Once considered a source exclusive to sell-side firms, analyst reports are now readily used by corporate professionals and consultants to enhance their market research and gain a competitive advantage. These reports help professionals across industries conduct comprehensive market landscape analysis, understand key market trends, and evaluate their competitors.

Unfortunately, analyst reports are not publicly available and often require companies to have relationships with specific brokerages or investment banking firms to access any information. Further, even if you do get access to the reports you need, manually extracting the insights within them requires significant time and effort—think multiple search engine queries and hours of combing through countless documents.

AlphaSense makes it easier than ever to gain access to valuable and differentiated insights only found in equity research from Wall Street’s top firms. We do this with our exclusive collection of analyst research, Wall Street Insights®, as well as our advanced AI search technology and automation.

Together, these offerings enable you to conduct a more comprehensive competitive analysis, improve client interactions, enhance internal research and strategy, and save your organization time and money.

Wall Street Insights®

Wall Street Insights® is our collection of the world’s leading real-time and aftermarket research, covering global sector themes, industries, and companies from 1,000+ sell-side and independent firms—indexed, searchable, and all in one place.

This content set aggregates research from leading banks including HSBC, Morgan Stanley, J.P. Morgan, and Bank of America, among others, and covers North America, EMEA, APAC, LATAM regions.

Available reports include company reports—including initiation reports, credit research, and price target revisions—as well as in-depth industry reports , fixed-income reports, regional outlooks, macroeconomic reviews, and more.

To learn more about how to best leverage analyst reports to be more informed and make better investments, check out our Wall Street Insights Guide.

Broker Insights From the AlphaSense Platform

Below we showcase a number of research reports from HSBC, one of our trusted providers of analyst insights:

Advantage Indonesia: Taking a Thematic Approach

Using HSBC’s Nine Themes, this report explores the long-term prospects for the Indonesian market, as well as the top emerging equity opportunities.

The Flying Dutchman: Stock Screen for Advantage Indonesia

An accompaniment to the Advantage Indonesia report, this report identifies 35 listed companies that are exposed to the evolving themes and growth stories discussed above, while also providing a screen of seven Buy-rated names within HSBC’s covered universe.

Cashing Out: Winner and Laggards

This report answers the question: who are the winners and laggards in the ongoing displacement of cash and its constantly evolving regulatory backdrop?

Ready, SEBBI, Go!: Machine Learning for Insurance

SEBBI (SEctor Bull Bear Indicator) is HSBC’s new Machine Learning model for the European insurance equity sector. In this report, SEBBI predicts whether the sector is likely to go up or pull back over the next month and suggests how best to position at a sub-sector level.

US Travel & Leisure: A New Ecosystem Emerges

This report discusses the main ways the pandemic has affected travel behaviors, as well as how travel and leisure companies can succeed in the new ecosystem.

A Guide to COP28: Will 1.5℃ survive?

This report sets the stage for the upcoming COP28 conference, including what to know about the global climate change process and what to expect from the event.

China Generative AI: Part One: A Guide to Monetisation

Using HSBC’s new proprietary RAAM framework, this report discusses the generative AI landscape in China and assesses who can best monetise this emerging technology.

Data Matters: This Month in AI

This report provides a round-up of the key events in AI during September, as well as an in-depth analysis of the signals from HSBC’s predictive machine learning models and analysis of correlations both across and within asset classes.

