Pivoting from a year characterized by dynamic macroeconomic volatility and unpredictability, along with the rapid evolution of technological innovation, the asset management landscape is undeniably on a path of transformation.

One of the most impactful factors has been the proliferation of artificial intelligence (AI) and generative AI (genAI) in the asset management space. From opportunity identification and due diligence to investment decision-making and portfolio management, AI is now a key tool for most asset managers. Those who have been slow or resistant to adopting these technologies have already begun to understand the significant competitive cost of lagging behind.

In addition to this, the asset management landscape is still contending with shifts stemming from the pandemic, as well as larger macroeconomic factors and trends. All of these factors, among others, have laid the foundation for a year rife with opportunity, growth, and even more transformation. Asset managers that find success in raising alpha amidst these evolving and often challenging conditions are those that will be able to pivot strategically, hone thought leadership, and implement adaptive protocol and programs to align with changing market trends with the end goal of attracting investor capital and bolstering performance for their stakeholders.

Below, we consider some of the key trends currently shaping the asset management industry, as well as what to expect in 2024 and beyond.

Key Trends At A Glance

- Recessionary fears, fluctuating inflation rates, and “new normal” interest rates

- Formalized integration of ESG and sustainability initiatives

- AI and digital transformation

- Competitive fee positioning

- An evolving workforce and accompanying cultural shift

Asset Management Trends in 2024

Fluctuating Inflation Rates and “New Normal” Interest Rates are Here for the Foreseeable Future

Informally, a recession is often defined as two consecutive quarters of decreased GDP, and formally defined as “a significant decline in economic activity that is spread across the economy and that lasts more than a few months.” Experts have diverged on whether markets will experience a ‘soft’ vs. ‘hard’ landing in 2024, as telling factors such as Treasury yields, interest rates, and inflation figures continue to fluctuate.

Since March 2022, the Federal Reserve has increased interest rates 11 times in an effort to curb rising inflation. In 2023, rates underwent an increase four times and remained on course the other three instances of the Federal Open Market Committee (FOMC) meetings. At the committee’s last session of the year, the Fed decided to hold rates steady, indicating three cuts coming in 2024.

