Recent M&A deals within the E&I space are setting the stage for robust competition in upcoming QoQs.

ExxonMobil (XOM) revealed plans at the beginning of this month to acquire Pioneer Natural Resources (PXD)—a stock-only merger assessed at $59.5 billion, or $253 per share.

Meanwhile, Chevron (CVX) announced last week that it has entered into a definitive agreement with Hess (HES) to acquire all of the outstanding shares of Hess in an all-stock transaction valued at $53 billion, or $171 per share based on Chevron’s closing price.

For Exxon Mobil and Pioneer, the incentives of these deals are endless: from increased cash flow and shareholder returns, to cost efficiencies and accelerated net-zero plans, these strategic mergers will only strengthen the position these major oil and gas producers hold.

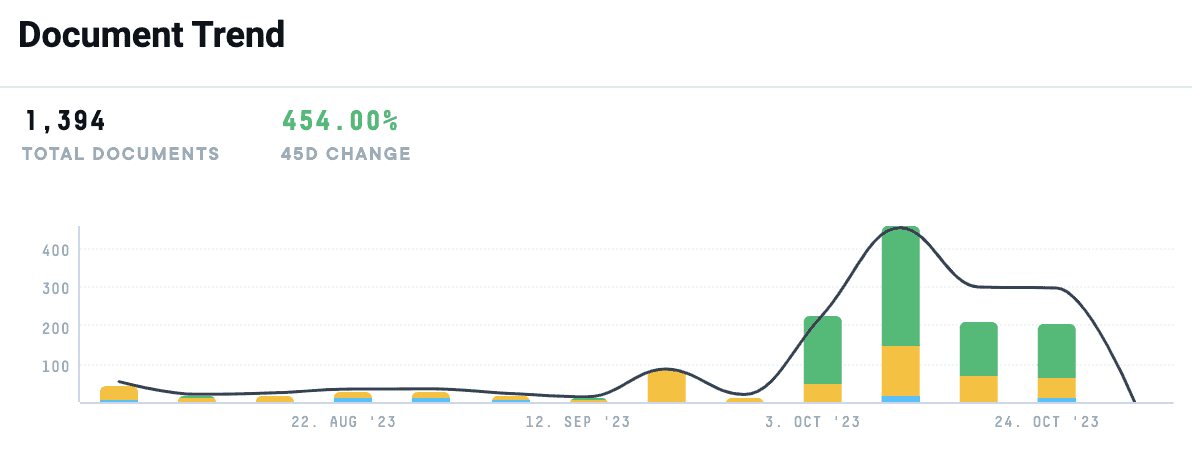

Within the AlphaSense platform, mentions of ExxonMobil and Pioneer have increased by nearly 455% over the last 90 days.

But as ExxonMobil and Pioneer build out their portfolio and profits, will this M&A activity inspire industry competition to partner up and reap larger profits? Could the E&I industry see increased mergers for quarters to come? Below, we dive into the nitty-gritty of these deals, what experts and industry leaders have to say about this new wave of deal activity, and share what the future might look like for the industry.