Find Market Trends Faster With Artificial Intelligence and Automation

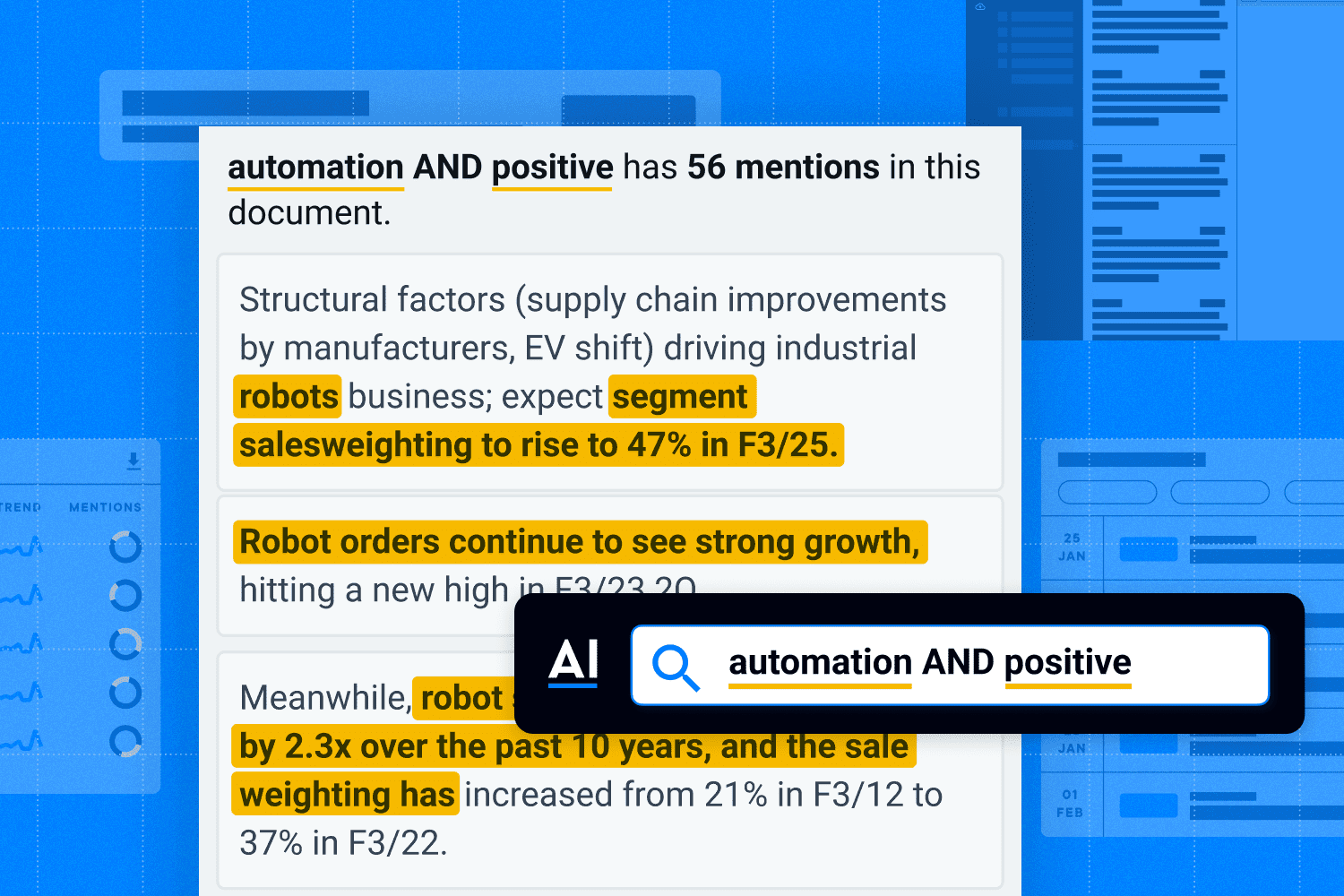

When you rely on a market intelligence platform that utilizes the power of AI search technology, you can be more confident in your research, knowing that you have all the most crucial insights right at your fingertips. And with automation, AlphaSense helps you cut down hours of manual work, streamlining your entire process so you can take action and make mission-critical decisions faster than ever.

Here’s how our semantic search and smart automations can transform your workflow:

Smart Search

Smart Search technology doesn’t just recognize the keywords included in your query—it understands the intent behind your search, delivering content sources with the highest relevance and value to your search. It allows you to find all relevant data points with a single search, saving countless hours and increasing precision in your research.

Additionally, equity research is often inconsistently tagged because different firms may use different classification taxonomies, or include their own terms to define industries and trends. In addition to recognizing relevant language patterns, Smart Search assigns correct tagging to reports from thousands of analysts and research firms, regardless of which analyst published the report.

Smart Synonyms™, our proprietary element of Smart Search, filters the excess noise by weeding out sources that may include similar keywords but are not topically relevant to your research, helping you get to the insights that matter faster.

Relevance Rankings

AlphaSense automatically ranks results by their relevance to your research using a number of algorithmic factors, including search term proximity, Smart Synonyms™, and document decay. You can be confident that the content sources at the top of your search results page are the ones most aligned with your current research needs.

Real-Time Alerts

Without a centralized search system, professionals have no choice but to perform multiple manual searches and parse through Google Alerts for any relevant updates. On the AlphaSense platform, real-time alerts are customizable and can be set up for any company, industry, keyword, or topic that is of interest to you (or a set/list of any of the above).

Customized alerts and watchlists give analysts real-time notifications about important news and updates while also ensuring they aren’t bogged down with alerts that are not in tune with what they really need.

Generative AI

AlphaSense’s generative AI is purpose-built for business professionals, leaning on 10+ years of AI tech development. Our proprietary genAI tool, Smart Summaries, generates insights across all four key perspectives—company documents, news, expert calls, and broker research.

Sourced from across all broker research you are entitled to, published within the past 90 days, and covers sections including:

- Upgrades and downgrades – Covers which brokers have upgraded/downgraded this company within the past 90 days and why

- SWOT analysis – Covers the topics/trends identified as strengths/opportunities or threats/weaknesses from across broker reports about this company

- Competitive landscape – Covers the competitive landscape for this company from across broker reports