into what ESG topics are most highly prioritized and discussed by top executives across industries, how ESG has evolved over time, and more.

Recently we partnered with SAP on an ESG & Sustainability trends report where we looked at the winners, losers, and future outlook of these two topics. This report is a great example of how you can combine the power of our sentiment analysis feature with aggregated access to years of earnings transcripts to find not only the trends but the C-Suite sentiment for said trends.

Some of our findings included:

- The ESG topics that are top-of-mind for C-Suite and which have been surprisingly deprioritized

- How sustainability compares to other business topics like digital transformation or procurement

- Which industries are committed to ESG and how it’s trending in each industry

The ability to find this type of information is crucial in understanding the ESG landscape for not just the companies in your portfolio but for your industries of interest at large.

Know What to Look for in Earnings Calls

As mentioned in the above section, earnings calls are some of the best resources for benchmarking, forecasting, and evaluating companies against their peers. They also offer a wealth of insights into a company’s commitment to upholding ESG practices and practicing transparency. Yet in order to properly evaluate the information in an earnings call, it is critical to both ask the right questions and understand the nuance behind a company’s response.

This infosheet on the top 10 ESG questions provides some examples of not only what to ask when conducting a call with a company, but also gives you an idea of what companies are expecting so you can come up with additional questions that they might not have prepared for.

When it comes to ESG initiatives, the name of the game is value creation. It should be crystal clear from the earnings call how the company’s ESG priorities link to value, and there should ideally be hard metrics supporting any statements.

Our use of natural language processing (NLP) allows you to strategically evaluate a company’s statements to help you understand the viability of their ESG efforts and also allows you to see how sentiment has changed over a period of time.

You can use AlphaSense to keep tabs on specific companies or specific ESG-related topics by searching a topic and filtering the results to display only earnings transcripts. Alternatively, you can also create a company watch list and add a tracking word, so you receive real-time alerts anytime a company on that list is associated with that word or topic.

Pay Attention to High-Level Macroeconomic Trends

We live in a time when companies can no longer stay silent on pressing social issues—consumers take their money where their morals are, and if the values of the company you are investing in are misaligned with its consumers’, that could be a direct affront to your portfolio’s bottom line.

However, it’s become commonplace for companies to simply give a vocal blanket statement with their stance on a particular issue, usually aiming to stay as neutral and apolitical as possible, with the goal of checking off the box of “doing the right thing.” Pay attention to the companies that actually put their money where their mouth is. Seek out the companies that stand firm in their values and show, through sustained action, that they are committed to doing good with their power.

As an ESG investor, it is critical that you both stay informed on key social issues and on how your companies of interest are discussing and responding to those issues. You also need to understand what issues are actually going to affect the market, and which are just passing fads.

AlphaSense’s extensive universe of public and private content allows you to get a full 360 view on any trend and understand how it may affect your bottom line, if at all.

Discover important trending topics through the news sources on the platform. Then, lean on the analyst perspective to separate the signal from the noise and identify the market-moving events among those topics. Finally, use the expert perspective to contextualize how these market-moving events can affect businesses and the market at large. AlphaSense gives you access to all of these voices, in one place, so you can seamlessly transition from research to analysis to strategy.

See how we used the AlphaSense platform to validate companies purporting to support the LGBTQ movement, as well as the BLM movement—the findings are eye-opening and highlight the importance of conducting careful due diligence as an investor.

Find the Problem-Solvers and Innovators

No matter what is going on in the world, the companies to watch are the ones that are constantly innovating and solving real consumer problems. Most likely these are also the companies whose values are aligned with ESG, and whose actions are consistent with their values.

This may look like a company mission centered around promoting and protecting human rights, backed up by tangible positive social impact, or a business model emphasizing corporate social responsibility.

Examples of such companies include Land O’Lakes—a dairy cooperative that created a culture of rural broadband access after the pandemic highlighted the need for greater digital inclusion in rural communities—and Levi Strauss—a fashion brand committed to further the health and safety of supply chain workers with its Worker Well-Being Initiative.

This could also be a company that has a sustainability strategy as part of its business operations. Such organizations are consistently finding innovative ways to lower their carbon emissions, and their growth strategy is built around sustainable development goals.

Some examples include:

- Lululemon – uses sustainable next-generation materials in their apparel

- Stripe – allows any internet business to support carbon-removal technologies

- Doconomy – created a calculator that allows companies and consumers to measure the carbon footprint of what they produce and purchase, respectively

Importantly, these are also companies that practice responsible corporate governance, from prioritizing diversity, equity, and inclusion on the corporate and board level to creating and executing policies that are in the best interests of their stakeholders.

In episode 5 of the AlphaSense podcast, Signals, Andrew Edgecliffe-Johnson told our our Director of Research, Nick Mazing, “CEOs have started to think about governance, not just as a word that defines the management and the oversight of their own companies but also in terms of governance structures within which they operate in their countries and globally.”

Studies have shown that good governance is a critical mark of an innovative and sustainable organization, so chances are high that many of the most innovative companies are also upholding good environmental, social, and governance standards.

A prime example is the Royal Bank of Canada—this is one of the most innovative firms in the financial services space, committed to creating value for their customers through technology, and it’s also a multi-year winner of the Ethical Boardroom’s Corporate Governance Award.

Level Up Your ESG Strategy with AlphaSense

ESG assets are forecasted to generate $53 trillion in valuation by 2025. With new regulations emerging to target ESG risks like greenwashing, and the importance of performing ongoing due diligence on new developments in the ESG space, an all-in-one market intelligence platform is critical to stay on the leading edge and keep making well-informed decisions.

Read this case study to see how Baillie Gifford is using AlphaSense to fundamentally transform ESG in the healthcare space.

AlphaSense helps you cut through the noise and delivers meaningful insights from over 10,000 content sources including company reports, broker research, news sources, and expert interviews, so you can uplevel your risk management and investment strategy today.