Supply chain disruptions brought on by the war between Ukraine and Russia are immeasurable, as industries depending on the imports from both countries are left at a standstill.

Essential commodities that many sectors rely on are no longer guaranteed, forcing suppliers to reconsider how they can acquire the supplies they need to meet their end users’ demands. As the strain on materials continues to grow in this conflict, the monetary deficit brought on by this shortage will inevitably induce a financial crisis not only for Ukraine and Russia but global manufacturers and distributors.

Most global sectors have experienced some shortfall due to the war, however, some have faced more adversity than others. Namely, the food, energy, microchip, metals, and transport industries have been disproportionately affected. To better understand the affiliated consequences of the Russian–Ukrainian war, using the AlphaSense platform, we’ve analyzed the roles both countries play within these sectors and the downfalls they have endured since the onset of the war.

Key Industries Impacted by the War

Energy

Russia has become Europe’s leading energy exporter, providing a variety of power supplies to the continent. Last year alone, 36% of gas, 30% of coal, and 10% of crude oil used in Europe came from Russia. Specific countries account for these statistics of dependency, with Germany importing over half (65%) and Italy (43%) of its gas from Russia. This reliance has allowed Russia to account for nearly a fifth of all global natural gas trades.

However, the COVID-19 pandemic shorted Russia’s gas reserves, which raised energy prices that have already detrimentally rippled across sectors. Most of Europe relies on gas to heat its structures and generate power. So, to outpace Russia’s shortage, Europe may enact rationing towards the end of the year to lower their gas demands, import liquefied natural gas (LNG) from other countries and generate more biofuel.

According to a McKinsey report, “These demand reductions and supply increases could reduce Europe’s need for Russian gas within the next year from 36% of its total use to about 10%.” However, if rationing is implemented, “based on recent statements from government leaders, industrial users might see their gas supplies reduced before other users.”

Agriculture

Together, Russia and Ukraine are responsible for roughly 30% of all global wheat trades and more than half (65%) of all sunflower oil exports—both essential commodities for manufacturing a variety of food products. If the harvesting and handling of wheat and sunflower oils are disrupted, importers will struggle to find supply replacements.

Countries like Turkey and Egypt, which account for more than 70% of all wheat imports, would suffer a sizable economic setback. In addition, Ukraine is the fourth largest exporter of corn, and market forecasters predict that over 40% of the country’s crop has not yet shipped, leading many to believe a majority of the stock will not make it to market.

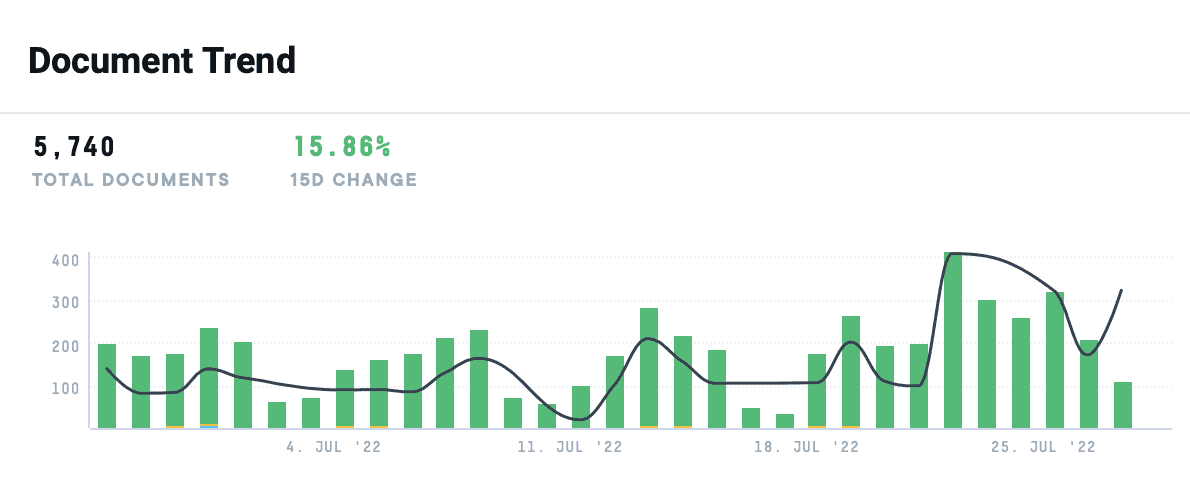

The two countries also produce a third of the world’s ammonia and potassium exports–the main components of fertilizer. Soon after Russia invaded Ukraine, fertilizers and several food ingredients rose in price by upwards of 20% to 50% due to a lack of natural gas supply. A clear area of concern, there are over 5,000 documents uploaded into the AlphaSense platform around the subject, with continued interest trending upwards.