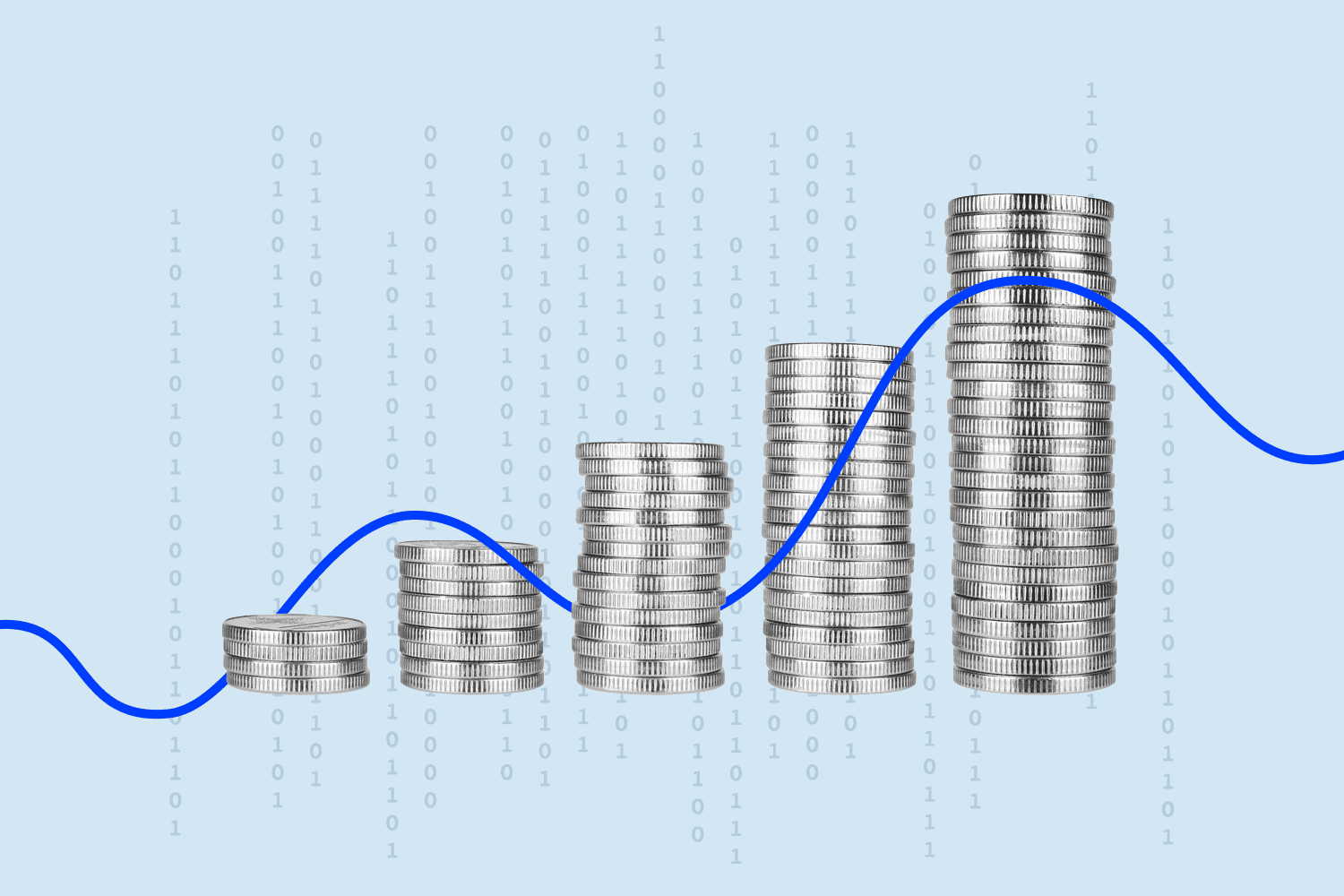

Decisions of this nature inevitably impact the markets and have a concerted trickle-down effect. For asset managers, navigating this ‘new normal’ of fluctuation will equate to pursuing asset classes and opportunities that best mitigate risk and capture the upside of these economic cycles.

