Importance of Effective ESG Due Diligence

ESG (environmental, social, and governance) practices refer to an organization’s commitment to environmental impact and sustainability, corporate governance, and social responsibility. In today’s world, ESG issues such as climate change, human rights, and ethics are top of mind for investors and key stakeholders, and are increasingly subject to regulatory reporting.

Increasingly, investors are integrating ESG criteria into their investment portfolios to align with this growing trend. This has created pressure for organizations to adapt to evolving regulation around sustainability practices, and has made it more difficult for investors to ascertain the authenticity of sustainable claims in their portfolios..

Unfortunately, this has resulted in some organizations turning to deceptive tactics like greenwashing and falsification of records, in order to create the perception of being ESG-focused and earn an investor’s trust. This puts the onus on asset managers to conduct more stringent due diligence and ensure they are avoiding risky investment decisions.

Additionally, the ESG landscape is continually evolving with new regulations, reporting metrics, and consumer expectations that investors must be aware of to stay proactive in their strategy.

That’s why today, ESG due diligence is absolutely essential for investors. It enables you to verify and validate company claims, while staying on top of emerging macroeconomic trends and regulatory changes—leading to a stronger portfolio and better decision-making.

Here’s how you can use AlphaSense to take your due diligence to the next level and solve the main challenges of ESG investing.

Top Challenges in ESG Due Diligence

Lack of Standardization and Transparency

There is currently no established standard for ESG metrics or reporting. This means companies can misrepresent or embellish their ESG practices, since they are not upheld to strict standards of transparency. This leaves asset managers vulnerable to making blinded investment decisions, which can negatively impact the portfolio’s performance and create reputational risk.

So how can asset managers mitigate these risks and verify companies’ sustainability claims without a single source of truth for metrics or reporting?

