M&A Database Overview

AlphaSense’s powerful platform leverages AI and generative AI to surface the market intelligence that investment teams rely on for their M&A research. Having the right information in hand is a crucial part of the process. Doing so ensures that teams are well-prepared and have the intelligence they need to confidently pursue opportunities—with greater speed.

Well-rounded, comprehensive research minimizes informational blind spots and helps identify red flags and potential risks, giving investors a competitive advantage and confidence in deploying capital. With AlphaSense’s all-in-one platform, researchers can:

- Surface key developments and disclosures for 68,000 public companies and structured data/financials on 37,000 public and 1.4M private companies.

- Access our expansive content universe featuring more than 10,000 documents on private and public companies, centralizing broker research, financial documents, expert insights, and earnings transcripts to pinpoint quality insights in seconds.

- Leverage purpose-built AI and generative AI features that distill and surface the insights and data most relevant to their research: our Smart Summaries, Smart Synonyms™, and sentiment analysis features quickly surface nuanced due diligence insights. These features, layered on top of our premium content universe, enable users to seamlessly access crucial market intelligence in a fraction of the time it would ordinarily take.

What’s in AlphaSense’s M&A Data?

To form the backbone of a strong investment thesis, analysts ordinarily sift through countless sources to obtain the insights they need. This includes earnings transcripts, IR presentations, press releases, equity research, niche news coverage, 10Ks, 10Qs, among many others. Obtaining the level of granularity needed to procure comp spreads, revenue streams, potential target profiles, and other key valuation metrics can be a tremendous undertaking.

To make sound and accurate recommendations, researchers rely on these coveted market and company-level insights and financials to drive their investment theses.

AlphaSense’s comprehensive M&A database aggregates all the most difficult to locate, fragmented sources of information in one easy-to-use platform. In an age of information overload, our AI and genAI capabilities deliver market intelligence in seconds to streamline and enhance M&A research.

With the power of our industry-leading platform, you can check off all your crucial due diligence boxes:

Company Coverage

With a lineup of intuitive AI and generative AI tools, covering dozens of companies at a time is made easy. Our expansive content universe captures information on over 68,000 public companies, as well as structured data and financials on 37,000 public and 1.4M private companies.