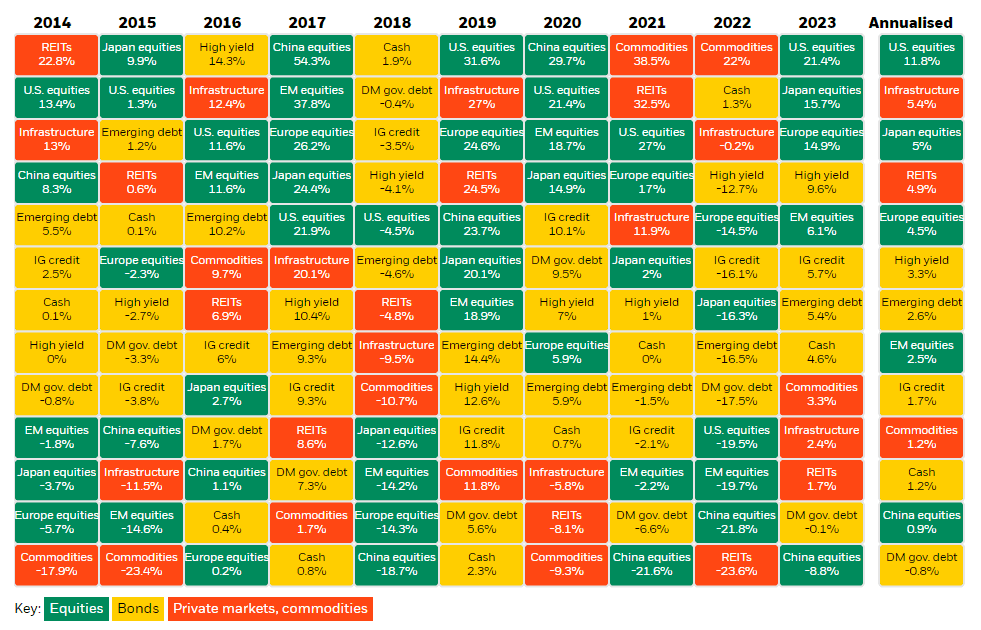

Looking at correlations between asset class data and Fed activity over the last couple of years provides some helpful insight on what to expect in the coming future. Among the asset classes that performed best in 2023, the United States, Japan, and Europe equities outperformed bonds and private markets/commodities (pictured below). In contrast, this equity group posted negative returns in 2022 during a year that saw double the number of interest rate hikes as in 2023 and an 8% interest rate (the highest in nearly four decades).

Higher inflation and interest rates also slowed private equity deal transactions throughout 2023, influencing financing and borrowing costs and placing pressure on margins, and ultimately impacting valuations. Stabilization around interest rates, as well as declining inflation, may reinvigorate deal activity in this space in 2024.

ESG and Sustainability Integration Continue to Dominate

ESG and sustainability initiatives continue to gain momentum, as firms formalize, integrate, and revamp their corporate architecture in order to better align with investor and board expectations, comply with regulatory and governance considerations, and mitigate reputational risk.

With forecasts for global ESG assets expected to surpass $53 trillion in valuation by 2025 (representing a third of total projected AUM), ESG trends will continue to dominate investor and stakeholder conversations, due diligence research, and ultimately portfolio allocations and investment decisions. Going into 2024, we expect to see more of the following:

- Reducing and reporting supply chain emissions

- Sustainability and operational longevity in biodiversity, reducing greenhouse gas emissions (GHGs)

- Investing in a net zero business model with proactive measures against greenwashing

- Embracing ESG Investing Regulations

- Collaboration in ESG reporting, including the European Commission’s Sustainable Finance Disclosure Regulation (SFDR) and more recent EBA ESG regulation for banks

In their 2024 Asset Management Outlook, Goldman Sachs states that “investors will increasingly use AI technology to analyze new sustainability datasets and find value amid the noise.” They also note “the US Inflation Reduction Act’s clean-energy incentives have encouraged companies to announce a wide variety of investments” as a potential trend for global markets to explore climate incentives.

The Far-Reaching Influence of AI and Digital Transformation

According to a BlackRock iShares outlook, “70% of executives will increase AI resourcing in 2024, with cost savings a major driver of adoption. Examples include analyzing legal briefs, automating repetitive tasks such as healthcare paperwork, and handling customer service. In the medium-term, we foresee AI driving incremental revenues by being embedded into existing products.”

Similarly, genAI is transforming the way the investment space is doing business. It has transformed how teams operate cross-functionally, enhancing automation capabilities across research due diligence, reporting, back-office operations, sales enablement functions, and even through product offerings such as robo (automated) investment advisers.

Some of the key generative AI use cases in financial services include:

- Financial Reporting: Automate financial reporting with genAI algorithms to generate accurate and comprehensive financial reports, saving time and reducing the chance of human error

- Earnings Analysis: Training models on historical earnings reports enables genAI algorithms to produce insights and predictions about future earnings to help drive informed investment decisions and identify potential opportunities.

- Market Research: GenAI tools can be used when conducting market research to analyze large volumes of market data, predict market trends, analyze customer preferences, and perform competitor analysis.

- Finance Planning: GenAI can analyze financial data to generate accurate forecasts, providing insights into future financial scenarios.

- Risk Assessment and Management: GenAI can play a crucial role in risk management by teaching algorithms to generate risk models and identify potential risks, helping to assess and mitigate risks, improve decision-making, and ensure operational stability.

- Performance Management: By analyzing performance data of financial products or portfolios, generative AI algorithms can generate insights and recommendations for optimizing performance.