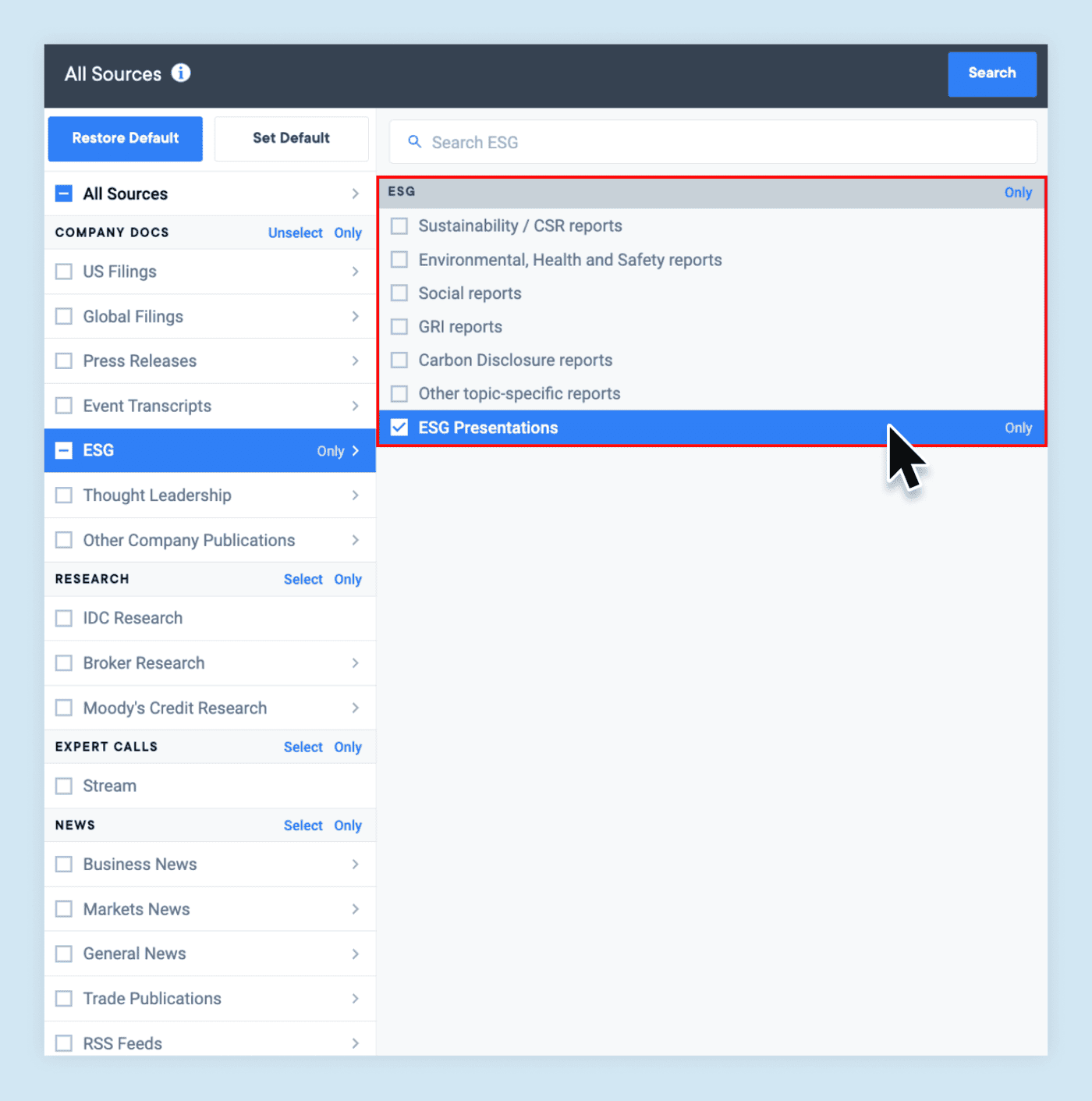

By utilizing a platform with streamlined content access—everything from earnings transcripts and ESG reports, to company presentations, news stories, broker research, and expert calls—you can obtain a holistic view of a company’s sustainability practices. By comparing insights across sources and perspectives, asset managers can be better equipped to make smart investment decisions and make themselves less vulnerable to misrepresented claims.

A Complement to Quantitative Metrics

While quantitative metrics play a pivotal role in the ESG due diligence process, they are only part of the story.

Depending on which metric an investor chooses to look at—Sustainability Accounting Standard Board (SASB), Global Reporting Initiative (GRI), Task Force on Climate-Related Financial Disclosures (TCFD), Principles for Responsible Investment (PRI), and MSCI—they might come away with a vastly different perception of a company. Each of these ratings has a different focus, including how a company is impacting the world, its carbon emissions, how ESG factors affect profitability, and so on.

Secondly, by only relying on their chosen metric as their source of truth, they miss critical context that is needed to gain a complete understanding of a company’s ESG performance. Key performance indicators such as employee health and safety, diversity and inclusion practices, compliance and legal framework, and risk management practices are all highly integral to assessing a company’s ESG standing—and they cannot be boiled down to simple numbers.

Soft data, like qualitative insights are essential to complement your research and due diligence process. Since qualitative data is inherently human in nature, you can leverage it to gain a deeper understanding of consumer needs, market movements, business motivations, and more.

Lack of Efficiency

Historically, there has not been an efficient research process for ESG data. Asset managers typically perform multiple manual searches across disparate sources, toggling between different tabs, and inevitably limiting the speed and scope of their research.

Manually parsing through pages and pages of a document is not only inefficient, but it leaves you vulnerable to human error and research blind spots. Moreover, spending too much time on manual tasks leaves little time for the higher-value focus of analysis and strategy building.

By relying on advanced AI search capabilities—such as thematic search, synonym recognition, and company tearsheets—you can find relevant information faster and even uncover critical insights you may not have known to look for.