ExxonMobil’s Purchase of Pioneer

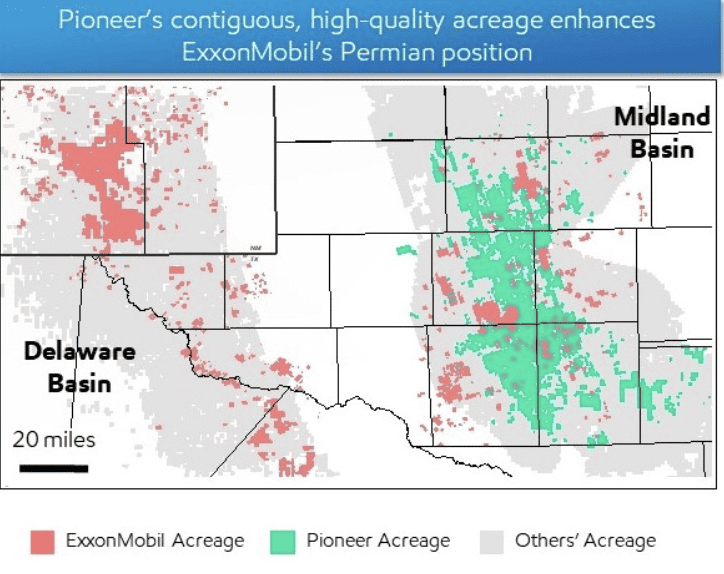

ExxonMobil’s purchase unites Pioneer’s expansive land holdings of over 850,000 net acres in the Midland Basin with the American multinational oil and gas corporation’s 570,000 net acres in the Delaware and Midland Basins—consequently, creating the industry’s foremost inventory of high-quality, untapped U.S. unconventional resources. Collectively, these companies are projected to produce an estimated 16 billion barrels of oil equivalent resources in the Permian Basin.

At close, ExxonMobil’s production volume in the Permian Basin is set to more than double, reaching 1.3 million barrels of oil equivalent per day, based on 2023 levels, and is anticipated to grow to approximately 2 by 2027.

ExxonMobil views this transaction as an opportunity to enhance U.S. energy security by bringing top-tier technologies, operational excellence, and strong financial capability to a vital domestic energy source, which will ultimately benefit the American economy and its consumers.

Key Selling Points

Accelerating Sustainability Goals

ExxonMobil has stated that its purchase will accelerate its mission of achieving net zero greenhouse gas emissions (Scope 1 and Scope 2) from its Permian unconventional operations by 2030. As an integral part of this merger, ExxonMobil intends to utilize its Permian greenhouse gas reduction strategies to expedite Pioneer’s own net zero emissions plan, moving its target forward by 15 years to 2035.

ExxonMobil will employ the same proactive approach and leverage its cutting-edge technologies for monitoring, measuring, and mitigating fugitive methane emissions, thereby reducing methane emissions for both companies. Furthermore, by harnessing their combined operational capabilities and infrastructure, they anticipate a substantial increase in the utilization of recycled water in Permian fracturing operations, aiming to surpass the 90% mark by 2030.

Expanding Business Territory

For ExxonMobil, this deal presents a distinctive chance to achieve superior capital efficiency, cost-effectiveness, and production growth by merging Pioneer’s extensive, premium-quality undeveloped Midland acreage with ExxonMobil’s proven, industry-leading approach to developing Permian resources.

According to a press release from ExxonMobil, “the unique, complementary fit of Pioneer’s contiguous acreage will allow ExxonMobil to drill long, best-in-class laterals—up to four miles—which will result in fewer wells and a smaller surface footprint. The company also expects to enhance field digitalization and automation that will optimize production throughput and cost.”

Image sourced from ExxonMobil Corporate

Cost Savings and Higher Shareholder Returns

By enhancing eco-conscious technology and its production with a lower cost-of-supply and offering increased flexibility in short-term capital allocation, Pioneer’s assets are expected to yield a cost of supply below $35 per barrel. By 2027, over 40% of the total upstream volumes will be short-cycle barrels, positioning the company to swiftly adapt to changes in demand and capitalize on both pricing and volume opportunities.

This merger unlocks a unique opportunity for value creation, resulting in substantial synergies and additional growth potential shared by shareholders of both companies. It is expected that the merger will immediately enhance ExxonMobil’s earnings per share and free cash flow, with a favorable long-term cash flow outlook. Combining ExxonMobil’s robust balance sheet with Pioneer’s surplus free cash flow creates additional potential to increase capital returns for shareholders after the transaction’s completion.

Chevron’s Purchase of Hess

Chevron’s acquisition of Hess not only elevates but diversifies Chevron’s already impressive portfolio. For example, Hess’s Stabroek block in Guyana is an extraordinary asset, boasting industry-leading cash margins and low carbon intensity that is expected to deliver production growth into the next decade.

Further, Hess’ Bakken assets add another leading US shale position to Chevron’s DJ and Permian basin operations and further strengthen domestic energy security. This merger is expected to grow production and free cash flow faster and longer than Chevron’s current five-year guidance. In addition, John Hess is expected to join Chevron’s Board of Directors.