The Ongoing Push and Pull of Active and Passive Management

Actively and passively managed strategies have gone neck and neck for the better part of the last decade, though the passive front now seems to be gaining the edge. According to a recent Cerulli Associates report, “total passive mutual fund and exchange-traded fund (ETF) assets will surpass total active mutual fund and ETF assets by early 2024.”

Active strategies are managed by an investment team of portfolio managers and analysts that carry out research, buy/sell decisions, and due diligence functions with the goal of outperforming a benchmarked index. Passive strategies, on the other hand, track, mirror, and replicate a particular index. As such, actively managed portfolios come with a fundamentally higher price tag compared to their passive peers that often cost a fraction of the basis points. And yet active management has historically outperformed passive management.

In a recent Morningstar Equity Research report sourced from the AlphaSense platform, analyst research finds “a confluence of several issues—poor relative active investment performance, the growth and acceptance of low-cost index-based products, and the expanding power of the retail-advised channel—has made it increasingly difficult for traditional asset managers running predominantly active portfolios to generate organic growth.”

These findings put asset managers at the mercy of favorable market conditions to bolster returns for their actively managed strategies. With lingering economic uncertainty for the foreseeable future, active products may continue to struggle to compete against their passive peers in 2024.

The Evolving Workforce Post-Pandemic and Accompanying Cultural Shift

In McKinsey’s 2023 Women in the Workplace Report, 83% of employees surveyed identified efficiency and productivity as a primary benefit of remote work. Furthermore, 38% of women with young children indicated that without workplace flexibility, they would be forced to leave their company or reduce their work hours.

Post-pandemic, flexible working arrangements are high on employees’ priority lists, often ranked a ‘Top 3’ benefit and deemed a critical factor to a firm’s success. Resistance to flexible work is becoming an increasingly archaic stance with work-life balance emerging as a predominant ‘must-have’ among employees following the Covid-19 pandemic.

This cultural shift is undeniable and continues to gain momentum across the financial industry. A study published by the CFA Institute found that 81% of investment professionals desired to keep remote work as an option following the pandemic.

Increasingly, firms need to recognize and be adaptive to these signaling trends to maintain employee engagement, retain valuable talent, and distinguish themselves as a competitive workplace. Ultimately, investing in employee satisfaction and engagement has a direct correlation with better performance and outcomes for the organization.

On a similar note, there is an increasing focus on Diversity, Equity, and Inclusion (DE&I) initiatives, particularly advancement opportunities for people of color and women. In 2024, companies that invest in these initiatives will be part of the majority, rather than an exception.

Get The Competitive Edge With AlphaSense

To stay ahead of the topics and trends making the greatest impact on the asset management landscape in 2024 and beyond, you need a trusted resource that delivers intelligence and insights with the speed of the changing market.

AlphaSense’s market intelligence platform stands out from the rest with an extensive universe of content layered with AI search technology. Access thousands of premium, public, private, and proprietary content sources—including broker research, company documents, expert calls, earnings call briefings and more—in seconds, for the most comprehensive due diligence and informed decision-making.

Our cutting-edge features enable you to sift through the noise and accelerate your research:

- Smart Synonyms™ is the backbone of the AlphaSense search engine, using natural language processing (NLP) to expand keyword and thematic searches beyond exact-match documents to include all relevant results

- Sentiment Analysis extracts the tone and nuance that exists behind the surface-level meaning of a document or set of sources

- Smart Summaries generates instant insights to reduce time spent on research during earnings season, quickly capturing company outlook, and generating an expert-approved SWOT analysis straight from former competitors, partners, and employees

- Table Explorer eliminates the need to manually spread financials, automatically calculates key metrics, and enables you to instantly validate your numbers by viewing the original source of each number with a single click

- Enterprise Intelligence enables you to securely search, discover, and interrogate your proprietary internal content and a vast repository of 300M+ premium external documents

Discover why 80% of the top asset management firms choose AlphaSense, and see how you can transform your workflow and leverage the insights and trends that matter. Start your free trial today.