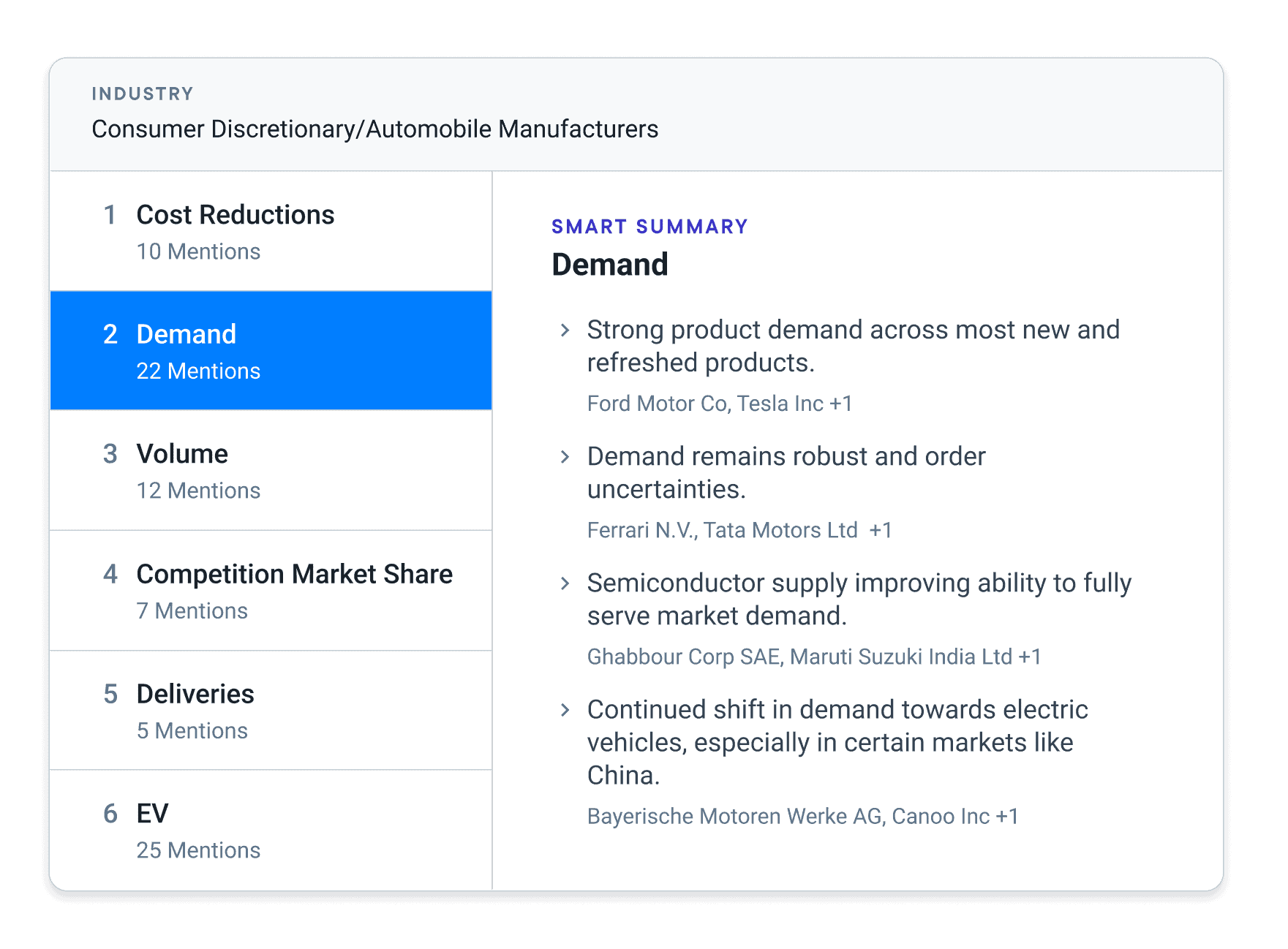

Tools such as our Smart Summaries leverage genAI to glean instant insights and trends across key companies. Our Industry Summary feature highlights top trending companies within a sector and surfaces overall trending topics, positives, negatives, and outlook across all companies in the industry.

You can also conduct a deep dive on any company, public or private, in no time. Private company profiles provide an inside glimpse into the company overview, contact information, current and former directors, group structure, key financials, ratio analysis, income statement, and balance sheet for 10M+ private companies across EMEA and Japan.

Industry Analysis

As the deal-making environment continues to fluctuate, keeping a pulse on leading industry trends is crucial in the periphery of a complex transaction, or while conducting due diligence.

With our Industry Dashboards, you can monitor trending activity around a particular industry with notifications to keep you in the know when a market event occurs. You can also set up real-time alerts to receive email notifications for those instances when you’re away from the platform.

Additionally, AlphaSense offers all the tools necessary to conduct total addressable market (TAM) analysis, proper market sizing, industry benchmarking, reputational risk management, management analysis, and more.

In-Depth Financials

Tracking down elusive financial metrics is easier than ever with AlphaSense. With our time series data modeling, you can filter SEC filings to access income statements, balance sheets, and more, from which you can export QoQ data for trend analysis. Our Table Explorer tool also enables you to generate a historical lookback of a company’s financial performance that can be exported to Excel for further analysis.

Broker Research

AlphaSense’s Wall Street Insights® aggregates research offerings from 1,500+ sources in seconds, including Goldman Sachs and Citi, all of which enhance due diligence and provide a deep understanding of the market landscape. By running a thematic search across all broker research in the AlphaSense platform, you can easily get a sense of analyst perspectives on a key topic for a potential investment.

Additionally, our aftermarket research provides valuable insights into metrics such as operational performance, market size, market share, profitability, growth rate and potential, and competitive position.

Use Cases for AlphaSense M&A Data

Making Better-Informed M&A Decisions

Leveraging a market intelligence platform like AlphaSense sets the stage for better-informed M&A decisions. With a mosaic of quantitative and qualitative insights that create a holistic overview of any particular theme, macroeconomic trend, company, or industry, analysts can gain the complete picture and shape their investment recommendations and decisions accordingly, leaving nothing to chance. Holistic insights drive confident and strategic decisions.

Mitigating M&A Risk

By aggregating data and insights in real-time, the AlphaSense platform is a one-stop-shop for accurate, timely, and relevant market intelligence. In eliminating the need for multiple platforms and sources of information, the likelihood of making inadvertent errors and potentially compromising a deal significantly lessens, which reduces overall risk.

Having a comprehensive, centralized, and holistic source of market intelligence mitigates the risk for incomplete or inaccurate findings and overlooked insights.

Leveraging M&A Data for Better Reporting

With AlphaSense, analysts can streamline their due diligence, simplify otherwise complex research tasks, and accelerate their process 10x. The ability to enhance workflows and consolidate vetted information and insights enables investment teams to create efficiencies and better capitalize on resources. In lieu of spending copious amounts of time on low-yield and scattered research, researchers can instead allocate their focus toward higher-value activities such as analysis, crafting a sound thesis, and deck preparation.

M&A Insights From AlphaSense

With insights sourced from the AlphaSense platform, gain an inside perspective into the trending M&A topics across every industry:

M&A Trends and Outlook

Using the AlphaSense platform, we uncovered the key trends, opportunities across sectors and geographies, and factors shaping the M&A space this year and beyond.

5 Ways Expert Insights Lead to Successful M&A

In this article, we explore five surefire ways that Expert Insights can lead to successful M&A for any firm.

M&A in Healthcare: 2024 Outlook

In this outlook, we explore the themes and prevalent trends shaping the M&A landscape within the healthcare industry, as well as where opportunities may exist for investors.

M&A Due Diligence: A Complete Guide

With this guide we take an in-depth look at how AlphaSense enables researchers to conduct every pillar of due diligence with confidence.

Energy M&A Boom in 2024

Discover the trends and themes driving the uptick in oil and gas M&A deals, and what opportunities may be on the horizon for investors and shareholders.

Growing M&A Activity in Oil and Gas

In this piece we do a deep dive into what experts and industry leaders have to say about the new wave of deal activity in the energy and oil space, and share what the future might look like for the industry.