The acquisition consideration is structured with 100 percent stock utilizing Chevron’s equity. In aggregate, upon closing of the transaction, Chevron will issue approximately 317 million shares of common stock. Total enterprise value of $60 billion includes net debt and book value of non-controlling interest.

Key Selling Points

Expanding Business Territory

Purchasing Hess means getting access to their reserves in Guyana, or more specifically, a 30% stake in an extensive reserve of over 11 billion barrels of oil equivalent with lucrative cash margins per barrel, a robust production growth outlook, and promising exploration potential.

Hess also has reserves within Bakken, with Chevron’s acquisition including possession of 465,000 net acres featuring top-quality, long-lasting inventory supported by integrated Hess Midstream assets. Complementary assets in the Gulf of Mexico and a steady stream of free cash flow from the natural gas business in Southeast Asia.

Cash Flow and Shareholder Returns

Chevron projects anticipated accretion to cash flow per share by 2025 after realizing synergies and initiating the fourth floating production storage and offloading (FPSO) vessel in Guyana. Inevitably, this will augment Chevron’s estimated five-year production and free cash flow growth rates, extending this growth into the coming decade.

Additionally, Chevron plans to propose an 8% increase in its first-quarter dividend per share to $1.63, subject to approval by the Chevron Board of Directors. Following the transaction’s closure, leadership intends to raise share repurchases by $2.5 billion to reach the upper end of its guidance range, set at $20 billion per year in a favorable oil price scenario.

The joint company’s capital expenditures budget is projected to fall within the range of $19 to $22 billion. With a more robust portfolio post-merger, Chevron anticipates expanding asset sales, generating $10 to $15 billion in before-tax proceeds through 2028. The transaction is slated to achieve approximately $1 billion in run-rate cost synergies before tax within a year of closing.

Commentary on Deals

The Wall Street Perspective on ExxonMobil

According to broker research found within AlphaSense, the acquisition of Pioneer positions ExxonMobil for major growth, marginally shifting XOM’s portfolio towards a greater emphasis on oil compared to U.S. natural gas.It also provides the opportunity to leverage XOM’s technology to enhance the asset base.

Analysts anticipate that upstream earnings will benefit from the initial contributions of the PDCE acquisition, although potential increases in downstream margins might be affected by timing considerations. Buybacks are expected to dip below the usual $4.4 billion quarterly rate (guided to be above $3 billion) due to the blackout period related to PDCE. However, research anticipates a return to the regular schedule in the fourth quarter.

The Expert Perspective on ExxonMobil

Expert calls found within AlphaSense’s library of expert call transcripts reveal a similar sentiment: experts see ExxonMobil’s acquisition of Pioneer as a strategic investment that will reap long-term profits.

This rings true with a former Advisor of Callon Petroleum Company—a competitor of ExxonMobil. Our expert believes XOM can bring significant incremental improvements to acquisitions, such as PXD:

“Right now, it seems like there’s a lot of consolidation going on in the market. Callon bought another company and that was maybe six months ago now. I can’t remember exactly when. Exxon just bought Pioneer. If you’re a company and you want to expand, you have to buy another company. Trying to organically grow by discovering new assets is not really feasible, especially in U.S. onshore unconventional.”

– Callon Petroleum Company | Former Advisor

The expert believes smaller companies are unable to optimize their asset base, relative to a larger company, saying:

“Everyone knows where we’re fat and what’s available, and it’s really just a game of monopoly of trying to increase your market share and having incremental improvements. I think Exxon wants to drill longer laterals and that’ll supposedly make it slightly more efficient. You’re buying something and thinking you can improve what the previous operator was doing, change the completion, drill longer laterals, change the spacing, something like that.”

– Callon Petroleum Company | Former Advisor

The Wall Street Perspective on Chevron

Fundamentally, brokers see that HES stands to gain substantially from the larger size and scale, the solid asset foundation, and the reinforced financial position of Chevron’s acquisition. This is further reinforced by the fact that the deal is structured entirely with equity.

Even with the premium factored in, most research suggests Chevron maintains a fair value estimate, considering the uptick in oil prices since our last assessment and the inclusion of synergies in the evaluation.