Discovering Solutions With AlphaSense

AlphaSense is an all-in-one market intelligence and research platform that combines aggregated access to a wealth of critical ESG information with powerful AI search technology.

The insights you’ll find in the platform provide a critical qualitative dimension to your research, ensuring you have the full picture of any given company’s ESG position, as well as the ESG landscape at large. And our advanced AI search technology, automation, and generative AI capabilities accelerate and enhance your research, further giving you the competitive edge.

Key Market Perspectives

By offering aggregated access to all four key perspectives of market research, AlphaSense allows you to identify the right ESG targets, vet companies’ ESG plans and scores, and track evolving ESG policies and benchmarks. Here’s how:

- Company – Go straight to the source to see how companies are reporting on their ESG initiatives; gain access to disclosures and presentations covering 26,000+ companies

- Analyst – Hear from top Wall Street firms (including Morgan Stanley, Bank of America, Goldman Sachs, and more) about ESG investments, outlooks, and company evaluations

- Journalist/Regulatory – Proactively monitor regulatory and reporting groups such as GRI, as well as 145+ top ESG-focused news and trade journals

- Expert – Get access to 40,000+ first-hand perspectives of companies’ past executives, partners, and customers on ESG strategy, ESG market leaders, and the ESG landscape

On the quantitative side, AlphaSense provides access to MSCI ratings, and you can also import additional ratings into the platform. Matching the insights you glean from the ratings with the qualitative insights you find in the four research perspectives helps you validate ESG efforts and establish truth in your research.

