Why Do Companies Choose AlphaSense?

AlphaSense is a leading all-in-one market intelligence platform and smart search engine. It’s the ideal tool for research and business professionals—from analysts and financial researchers to corporate professionals—looking to implement a qualitative research strategy powered by proprietary artificial intelligence (AI) technology and automation.

Here’s what sets AlphaSense apart from other market intelligence tools:

Premium Content Sets

In market and competitive intelligence, the more diversified content sources you have access to, the better and more accurate your insights will be.

AlphaSense’s extensive content universe provides access to over 10,000 private, public, premium, and proprietary sources—indexed, searchable, and all in one place. That content is organized by the four key perspectives:

- Company – These are documents published by public and private companies, including SEC and company filings, earnings reports, presentations, transcripts, and ESG reports.

- Journalist – This is content published in major news networks, trade journals, and government and NGO publications.

- Analyst – Our Wall Street Insights® content library includes leading equity research from 1,000+ sell-side and independent firms, covering global industries, sector themes, and companies.

- Expert – Our expert transcript library houses 40,000+ interviews conducted by experienced buy-side analysts with pre-vetted industry experts (former executives, customers, competitors, and partners).

Advanced AI Search Technology

Smart Synonyms™

Analysts are most effective when they can spend their time on actual research—instead of fruitlessly searching for sources. Our Smart Synonyms™ technology enables you to access every relevant source and insight in a single search, while filtering out any irrelevant results.

Smart Synonyms™ recognizes the intent behind your search, then automatically includes results for your search terms and those with the same or similar meaning. This feature mitigates the risk of user error or missing information, and saves you countless hours previously spent on manual research—freeing up time for higher-level tasks like strategy and analysis.