Natural gas is necessary to produce ammonia, the main ingredient in nitrogen fertilizers. Russia’s depleting gas reserves have caused prices to skyrocket, leading farmers to face higher costs to grow and yield fewer crops, ultimately raising the price of certain food products.

All importing countries will be subjected to warfare-driven prices, unless protected by fixed-pricing contracts that have already been established. However, nations within the Middle East, North Africa, and Western and Central Asia will likely face the most severe consequences of this potential shortage due to their high dependency on wheat and corresponding inflation.

The near future of the agriculture sector is already looking troublesome, as the UN has forecasted that 30% to 40%of Ukraine’s fall 2022 harvest is in jeopardy due to combat, preventing farmers from planting crops.

Transportation

Russia’s military forces within Ukraine have caused the transportation of goods to be dramatically derailed. Foreign supply chain firms have reported that Russia has severed numerous shipping routes with Ukraine. Specifically, Russian naval forces have halted all trade in and out of the Sea of Azov — a central access point for Ukrainian trade, as nearly 70% of Ukraine’s exports are distributed via ship.

Russia is also facing transportation repercussions. Several carriers have suspended services within the country, encompassing nearly 62% of total ocean freight capacity.

At the onset of the war, Ukraine halted civilian flights and airlines, which limited air capacity for shipping goods, raising air freight shipping rates. In turn, many airlines now avoid Russian airspace, meaning shipping routes take alternate, longer routes which increases fuel costs for carriers. While these alterations in shipping routes to avoid Ukraine and Russia may be costly, experts project that disruptions in shipping will be limited.

Microchips

Ingas and Cryoin, Ukraine’s largest suppliers of neon–an essential ingredient for making microchips–have paused production due to escalating warfare, leaving manufacturers concerned about the raised prices (neon gas has surged ten times) and a supply shortage.

The two companies produce anywhere between 45% to 54% of the world’s neon, which powers lasers to craft chips for various products (laptops, cellphones, cars, etc.) that have continued to be in demand since the onset of the COVID-19 pandemic. However, stockpiles have been meager since March of 2020, curtailing global supply chains and hindering the manufacturing of these end-use products. Analysts project that if chipmakers do not have alternative fulfillment plans arranged by April, these constraints will worsen exponentially.

Before the war, Ingras alone produced 15,000 to 20,000 cubic meters of neon per month and exported 75% of the neon to chip-making manufacturers. Similarly, Cryoin yielded 10,000 to 15,000 cubic meters of neon per month. But since the company halted their operations due to Russian combat this past February, Cyrion has projected they will not fulfill roughly 13,000 cubic meters of neon starting this coming March if the war continues. Moreover, further delays in fulfillment are possible if their facilities or equipment experience any damage due to warfare, which would cause financial setbacks and prevent operations from starting again.

Automobiles

A number of materials and parts for automobile manufacturers have been scarce, leading to dramatic climbings in pricing and the slowing of production globally. As previously mentioned, neon gas has risen in price by ten-fold, detrimentally affecting Asia-Pacific region automobile manufacturers, while sanctions imposed on Russia will shortcut palladium supply. Such setbacks have led automotive research firm IHS Markit to lower its annual global light vehicle production forecast by 2.6 million units for 2022 (81.6 million) and 2023 (88.5 million units).

Ukraine, specifically, plays an important part in automobile production. Many automakers import wire harnesses from the country, which supply electrical power in vehicles and communication between parts. As a result, analysts believe that auto manufacturers will experience the most disruption, with Europe cutting nearly two million units from production, with about one million units accounting for lost demand in Russia and Ukraine. The large percentage of production cuts stems from material and part shortages.

Interested in a further analysis of transportation, defense, and CapEx trends over one year into a new presidency and ongoing post-COVID recovery? The New Normal: Planes, Supply Chains, and Industrial Innovations is an exclusive virtual event led by Morgan Stanley’s Kristine Liwag, Head of Aerospace & Defense Research, Ravi Shanker, Senior Airlines & Transportation Analyst, and Josh Pokrzywinski, Senior Multi-Industry Analyst.

Across three interactive sessions, the analysts discuss the post-COVID global supply chain issues, the path forward for aerospace and defense after a historic year, and themes shaping a pro-CapEx environment.