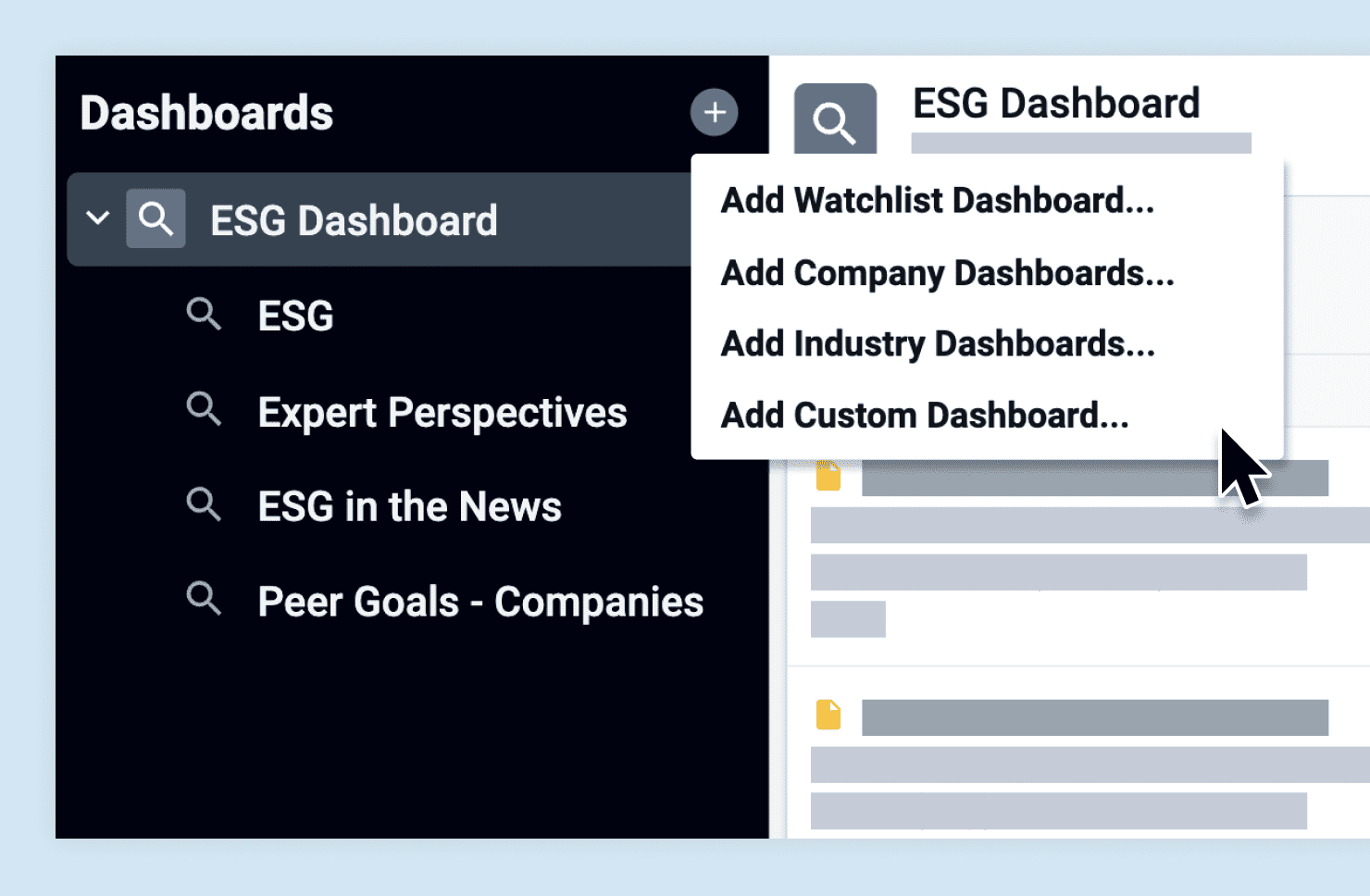

AlphaSense’s customizable dashboards also allow you to proactively monitor the companies, industries, or trends that are most interesting to you, helping with risk management and ensuring you are always in the know.

Speed Up Time to Insight

AlphaSense incorporates powerful AI search technology, eliminating manual research tasks and enabling you to develop and implement your ESG strategy faster. Our smart search capabilities give you back more time for high-level analysis and strategy in the following ways:

Thematic Search

This feature helps you find the right acquisition targets, as well as gain a full-scale understanding of ESG within any specific industry—all while accelerating your research process 5-10x. Simply create a search for “esg”, filter according to the industry you are interested in, and our platform will instantly provide you with all the key themes and companies you should be aware of.

Real-Time Alerts

Never miss a critical company, industry, or market update again with our customizable instant alerts. Let’s say you are scoping out a potential ESG target and want to be notified of any negative emissions updates from that company. By setting up an alert for “emissions negative”, you ensure that you will instantly receive a notification, should any negative updates emerge.