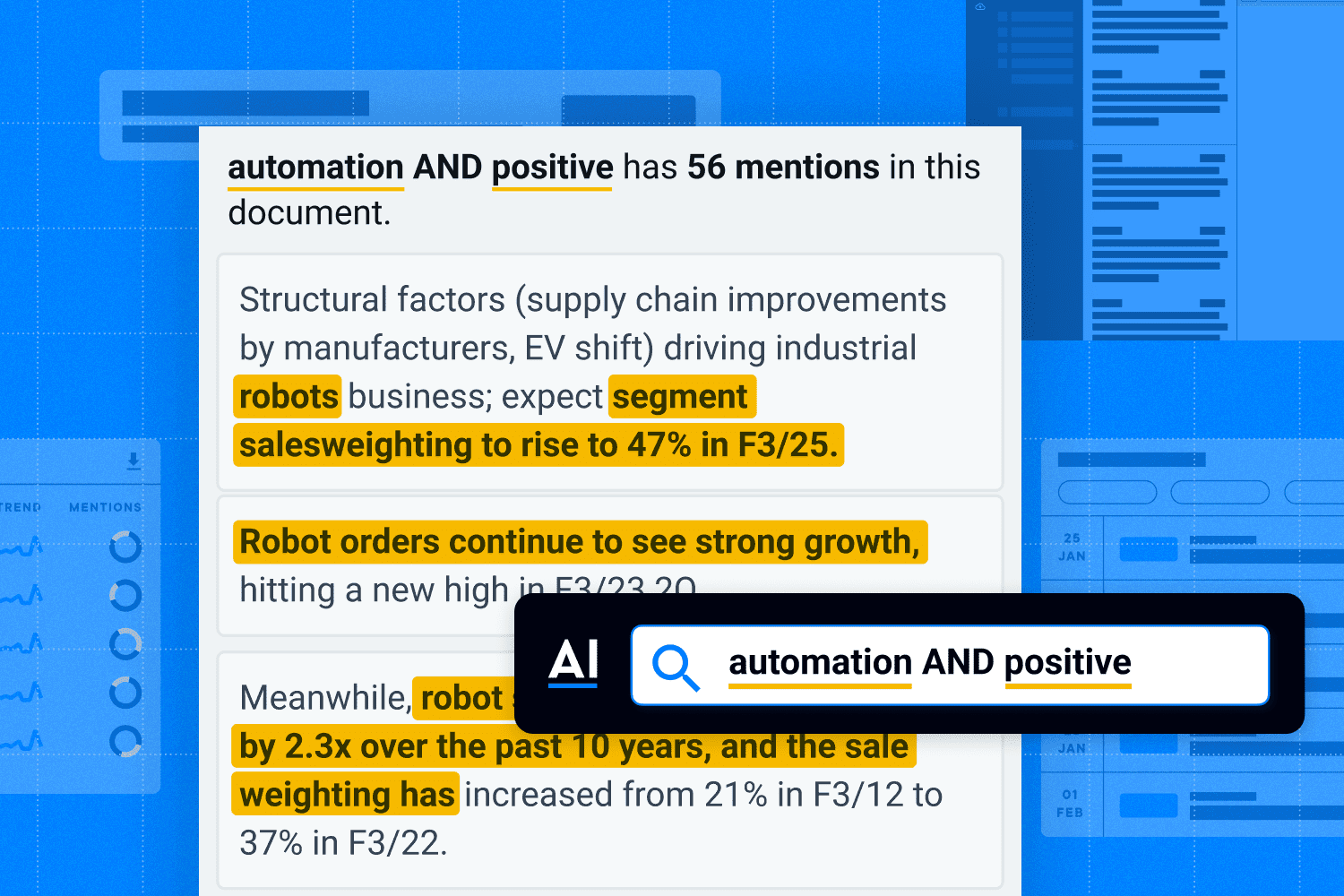

Sentiment Analysis

Sentiment analysis is a natural language processing (NLP)-based feature built into the AlphaSense platform. When the platform detects a slight change in a text’s tone and subjective meaning, it highlights it using different color codes. These color changes help you identify if documents have negative, positive, or neutral sentiments.

Further, each search term gets a sentiment change score. Using this numerical score, you can track slight market sentiment changes over time. Subtle inflection points in language can often provide early indicators of shifting corporate performance.

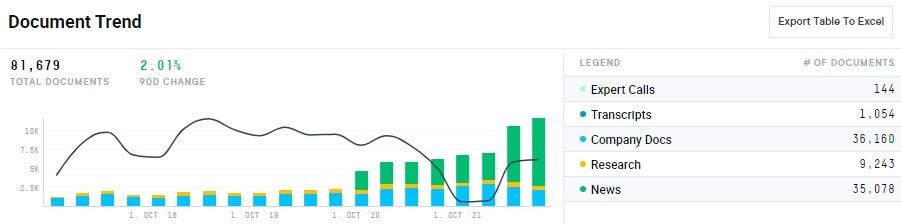

Document Trend Analysis

When conducting research or analysis on a particular topic or company, it is important to understand the frequency of and context in which your search term appears across data sources over time.

In the AlphaSense platform, each user search generates a document trend analysis—a graphic visualization of how often a keyword, company, or topic is being mentioned across content sources on the platform over a given time period.

It’s a simple yet powerful way to understand and evaluate the relevance of market movements and trends over time. Document trend analyses can also be sorted by content type for a more detailed understanding of the how and who of a topic being discussed.

Multiple integration Options

AlphaSense provides easy integration with commonly-used programs such as OneNote, Sharepoint, and Evernote to enhance your productivity and streamline your collaboration.

Integrations are key in improving your team’s workflow in a secure and automated way, and AlphaSense integrations are powered by AI and help capture what others easily miss. With integrations, you can easily search across all internal and external content to find actionable insights, as well as collaborate with team members to share those insights internally.

Top AlphaSense Use Cases

Corporate

Competitive Intelligence

AlphaSense helps you quickly filter through the noise, so you can respond to ad-hoc business questions and requests with speed and ease and produce more comprehensive market landscapes to share with colleagues.

“The AlphaSense platform helps me quickly generate meaningful insights, and those insights are influencing strategic decisions for us on a day-to-day basis. AlphaSense packages information in a way that influences how we remain at the forefront of the competition.”

– Abhishek Chandiramani | Director of Competitive Intelligence, Precision BioSciences

Corporate Strategy

AlphaSense enables you to stay ahead of and confidently navigate market movements. The platform enables you to easily pinpoint insights, so you can quickly gather the context you need to understand market headwinds, tailwinds, and competitive landscapes.