The Expert Perspective on Chevron

When it comes to Chevron’s acquisition of Hess, experts aren’t as surprised by the deal due to Hess’s position—sustainable for the future but closed off to innovation. This particular sentiment is expressed in an expert call found in the AlphaSense transcript library, Expert Insights.

A former Hess consultant expressed that Hess, as a company, appears committed to its longstanding emphasis on traditional oil and gas operations. Competitors perceive it as a follower rather than a pioneer in the realm of alternative energy, and its propensity for change is perceived as sluggish.

“If I started talking about some of the stuff that I’m into now, like green hydrogen, ammonia, methanol, things like that. Offshore wind, alternative solar projects, things like that. There’s none of that there. They’re almost on the other side of it saying, “Okay, yes, oil and gas will be needed throughout the energy transition.” It’s all almost a slight to the energy transition as opposed to saying, “Okay, we’re eagerly trying to support it or be a part of it.”

– Hess Corporation | Former Consultant

The departure of senior employees has resulted in a notable loss of intellectual capital within the organization, leading to concerns about a significant brain drain. The expert’s assessment suggests the company’s stability is unwavering in the foreseeable future, but a strong inclination for innovation should not be anticipated.

“We’re going to stay status quo, enjoy these prices right now, as they will be for a while, and just keep doing our business and eventually, which is their M.O. when the transition is here, then they’ll try to invest in some portion of it, but it’ll be at a higher price, just like they did with some of the assets they bought past the time where it was new and interesting. They’re not a first mover there.”

– Hess Corporation | Former Consultant

A Comprehensive Review of Q3 2023

According to Kroll, a small group of key players dominated the entirety of oil and gas M&A activity, with five countries contributing to 96.3% of the total global disclosed value, accounting for 64.3% of the volume of announced deals. The top three countries currently leading in M&A activity are the U.S. (74.6% of value and 35.7% of deals), China (17.0% of value and 5.8% of deals), and Canada (2.2% of value and 15.6% of deals).

The number of megadeals (transactions over USD 1 billion) decreased to nine in Q3 2023 from 14 in Q2 2023. These nine megadeals constituted 5.8% of the total number of transactions, with their disclosed value making up 82.8% of the global disclosed value. Megadeals continue to be concentrated in the U.S., with seven deals valued at USD 36.9 billion, representing 88.3% of U.S. deals and 65.8% of global deals.

The acquisition of three U.S.-based utilities by Enbridge to form Dominion Energy stands out as the largest transaction of Q3 2023 at USD 14.0 billion, constituting 25.0% of the global disclosed value. This acquisition has resulted in the formation of the largest natural gas distributor franchise in North America.

Among the 80 transactions recorded in North America, 15 (18.8%) remain undisclosed. The impact of tightening financial conditions is evident in the gradual decrease of the average TV/EBITDA multiple, currently standing at 5.3 compared to 9.1 in Q3 2022.

European activity witnessed a significant decline of 35 transactions (57.4%) QoQ, dropping from 61 transactions in Q2 2023 to 26 transactions in Q3 2023. Out of these 26 transactions, 19 (73.1%) lack disclosure of transaction value. Additionally, the financial details from the disclosed transaction values do not provide sufficient data to calculate a multiple.

In the Asia Pacific region, the majority of the activity originated from China and Australia, each contributing nine transactions. Together, these countries accounted for 58.1% of the total activity within the region (31 transactions in total). In terms of disclosed value, China dominates, representing 91.9% of the disclosed regional value. The aforementioned highlighted regions collectively make up 89.0% (137 transactions) of the total announced deals (154 transactions) in Q3 2023.

Forecasting the Future of E&I

According to equity research found within the AlphaSense platform, analysts anticipate that US companies will persist in their efforts to consolidate smaller scale firms.

However, the scope of activity for International Oil Companies could be somewhat restricted due to the limited number of viable targets, both in terms of size and geographical location. Additionally, there are inherent risks associated with acquiring unconventional resources, particularly given the relatively high commodity prices.

Looking to keep tabs on the latest oil and gas developments? With AlphaSense, you can significantly cut your lead time to find the answers you need and make faster, more informed decisions in anticipation of macro- and microeconomic events shaping the E&I industry.