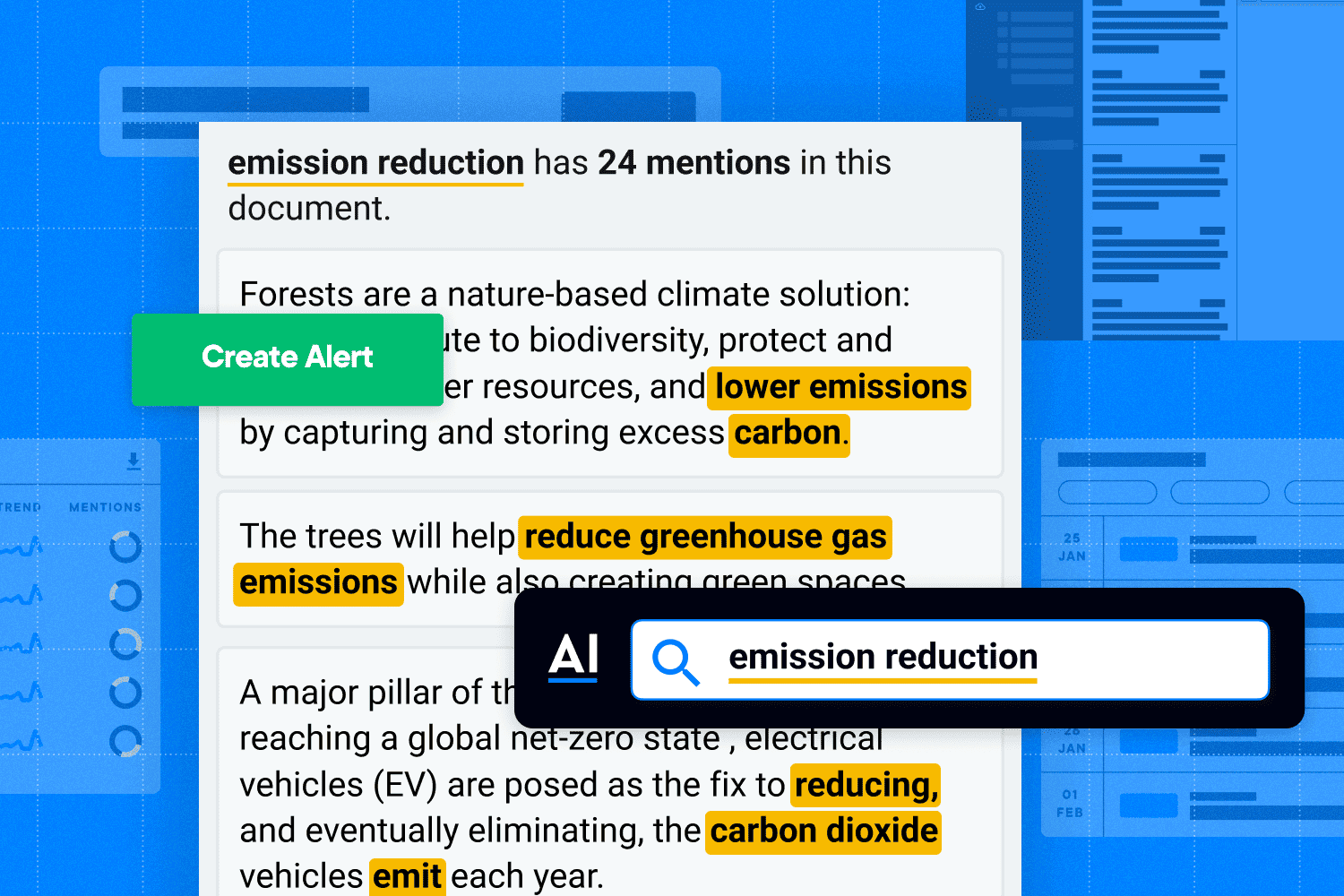

Smart Synonyms™

This AI-based feature enables you to filter through the noise faster by understanding the core of your search intent and surfacing only the most relevant results (e.g. when you search “emission reduction” the platform will also surface results for “Scope 1”, “greenhouse gas emissions”, “customers’ emissions”, etc.). This saves you time and prevents any research blind spots, allowing you to confidently move onto higher-level tasks.

Sentiment Analysis

This natural language processing (NLP)-based feature understands the nuance and underlying tone in documents such as earnings transcripts, helping you not only uncover key trends but also the C-suite sentiment and market perception behind those trends. This not only gives you a much more accurate picture of ESG performance and targets for companies in your investment universe, but also helps you spot red flags in portfolio companies before any of your competitors.

To read about how AlphaSense helped a midstream energy investor navigate earnings transcripts more efficiently and effectively than ever before, read this case study.

Generative AI

AlphaSense’s genAI tool, Smart Summaries, leverages our 10+ years of AI tech development and draws from a curated collection of high-quality content. This feature allows you to glean instant insights on complex and comprehensive topics, instantly summarizes earnings transcripts, quickly captures company outlook, and helps you understand the expert SWOT perspective. Forget spending hours using Control-F to find ESG hits in transcripts each earnings season. With Smart Summaries, you can see, in seconds, if ESG was a key topic in a transcript or top of mind for management in any given quarter.