“AlphaSense has greatly improved my mood, and it’s helped me save so much time… This is the best tool I’ve ever used for surfacing market intelligence that’s critical to staying up-to-date on industry topics.”

– Monica Garcia San Millan | Automotive Market Intelligence Manager, NXP Semiconductors

Investor Relations

AlphaSense is an instrumental tool during earnings season, helping you craft the right narrative and prepare the C-suite for earnings calls. The platform also allows you to analyze earnings transcripts from previous quarters, prep for analyst Q&A, and benchmark language for earnings season.

“From a research standpoint, particularly other companies’ investor presentations, it’s awesome to not have to go to every company’s website to find the information I need. It’s all aggregated into one place.”

– Director of Investor Relations

Corporate Development

AlphaSense helps you evaluate market opportunities in minutes. With access to accurate and detailed information on an extensive list of companies, including emerging players and private companies, you can build target lists, speed up due diligence, and uncover the context behind financials you won’t find anywhere else.

“Broker research is perhaps the most powerful element of AlphaSense for us because it enables us to review and easily extract market intelligence from all available sources and utilize that data for our own unique analytical needs.”

– Director of Business Development at Large Midstream Company

Financial Services

Asset Management

AlphaSense helps asset managers stay ahead of key macroeconomic trends, read between the lines of financial statements, and secure strategic investments before anyone else. Our AI search technology allows you to easily comb through initiating coverage reports, expert call transcripts, and industry reports—without sacrificing time or comprehensiveness.

“What makes AlphaSense unique from other platforms is the extra coverage. Instead of having to create our own AI-based tool, which would take 6 months to a year and costs significantly more than AlphaSense, we save a lot of time and money with this tool.”

– Sebastian Steib | Lead Investment Manager, DCAP Ltd

Hedge Funds

AlphaSense helps you find the needle in the haystack, giving you a bird’s-eye view of all niche investments and an edge over your competition. With our extensive collection of expert calls, regulatory documents, and company data, you can easily discover undervalued companies in blackbox industries.

“AlphaSense has the best and most accurate language processing when I’m searching across filings, transcripts, and other resources, the searchability with AlphaSense is second to none.”

– Aaron Chan | Founder and Managing Partner, Recurve Capital

Private Equity & Venture Capital

AlphaSense ensures you’re prepared for any questions from the investment committee. Our platform aggregates company documents, aftermarket research, expert call transcripts, and news—indexed, searchable, and all in one place—so you can be fully confident in a due diligence process free of research blind spots.

“I’ve been using AlphaSense for several years now and I took it from my previous firm to my current firm. I just love the platform, it saves me a ton of time.”

– Private Equity Analyst

Corporate Finance & Investment Banking

Win more with less work. Our AI search technology instantly surfaces insights across historical documents, industry reports, expert calls, and embargoed research, so you can stop wasting time searching for information across multiple platforms.

“This project would typically take five hours over the span of a few days, and I did it myself in 10 minutes…while we were on the phone with the client.”

– Diversified Industries Associate | Bulge Bracket Firm

Sell-Side Research

AlphaSense helps you read between the lines and provide even deeper industry and company analysis for your clients. From Smart Synonyms™ to sentiment analysis, our AI capabilities will give you a better understanding of when to buy, hold, or sell investments for your clients—and why.

“AlphaSense is my primary tool for surfacing insights on macroeconomic and industry themes. I could not as easily do my job without it.”

– Howard Mason | Financial Analyst, Renaissance Macro

Consulting

AlphaSense helps consultants with the following key tasks:

Building Stronger Proposals

With access to broker research, expert call transcripts, earnings transcripts, and more, you can get smart on a company’s strategy and performance faster than ever before.

Deepening Client Relationships

We help you proactively bring new ideas and thought leadership to the table by surfacing the precise insights you need.

Conducting More Productive Research

Our platform allows you to tackle new client projects more efficiently and comprehensively by replacing manual efforts with smart AI capabilities.

“AlphaSense really helps with savings at a large scale—time savings translates across the whole team; we can get more work done and complete more engagements in the year.”

– Managing Director | Management Consulting Firm